The sales of small -scale taxpayers in the second quarter were not over 450,000 yuan.

Author:State Administration of Taxati Time:2022.07.11

The "Announcement on the Exempted VAT" (No. 15, 2022) issued by the Ministry of Finance and the State Administration of Taxation (No. 15, 2022) clearly stated that from April 1, 2022 to December 31, 2022, the value -added tax is small. The taxable sales income of a 3%levy rate of taxpayers is exempt from value -added tax; a pre -paid value -added tax project with a pre -levy rate is applicable to suspend the prepaid value -added tax. At present, it is in the July period, and the sales of small -scale taxpayers in the second quarter of the second quarter are not over 450,000 yuan.

Related question and answer

The small -scale taxpayers declared on a quarterly -based sales in the second quarter did not exceed 450,000 yuan, and enjoyed the preferential policies for exemption of value -added tax. How to fill in the declaration form?

Answer: The "Announcement of the State Administration of Taxation on Small scale taxpayers exempts VAT and other collection management matters (2022 No. 6) stipulates that the VAT taxpayer has a value -added taxable sales behavior. If more than 150,000 yuan (with a quarter of a tax period in one quarter, and the quarterly sales of less than 450,000 yuan), the sales such as the exemption of value -added tax shall be filled in "Large -scale taxpayers)" "Small and Micro -Enterprise Duty Free Sales" or "Sales Sales of Unprepatic".

In the second quarter, your company's total sales are expected to be about 400,000 yuan, not more than 450,000 yuan. When applying for a value -added tax tax declaration, the tax -free sales should be filled in in the "VAT and adding taxes (small -scale taxpayers) (applicable to small -scale taxpayers) 》 The 10th column "Small and Micro -Enterprise Duty Free Sales" (If it is an individual industrial and commercial households, it should be filled in the 11th column "Unprovable Sales Sales"). If there are no other tax -free items, there is no need to fill in the "VAT tax reduction and exemption declaration".

Video production: Henan Taxation, Zhengzhou Taxation

- END -

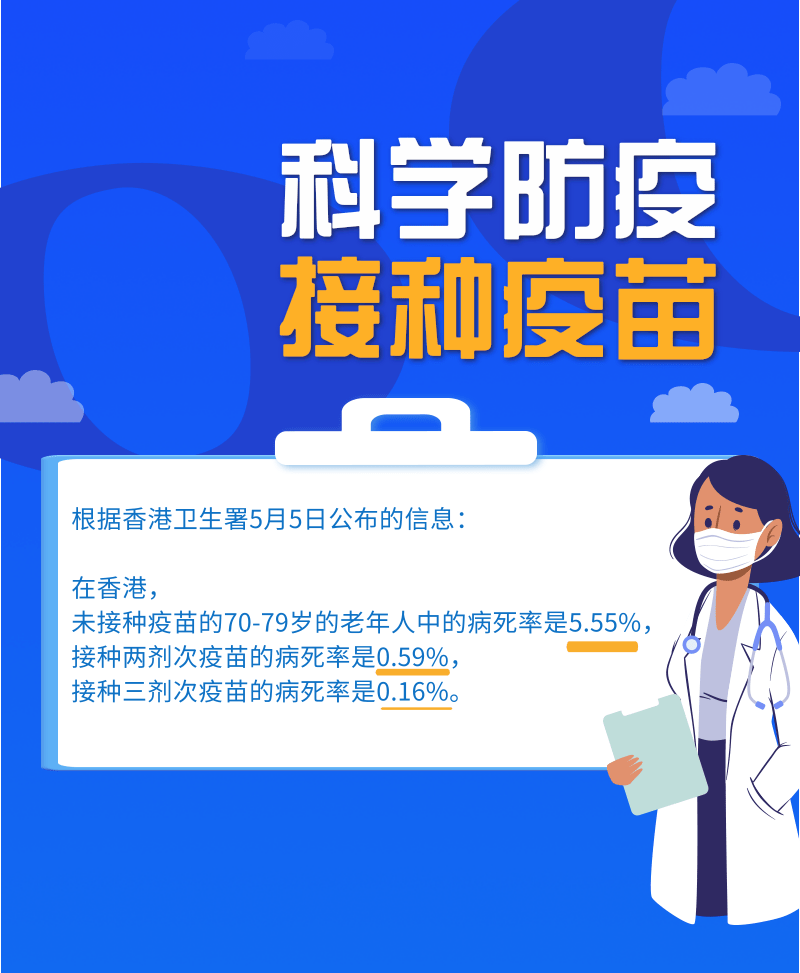

[Caption] What is the difference between the elderly does not take vaccines and two stitches and thr

From the current regions where Omik Rong is popular, especially in the extensive a...

State Grid Xianning Power Supply Company Leader "Double Promotion" rotation training: From

On June 11, the Party Committee Organization Department (Human Resources Departmen...