50.6 billion!Rising 31.45%, when will the pharmaceutical investment and financing "do" again

Author:Yaizhi.com Time:2022.07.11

50.6 billion! Rising 31.45%, when will the pharmaceutical investment and financing "do" again

Source: Yaozhi.com/Cobe

"New financing low", "serious differentiation", "cautious" ... The evaluation of the investment and financing of the pharmaceutical industry since the beginning of the year has basically maintained the same opinions.

Indeed, today's pharmaceutical industry project valuation cannot be compared with the previous two years, and it has continued to shrink down for a long time. Especially this year, it has experienced epidemic control again. In the process of financing, it is difficult to grasp the initiative of "valuation".

As for the current dilemma, people in the industry frankly said: "I thought it was promoted by the epidemic, and the field of pharmaceutical investment would become hot again as before, but the result was that almost all industries were gradually" calm ". Previously, pharmaceutical investment and financing status was impulsive consumption, and today's pharmaceutical investment and financing emphasized "cost -effectiveness and practicality". Time to treat projects, institutions inspect and evaluate the time exactly, which indirectly leads to the continuous valuation of the integration industry. Low down.

However, the so -called property must be reversed. The field of pharmaceutical investment and financing has undergone a depressed atmosphere in nearly half a year. Since June, the trend in the field of pharmaceutical investment and financing has also undergone changes. Industry people speculate that the field of pharmaceutical investment and financing may usher in a new wave of "rebound" opportunities.

The pharmaceutical industry financing began to enter the rebound stage

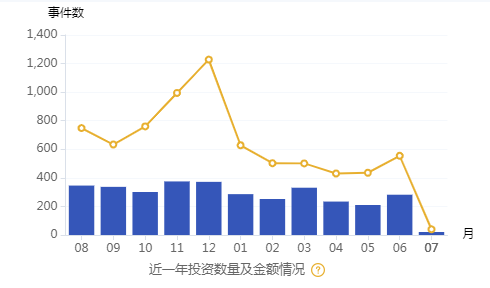

In June 2022, a total of 282 financing events (including medical equipment) occurred in the global biomedical field, with a total financing amount of 55.445 billion yuan, of which 103 were in the country, with a cumulative amount of 14.471 billion yuan. Compared with May, financing events rose increased in May. 24%, the financing amount rose by 38.45%.

There is no doubt that whether it is the global pharmaceutical field or the domestic pharmaceutical field, the financing situation in the domestic pharmaceutical field has a significant upward and changing trend compared to the previous months. The enthusiasm for medical financing that has been suspected before has also been proven.

From the perspective of the distribution of financing stages, the number of financing companies is similar to the past, and still has the most financing incidents that occur during the A round to the A round, and the three accounts for nearly 53%, which is the main main medical field of financing.

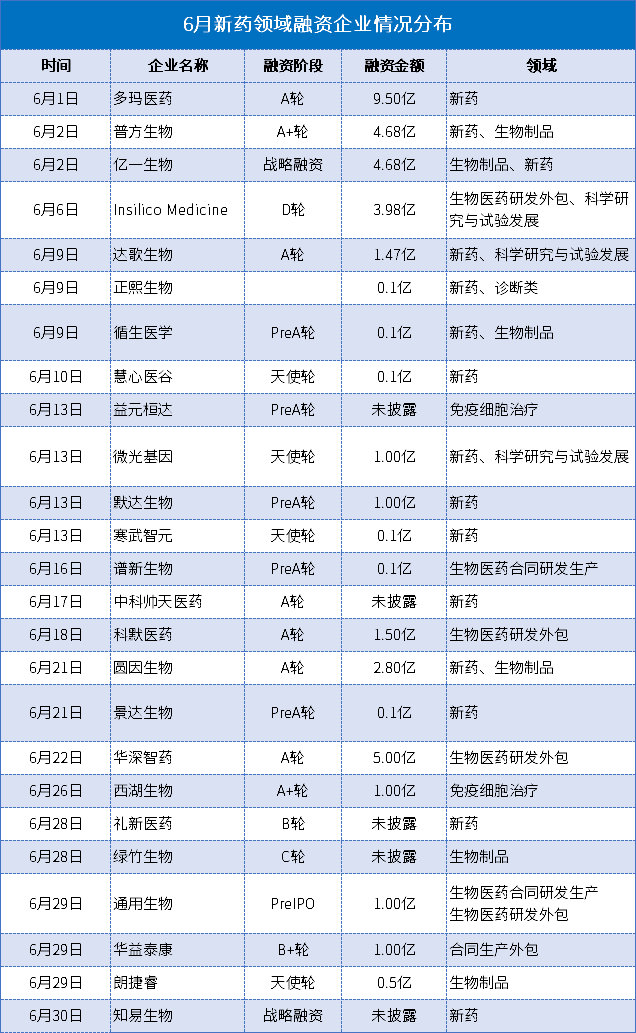

From the perspective of domestic financing quotas, in the 103 financing incidents in June, there were 8 financing of more than 500 million yuan in financing; 38 financing incidents with a single financing amount exceeded 100 million yuan, and the total financing amount was about 12.786 billion yuan. , Accounted for 95.76%of the total financing scale in June.

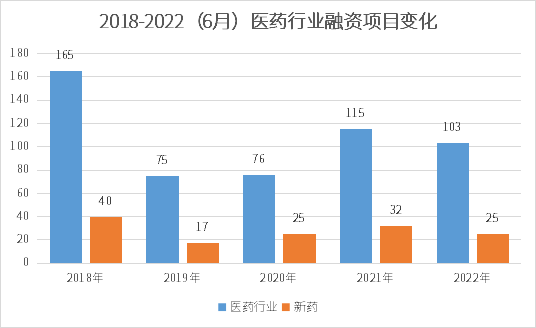

Among them, the "New Medicine Field" as a popular player in pharmaceutical financing projects, although there were only 25 projects in June in the financing project, and the amount of financing was only 3.891 billion yuan, accounting for 28.57%. The field is still undoubtedly the hottest and most valuable investment project in the field of pharmaceuticals today.

New drug financing fields are distinctive, and the future can be expected

The Chinese New Pharmaceutical Market has always been considered the blue ocean market with "deep water", and investment and financing activities are also very active. Among them, due to the strong technical barriers and core intellectual property rights in the field of "innovative drug research and development", high -quality enterprises have always been the best Focusing on the market. Under capital assistance, the field of innovative drugs has also repeatedly set a record of financing.

In the field of new drugs, of the 103 domestic financing projects in June, a total of 19 new pharmaceutical companies completed financing. The largest financing amount was Doma Bio. The amount of financing of 950 million yuan was not only the top of the new drug. In June, all pharmaceutical financing The project is the best. What's more interesting is that before, in the field of new drug investment and financing in June, a lot of meaningful changes have been produced.

Chu Chuang Pharmaceutical Company has attracted much attention, and the new round of development is about to develop

According to the content of the form, most of the 19 innovative drug financing records were before the A round stage, and more than 10 companies were established between 2021 and 2022. For example, Doma Pharmaceutical, even less than a year, has exceeded the amount of financing more than most of the enterprises that have been operating for several years or even decades. What's more, this is not rare in the field of new drugs, but also abound in the new drug financing projects in June.

This undoubtedly shows that the pharmaceutical industry is ushered in a new round of development, and start -up innovative pharmaceutical companies are the most obvious main forces.

However, on the other hand, it is important to note that although the total amount of financing and the maximum amount of financing in the new drug field has been showing a good increase in recent periods, the overall financing number is declining At the same time as the advantage enterprises pay more attention, they are becoming more and more cautious about the direction of investment. In this regard, companies that have been verified by a certain market are often favored. It also increased.

Tumor cancer is still the main line, and the field of gene therapy expands

Among the 19 innovative pharmaceutical companies that completed financing, at least 10 pharmaceutical companies involved in the field of tumor cancer, accounting for nearly 50%. From this, it can be seen that tumor cancer diseases are still the most watched disease field in the pharmaceutical industry in the future.

Among them, the proportion of new areas such as gene therapy and cell therapy has also increased year by year.

As an emerging treatment method nowadays, compared with the present or the future, it will become one of the directions of the key layout of the pharmaceutical industry.

For example, Pharma Biological focuses on the ADC drug development field for physical tumor treatment, and is committed to developing innovative targeted drugs through the proprietary platform to achieve targeted administration of tumors; The research and development of blood cell products has been successfully created Redocyte engineering transformation platform Redx. Through in vitro engineering technology, it produces engineering red blood cells with the treatment function of peripheral blood stem cells or adult red blood cell sources. Major diseases.

Picture source: West Lake Biological Website

If you focus on the use of circular RNA technology to develop new types of vaccines and innovative therapy, use the ring RNA in terms of expression, stability, controlling immunogenicity, and production. The development of the research and development of independent intellectual property rights has developed the method of an independent intellectual property rights and using the new crown vaccine as the starting point. It has preliminarily displayed the advantages of dosage and activation cell immunity to further expand the availability of MRNA therapy.

Today's new drug field is no longer limited to the previously emphasized new tumor drugs, but instead explores in a deeper field. Emerging areas such as gene therapy, stem cell therapy, cellular immunotherapy are fundamentally changing the entire industry, and as medicine as medicine The vanguard of the industry trend is undoubtedly the latest area of new drug investment financing. Even from the research direction of start -up companies, it can largely foresee the development direction of the industry in the next ten years.

The development of outsourcing is up again, and the prospects are available

With the continuous complexity and refinement of the industrial chain and production of new drug research and development, it has fundamentally increased the increase in the cost of research and development of new drugs. constantly improving.

During the epidemic, many pharmaceutical outsourcing industries, including Kailei and Tiger Pharmaceutical, have recently reached a high market value of listed companies. The research and development outsourcing startups are constantly financing and good all the way. It is favored by investors.

In the past one or two years, with the initial listing of a large number of innovative drugs, the business team has gradually taken shape, and its overall market space is gradually being opened, and the pharmaceutical outsourcing service market has ushered in a new wave of opportunities.

As of the formation, of the 19 innovative drug -related enterprises that completed financing in June this year, 4 have developed outsourcing enterprises. The highest financing amount of Huashen Smart Pharmaceuticals with the overall financing amount of 500 million in Series is not only becoming the monthly outsourcing industry in the month. The amount of financing is first, and it is also among the best in the innovative drug financing project in June.

In contrast, innovative pharmaceutical companies and the development outsourcing industry, the latter obviously depends on the survival of innovative pharmaceutical companies, but it is flatter and smoother than the former on the financing path. This may have many considerations in the risk and investment cost -effectiveness, but it is undeniable that at least the current research and development outsourcing industry is more like the darling of the capital market, and as long as the development of innovative drugs continues, the core of the market outsourcing industry will not be the core of the outsourcing industry. It will change, and it will become more and more to be seen in the market.

Conclusion

Overall, after experiencing the low valley since 2022, the field of pharmaceutical investment and financing has gradually begun to rebound since May, and it has been obviously confirmed in June.

The market's attitude towards the field of investment and financing in the pharmaceutical industry was released in June after experiencing long -term depression. In terms of investment logic and similar to previous years, innovation therapy and R & D outsourcing are still the most important areas of the capital market, which has changed a lot.

In addition, the field of pharmaceutical financing, as a front -end manifestation of the overall pharmaceutical industry, has a certain predictive role in the future of the pharmaceutical industry. Smart people can already predict the overall trend of the industry from the current investment field. Only wait and see.

- END -

Is there any "loading garlic" if you can't shoot garlic?

Many netizens said that shooting garlic is one of the most common scenes of Chinese cooking. The old -fashioned kitchen knife that does not support garlic shooting is the Chinese kitchen knife? Some n

Zhangjiachuan County Natural Resources Bureau carried out the promotion of grassland forbidden animal husbandry in 2022

Zhangjiachuan County Rong Media Center News In order to create a good atmosphere o...