Will Japan continue the currency easing policy?The yen has depreciated to the lowest since 24 years

Author:Cover news Time:2022.07.11

Cover Journalist Zhu Ning

On July 11, as of press time, the yen fell 0.69%to USD 1 to 1 US dollars against 137.022 yen. In the morning, the yen fell below the 137 mark to 137.12, the lowest in 1998.

On the news, according to the Caizhong News Agency reported on July 11, the governor of the Bank of Japan Kuroda Kuroda said that it is expected that the short -term and long -term policy interest rate targets will be maintained at the current or lower level; At the same time, we will continue to pay close attention to the impact of the epidemic on the economy.

The yen continues to depreciate

On July 8th, former Japanese Prime Minister Shinzo Abe was assassinated. After the news of the assassination came out, the Japanese yen, which continued to fall against the trend this year.

Since the beginning of this year, the yen has continued to depreciate against the US dollar. The yen against the yen has reached 136 yen. The yen exchange rate has reached a new low in 24 years. From this year, the depreciation of the yen years has been close to 20%. Become the weakest mainstream currency this year.

The news of the former Prime Minister Shinzo Abe's assassination stimulated the weak rebound in the weak yen. The reason behind it was the current yen continued to depreciate sharply, mainly due to the implementation of large -scale currency easing policies in the Bank of Japan, and Shinzo Abe was currently currently. The main supporter of the President of the Bank of Japan Kuroda. His accidental death also caused the market to worry about the prospects of Japan's super loose monetary policy.

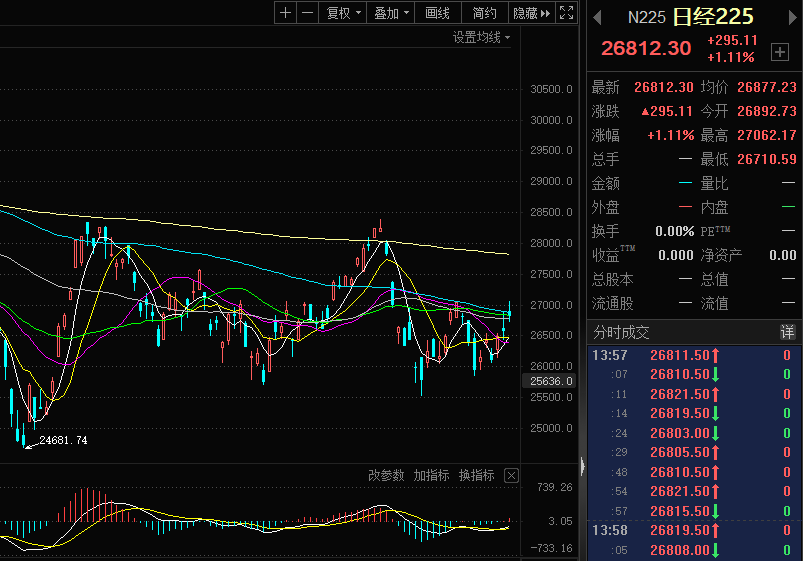

But from today's market performance, this kind of concern seems to be temporarily relieved. On July 11, the yen fell below the 137 mark in the morning against the US dollar to 137.12, the lowest in 1998. At the same time, Japanese stocks also rose sharply. The Nikkei 225 index rose more than 2%in the morning, as of the closing of 1.11%to 26812.3 points.

The reason why the Bank of Japan adheres to the loose monetary policy is the reason or to cheer for the weak domestic economy, and the sluggishness of the macroeconomic fundamentals has become the root cause of the decline of the yen. Compared with the macro data of major economies, reporters found that the US and European countries have returned to the level before the epidemic as early as the second and third quarters of last year, but the Japanese economy has not yet returned to the normal state before the epidemic.

Some analysts pointed out that the Japanese government hopes to drive the yen to depreciate by maintaining a loose monetary policy, and use the decline in the yen to create a significant export growth, the price of corporate profits, employment and wages continues to improve. Comprehensive booster of the economy.

Persist in currency easing policies

Haruhiko Kuroda, governor of the Bank of Japan, insists that Japan's low inflation means that the domestic interest rate has increased by the raising rate of the Federal Reserve -at least it is not necessary. In addition, Kuroda Dongyan reiterated on Monday that if he needs to boost the weak economy, he will not hesitate to increase monetary stimulus measures. It should be pointed out that Kuroda Dongyan's speech this morning was the first statement after the former Prime Minister Shinzo Abe's assassination.

What's more noteworthy is that he has made many statements this year for Japanese monetary policy. On March 25, Kuroda Dongyan said that "the disadvantaged yen is generally beneficial to the economy." On April 29, Kuroda Dongyan reiterated that "the devaluation of the yen is generally beneficial. The Japanese central bank promotes the devaluation of the yen. The main reason is that the Japanese economic fundamentals are weak and they have not got rid of the risk of shrinking."

On June 6, Kuroda Dongyan made it clear that "the Japanese central bank is necessary to continue to implement a positive loose monetary policy, mainly with three main reasons." First, the Japanese economy is still in the stage of recovery after the epidemic. The actual GDP has not returned to the level before the epidemic, and employment and income are still relatively weak. The second is that Japan is a commodity importer. Recently, the price of international commodities has risen, which has led to the deterioration of the deterioration of Japanese trade conditions to reduce this negative impact by continuing to implement currency easing. Third, the target of 2 % of the price stable target needs to be achieved in a sustainable and stable manner.

Yen "risk aversion currency" or unrealistic name

As the yen depreciates accelerated, the sound of buying the rebellious operation of the yen is also increasing. The simple market logic is that the increasing global economy of hedging and uncertainty, cheap risk aversion currency should be the best choice.

In this regard, Benjamin Shatil, head of the Japanese foreign exchange strategy in JP Morgan, believes that investors should be vigilant about the statement that the yen is seriously underestimated. None of these changes in the Japanese economy, these changes have fundamentally changed the transaction background of the yen. The most important changes are the changes in Japan ’s import and export balance over the years.

Benjamin Shatil said that so far, the yen is not true in risk aversion, partly because the popularity of the yen "arbitrage transaction" has declined. The so -called arbitrage transactions, that is, use the yen to provide funds for the purchase of assets with higher yields in other regions.

In the past 10 years, in the face of a large amount of low -yield to negative return, traders borrowed the scale of the yen is far lower than the level before the financial crisis. According to data from the Bank of Japan, the Japanese bank borrowed from its Tokyo subsidiary, a yen borrowed from its Tokyo subsidiary, a indicator of foreign countries' demand for Japanese yen -only 40 % of the peak before the financial crisis.

The financial crisis prompted investors to sell high -risk assets, so that the transactions with yen financing quickly closed their positions, and in early 2008, the exchange rate of the yen against the US dollar rose sharply by 19 %. Now, when the market pressure is high, people no longer rush to buy the yen closing.

CITIC Securities also stated that due to the strong US dollar, the volatility of traditional risk aversion currencies such as the yen and Swiss francs was magnified, and the risk aversion attributes under geopolitical conflict were not obvious.Since mid -2021, the US dollar index has entered an uplink channel. Before the outbreak of the Russian -Ukraine conflict on February 24, 2022, the US dollar index has been operating above the 95 mark for many months.After the outbreak of the Russian crisis, the risk aversion of the global market was heating rapidly, and the demand for hedging demand driving funds flowed to the US dollar, US debt, gold and other hedging assets.Compared with the higher US dollar, the yen and Swiss francs in traditional risk aversion have performed mediocre, and have not appreciated by a significant appreciation due to market panic.

- END -

Endem the new journey to build a new era.

Xinhua News Agency, Guiyang, June 16th. Question: The green mountains and green mountains of the bird: the villagers' happiness real estateXinhua News Agency reporters Li Fan and Luo FeiIn the midsumm...

Warm heart!The police help the masses to get back the loss of children to get the banner

Don't be afraid of heat in the hot summerThere are always these special figuresAcc...