Is there a surprise in the second quarter?Guoyuan Securities took the lead in the "transcript" for half a year, wiped out the losses in the first quarter, and the net profit fell by more than 11% year -on -year.

Author:Daily Economic News Time:2022.07.11

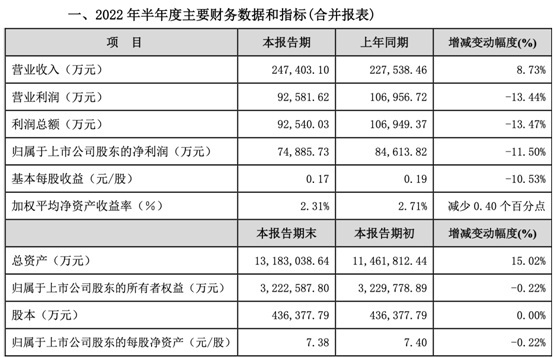

On the evening of July 11, Guoyuan Securities (SZ000728, a stock price of 5.99 yuan, and a market value of 26.14 billion yuan) released the 2022 semi -annual performance express report. The company achieved operating income of 2.474 billion yuan in the first half Yuan, a year -on -year decrease of 11.50%. This is also the first listed broker to release semi -annual performance.

Photo source: take by reporter Zhu Wanping (every information map)

Tianfeng Securities Research Report shows that the market has launched a rebound since the end of April, and it is expected that brokerage firms have improved significantly in the second quarter.

Guoyuan Securities achieved a profit in the second quarter

Guoyuan Securities' semi -annual performance Express in 2022 shows that the company's fixed income investment, investment bank underwriting and futures business have steadily increased, and securities brokerage and credit business are relatively stable. ; Realizing net profit attributable to shareholders of listed companies was 749 million yuan, a decrease of 11.50%compared with the same period last year.

In the announcement of the Guoyuan Securities, in the first half of 2022, in the face of the dual pressure of domestic economic operation downside and epidemic prevention and control, the main index of the securities market was reduced to a certain extent, and the company's equity and derivative financial instrument investment lost losses. As a result, the company lost money in the first quarter; in the second quarter, with the gradual stability of the securities market, the company actively adjusted the investment structure, strictly controlled investment risks, and reduced securities investment losses.

Data show that in the first quarter of this year, Gu Yuan Securities achieved operating income of 583 million yuan, a year -on -year decrease of 36.71%; the net loss of home mother was 120 million yuan. The first quarter performance was mainly due to the large -scale adjustment of the securities market. The company's self -operated securities investment business caused a large floating loss. In other words, Guoyuan Securities achieved a loss in the second quarter.

In addition, as of the end of June 2022, the company's total assets increased by 15.02%over the beginning of the year, mainly due to increasing the increasing investment in the scale of bond repurchase and increasing the increase in customer securities transaction settlement funds; It is mainly due to the 2021 cash dividend of 785 million yuan.

The reporter noticed that today, the Shanghai Stock Exchange disclosed that the Shanghai Stock Exchange showed that Anhui Anxin Electronic Technology Co., Ltd. passed the Shanghai Municipal Party Committee's meeting. This is the fourth order IPO passed during the year of the National Yuan Securities, which is tied for 16th in the industry. In addition, Wind data shows that since this year (according to the issuance day), the initial project of the National Yuan Securities underwriting was 1.525 billion yuan, ranking 23rd in the industry.

It is expected that the industry's second quarter performance will improve significantly from the previous quarter

In the first quarter of 2022, the performance of the listed brokers was suppressed by the sluggish market. The net profit attributable to the mother was 22.9 billion yuan, a year -on -year decrease of 46%, of which the net loss of self -operated income was 2.1 billion yuan (the net profit was 32.8 billion yuan in the same period last year). The main reason for dragging the performance of securities companies. Tianfeng Securities Research Report shows that the market has launched a rebound since the end of April, and it is expected that brokerage firms have improved significantly in the second quarter.

Regarding the various business conditions in the second quarter and the first half of the year, the non -bank research report released by China Thailand Securities on July 11 showed that the brokerage business was expected to increase slightly in the first half of the year, but the impact was limited. In terms of investment banking business: In the first half of the year, the IPO business was growing, the re -financing business structure was adjusted, and the financing of allocation was more sought after. In terms of asset management business: Non -cargo bases in the first half of the year/net value increased by 28%and 12%year -on -year, respectively, and the June of Xinfa Fund has been significantly improved in June. In terms of investment business: The stock market index bottoms to the top, and it is expected that the industry's investment income in the second quarter will recover from the previous quarter. In terms of credit business: The balance of the two melodies has declined in the same month.

Looking forward to the investment opportunities of securities firms in the second half of the year, Tianfeng Securities Non -Silver reported that with the orderly advancement of comprehensively deepening the capital market reform, it is expected that the entire market registration system will soon be implemented. The quantity is to promote the emergence of the securities firms at the molecular end; on the other hand, the current macro level is in a loose range, and the epidemic affects the impact. The expected macro -loose environment will continue, and the Beta investment logic of the clinical end of the broker sector will bring the securities sector.

Daily Economic News

- END -

Wushu International Review 丨 Be alert to the impulse to revise the constitution of the Liberal Democratic Party

Entering the Hou Abe Times, a new round of shuffle may appear in Japanese politics, but its tendency to become right and tough is especially worthy of high vigilance in surrounding neighbors.Hunan D

Zhang Xiaoquan's kitchen knife was broken again, this time because of chopped chicken legs ...

Hello everyone, I am Xiao Feiliang.The hottest brand these days is Zhang Xiaoquan....