The signal of the commodity price reduction, the economic recession?

Author:Global Times Time:2022.07.12

Zhang Sisi, a special reporter in the United States and Germany, Zhang Sisi ● Zhen Xiang

"Commodity prices are declining -but this is not worth celebrating." Swiss "New Zurich" said on the 8th that gasoline, electronic products, architectural materials, grocery: Everything has become more and more expensive. However, prices are falling in the field of raw materials, especially crude oil and copper prices have dropped sharply. The benchmark crude oil prices in the United States and the United Kingdom have fallen by more than 10%recently. Copper, nickel, and zinc on the international market have also reached the world. The biggest decline since the financial crisis. In addition, wheat prices have fallen from this year's high. The British "Financial Times" reported on the 7th that investors are reversing long bets on almost all commodities, which is the latest signs of economic recession worrying about the financial market.

Metal industry raw materials are lower

"This is the upcoming signal of recession?" The German "Economic Weekly" reported on the 9th that copper, aluminum, 钯, and platinum, the fear of economic recession, made metal prices the biggest decline since 2008. "Copper prices are traditionally regarded as a barometer of the global economy, and now it has fallen nearly 19%in just one month." Daniel Brisman, a commodity analyst of commercial banks in Germany, said: "The price of copper has fallen sharply, which can be attributed to the market. Participants worry about economic recession. "

The German "Focus" Weekly reported on the 6th that the copper price of the London Metal Exchange (LME) on the same day was about $ 8,000 per ton, touching the lowest level since 2021. Other industrial metals also dived in June. The decline in copper prices has been surpassed by 21%and 23%of zinc and nickels in the same period. The price of aluminum and platinum fell about 13%. Calculated throughout the second quarter, the price decline of the most important industrial metal in the LME basket is greater than at any time since the 2008 financial crisis.

Bloomberg analysis pointed out that at present, the lack of the news of the bull market in metal commodities is promoted. The European and American economy is facing the risk of recession. High inflation may bring further tightening monetary policy. influences.

Financial media "Baron Weekly" analyzed that as an important industrial metal, copper prices are regarded as economic vane. Recently, the weakening of copper prices reflects the market's concerns about the slowdown of the global economy. Some analysts also pointed out that due to the expectations of potential economic recession, the market demand of industrial metals is destroyed, which is the key to the current decline of metal prices such as copper.

"An explanation of the collective decline of commodity prices is that concerns about economic recession are formed." The "Economist" website analyzed on July 8th that according to this view, interest rate rise is cooling down the new house market, suppressing copper and copper and copper and copper and copper and copper and copper and copper and copper The demand for building materials such as wood to reduce the expenditure of clothing, home appliances and cars, which in turn will damage all products from aluminum to zinc.

The SENTIX economic index in July shows that the confidence of investor in 19 countries in the euro zone has fallen to the lowest level since May 2020, indicating the decline of "inevitable". More and more people are worried that the economy will not grow as strong as the initial assumption, and even in many cases, it will even fall into decline. Analysts believe that the risk of US economic recession this year is about 15%to 40%.

German media believe that in the worst case, the metal market may be provided for many years. If the United States, Europe and China have a weak economic growth or decline in economic economic growth, a 10%surplus will appear for at least two years. At present, the Chinese government has counterattacked to the economic stimulus plan for infrastructure to invest a large amount of investment.

Energy prices are linked to economic prospects

It is expected that the US economic recession expects large commodities such as oil. According to the "American" website on the 7th, the crude oil prices plummeted in the first week of July due to concerns about the coming economic recession may weaken demand.

It is reported that US crude oil prices have fallen below $ 100 per barrel for the first time since May. As the U.S. benchmark, the price of the Sedics -intermediate base crude oil (WTI) once fell to $ 99.50 per barrel. The Brent crude oil in Beihai, Britain for the first time since April last week, fell below $ 100 per barrel.

The Qatar Peninsula TV said that the financial market was turbulent due to concerns about the potential economic recession, and international oil prices fluctuated recently. As the central banks including the Federal Reserve raised interest rates to suppress inflation, although the spot crude oil market continued to show vitality, investors have been the consequences of digestion and economic slowdown. It is reported that concerns about economic recession continues to pressure the market. According to some preliminary estimates, from April to June this year, the United States may have economic recession. This will be the second consecutive quarter of recession in the country, and this is also considered a technical recession.

James Knightli, chief international economist in the European Bank of Europe, said that the US economy has "preliminary" slowing signs. He pointed out that consumer confidence has declined, and enterprises fill the vacancy of job vacancies. He said, "There are some obvious signs that the best growth time has passed."

The opinions of Wall Street institutions are inconsistent with the trend of energy prices. In the latest report, Citi Bank analyst pointed out that if the US economy has fallen into a decline, market demand will be severely impacted, and international oil prices may fall to $ 65 per barrel at the end of 2022, and fall to 45 per barrel after a year later. Dollar.

Goldman Sachs and Morgan Chase continued to sing more oil prices. Goldman Sachs believes that oil prices have plummeted due to economic recession. Although the plunge is due to concerns about global economic recession and technical selling, the market fundamentals have almost no change. Morgan Chase emphasized the impact of political situation on energy prices and made a prediction of "international oil prices may rise to $ 380/barrel". JP Morgan analysts believe that if the US and European sanctions have prompted Russia to implement retaliatory production, global oil prices may reach $ 380 per barrel.

Euro, gold prices are falling

"The operation of financial speculators is also an important reason for the fluctuation of commodity price fluctuations." The "Economist" website believes that concerns about the economy is not the only force to reduce the price of commodity commodities. Industry experts said that most of the funds that escaped the commodities were financial speculators. According to the data of JP Morgan Chase, as of July 1st, about $ 16 billion out of the commodity futures market, which made the total amount of $ 145 billion in a record so far.

"Japan Economic News" states that the global market is shaken from April to June due to currency tightening and economic depression. Global currency loose and plenty of funds caused by the epidemic began to flow backwards. The number of assets that rose from April to June in the world are US dollars. The US dollar appreciated 6.5 % in the last 3 months. The long -term interest rates brought about by the US interest rate hikes have emerged. At the same time, the US dollar as axis currency attracts investors who pursue security assets.

"The parity of the US dollar and the euro is imminent." The German "Business Daily" pointed out that on July 8th, the exchange rate of the euro to the US dollar reached 1.0072, the lowest level since 2002. A year ago, the exchange rate of the euro to the US dollar was still higher than 1.20. Ulric Stephen, chief investment strategist of Deutsche Banking companies and private customers, said the US dollar is the "shelter" of investors. Due to the fierce price of the commodity and stock market, the demand for the US dollar is generally strong.

At the same time, gold that is easy to undertake risk aversion also seems weak, and gold prices fall by 7.5 % from April to June. In the interest rate hike cycle, the advantage of holding the gold that does not generate interest has weakened. Kitako Koichiro, the representative of Japan's Market Strategy Institute, said, "In view of the plunge of stock prices and Bitcoin, investors were forced to add margin to gold."

"The price of gold fell to the low point of the year." The German "Manager Magazine" reported on the 7th that the price of gold was $ 1765 per gold ounce, which was at the lowest level since December 2021. Due to the uncertainty of the financial market, investors are increasingly inclined to the dollar. This is under pressure on the price of gold. ▲

- END -

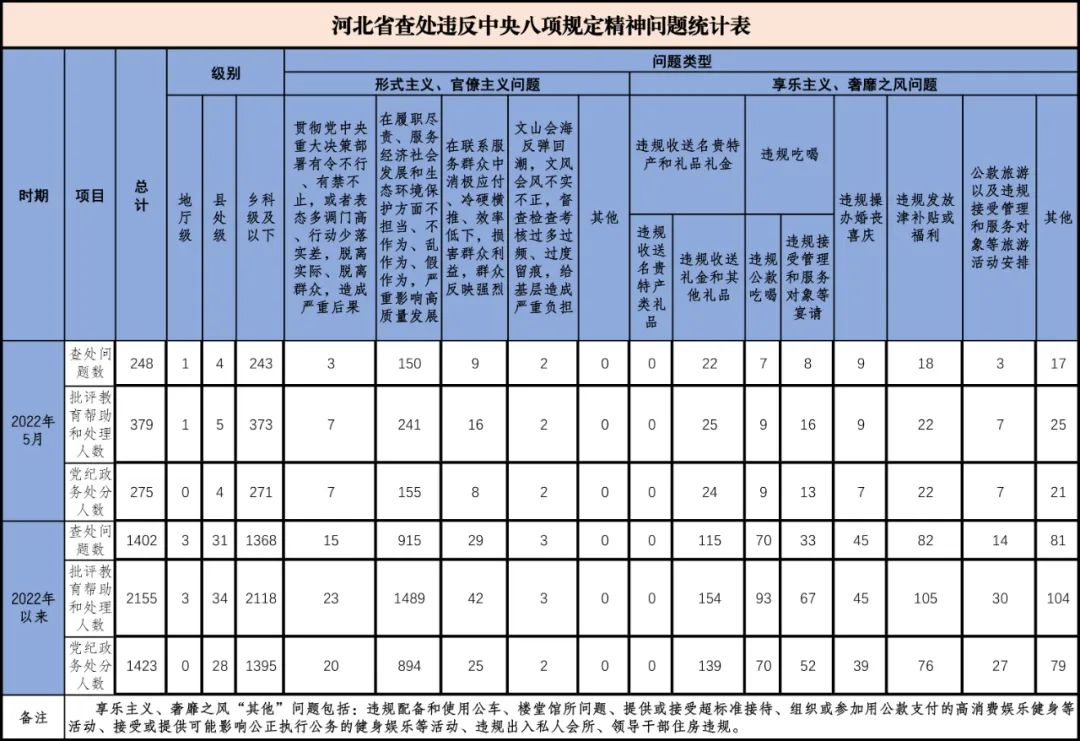

Hebei Province investigated and dealt with 248 mental issues that violate the eight central regulations of the Central Committee

In May 2022, disciplinary inspection and supervision organs at all levels at Hebei...

Mountain Pen Water is a new village for ink

The beautiful scenery of Yangjiatai Village. Shunping County Photo ConferenceAlong...