Ant wealth emergency rumors!

Author:Hubei Daily Time:2022.07.12

Recently, some netizens said on social platforms that Shengjing Bank (HK02066, which had previously collaborated with Alipay, with a stock price of HK $ 6 and a market value of HK $ 52.78 billion).

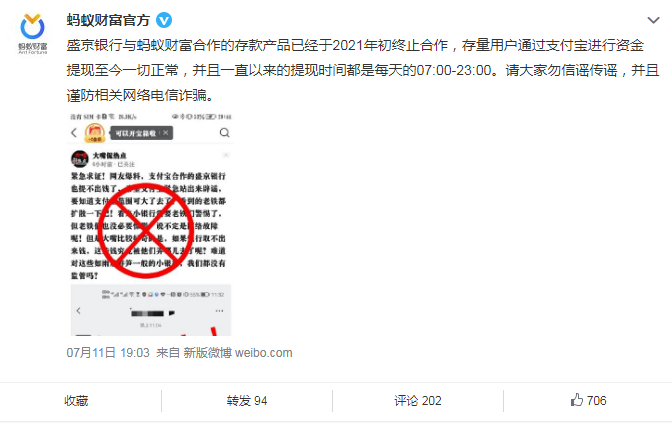

On July 11, the Ant wealth response corresponding to the Alipay platform: The deposit products that Shengjing Bank and Ant wealth cooperated had terminated cooperation in early 2021. The existing users have made all normal with the withdrawal of funds through Alipay. 07: 00-23: 00. Please do not believe in rumors and beware of relevant online telecommunications fraud.

Shengjing Bank response: The withdrawal time has a fixed time

Shengjing Bank exclusively replied to the First Financial and Economics: "According to the requirements of regulatory 9, our bank has stopped selling deposit products through Alipay platforms, and only retains services to existing customers through the Alipay platform, purchasing details, and advance withdrawal in advance; According to the Alipay platform rules, the related service operation time is 07: 00-23: 00 Beijing time daily. The current service is normal. "

It is understood that on January 15, 2021, the China Banking Regulatory Commission and the Central Bank issued the "Notice on Regulating Commercial Banks to Carry out Personal deposit business related matters through the Internet" (issued by Banking Insurance Supervision [2021] No. 9, hereinafter referred to as the "Notice"), hereinafter referred to as the "Notice"). It is clearly stated that commercial banks must not carry out regular deposits and settlement of deposit business through non -self -operated network platforms, including but not limited to providing marketing publicity, product display, information transmission, purchase of entrance, interest subsidies, etc. from non -self -operated network platforms.

As a result, a third -party platform began to remove deposit products.

Shengjing Bank's net profit decline last year

In order to return the funds, Evergrande was forced to sell a lot of high -quality assets, and Shengjing Bank was one of them.

The official website of Shengjing Bank shows that the bank is headquartered in Shenyang City, Liaoning Province. It was formerly a commercial bank in Shenyang City. In February 2007, it was approved by the China Banking Regulatory Commission to change its name to Shengjing Bank. It is a strong headquarters bank in Northeast China. On December 29, 2014, it was successfully listed on the main board of the Hong Kong Stock Exchange (shares code: 02066).

At present, Shengjing Bank has set up 18 branches in Shenyang, Beijing, Shanghai, Tianjin, Changchun, Dalian and other cities. Financial Co., Ltd. and 6 village banks have more than 200 business institutions.

In 2021, Shenyang's state -owned assets increased the holdings of Shengjing Bank twice and spent nearly 11 billion, replacing Evergrande as the largest shareholder of Shengjing Bank.

On September 30, 2021, the official website of Shengjing Bank issued the "Shenyang State -owned Assets Exchange Become the largest shareholder of Shengjing Bank" stated: "On September 29, Shenyang Shengjing Financial Holdings Group Co., Ltd. was transferred to Evergrande Group (Nanchang) 19.93%of our banks held by the Co., Ltd., becoming the largest shareholder of our bank. Following August 17th, the company's enterprises affiliated to spend 1 billion yuan to increase our shareholding shares, Shenyang Shengjing Gold Control Group Co., Ltd. The company spent 9.993 billion yuan, and once again increased its holdings of our bank. After this increase, the total shareholding ratio of state -owned assets in Shenyang City reached 29.54%. "

According to the 2021 report, as of December 31, 2021, the total assets of Shengjing Bank were RMB 1006.126 billion, the total amount of loans and pads was 586.033 billion yuan, the total amount of deposits was 737.033 billion yuan, and the operating income was 15.467 billion yuan. The profit was 402 million yuan, a year -on -year decrease of 66.6%. The non -performing loan rate was 3.28%, and the coverage rate was 130.87%.

Source: China Fund News, First Finance, 21st Century Economic Herald, Shengjing Bank's official website

- END -

China Earthquake Network officially determined: At 04:21 on June 24th, a 4.2 earthquake occurred in Hualien County, Hualien, Taiwan (23.59 degrees north latitude, 121.50 degrees east longitude).

China Earthquake Network officially determined: At 04:21 on June 24th, a 4.2 earthquake occurred in Hualien County, Hualien, Taiwan (23.59 degrees north latitude, 121.50 degrees east longitude), and t

Ten Hua Police: Forging Iron Army Professionalization | Strengthening Information Empower to Create Smart Police

In order to comprehensively improve the standardization and institutionalization o...