Monthly observation report of Chinese private equity funds | In June, private equity fund filing recovers, "public and private" has intensified, and Jiangsu's filing of private equity broke out!

Author:Daily Economic News Time:2022.07.12

Every reporter Li Peipei every editor Zhao Yun

The filing of private equity funds ushered in rapid recovery in June.

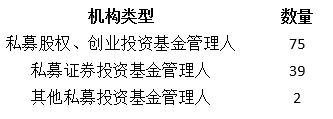

According to the new fund preparations announced by the China Securities Investment Fund Industry Association (hereinafter referred to as the China Foundation Association), the "Daily Economic News" statistics found that in June, 116 private equity funds completed in the China Foundation Association, and 71 in May 71 in May The home increased by 63.38%compared to. Among them, the majority of private equity and entrepreneurial investment fund managers accounted for 75, with 39 private equity investment fund managers, and 2 other private equity fund managers. Statistics of private equity networks also show that the number of filed for private equity investment funds in June increased by 25%from May, and the recovery trend was obvious.

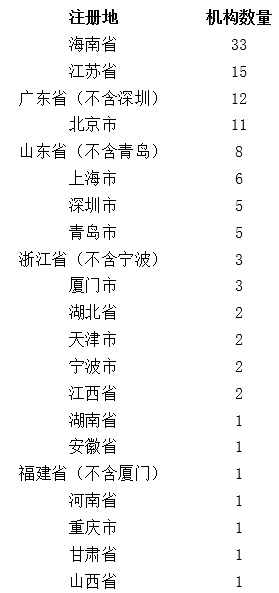

In terms of the choice of registration, Hainan still occupies an absolute leading advantage, ranking first with the number of newly recorded private equity in 33 newly recorded private equity. However, it is worth noting that the number of private equity fund managers filled in Jiangsu in June appeared in a small explosion. A total of 15 private placements completed the record, surpassing Guangdong (excluding Shenzhen), Beijing, Shanghai, etc. The jurisdiction rushes to the second place in all registered places.

In addition, after many public offerings "Ben Private" in May, the tide of "Public Ben Private" in June continued. Several public offerings joined private equity funds, among them, and some of the well -known people who have worked on Wall Street have set off a wave of climax of "public and private". In addition, foreign private equity was also completed in June.

In addition, the China -Foundation Association canceled the registration of 68 private equity funds in two batches in June. Among them, the 29th batch of publicity periods were lost for three months and did not take the initiative to contact the association. There were 38 private equity fund managers registered; at the end of June, 30 private equity was canceled by the administrator's registration due to the expiry of the special legal opinion.

In June, private equity filing recovered, and Jiangsu broke out

According to the statistics of private equity row, securities private equity managers have been filing a total of 11,900 private equity funds since this year. Although the decline declined significantly compared with the 304,000 in the same period last year, with the gradual restoration of the domestic economy, the market confidence has also improved significantly, especially the rhythm of the war of warming in the late second quarter. It increased by 25%in May.

According to the filing information of the China Foundation Association, the record of the private equity fund manager in June this year has recovered a relatively obvious recovery. Compared with 71 in May, a total of 116 private placements were recorded in June, and the number increased significantly. Each reporter made a comprehensive statistics on this newly added fund.

First of all, from the perspective of institutional types, 75 of these 116 private equity are private equity and entrepreneurial investment fund managers, and the main force of the new filing fund in June. 39 are managers of private equity investment funds, and 2 are other private equity fund managers.

It is worth mentioning that on June 24, a private placement called "Ruilian Private Equity Fund Management (Hainan) Co., Ltd." completed the record in the China -foundation Association. This manager established in February this year and 5 million yuan in capital is a wholly foreign -owned enterprise, wholly -owned Holdings of Swiss United Asset Management Asia Co., Ltd. The registered place and the office are in Hainan. The business type is pilot agencies such as QDLP. It is another foreign private placement that has completed the filing in China. The successful record of Ruilian Private Equity also means that more than 40 foreign private equity has now entered the Chinese market.

From the perspective of fund registration, Hainan is still the most newly recorded area. Throughout June, a total of 33 private equity funds chose to register in Hainan, accounting for 28.45%of the newly recorded private equity. According to the statistics of each reporter, the number of newly registered funds registered in Hainan has reached 155 since this year, which has exceeded the total number of private equity fund managers in many regions.

Another noteworthy is that the number of funds filled in Jiangsu Province in June also increased significantly, reaching 15, which exceeded the previously ranked Guangdong Province (excluding Shenzhen), Beijing, Shanghai and other jurisdictions. It can be said that a small universe broke out. In addition, the top five of the number of filing agencies are Guangdong (excluding Shenzhen), Beijing and Shandong (excluding Qingdao), including 12, 11 and 8 respectively.

Look at the registered capital of these new filing funds. The number of 50 to 10 million yuan is still the largest, reaching 99, of which 10 million yuan is mainly, reaching 86, accounting for 75.44%of the newly recorded private equity in June; followed by the registered capital in the range of 1001 to 50 million yuan, There are 12 institutions, 3 and 2 of 5001 to 100 million, and less than 5 million yuan. Similar to the situation in May, the registered capital of private equity institutions in June did not exceed 100 million yuan, and the highest was 3 100 million yuan institutions.

Finally, look at the newly filed private equity in June. Compared with the newly filled private placement in May, there are no funds in charge. The situation in June is more diversified. Although a large number of new institutions still have no funds in charge, some have already managed multiple funds. For example, Guangdong Xinzhang Private Fund Management Co., Ltd., which was established in October last year and completed in early June this year, has eight funds at the management of the management Co., Ltd. Another Zhilin Ren and Private Equity Fund Management (Shandong) Co., Ltd. also have three funds in the management fund. Zhang Xinfeng, the legal representative and general manager of the agency, previously served as chief analyst at CITIC Securities. In 2013 Qianhe Capital engaged in research and investment in the TMT industry, and later worked in other private equity. In 2021, he and two other natural persons jointly invested in the establishment of Zhilin Ren and Private Equity. "Gongben and Private" intensified, and the enthusiasm of industrial capital is still rising

Following a number of public offerings in May, the "Public Penalty" in June set off a wave of climax. Many public offerings and fund managers joined forces to start a business and set up their own private equity funds.

On June 2nd, a private placement named Guangdong Dongsheng Private Equity Investment Fund Management Co., Ltd. (hereinafter referred to as Dongsheng Private Equity) completed the record in the China Foundation Association. The fund was established in June last year, with a registered capital of 5 million yuan and 6 full -time employees.

The establishment of Dongsheng Private Equity has received widespread attention from the industry, mainly due to the executive team behind it. The filing information shows that Cao Xiang, the legal representative and general manager of Dongsheng Private Equity, has many years of experience in the asset management industry. In August 2010, he entered the South Stock Exchange Futures to serve as researchers for the Ministry of Financial Engineering. Researcher; In August 2015, he joined the Western Profit Fund and became a public fund manager. He had been in charge of many funds such as the Western Profit Fund and the selection of the Western Profit Growth Fund. Entrepreneurship and participated in the establishment of Dongsheng Private Equity in 2021.

Yanzhou (Hainan) Private Equity Fund Management Co., Ltd. (hereinafter referred to as Yanzhou Private Equity), which has completed the filing with Dongsheng Private Equity, has attracted much attention because its senior management teams are senior public offers.

The filing information shows that Yanzhou Private Equity was established in August last year and completed the filing in early June this year. Registered in Sanya City, Hainan Province, the office address is located in Shenzhen, Guangdong Province, with a registered capital of 10 million yuan and a total of 6 full -time employees.

Chen Zefeng, the legal representative and general manager of the company, is an asset management veteran with more than ten years of employment. He entered the public offering industry at the end of 2009 and once served as the channel manager of Haifu Tong Fund; in 2012, he joined the ICBC Credit Suisse Fund as the deputy director of the marketing management department. After the public offering industry, Chen Zefeng "Ben Private" joined the well -known quantitative private equity Ruitian Investment and served as senior vice president; in 2021, he participated in the establishment of Yanzhou Private Equity.

Another executive of Yanzhou Private Equity, deputy general manager Lin Fengyuan has also had an employment experience in the public offering industry. In 2015, he joined Huaxia Fund as the investment manager of the Investment Department, and then left in October 2017; in 2018, he entered Golden Monkey Securities Co., Ltd. (Hong Kong) as an investment director. Chief Investment Officer.

In addition, on June 20, a private placement called "Hainan found the Private Equity Fund Management Center (Limited Partnership)" (hereinafter referred to as Hainan found) was completed. Public information shows that this agency was established in March this year and a registered capital of 10 million yuan. Although there are only 3 full -time employees, two of them are relatively senior public offers.

The filing information shows that Jia Xu, the actual controller and general manager found in Hainan, joined the Pengyang Fund in 2017, served as the director of mutual gold and the three parties in the Retail Direct Sales Department, and later served as the Director of Mutual Gold and the Three -Party Business Director of the Marketing Department. In July 2021, after leaving Pengyang Fund, Jia Xu successively launched and set up Hainan Sending Investment Co., Ltd. and Hainan Sending Enterprise Management Center (Limited Partnership), and these two companies are investors found in Hainan.

Another executive of the company, deputy general manager and fund manager Jiang Shaokun, is an out -of -the -box quantitative investment veteran. He has worked on Wall Street for more than ten years. As an employee of the former Lehman brothers, he experienced the turmoil of Lehman's bankruptcy and Wall Street in 2008. After returning to China, Jiang Shaokun joined Qianhai Open Source in 2015 and served as director of the investment department and FOF Investment Department. In June 2017, he entered Qianhai Kaiyuan Overseas Related Enterprise No. 1 Qianhai Financial Co., Ltd. as the managing director, joint investment director, and Responsible Officer on the 4th and 9th licenses. In 2018, he officially joined the Pengyang Fund as the director of quantitative and multi -asset strategy. After leaving the public offering industry, Jiang Shaokun had been an investment portist in a systematic global macro/multiple asset category in the giant investment. In April this year, he officially served as the deputy general manager and fund manager found in Hainan.

In addition to the tide of fiery "Ben Private", industrial capital's interest in the private equity industry has also continued to rise.

On June 10, the private equity subsidiary of the listed company and the medical AI company medical beyond technology completed the filing.

According to the China -foundation Evolutionary Information, Yuduyun Private Equity Fund Management (Beijing) Partnership (limited partnership, hereinafter referred to as Yuduyun Fund) was established in March this year, and the record was completed on June 10th. The registered capital was 10 million yuan. 5-people. The actual controller of the private equity fund (Yudu Technology Co., Ltd.), the actual controller of the private equity fund, is Liang Yupeng, the former investment director of Tencent's investment partners (appointment representatives), and partners. Multiple rounds of financing. After leaving Tencent, Liang Yupeng participated in the establishment of Hainan Ruixin Medical and served as the chairman. In September 2019, he joined the Shanghai Yizhi Medical Strategy Investment Department as senior vice president. The company (hereinafter referred to as Yuda Cloud Consultation) and the legal representative of Beijing Pengdu Management Consulting Co., Ltd..

Since the beginning of this year, the situation of biomedical giants has formed an investment team or even the establishment of a private equity company company, and other industrial giants are also accelerating the layout of private equity business.

On June 24th, a private equity manager named Hechuang Digital Private Equity Fund Management (Beijing) Co., Ltd. (hereinafter referred to as Hechuang Digital Private Equity) completed the record in the China -foundation Association. The private placement was established in May this year, with a registered capital of 100 million yuan and 7 full -time employees. More importantly, the actual controller behind Heturaga's digital private equity is China Mobile's China Mobile Capital Holdings Co., Ltd..

According to the filing information of the China Foundation Association, there are two private equity managers who are currently controlled by China -China Capital Capital, respectively, which are the China Express Equity Fund Management Co., Ltd. and the Creation Digital Private Equity of this filing. The investors of the latter include medium -migrant capital (23%of the subscription ratio), Chengtong Fund (23%), Shenzhen Dingyihua Heng Investment Consultant Co., Ltd. (18%), Zhuhai Hengrong Xintong Management Consulting Co., Ltd. ( 18%) Investment with Shanghai Yinyuan (18%).

In fact, since this year, large enterprises and listed companies have set up industrial investment funds, and the integration of industries and capital has become the norm. This approach can not only reshape the industrial structure, but also bring financial performance to a certain extent, and is becoming the direction of more and more industrial giants.

Registration of 68 private equity managers registered, and well -known investment institutions were also punished

On June 2 and June 24, the China -Foundation Association continuously announced two batch of lists of registered people's registration of private equity fund managers, involving a total of 68 institutions.

Among them, 38 institutions such as Beijing Fangfang Global Investment have been canceled for the registration of private equity fund managers for the reaching three months of the publicity period and did not actively contact the association and provided the cancellation of effective proof materials. Thirty private placements such as Beijing Jinyao Capital had abnormal business situations and failed to submit special legal opinions that comply with the prescribed regulations within 3 months after the written notice was issued, which was canceled and registered. Earlier, many private equity in these lists had issued problems such as overdue private equity products that could not be redeemed and punished by regulatory punishment.

In the monthly report of the private equity fund manager of the China Foundation and the monthly report of the product filing, in May 2022, the association stopped applying for the registration of private fund managers who handled 10 related institutions and canceled 178 private equity fund managers. According to the incomplete statistics of each reporter, the number of private equity managers, including active cancellation and association cancellation, throughout June.

In addition, the China -Foundation Association also issued a punishment for some well -known institutions in June. On June 8th, the China -Foundation Association announced a decision of disciplinary sanctions. The target was the industry's well -known institution of Shanghai Xiaocun Asset Management Co., Ltd. (hereinafter referred to as Xiaocun Capital).

The decision of disciplinary sanctions shows that there are many illegal facts such as small village capital have not fully revealed relevant risks, did not fully fulfill their prudential obligations, have not fulfilled the filing procedures for private equity funds, and have not updated the registration information in time. The Foundation requests it to make corrections within a time limit and suspend the acceptance of its private equity products for six months.

According to the statistics of each reporter, since this year, the Central Association of Foundation has announced the disciplinary decision of 14 private equity institutions and 21 practitioners, showing the continuous and determination of relevant departments to supervise the industry.

Daily Economic News

- END -

Hunan Provincial Market Supervision Bureau: Strengthening the supervision of new types of unfair competition behavior

Recently, the Hunan Provincial Market Supervision Bureau issued the Guiding Opinions on Further Strengthening Anti -Unfair Competition Law Enforcement Work (hereinafter referred to as the Guidance

Wendengying Town, Wendeng District, Shanghai Haoting Community: "Party Construction 123" comprehensively improves the effectiveness of governance

In order to strengthen the grass -roots party building work of the urban community...