"Fengkou Research Report · Company" has a 8x jump in the future!"Mining+Infrastructure" has led the whole country!The supply -side reform of the electronic detonator+the acquisition of the acquisition will be put into production in the+LNG project, and the strongest logic of the

Author:Federation Time:2022.07.12

The performance is expected to achieve an 8 -fold jump! This company welcomes "the supply -side reform of the electronic detonator+the acquisition of the acquisition and landing on the+LNG project". Analysts said that they had the strongest logic of the industry. Significantly thickened the company's profits. If the reorganization advances, the process has entered the countdown stage.

Company essence:

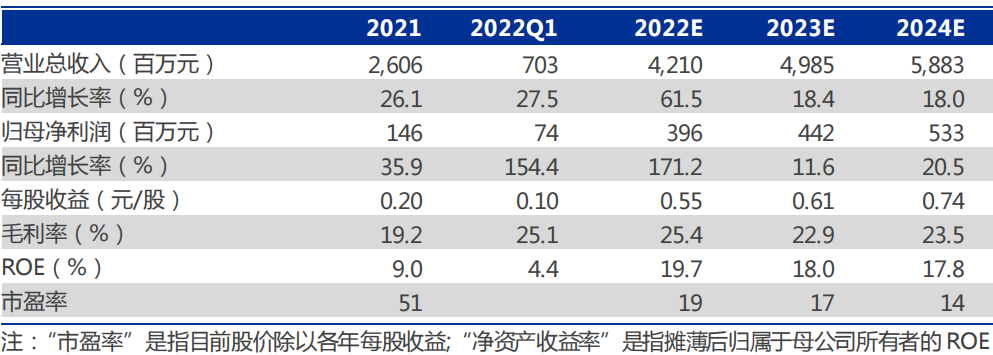

① Dai Mingyu, Shen Wanhongyuan Securities, is optimistic that the company is the leader of Xinjiang people. The state requires the stop production of other industrial thunder tubes outside the industrial digital electronic detonator by the end of June 2022. The industry ushered in a large -scale supply -side reform;

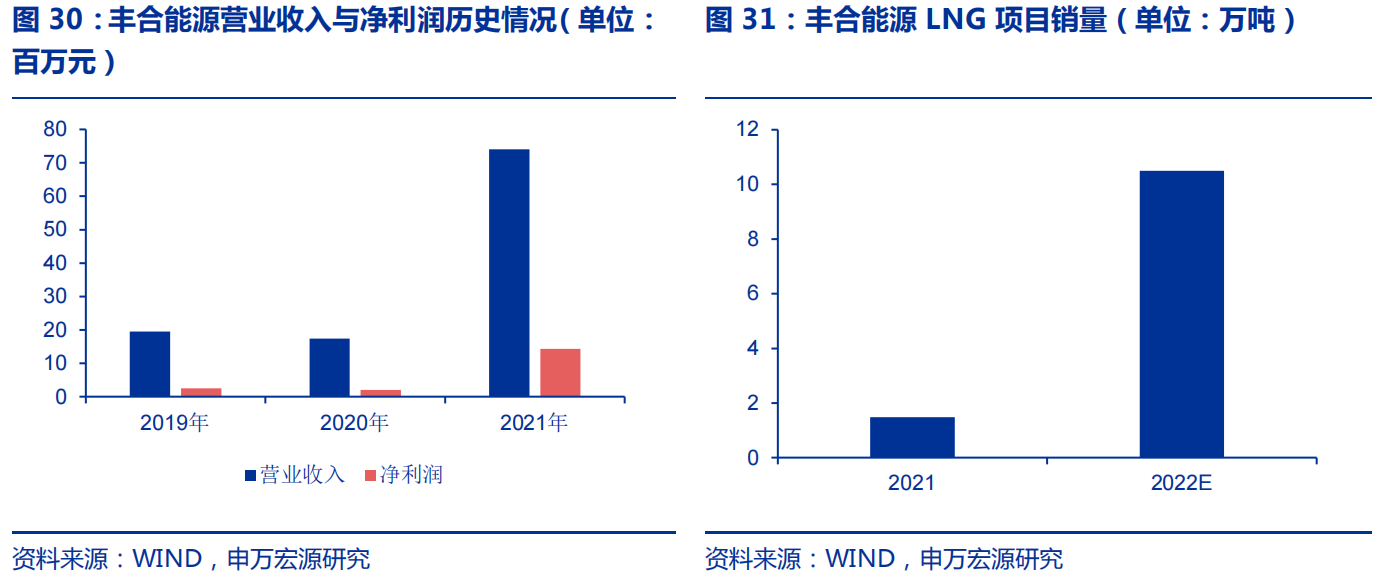

② In November 2021, the company's LNG (liquefied natural gas) project was officially put into production, and the scale of production capacity theory reached 500,000 tons. As of the end of May 2022, the company had produced a total of 4.48 million tons of LNG and transported natural gas by 197 million cubic meters. 125 million yuan;

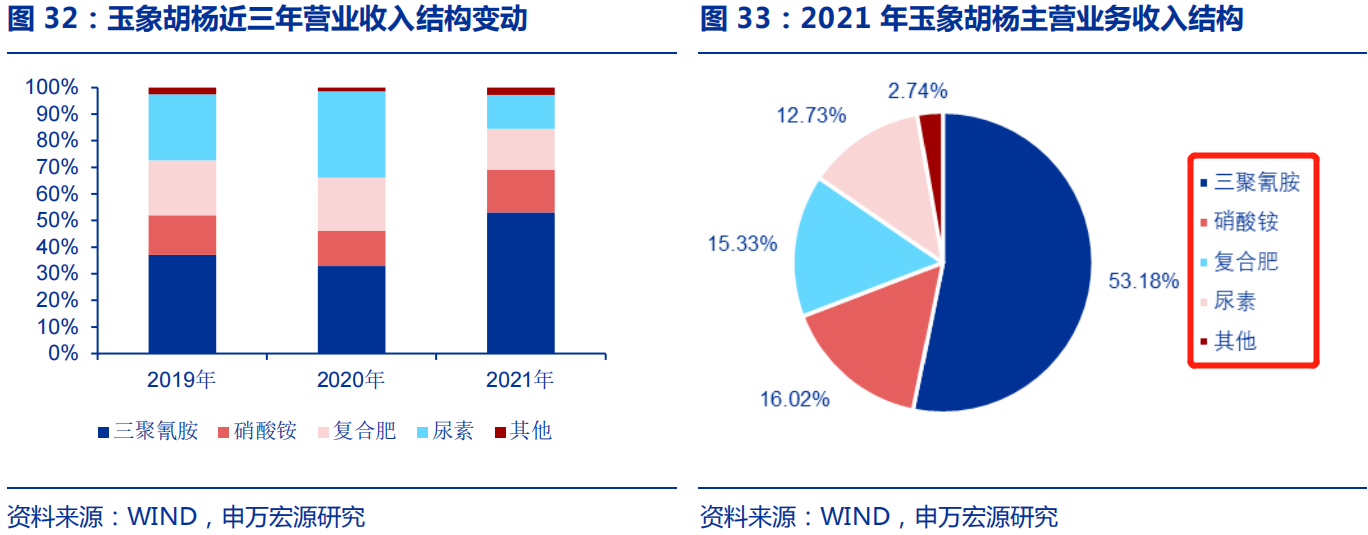

③ In January 2022, the company announced that it was planned to acquire 100.00%stake in Yuxiang Populus Popularity. The target realized a net profit of 750 million yuan last year, and the acquisition price was only 2.8 times. The landing has entered the countdown stage;

④ Dai Mingyu calculated that if we consider reorganization, the company's net profit returned from 2022-2024 is expected to be 12.01/13.28/1.507 billion yuan, respectively, and the reasonable valuation of 2022 is 16.7 billion yuan, which is 10.9 billion yuan from the closing market value on July 11th. 53%repair space;

⑤ Risk reminder: Xinjiang infrastructure investment growth is lower than expected, reorganization is not as good as expected.

The people's explosion is the industry that is currently undergoing supply -side reform. The β logic advantage of the track is significant, and the characteristics of the industry have led to the "land of land" in the supply and demand pattern, laying the foundation for performance flexibility.

Shen Wanhongyuan Securities Dai Mingyu's latest excavation of Xinjiang people's explosion leader Xuefeng Technology (603227). The company has the strongest α Xinjiang. The two lower reaches of "mine+infrastructure" will lead the country, and it is expected to resonate the price and price.

In addition, the company's LNG project will be put into production at the end of last year. It is expected that the company will achieve 120,000 tons of sales throughout the year, which is expected to significantly increase the annual profit. The implicit profit will not be less than the company's overall performance in 2021 even if considering a small number of shareholders' equity deductions.

On the other hand, the company intends to acquire the target Jade Elephant Populus Populus Popularity has been approved by the SASAC and was accepted by the Securities Regulatory Commission. The target was to achieve a net profit of 750 million yuan last year. Progressive, it is expected to significantly thicken the company EPS.

Dai Mingyu calculated that if we consider reorganization, the company's net profit returned from 2022-2024 is expected to be 12.01/13.28/1.507 billion yuan, respectively, corresponding to the reasonable valuation of 16.7 billion yuan in 2022, which is 53 from the closing market value of 10.9 billion yuan on July 11th. %Repair space.

"Energy crisis+infrastructure forces" laid the strongest α, and the main force of supply -side reforms were elastic and elastic.

The company takes the civil explosion business as the cornerstone, based on regional advantages, and actively completes the integration of the industrial chain.

① Carbon neutralization has caused domestic coal to intensify, and the supply of production capacity needs to be released urgently. Xinjiang expects that the production capacity will increase by more than 60%during the "14th Five -Year Plan" period.

② The "Fourteenth Five -Year Plan" of Xinjiang Autonomous Region and the "Fourteenth Five -Year Plan" of the Xinjiang Production and Construction Corps have proposed the overall planning of traditional and new infrastructure construction. It

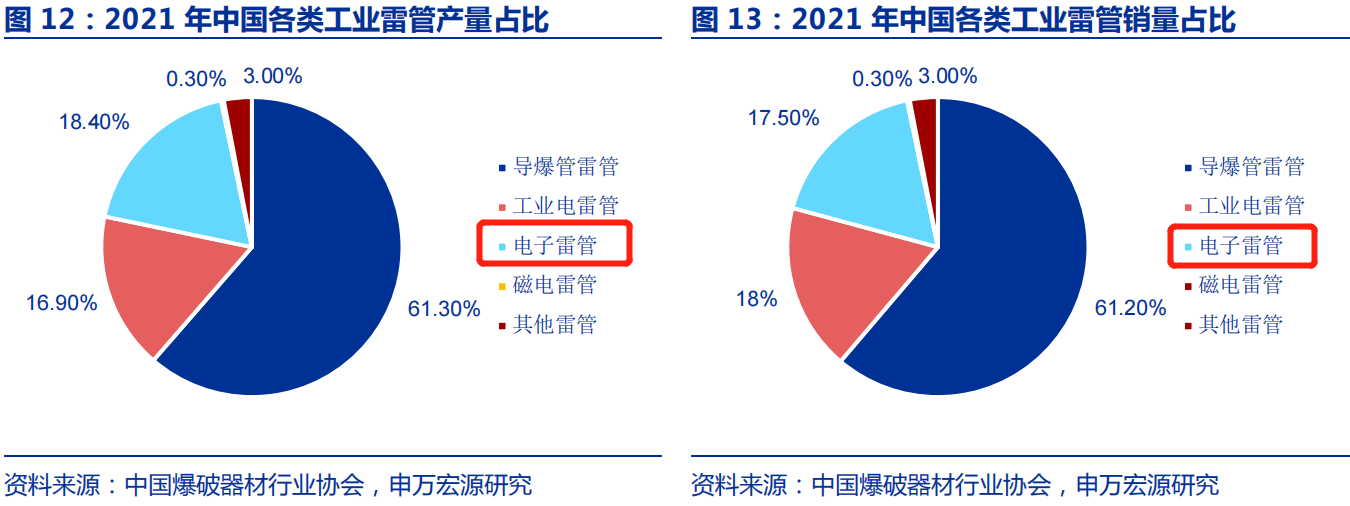

③ State request to stop production before the end of June 2022, and stop selling other industrial thorn tubes except industrial digital electronic detonators by the end of August. The industry has ushered in a large -scale supply -side reform. The company has basically completed the replacement task. Essence

Dai Mingyu believes that the supply-side reform is one of the strongest logic of the investment side of the building materials industry. Taking the cement industry as an example, since the setting of supply-side reform in 2015, the index increased by more than doubled in 2016-2017, and the core stock increase increased. More than 2 times. The people's explosion is a rare track in the infrastructure industry chain that has the logic of supply -side reform. If the impact of policy landing on the industry's supply and demand pattern can be called disruptive.

LNG put into production+state -owned enterprise reform dividends "will significantly increase the company's profits

As the company's "Chemical+Energy" two -wheel drive prototype has begun to appear, this year will become the first year of the company's new growth, which is expected to exceed market expectations.

In November 2021, the first phase of the company's LNG project was officially put into production, and the scale of production capacity reached 500,000 tons. Positioning can provide reliable gas sources for enterprises such as urban residents, LNG gas stations, and "coal -to -gas". As of the end of May 2022, the enterprise had produced a total of 4.448 million tons of LNG, transporting natural gas by 197 million cubic meters, and a profit of more than 125 million yuan. Compared with the production of 11,000 tons of LNG per month compared to last year, an increase of 3,000 tons.

On January 18, 2022, the company announced that it was planned to acquire shareholders held by shareholders such as Xinjiang Agriculture and Animal Husbandry Investment. The production and sales of nitro compound fertilizers, ammonium nitrate, synthetic ammonia, urea and other products is a leading enterprise in Northwest China.

As of now, the reorganization plan has been approved by the State -owned Assets Commission and has received the announcement of the "Application Form for Administrative Licensing of the China Securities Regulatory Commission". According to traditional experience, if the reorganization advances, the process has entered the countdown stage.

- END -

Eating or practicing is not wrong!Guangzhou Zoo "Seven Tsai" was photographed in the water to drink milk scenes

Is the way to breastfeed hippocampus very special? On June 28, the little hippo...

Tomorrow | Learn to interpret the business logic of the Internet through the financial report

Financial report is the only authoritative data to understand the business model.C...