Musk responded to Twitter: I did n’t let me buy it at the beginning, so I ca n’t buy it now, so let ’s see it on the court

Author:Quantum Time:2022.07.12

Wanbo from the quantity of the Temple of the Temple | Public Account QBITAI

A set of emoticons in Musk's late night was full of taunting.

Four paragraphs of copywriting with gradually laughing to blurred self, not only summarized the attitude of contradictions before and after the acquisition of the acquisition, the most important thing is the third emoticon copy:

They want to force me to buy Twitter in court.

The latest direction of the acquisition of Twitter storms is directly predicted:

Twitter sent a lawyer letter to the US Securities and Exchange Commission (SEC), forcing Musk to return to the acquisition negotiation table.

The fourth copy of the copy is more intriguing:

They had to post information about false accounts in court.

Seeming everything is in the mastery of Musk.

Musk's prediction of Twitter's prediction

Within less than 20 hours after Musk pushed the next step of Twitter, Twitter's official counterattack came.

Everything as Academician Ma thought, Twitter stated in the lawyer's letter to the SEC: Musk had to return to the acquisition negotiating table.

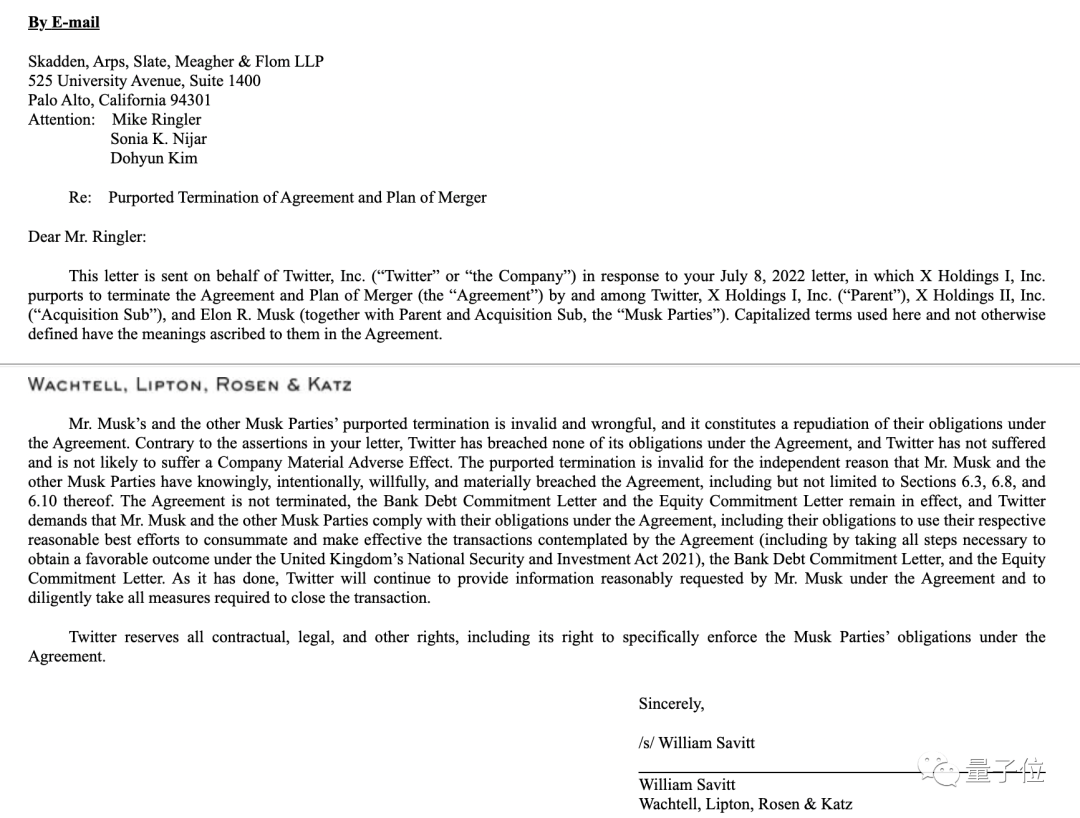

Twitter believes that Musk's so -called termination is ineffective and wrong, which violates the obligation of the acquisition agreement.

Twitter did not violate any obligations stipulated in the agreement, and at the same time Twitter would not be able to suffer major adverse effects.

In other words, in the termination of the reasons for the termination of the acquisition of Musk's termination of the acquisition lawyer on July 8, local time, the attitude of Twitter is: one is not recognized.

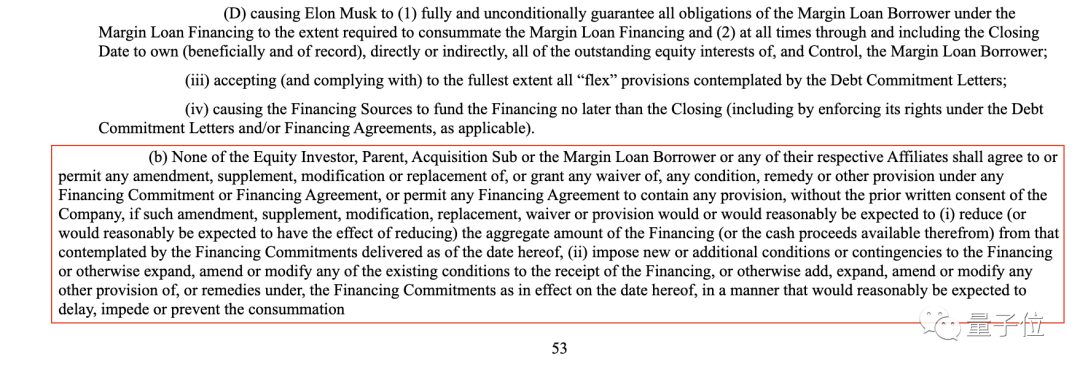

Twitter pointed out in a lawyer's letter that Musk's behavior violated paragraph 6.3, 6.8, and 6.10 of the acquisition agreement. Among them, 6.8 B has the following key provisions:

Without the written consent of the company in advance, equity investors, parent companies, acquisitions subsidiaries, or borrowers of deposit loans or any related parties in their respective parties shall not agree or allow any conditions, remedial measures or remedial measures under any financing commitment or financing agreement. Other regulations can be corrected, supplemented, modified or replaced.

Finally, Twitter also showed:

Twitter will continue to provide information on the reasonable requirements of Musk and take all necessary measures to complete the transaction.

From the beginning Musk wanted to buy but Twitter did not want to sell. Now that his identity has reversed the plot, the incident has developed to now, and Musk's acquisition of Twitter's big drama is too compact.

And from the perspective of Twitter's attitude, it seems a bit urgent.

Depending on time, Musk terminated the lawyer's letter to the acquisition of Twitter. On July 8th local time, in the lawyer's letter, Musk's fine count of Twitter:

Do not provide false account information according to the agreement; calculate the false accounts that have been suspended in MDAU data. In addition, a large number of changes in Twitter executives are also a reason for Musk to terminate the acquisition.

Soon after, at less than 6 o'clock in the morning on July 9, local time, the chairman of Twitter issued a response: We see it in court.

Immediately after July 10, local time, Twitter hired WACHTELL, Lipton, Rosen & Katz LLP Law Firm to deal with Musk, and saw the reports, and from the lawyer's letter submitted to the SEC, it was also on the same day. Just draw up.

The response is fast enough, and the choice of the lawyer team is also very attentive.

It is reported that the partner of WACHTELL, Lipton, Rosen & Katz LLP Law Firm Leo Strine, who has served as a judge in Tellawa, and the lawsuit filed by Twitter is just here.

During his tenure as a judge, Sterling himself ruled a similar acquisition case and supported the acquisition to continue when judging.

Twitter at home seems to be unfavorable to Musk.

In the capital market, affected by the tug -of -war between the two sides, Tesla and Twitter's stock price fell.

As of yesterday's closing, Twitter's stock price fell 11.3%to $ 32.65, which was 40%of the $ 54.20 bid price than Musk, which was the largest single -day percentage decline in more than 14 months.

Tesla's stock price also fell nearly 7%to $ 703.03/share.

Can Musk get her wish?

There is to listen to a professional analysis.

Laari Hammesh, a professor of law at the University of Pennsylvania, revealed that whether Musk can terminate the acquisition as expected depends on whether Twitter's disclosure of false accounts has a significant adverse effect (MAE).

At this point, Twitter has denied it in the lawyer's letter.

In addition, in the acquisition agreement, Twitter executives are given a specific execution right, that is, if the false account information does not rise to the level of major adverse affecting, Twitter can ask Musk to complete the acquisition.

In addition, Ann Lipton, a professor of university professor, also issued an opinion that Twitter was legally favorable.

Then the next trend is as netizens said, "Waiting for the next good show in court":

Reference link:

- END -

Kenli: help enterprises and people who have real -time recruitment of social security services with temperature

Kenli District follows the goal orientation, demand -oriented, problem -oriented, ...

Safety emergency rescue drills enter the State Grid Wendeng District Power Supply Company