Layout the domestic ETF market in the field of the track continues to expand

Author:Economic reference Time:2022.07.12

On July 11, three Chinese medicine ETFs from the three fund companies of Penghua, Yinhua and Huatai Berry officially began subscribing, and ETF subdivided the track added new products. This type of ETF tracking the Chinese medicine index is mainly selected as a sample involving Chinese medicine production and sales such as the production and sales of traditional Chinese medicine to reflect the overall performance of the Chinese medicine concept listed company. In recent years, ETF Fund has continuously accelerated, and ETFs in multiple segments including carbon neutralization and Chinese medicine have rapidly expanded, and new varieties have been launched one after another.

In addition to the Chinese medicine ETF, another segmentation track in the field of medicine, the vaccine, will also usher in the corresponding ETF products. The State Certificate Vaccine and Biotechnology ETF from Huatai Berry, Cathay Pacific, and Wells Guo Fund have recently received approval, becoming the first batch of vaccine theme ETF funds in the market. In addition, the three companies of Boshi, China Merchants, and Castrol also submitted the application materials for the Sino -CSI vaccine and biotechnology ETF. As of now, six vaccine index funds have been in the process of approval, and the industry is expected to be approved for issuance in the near future.

In recent years, ETF investment theme innovation has continued to innovate, including medicine, carbon neutralization and other fields to become the main direction of ETF product innovation layout.

On July 4, the first eight carbon and ETF were released. From the perspective of the first day of subscription, the Yifangda Fund's carbon neutral and ETF subscription funds exceeded 1 billion yuan, and the carbon neutral and ETFs under the Fund Companies such as Guangfa and South China also attracted nearly 1 billion yuan. Previously, on April 21, eight funds such as Yifangda, Guangfa, Fuguo, Southern, China Merchants, Huitianfu, ICBC Credit, Dacheng, and Dacheng reported carbon neutralization and ETF; on June 28, eight ETFs were approved; July 4th On the day, the first batch of carbon neutral and ETF was launched. As the first batch of carbon neutral and ETFs in China, this type of product adopts a complete replication method to track and copy the carbon neutrality index of the China Securities Shanghai EMB.

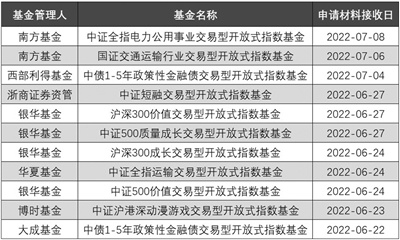

At the same time, other subdivide track ETFs also show "blooming everywhere", which continues to "increase" in the distribution market. According to Wind data, as of July 11, 127 ETF products application materials have been received during the year, and many segments such as infrastructure, power, biological breeding and other segments have been involved. Specifically, since July, there have been three ETF products declarations, namely ETFs, ETFs, ETFs of the transportation industry of Southern Fund, ETF in the transportation industry, and ETFs of the China Debt Bonds of the Western Lice Fund for one year to 5 years. In addition, on May 9, the ETF application materials declared by eight fund companies such as South, Guangfa, Huaxia, and Tianhong were collectively received.

Industry insiders said that based on the proportion of foreign passive index funds as the standard, my country's ETF and index fund products still have a lot of room for development. However, because ETF has a distinctive first -mover advantage, there are already giants control on the track with sufficient demand. For fund companies that have no obvious scale advantages at present, the future layout subdivided products may become a breakthrough point for more fund companies to make breakthroughs. Essence

- END -

Taiping Life Life Guangdong Branch Jia civilian: Combining the changes in market demand in the Greater Bay Area continues to optimize the exclusive product system of the Bay Area

Southern Finance All -Media Li Jingjing Guangzhou ReportTaiping Life will adhere to the national strategy, with the help of policy dividends and corporate resources, combined with changes in market d

The members of the Standing Committee of the Hangzhou Municipal People's Congress "listen to public opinion and gather people's wisdom" before

It is recommended to tilt up to the grassroots at the grassroots level in the intr...