Buffett reduces BYD?Regardless of running, let's like the "stock god" first

Author:Daily Economic News Time:2022.07.12

In the generation of Z, Brother Z is the most realistic.

Yesterday, the "lithium king" Tianqi lithium industry fell sharply.

Today, the 900 billion "Di Wang" BYD plummeted again. For two consecutive days, the new energy track was hit hard.

It is a rumor about Buffett's reduction of holdings.

According to reports, the Hong Kong Stock Exchange data shows that BYD (HK01211, HK $ 270, a market value of HK $ 786 billion) was transferred to Citibank on July 11. As a result, the market speculated that these shares may be from Berkshire Hathaway, a subsidiary of Buffett. If it is true, it means that Buffett will finally "run away" after holding 14 years and earning 34 times.

Affected by this rumor, BYD shares have a maximum decline of nearly 14%, BYD (SZ002594, stock price of 309 yuan, and a market value of 899.543 billion yuan) has a largest decline of more than 7%. At the same time, the stocks of the entire new energy vehicle track have fallen sharply.

BYD's plunge has also triggered various speculations in the market, as well as Buffett.

Everyone speculates, did Buffett really reduce their holdings?

It is reported that the response given in BYD's market is that it is still confirmed.

There is also a saying that Berkshire Hathaway's holdings have not changed.

For this statement, some people think that it may be "the process of reducing holdings."

As of the release of Brother Z, there is no clear statement. But Brother Z believes that Buffett's "clearance" is unlikely to reduce BYD. After all, the 225 million BYD's shares account for 7.73%of the total share capital. If you really want to reduce your holdings, you obviously need to be disclosed in advance, and it is impossible to engage in sudden attacks.

Today, there are rumors of Bydue by securities firms, thinking that this is a misunderstanding. The explanation of the brokerage company is more consistent with Brother Z.

The securities firm pointed out that the cause of the incident was that the Hong Kong Stock Exchange data showed that BYD's 225 million shares were transferred to Citibank on July 11. Because Berkshire Hathaway holds a total of 225 million shares, naturally someone will speculate that it may be Buffett BYD in the clearance.

But in fact, this is a misunderstanding: the real reason is that the rules of the Hong Kong Stock Exchange have changed, and physical stocks have become electronic stocks. Electronic stocks need to pass brokerage channels such as Citi, Morgan Stanley, etc. These brokerage companies have a CCASS account. According to the company's exchanges with Berkshire Hathaway, there is currently no planning or reduction plan, and if it really wants to reduce its holdings, it is naturally announced. There is no announcement that it is not verified that it is not reduced.

Perhaps it is the interpretation of this securities firm that eased the market's concerns about BYD, and the stock price of BYD has rebounded significantly in the afternoon.

Then talk about it, if Buffett wants to reduce BYD, it is likely to encounter more questions in the market. The reason for questioning is not to say that he has been holding for 14 years and has made a lot of money, and now he wants to smash. Instead, in the era of embracing new energy in the entire market, Buffett's counterparts, increased their traditional energy oil stocks, and reduced the new energy BYD.

According to reports, since June this year, Buffett has purchased Western oil stocks many times. As Buffett said at the fourth quarter of Western Petroleum in the fourth quarter of 2021: For Western oil, we can buy as much as we can buy. The stock god used real gold and silver to express his preference for petroleum stocks.

Of course, now Buffett has "run" without "running", and it is indeed no conclusion.

But as Brother Z said in the title, no matter how he runs, he first praises the stock god. What do you like?

First of all, Buffett's investment in BYD can be said to be another success of long -term value investment concept.

Buffett bought BYD in 2008. At that time, the stock god was 78 years old, while BYD chairman Wang Chuanfu was only 42 years old. BYD also became the only Chinese company in Buffett at that time.

Today, Buffett is 92 years old, holding BYD for 14 years, and has never been sold during the period. The stock market value has made more than 34 times from HK $ 1.8 billion in that year to HK $ 63 billion.

How many people can be so long to a company? (Except for primitive investors)

Secondly, in 2008, it was 78 years old. For many people, it has long been to lying down to enjoy life. At this age, you can also invest in classic cases such as BYD. I think only the gods can do it. And this holding is 18 years, it is not easy. Instead, it is Z, buying a stock, you may be able to do it for one year. You may be able to do it for two years. Do n’t buy it for three years? Most of them are deeply covered, and they are reluctant to cut meat.

Therefore, even if the stock god really sells BYD this time, you must like it. If he really sells BYD, it is simply the most intuitive manifestation of his investment wisdom -buying in loneliness and sale when he is booming.

After talking about Buffett and BYD, and finally talk about the Fund's second quarterly report.

Today, the first batch of funds were released in the second quarter. The two active rights funds of the Great Wall Jiufu and the Great Wall emerging industries announced the second quarterly report. These two funds were managed by Chen Liangdong.

From the second quarter report, the two funds mentioned above have greatly increased their stock positions in the second quarter. At the end of the first quarter, Great Wall's mixed stock positions were only 79.43%, but by the end of the second quarter, it increased to 90.53%. It was obvious that a lot of cheap was picked up at the lowest time.

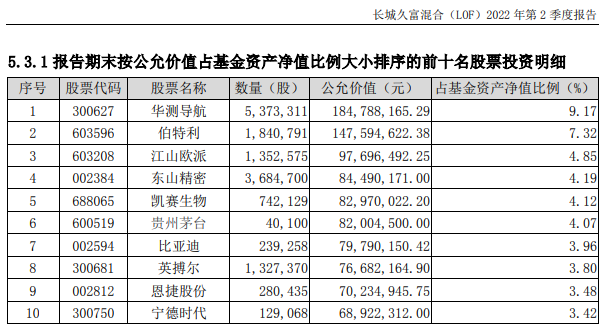

In addition, the stock positions of the Great Wall emerging industries also increased from 77.95%at the end of the first quarter to 90.52%. The direction of the two products is mainly electric smart cars, photovoltaic wind power, etc. As far as individual stocks are concerned, the key addition of Dongshan Precision, Guizhou Moutai and BYD have been transferred to Dunan environment, Chinese chemistry, Gujiajiaju and so on. In addition, it has increased the period of Chinese test navigation, Yingbor and Ningde, and reduced its holdings.

Chen Liangdong said that looking forward to the market in the second half of the year, after the market recovery and performance growth, the digestion of valuations, the overall valuation returns to a relatively reasonable range. At present, it is suitable for investment based on industry and company fundamentals. The prosperity and long -term growth space industries, at the same time, pay appropriate attention and deployment of consumer electronics, semiconductors, innovative drugs, and real estate industry chains in the future.

In addition, he is optimistic about long -term investment opportunities in the market, especially optimistic about investment opportunities in the high -quality development of China's industry and under the trend of industrial upgrading. On the one hand, the rapid growth of emerging industries such as new energy intelligence cars and photovoltaic and photovoltaics and the improvement of the global industrial chain status. On the other hand, the market share of the leading enterprise with super competitive industries with super competitive industries has brought about the efficiency of traditional industries Investment opportunities.

(Risk reminder: Equity funds are high -risk varieties, and investment needs to be cautious. This information does not serve as any legal documents. All information or opinions in the information do not constitute the final operation suggestions of investment, law, accounting or taxation. The content in the middle of the operation is made of any guarantee. In any case, I am not responsible for any loss caused by any of the content caused by any content in this information. my country's fund operation time is short, which cannot reflect the development of the stock market development. All stages. The performance of fixed investment past does not represent future performance. Investors should fully understand the difference between the fund's regular quota investment and zero deposit and other savings methods. Period quota investment is a simple and easy to guide investors to make long -term investment and average investment costs. The investment method. But regular fixed investment cannot avoid the risks inherent in fund investment, cannot guarantee investors to obtain benefits, nor is it an equivalent financial management method for savings.

Before investing in the fund, please read the fund's legal documents such as the fund contract and the recruitment manual, and comprehensively understand the fund's risk income characteristics and product characteristics. On the basis of the situation and listening to the appropriate opinions, judge the market rationally, and make investment decisions carefully according to factors such as their investment goals, periods, investment experience, asset status and other factors, and independently bear investment risks. The market is risky, and you need to be cautious to enter the market. The fund manager reminds investors '"buyers' self -responsible" principles. After investors make investment decisions, the investment risks caused by the fund operation status, fund shares listed transaction price fluctuations, and fund net value changes shall be responsible for themselves. )

Daily Economic News

- END -

How can the NFT digital collection copyright of "see, can't touch"?

Xinhua News Agency, Beijing, July 8th: How to protect the copyright of NFT digital...

True love service, the first heart of the official Zhuangzhang chapter 丨 Secretary took the lead to calculate the account to calculate the revitalization and promote unity

How many people in your family have enjoyed the assistance policies and how much s...