The founder "Run"!People go empty!This hedge fund is completely cold: it used to have 10 billion US dollars

Author:China Fund News Time:2022.07.12

China Fund reporter Ivan

The storm, which began to fall sharply after the global central bank's interest rate hike, has performed stronger after the anchor of LUNA and Terrausd last month. At present, this storm is far from stopping.

On July 11, Eastern Time, according to the court disclosure documents, the founders of the cryptocurrency hedge fund that have submitted bankruptcy applications have been submitted to the bankruptcy application have not cooperated with the company's liquidation procedures to participate in the company's liquidation procedures. As of last Friday (7 (7 On the 8th), where they are still unknown where they are.

In addition, the court documents also showed that the liquidation of Sanjian Capital went to his office in Singapore and hoped to catch up with his founder. The office seemed to stop business: the door was locked, the computer was not running, and the email was stuffed on the door. People who work in a nearby office said they have not seen anyone entering and leaving the office recently.

(Sanjian Capital Singapore Office Source: Bloomberg Society)

(The address status of the Sanjian Capital Office is displayed as "Permanent Close" Source: Google Map)

On the surface, Sanjian Capital's office in Singapore has "went to the building."

The lawyer of the three -arrow capital bankruptcy case said in a document submitted to the court that a representative of a British Virgin Islands judge appointed the handling of clearing the three -arrow capital has not yet gained any substantial cooperation with Kyle Davies and Zhu SU. Advisory company Teneo is trying to organize and protect the assets of the hedge fund.

The lawyers of Zhu and Davies told Sanjong Capital's liquidator that they intended to cooperate. The conference between the liquidator and the lawyer was held on Monday, and the court hearing was scheduled to be held on Tuesday. Teneo's representative Russell Crumpler said in an oath statement that the liquidator is trying to prevent the fund's potential "loss". According to Coindesk, the Teneo legal team has required frozen three arrow capital, assets and requiring to issue a subpoena to Davies and Zhu to find information about company records, assets and other accounts.

The liquidator lawyer said that because a large part of the debtor's assets are cash and digital assets, such as cryptocurrencies and irreplaceable tokens, these assets are very easy to transfer.

Foreign media reports also pointed out that due to unknown reasons, NFT, which belongs to Sanjian Capital NFT Fund Starry Night, has been transferred to a new wallet.

The "top flow" of the currency circle falls down

The "Domino" effect appears

Sanjian Capital fell in the large -scale cryptocurrency selling tide last month. Its bankruptcy procedure was launched in the British Virgin Islands, and then submitted Chapter 15 of Chapter 15 in the United States. This has caused a stir in the digital asset industry.

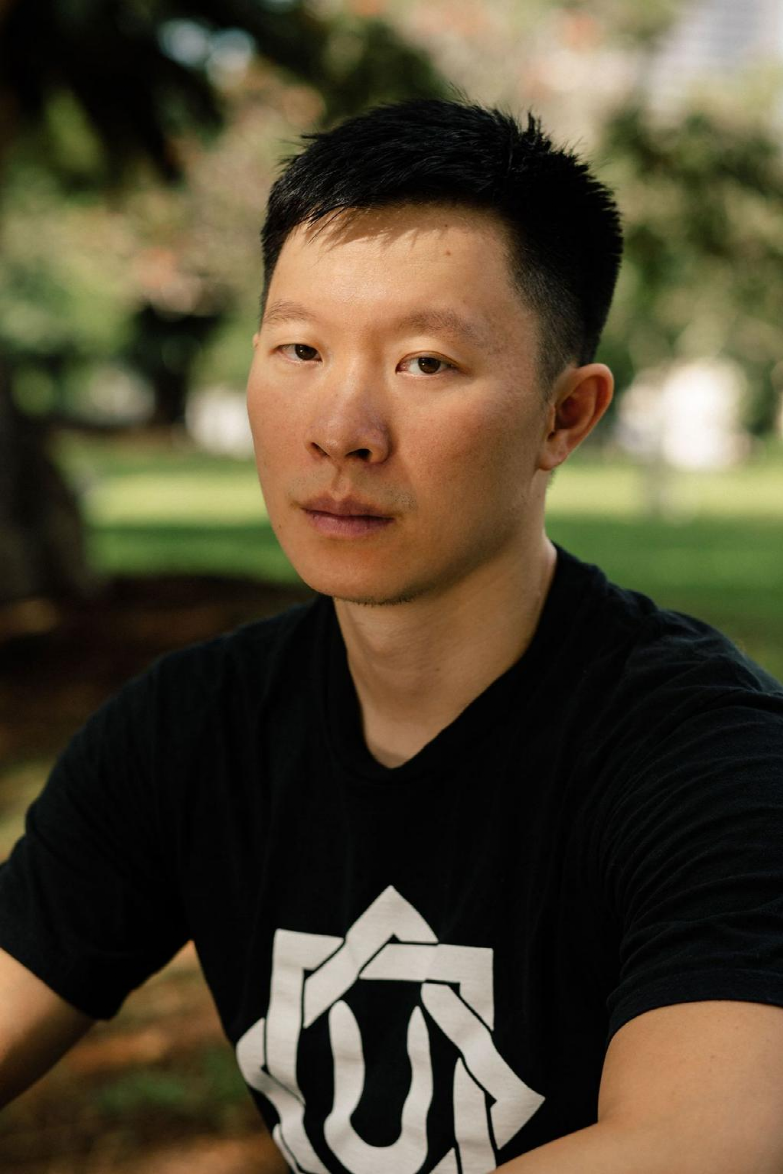

Sanjian Capital was founded in 2012 by Su Zhu and Kyle Davies. It is one of the largest hedge funds in the cryptocurrency market. It has also existed as "top flow" among many hedge funds in the currency circle. It reaches $ 10 billion and the investment portfolio includes tokens such as Avalanche, Solana, Polkadot and Terra.

(SU ZHU, one of the co -founders of Sanjian Capital, Source: Bloomberg Society)

The fall of Sanjian Capital seems to have promoted a "Domino" that promotes the borrowing transactions and cryptocurrency hedge fund crisis, which cannot be underestimated by the industry.

Some analysts have pointed out that the liquidation of Sanjian Capital will exacerbate the market's concerns about other crypto business prospects, or the prices of cryptocurrencies such as Bitcoin. Investors are also becoming more pessimistic. According to the latest survey of Mliv Pulse, 60%of the 950 investors believe that Bitcoin is more likely to fall to $ 10,000, and the remaining people believe that Bitcoin may rise to $ 30,000.

At present, the two major cryptocurrencies Bitcoin and Ethereum have not stopped. As of the receipt, according to Coinbase data, Bitcoin has fallen by 28.85%in the past month. At present, it has hovered around $ 19,000; Ethereum has fallen 27.5%, and currently hovering around 1,000 US dollars. Looking at it for a long time, according to Coingecko data, since the end of last year, the total market value of the cryptocurrency market has evaporated about $ 2 trillion.

(Source: Coinbase)

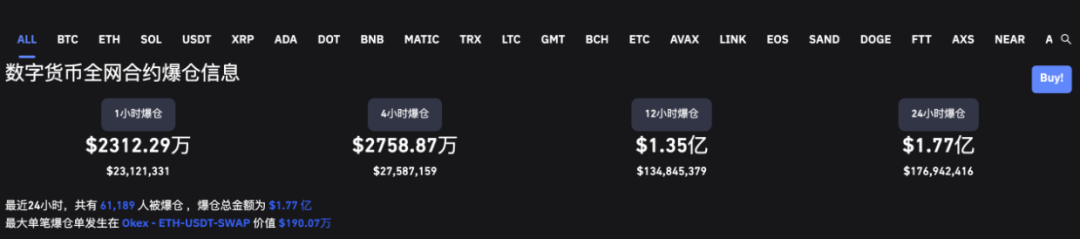

According to CoingLASS data, in the past 24 hours, more than 60,000 people have burst out of the entire network, and the funds have reached $ 177 million.

(Source: Coinglass)

The storm that the Sanjian Capital has fallen down has happened. Bloomberg pointed out that the liquidation of Sanjian Capital has led to at least one cryptocurrency platform that was once a three -arrow capital trading opponent. The Canadian cryptocurrency broker Voyager and Blockfi, which provides loans for Sanjian Capital, have been implicated -Voyager Digital has also announced the application for bankruptcy protection on July 6, and has completely suspended transactions, deposits, withdrawals and loyalty awards.

Voyager Digital said that the company has about 100,000 creditors, with assets of US $ 1 billion to US $ 10 billion, and the liability amount is within the same range. According to the media reported, the loan that has not been repaid for Sanjian capital involves approximately US $ 666 million, of which Including 15250 Bitcoin, US $ 350 million, USDC stabilization coins. Blockfi co -founder Zac Prince revealed that the loss directly related to Sanjian Capital was about $ 80 million, and emphasized that this was only "a small part of the loss reported by others."

Cryptocurrencies are facing strong supervision in the new

According to the Wall Street Journal, the Singapore's highest financial regulatory agency Financial Administration ("Financial Management Bureau") publicly condemned Sanjian Capital at the beginning of the month, saying that it provided false information to officials, and the size of the assets management exceeded the allowable range.

Singapore's HKMA stated that when the company transferred its fund's management rights to an entity in offshore tax avoidance in September 2021, it provided false or misleading information to the regulatory agency. When doing this, Sanjian Capital did not disclose one of its founders as the shareholders of these two entities.

Data show that Sanjian Capital has been operated as a regulatory fund management company in Singapore since 2013. Last year, the company transferred it to the British Virgin Islands as part of the plan to move its business to Dubai.

The Singaporean Monetary Authority followed that the hedge fund was approved as a maximum of 30 investors management funds, and the management scale was up to 250 million yuan (approximately $ 179 million), but the size of its management assets exceeded the allowable upper limit to allow the upper limit Essence

In fact, although the governments around the world are polarized for cryptocurrency investment activities, under the goal of "becoming a global cryptocurrency hub", Singapore has continuously introduced measures in the field of cryptocurrency policy in recent years, and it has become Asian cryptocurrencies The momentum of "New World".

Cryptocurrencies are also known as digital payment tokens in Singapore (DPT). On January 28, 2020, Payment Service Act takes effect. Applying for a license to the authorities includes cryptocurrency exchanges that provide DPT services.

Nicholas Hanna of Pinsnt Masons Mpillay said that the due diligence of Singapore's dedication to the distribution of cryptocurrency business licenses was very strict, and the Singapore Financial Administration (MAS) responsible for the issuing DPT license to the DPT license. As of the end of June this year, only about 11 DPT licenses and principles were approved in the 196 applications received.

In January 2022, in order to invest in high -risk investments for the public's might have been seduced without sufficient warning, Singapore issued a new policy, which strengthened restrictions on the promotion of crypto assets. The newly restricted DPT service providers include payment institutions, banks and other financial institutions, as well as applicants for the "Payment Service Law".

Readers of fund newspapers are watching:

Sudden! Xi'an emergency center Li Qiang was "double -opened", long -term obsessed with mobile games! Witness history: 1 euro = $ 1! European and American finance "exploded" ...

Find the reason for the plunge! Buffett is really going to run? Analysts are urgent: This is misunderstanding! In the future, the multiple real estate industries are mainly "forced to stop loan"! Shanghai advocates 14 -day food and medicine reserve, the latest response

After "Ice Cream Assassin", there is another "Fund Assassin"! Kimin only earned 1%, but the management fee received 0.9%

Edit: Captain 舰

- END -

Love in Siyuan: The fire of interest lits the future dream in hopes to bloom in the depths

China Shandong.com -Perceived Shandong July 8 (Reporter Liu Wansheng Hu Tairan) Re...

Tieling County Meteorological Bureau issued lightning yellow warning [Class III/heavier]

Lightning yellow warning signal: It is expected to have lightning weather in Tieling County on the afternoon of the 8th to the night of the 8th. At the same time, it may be accompanied by strong strea