San'an Optoelectronics's controlling shareholder received 5 billion yuan in capital increase listed companies: the controlling shareholder and actual controller did not change

Author:Daily Economic News Time:2022.07.12

On the evening of July 12, San'an Optoelectronics (SH600703, a stock price of 21.65 yuan, and a market value of 96.98 billion yuan) issued an announcement saying that the controlling shareholder Xiamen Sanan Electronics Co., Ltd. (hereinafter referred to Limited partnership) (hereinafter referred to as "Changsha Set Core") 5 billion yuan in capital increase.

"Daily Economic News" reporter noticed that the Changsha core core was established at the end of June this year, only half a month. The shareholders behind it are the background of Changsha's state -owned assets.

The increasing capital belongs to Changsha state -owned assets

According to the San'an Optoelectronics Announcement, the relevant capital increase agreement stipulates that Changsha Jixin increases 5 billion yuan to Sanan Electronics, of which 49.03 million yuan is included in Sanan Electronics Registered Capital, and the remaining 4.951 billion yuan is included in Sanan Electronics Capital Capital.

Data show that Changsha's core core was established on June 27, 2022, that is, it is only half a month to say that its establishment distance is now. Qixinbao showed that Changsha Xinxin holds 90%of Changsha City Development Group Co., Ltd. (hereinafter referred to as "Changsha Development"), and Changsha Pilot Industry Investment Co., Ltd. holds 10%(hereinafter referred to as "Changsha Pilot"). The Changsha Development was controlled by 100%of the Changsha Municipal SASAC, and Changsha's pioneer also developed 90%of the shares of Changsha, and Hunan Provincial State -owned Investment and Management Co., Ltd. indirectly held 10%of the shares.

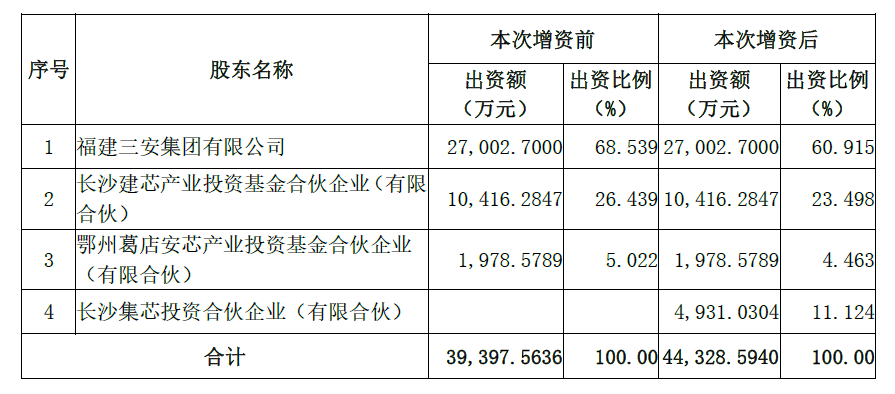

Before the capital increase, Sanan Electronics was from Fujian Sanan Group Co., Ltd. (hereinafter referred to as "Sanan Group"), Changsha Jianxin Industry Investment Fund Partnership (Limited Partnership), Ezhou Getian Anxin Industrial Investment Fund Partnership (Co., Ltd. Partnership) holding 68.54%, 26.44%, and 5.02%respectively. After the capital increase is completed, the above three shares holding Sanan Electronics will be diluted to 60.92%, 23.5%, and 4.46%, while the Changsha core core will hold 11.12%of Sanan Electronics.

Changes before and after capital increase of equity structure Source: Screenshot of Announcement

San'an Optoelectronics said that as of now, Sanan Electronics holds 1.214 billion shares of listed companies, accounting for 27.10%of the company's total share capital, and is the company's controlling shareholder. At the same time, Sanan Group holds 244 million shares of the company, accounting for 5.44%of the company's total share capital. Sanan Group is the controlling shareholder of Sanan Electronics. After the change of equity structure of the controlling shareholder, the controlling shareholder of the listed company has not changed.

In addition, Lin Xiucheng holds 59.68%of Sanan Group, and has indirectly controlled 32.54%of the shares of listed companies through Sanan Group and Sanan Electronics. People have not changed.

New expansion capacity is gradually being released

After spent 5 billion yuan to increase the capital of Sanan Electronics, Changsha's core core will also indirectly hold 3.01%of listed companies.

In terms of fundamentals, in 2021, San'an Optoelectronics achieved sales revenue of 12.572 billion yuan, an increase of 48.71%year -on -year; net profit attributable to mother was 1.313 billion yuan, a year -on -year increase of 29.20%.

According to the research report issued by Zhejiang Business Securities on May 20, in 2021, the sales of listed companies MINI/MicroLED increased by 246.61%year -on -year. Integrated business has achieved major breakthroughs, compound semiconductor production capacity expansion, and business may usher in a significant growth. In the future, with the release of the production capacity of San'an in Quanzhou, the product delivery capacity will be greatly improved, and the revenue of semiconductor business of compounds may increase significantly. With the release of Hubei San'an capacity, the profitability of MINI/MicroLED in the future may continue to grow.

On July 12, Everbright Securities released a research report that the rapid development of 5G and new energy vehicles has brought about the increase in radio frequency and the fast charging industry, and GaaS and GANs have entered the growth expressway. GAAS and GAN are widely used in the fields of RF and fast charging due to their excellent physical characteristics, and the market size has grown rapidly. San'an Optoelectronics currently has two GAAS factories, and its order has enhanced the steady delivery capacity, further accelerating the iteration of customer products to ensure that the customer's future supply chain is safe and stable.

SIC products have excellent performance in the new energy car owner drive module, and gradually enter the capacity window period. San'an Optoelectronics's SIC diode has pioneered more than 500 customers in 2021, and more than 200 shipments were shipped, and more than 60 products have entered the mass production stage; SICMOSFET industrial -grade products have been sampled by customers to verify, and car regulatory products are positive. Cooperate with a number of car companies for streaming design and testing; the cooperation between SICMOSFET vehicle regulations and new energy vehicle key customers has made significant breakthroughs.

In addition, the size of the MinileD market has ushered in rapid growth, the technical accumulation and the advantages of production capacity, and sharing the first wave of dividends with large customers. San'an Optoelectronics has achieved initial results in the MINILED market expansion and has cooperated with important customers at home and abroad. The new expansion capacity of San'an and Hubei San'an in Quanzhou is gradually being released. In the future, the scale of operating income will continue to increase, and its profitability will continue to improve. Therefore, Everbright Securities maintains the "buy" rating of Sanan Optoelectronics.

Cover picture source: Each reporter Liu Guomei (information map)

Daily Economic News

- END -

Xinzheng Meteorological Station issued a high -temperature orange warning [level/severe]

Xinzheng Meteorological Observatory, June 08, 2022, at 08:40 at 08.40, released high -temperature orange warning signals: Today, Longhu Town, Mengzhuang Town, Xincun Town, Guodian Town, Xindian Town,

46 days!There is a sports feast in Qinghai waiting for you to go to the appointment

Qinghai News Network · Damei Qinghai Client News On July 12, the press conference of the 18th National Games of Qinghai Province and the Fourth National Fitness Conference in Qinghai Province was hel