what's the situation?In early July last year, 15 listed securities firms previewed the performance of the interim report. This year, "No one can play" this year?

Author:Daily Economic News Time:2022.07.12

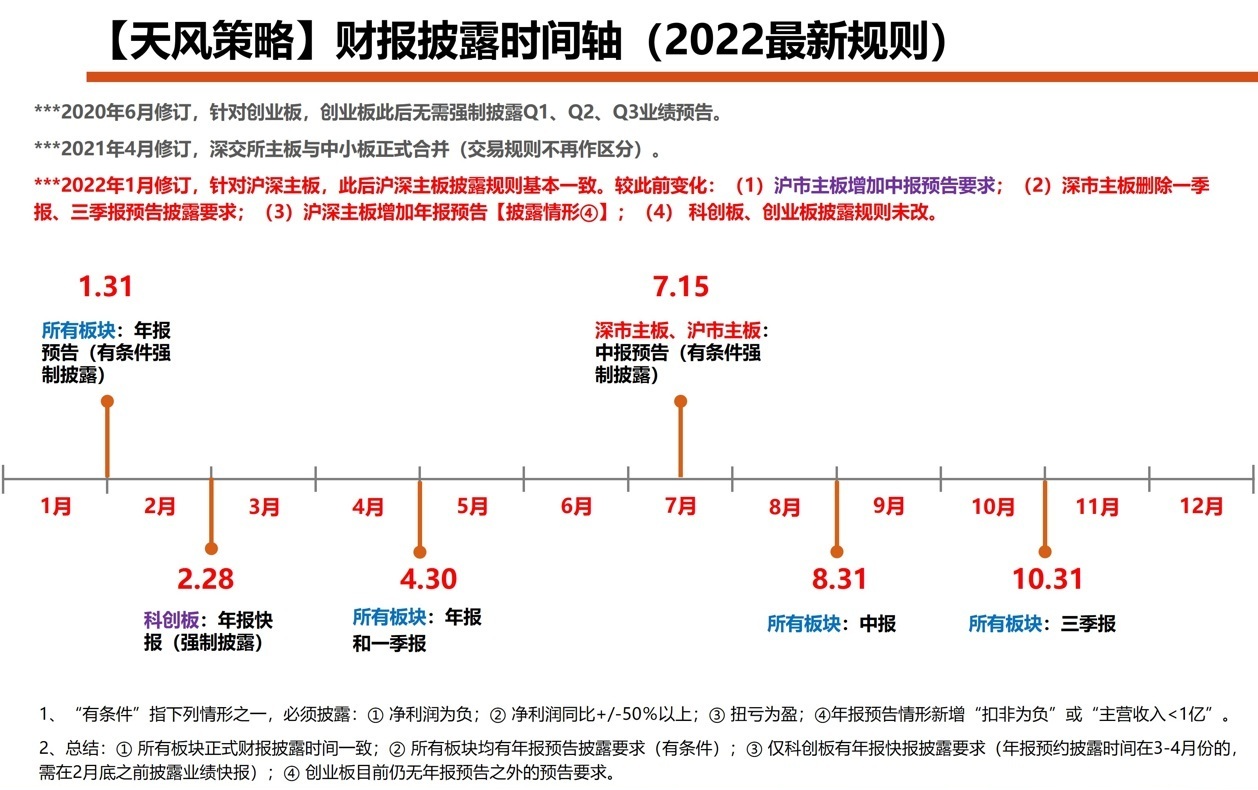

According to relevant regulations, before July 15th, the window period of the Shanghai -Shenzhen Main Board Company issued a seminars in the interim report. However, as of this night, no company has released the performance trailer for this year's interim report. According to statistics, 15 securities firms issued the interim results preview last year in early July.

Picture source: Photo Network -501142565

It is understood that the requirements for the preview of the interim reporting performance of the regulatory report are that the Shanghai -Shenzhen motherboard company, which has increased by more than 50%year -on -year or decreased by more than 50%, needs to release the interim performance preview. SZ300059, the stock price of 23.14 yuan, a market value of 305.8 billion yuan), the remaining 40 listed brokers are Shanghai -Shenzhen motherboard companies. So, what causes the A -share broker this year to be delayed to release the interim performance preview?

Listed securities firms have been delayed to release the interim report performance trailer

According to relevant regulations, before July 15th, it is the window period for the Shanghai -Shenzhen -Shenzhen listed company to release the interim performance preview. According to CHOICE data, as of now, more than 400 listed companies have released the performance trailer for this year's interim report, and this number is still expected to continue to increase.

However, as of this night, the A -share brokerage sector has not yet issued this year's interim performance preview. It is worth mentioning that the Guoyuan Securities (SZ000728, the stock price of 6.44 yuan, and a market value of 28.1 billion yuan) released the interim performance fast report, not the performance trailer.

However, according to CHOICE statistics, nearly 20 listed securities firms released the interim performance preview last year. Among them, some securities firms' interim performance increased by more than 50%year -on -year. Relevant brokers include Central Plains Securities, Oriental Securities, Huacchuang'an, Xingye Securities, Changjiang Securities, Oriental Fortune, Caida Securities, CICC, Guoxin Securities, Southwest Southwest Securities, etc.

In addition, although last year's interim reporting performance increased year -on -year, although not more than 50%, but also a certain increase in securities firms also pre -pre -pre -pre -pre -pre -pre -pre -pre -pre -disclosing last year. Galaxy, China Merchants Securities, Zhejiang Shang Securities, etc.

Judging from the disclosure time of last year's interim reporting preview, according to CHOICE statistics, 15 securities firms released the interim reporting preview last year in early July last year, accounting for nearly 80%.

In the second quarter, the brokerage company's performance was recovered in the same year to heating?

So, what causes the A -share broker this year to be delayed this year?

Picture source: Tianfeng Securities Strategy Team

It is understood that the requirements of the regulatory preview of the interim reported performance are that the performance increased by more than 50%year -on -year or decreased by more than 50%, or the net profit was negative, or the net profit of the Shanghai -Shenzhen motherboard company needed to release the interim performance trailer. Essence In the A -share brokerage sector, except for Oriental Wealth, more than 40 listed securities firms are Shanghai -Shenzhen motherboard companies.

From this point of view, as of now, the reason why listed securities companies have chosen not to release the performance of this year's interim report performance may be that the performance of this year's interim report is not within the scope of the required trailer, that is, the performance of the interim reported performance has not increased by more than 50%year -on -year, and there is no decrease year -on -year decrease. More than 50%, there is no performance loss or a profitable situation.

In this regard, a head of a head brokerage company non -banking analyst told reporters through WeChat, "This situation meets expectations. We estimate that the average decline in the first half of the year's brokerage industry will be about 30%in the first half of the year."

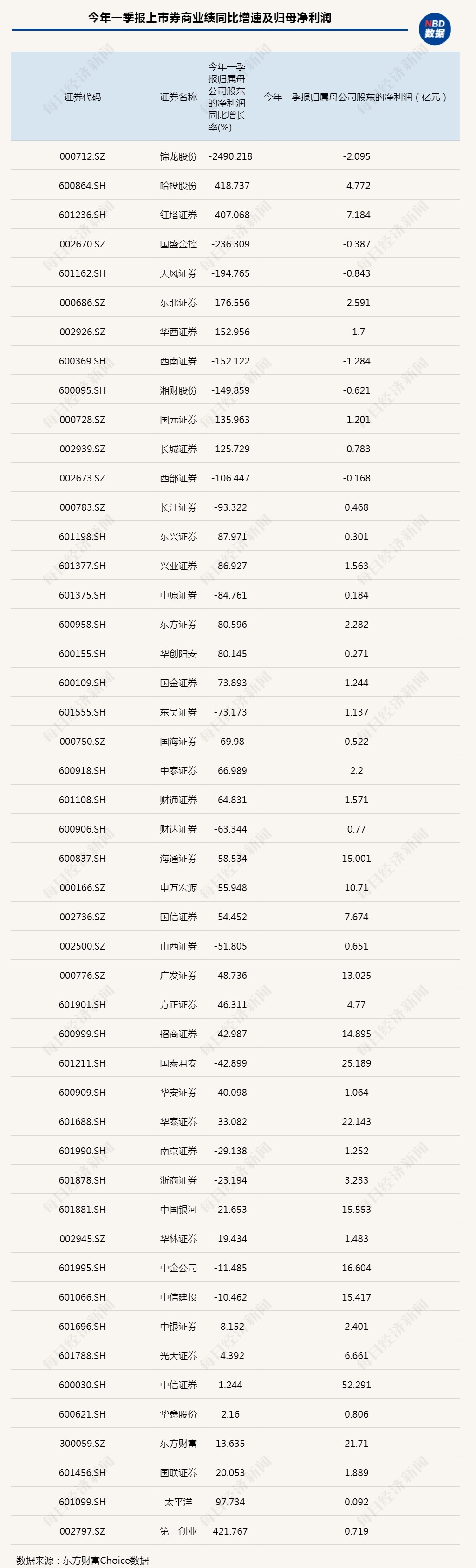

It is worth mentioning that due to the significant decline in the A -share market in the first quarter of this year, it has brought a greater negative impact on the pillar of revenue and other revenue in the wealth management and self -employment of securities firms, which has led to the general performance in the first quarter of this year.

According to the statistics of Choice, of the 48 listed companies in the brokerage sector (Shenwan Industry Category), 42 companies have increased their performance in the first quarter of this year. The company has 12. The 12 companies are Jinlong, Harchou, Hongta Securities, Guosheng Financial Holdings, Tianfeng Securities, Northeast Securities, West China Securities, Southwest Securities, Xiangcai Co., Ltd., Guoyuan Securities, Great Wall Securities, and Western Securities. The performance of these 12 companies in the first quarter of this year was losing money.

As of now, none of these 12 companies have released the results of this year's interim report. However, judging from the interim reporting performance released yesterday, although the company's performance in the first quarter of this year, the performance in the second quarter improved significantly in the second quarter, and the net profit in the single quarter reached 870 million yuan.

In this regard, in yesterday's announcement, Guoyuan Securities explained the ups and downs of its performance in the first half of this year: In the first half of 2022, in the face of the dual pressure of the domestic economic operation downside and epidemic prevention and control, the main index of the securities market appeared. The loss of the company's equity and derivative financial instrument investment in a certain degree of loss caused the company to lose money in the first quarter. In the second quarter, as the securities market gradually stabilized, the company actively adjusted its investment structure, strictly controlled investment risks, and securities investment losses were The decrease is reduced, fixed income investment, investment bank underwriting and futures business steadily increased, and securities brokerage and credit business are relatively stable.

Part of the market performance today

The market obviously also held a positive attitude towards this performance. Today, China Yuan Securities opened up. The daily limit in the afternoon, rising 7.5%throughout the day, ranking first in the brokerage sector.At the same time, today's brokerage industry is also one of the few rising industries in A shares.According to statistics from the non -banking team of Soochow Securities, the main reasons for the decline in the performance of brokerage firms in the first quarter of this year were the severe decline in self -operated business.According to statistics, due to poor market performance, 42 listed securities firms fell by 106%year -on -year in the first quarter of this year, while the remaining major businesses were relatively stable.

The non -banking team of Soochow Securities predicts that the net profit of the brokerage industry will decrease by 7.55%year -on -year throughout the year. Among them, the investment banking business will contribute incrementing, and wealth management and self -operated business are expected to be significantly under pressure.

Daily Economic News

- END -

Linzi's ancestor and grandson, the three people, the red inheritance of the soldiers

Reporter Liu Wei Correspondent Li NanFu Webu, come to see us again! On July 15th, ...

The China Office issued the "Regulations on the Management of Enterprise Management of leading cadres, children, and their spouse business business office

Xinhua News Agency, Beijing, June 19th. Recently, the General Office of the Central Committee of the Communist Party of China issued the Regulations on the Management of Enterprises of Leading Cadres