Before listing, the assault dividends, revenue declined successively, the row card home listing victory geometry | IPO observation

Author:City world Time:2022.07.13

On July 14, the sanitary front arrow home will usher in the starting meeting. The prospectus shows that this IPO, Jian Zhe Home Plan issued 98.99 million shares, with a plan to raise about 1.809 billion yuan. Among them, the smart home product production capacity technology reconstruction project is planned to use the raised funds of about 482 million yuan; the annual output of 10 million sets of water faucets and 3 million sets of shower projects intends to use the raised funds of about 460 million yuan; The funds raised about 174 million yuan.

Digital intellectual upgrade technology transformation project intends to use the raised funds of about 90.547 million yuan; the marketing service network upgrade and brand construction project based on the new retail model are planned to use about 263 million yuan, supplemented with 340 million yuan of mobile funds, and the total investment is 2.029 billion yuan Yuan, insufficient funds shall be paid by the company's own funds.

As a domestic bathroom "one brother", the road to the market of Jianzai Home is not flat. As early as December 2021, due to information disclosure and standardized issues, the CSRC put forward up to 61 feedback on the application of the arrow sanitary ware. Subsequently, in February 2022, the SFC was suspended by the Securities Regulatory Commission because of the sponsor's law firm involved in LeTV. The subsequent arrow home submitted a written reply letter, and the CSRC resumed the review.

It is indeed a happy event for rejuvenating the review. However, from the perspective of industry prospects and operating conditions in the past few years, the arrow sanitary ware is probably difficult to be happy. The prospectus shows that from 2018-2020, the company realized revenue of 6.81 billion yuan, 6.658 billion yuan, and 6502 million yuan, respectively, and revenue declined year by year.

For the decline in operating income, the explanation given by Wriggery Home is that due to the changes in consumer preferences too fast, the company's product sales declined.

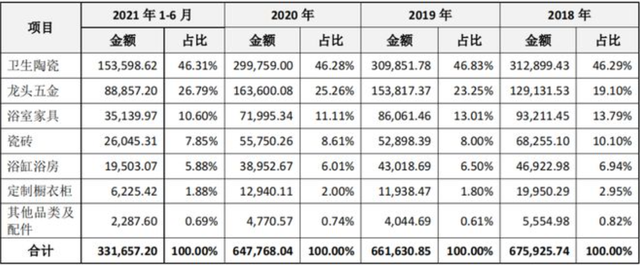

But in fact, the revenue of Wrigley Home Flows has declined, and it cannot be summarized by consumers' preference simply. From the perspective of revenue structure, sanitary ceramics is the main source of revenue for such arrow homes. In the past few years, the proportion of sanitary ceramics has always maintained at about 46%in the revenue of Arrow Card Home, but the sales amount has declined year by year. The decline in sales of sanitary ceramic products is also one of the main reasons for the decline in the revenue of Wrigley Home.

The decline in the company's hygiene ceramic revenue and prices are also one of the important factors. From 2018-2020, the prices of arrow home health ceramic products have risen across, and the toilet has increased from 570 yuan to 630 yuan. Other types of products have increased price increases to varying degrees.

The result brought by price increase is the decline in sales. From 2018 to 2020, the sales of sanitary ceramics also decreased from 8.959 million pieces to 7.495 million in 2020, a decrease of 10.72%. In the same period, the shipments in China's health ceramics industry still increased slightly.

It is worth mentioning that sanitary ceramics, as a downstream product of real estate, also follows the real estate market fluctuations. Due to the sluggish sales of real estate in 2022, the sales of sanitary ceramics also declined sharply.

Taking the toilet in sanitary ceramics as an example, according to the data given by Aowei Cloud, in the first quarter of 2022, only 341 toilet supporting projects in the hygienic ceramics in the refined decoration market, a year -on -year decrease of 44.60%. The scale of supporting facilities was 225,900 units, a year -on -year decrease of 51%.

Although the arrow home home has not yet given the first quarter of the 2022 financial report, from the perspective of the industry, the revenue of Arrow card home sanitary ceramics will have a significant decline, and the company's revenue may also decline.

In the black cat complaint, there are 584 complaints about the arrow sanitary ware, of which 248 have been certified, most of which are the product quality problems of the complaint of the arrow sanitary ware.

In addition to products and operations, the company's actual controller is also suspected of being wool. On the eve of the listing in 2020, the arrow card home made a profit distribution with a distribution amount of 450 million yuan, accounting for 76.67%of the net profit of 2020, and most of the dividends entered the pocket of the actual controller family.

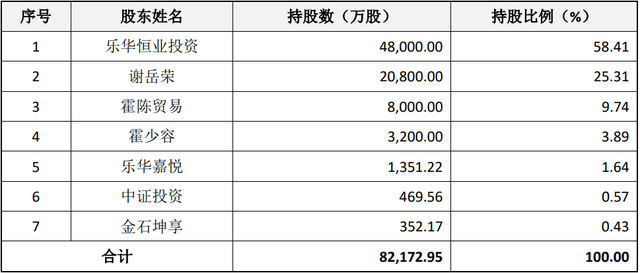

According to the prospectus, the company's actual controllers were Xie Yuerong, Huo Qiujie, Xie Anqi, and Xie Wei. Among them, Xie Yuerong and Huo Qiujie were the relationship between husband and wife, and Xie Anqi and Xie Wei were children of the two.

Among them, Xie Yuerong directly holds 23.94%of the equity of Wrigley Home. In addition, Xie Yuerong, Huo Qiujie, Xie Anqi, Xie Wei and other 4 people hold 65%of Lehua Hengye's investment. There are 55.24%stake in the company.

In addition, Huo Qiujie's relatives Huo Zhenhui and Huo Shaorong held 9.74%and 3.68%equity of arrow home home furnishings, respectively. The Xie and Huo family held a total of 92.07%of the arrow home furnishings, which means that the 450 million yuan dividends in 2020 were 414 million yuan into the actual controllers.

After the dividend was completed, the arrowal home submitted the prospectus to announce the IPO financing plan of 1.8 billion yuan, while dividend and financing.

The arrow home sponsor CITIC Securities is also an indirect shareholder of Wrigley Home. The prospectus shows that in November 2019, the Arrow Card Home Reconstruction was restructured to a joint -stock company. Before the restructuring, Arrow Card Houses had made a capital increase. Among them, CSI Investment and Jin Shikun enjoyed as an external investor and subscribed to 0.55%and 0.41%of the arrow home home furnishings of RMB 4.6956 million and 3.5217 million yuan, respectively.

It is worth noting that CSI Investment and Jin Shikun enjoyed CITIC Securities Subsidies, while CITIC Securities was the sponsors who were listed on the market for Jianzao Home.After the completion of the capital increase in 2019, in October 2020, the arrow brand launched the sixth capital increase, and the market valuation of this capital increase was 11.25 billion yuan.Based on CSI Investment and Jin Shikun's shareholding ratio, the investment amount is now valued at 61.7 million yuan and 46.27 million yuan, respectively, with 13 times the value of just one year.

(Author: Duan Nannan Editor: Liao Ying)

- END -

The bus "Labor Birds" came to Hangzhou to Happy holidays. During the first event of the holiday, they turned into a small Chinese medicine medical material

Right now, there is another group of buses Migratory Birds to Hangzhou to reunite ...

Wuzhong morning tea "taste" you come | Bus "special column" free pick -up and send citizens to "like"

Source: Wu ZhongwangAs long as you come, we will pick up and drop off the bus. You...