Global Financial connection | The United States CPI rose 9.1%year -on -year in June, 50 basis points of the Central Bank of Korea, and the total value of foreign trade imports and exports in the first half of the year increased by 9.4%.

Author:21st Century Economic report Time:2022.07.13

21st Century Business Herald reporter Shi Shi Shi Shi Shanghai report

In the first half of the year, my country's foreign trade achieved steadily growth

This morning, the National New Affairs Office held a press conference. Li Kuiwen, a spokesperson for the General Administration of Customs, introduced that the total value of foreign trade imports and exports in the first half of the year was 1.98 trillion yuan, an increase of 9.4%year -on -year, and foreign trade achieved steadily. Below we will listen to Zhao Ping's interpretation of the foreign trade situation in the first half of the year.

The development of foreign trade in my country is stable and good -looking

"Global Financial connection": How do you evaluate the foreign trade situation in the first half of this year?

Zhao Ping: my country's foreign trade industry has a large scale, strong development resilience, and potential for growth. In the first half of the year, the domestic epidemic situation was issued, the slowdown of the world economic growth has led to weak external demand, the price of commodity prices continued to rise, and the cost of shipping costs at high levels. The total foreign trade imports and exports have achieved a high growth rate, and the development of foreign trade has shown a stable and good trend.

The first is higher growth. Although the growth of foreign trade facing a large challenge, the total growth rate of foreign trade imports and exports in the first half of the year far exceeded expectations, not only achieved positive growth, but also reached a higher level.

The second is structural optimization. The competitiveness and development vitality of foreign trade have continued to improve. Among them, electromechanical products with higher added value account for relatively high electromechanical products, and labor -intensive enterprises have grown steadily, and the growth rate of private foreign trade enterprises has a rapid growth and high proportion.

The third is the market balance. The growth of my country's foreign trade imports and exports to major economies in China has made a balanced development on the European and American markets and emerging markets, especially for the continuous high growth of exports to countries along the “Belt and Road”, and the ability to prevent risks of foreign trade has further improved.

Global green development and innovation development brings new opportunities

"Global Finance and Economics": What are the challenges and opportunities for foreign trade growth in the second half of the year?

Zhao Ping: The challenge mainly comes from two aspects. One is the uncertainty that the mutation of the new crown virus to the economy and society. As the new crown virus has appeared in the new mutant strains of BA.5, changes in the immune prevention policy of various countries may cause new disturbances to the foreign trade supply chain. Second, the risk of global economic stagflation has been further increased. The price of commodities in the world is still high. The interest rate hikes in major economies have led to the risk of economic recession in Europe and the United States. The third is the impact of tail factor. In the second half of last year, foreign trade imports and exports were large and the growth rates were high, which put a lot of pressure on the year -on -year growth rate of foreign trade imports and exports in the second half of this year.

Opportunities come from two aspects: First, the experience of preventing and controlling the prevention and control of the normalization epidemic in my country has continued to accumulate. The risk of the domestic epidemic supply chain supply chain supply chain is controllable. Essence Export demand or re -increase of products such as epidemic prevention materials. Second, the new opportunities brought by global green development and innovation development. With the accelerated development of the global green industry, the green lifestyle is deeply rooted in people's hearts, and the market demand for green low -carbon products such as photovoltaic and wind energy, new energy vehicles, and green home appliances will continue to strengthen. Due to the normalization of many countries' lives and increased social opportunities, the demand for new products is increasing, and products that have achieved greater progress in technological innovation, product design, and functional improvement will have a lot of opportunities in the international market.

50 basis points in the South Korean Central Bank raised interest rates

The Central Bank of Korea announced on the 13th that 50 basis points raised the benchmark interest rate from 1.75%to 2.25%. Since August 2021, the Bank of Korea has raised interest rates 6 times. Earlier, 25 basis points raised their interest rates each time. The 50 basis points of the People's Bank of Korea for the first time are based on the considerations? How's the effect? Let's connect Shao Yu, chief economist and assistant president of Oriental Securities.

South Korea's interest rate hikes to control inflation and capital outflow risks

"Global Finance and Economics": Since 1999, the Bank of Korea has raised interest rates for the first time. What are the considerations of the country? What effect is expected to achieve?

Shao Yu: The first reason is that the United States is the benchmark of the entire monetary policy. If the United States raises a sharp interest rate in order to cope with inflation, then other countries can only follow, otherwise it will bring a large risk of capital outflow. Therefore, in this case, most countries will choose to raise interest rates, so that this is to maintain the stability of the exchange rate.

The second reason is to control the internal inflation. For South Korea, it may also be because of similar considerations. In order to control the risks of capital outflow and fighting inflation, it naturally chose a strong interest rate hike attitude. It should be said that this is an inevitable policy choice.

Global liquidity tightening or negative effects

"Global Finance and Economics": In addition, New Zealand also raised interest rates of 50 basis points, and the Bank of Canada is expected to raise interest rates sharply. How does the central banks from accelerate the pace of tightening and are expected to have a global capital flow?

Shao Yu: Other developed economies also face similar dilemma. Both New Zealand and Canada are resource economies, and may also have some interest rate hikes to respond to inflation and maintain the stability of currencies. And other emerging markets may be affected more. We have also seen examples like Sri Lanka. If we cannot properly cope with inflation and maintain the stability of the exchange rate, we may bring a relatively large economic turmoil and even national risks.

Naturally, in this case, global liquidity will face a clear tightening. This tightening may bring some negative effects, which improves the center of risk -free interest rates, and also affects the valuation of the entire market.

The US June CPI increased in June

On July 13, local time, data from the US Labor Statistics showed that the US CPI in June increased by 9.1%year -on -year, the highest increase since November 1981, higher than the previous value of 8.6%and 8.8%expected. In addition, on July 12, local time, the International Monetary Fund (IMF) reduced the expected US economic growth in 2022 and 2023 to 2.3%and 1%, respectively. This is the second time IMF has lowered the expectations of US economic growth since June this year, highlighting the deterioration prospects of US economic growth in the background of the Fed's interest rate hike.

Will the United States repeat the stagnation of the 1970s? Economic recession risk geometry? Is the Fed's tough policy stance that may reverse? Let's take a look at the 21st Century Business Herald reporter Zheng Qingsing's interview with Xing Ziqiang, the chief economist of Morgan Stanley.

The US economy will not repeat the stagnation of the 1970s

"Global Financial Services": With the highest level of inflation in the United States in 40 years, many people began to worry about whether the vicious inflation in the United States will repeat itself in the 1970s. In your opinion, is the current situation reappearing yesterday?

Xing Ziqiang: Today's situation is not the same as the economic growth rate in the 1970s and 1980s. The keyword this time is "overkill" to correct the expectations of inflation, and it must be increased faster to raise interest rates. For example, add 75 basis points in July, and 50 basis points will be added every month. This year At the end of the year, the US interest rate rushed to a range of 3.6%-3.7%. This is also the rare level of high interest in the United States in the past ten years, which has even made US mortgage loans higher than China. This situation will certainly suppress the demand.

I just mentioned a large fast -moving interest rate hike. Its purpose is to press down the expectations of inflation and press the expectations of rising wages. Then the cost may be the hard landing of the economy and cause recession. But it is more likely that this time it is a technical decline, which slipped quickly from the overheating state, but the decline and time span were relatively mild, which may be like the bubble of the Nasdaq technology stocks in the United States from 2000 to 2001. The short -term recession appeared later. In other words, its impact on the long -term growth of the United States may not be as harmful as the 1970s and 1980s.

why? At present, the U.S. residential sector and the corporate sector's balance sheet is very healthy, and there are no phenomena of people over the past few financial tsunami or long -term major economic crises. Special big.而在这一轮经济危机中,可能美国除了股市会随着利率的上升进行一些正常的调整外,在其他的部门,老百姓和企业的资产负债表、储蓄率、负债率还都比较健康,所以我们It is more inclined to feel that the US economy will slow down significantly, and even enter a mild technical recession, not long -term stagnation in the 1970s.

"Global Financial connection": Why does the US economy risk in the risk of technological recession from the end of this year to the first half of next year?

Xing Ziqiang: The changes in financial conditions are transmitted to the real economy for about half a year. Judging from this perspective, it may be the end of this year to the first half of next year. In the process, the United States must greatly amend the monetary policy of large water irrigation in the past two years. This may be ignored by many American economists and market analysts, which is similar to the Federal Reserve's previous unlimited increase in loose policies. I feel that these stimulus policies will not bring sequelae of inflation. Morgan Stanley began to warn as early as June and July 2020. The United States' stimulus policy will cause inflation to come back, which may eventually lead to a sharp interest rate hike and the risk of severe economic adjustment. Unfortunately, various indicators showed that our analysis was in words.

But in general, I think this is not a decline in the potential of long -term growth, because one of the cases of injury and long -term growth potential in history are the problem of the supply side, such as the oil crisis broke out in the 1970s in the 1970s. Overlapping productivity decreases. Although we are also facing geopolitics today, such as Russia and Ukraine conflicts, we are still slightly slightly slightly slightly slightly more slightly impactful than the long -term continuous impact of the oil market at that time. Another situation is that there have been major problems in the balance sheet. In 2008, the US financial crisis also had a 10 -year sluman impact on the US economy. Because of the long repair process of residential balance sheets It's right. However, the balance sheets of the U.S. residents and the corporate sector are very healthy, and there are excess savings on hand, so even if there is a decline, the subsequent rebound may be faster. This is not the same as the two major crises in the past.

"Global Finance and Economics": In history, the Fed has repeatedly fell into the policy trap of "tightening and then stimulating". At present, in the face of the threat of economic recession, is the Fed's tough policy standpoint that may be reversed?

Xing Ziqiang: The central banks of each country must be trial and keep pace with the times. If the interest rate hikes that are fast -running to the end of this year and the first half of next year have achieved the effect of suppressing inflation expectations, of course, it will adjust the monetary policy again. In fact, the Fed has stated that its prediction of future interest rate curves also covers a judgment that might cut interest rates in 2024. In other words, it is more flexible. Once the inflation expectations are successfully suppressed, and the economy has experienced a significant decline or slight decline, it provides the possibility for it to re -adopt some loose monetary policy in the future. The Federal Reserve has already gained a lot of scripts in the past four or fifty years, and it is more handy. From a large interest rate hike to a moderate reduction of interest rates according to economic changes, and continuously using policy tools to manage the business economic cycle is also the meaning of it. (The market is risky, and investment needs to be cautious. The opinions of the guests on this show only represent their own opinions.)

Planning: Yu Xiaona

Produced: Shi Shi

Editor in charge: He Jia Du Hongyu Zhao Yue Li Yinong

Production: Li Qun

Trainer: Hao Jiaqi Zhang Yuxiao

Shooting: Chen Chen

New media overall planning: Ding Qingyun Zeng Tingfang Lai Xixun

Produced: Southern Finance All Media Group

- END -

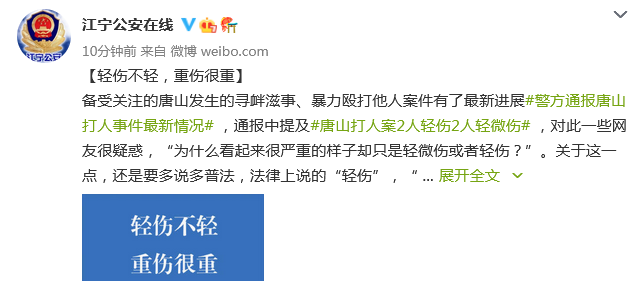

Why did Tangshan be beaten girl who looked serious but was just a minor injury?Police interpretation of minor injury standards

World Population Day | Shaanxi Fengxian: protects the "one small" to give birth to a new life

Moon Lord, Mingyan, I was washing clothes in the river; washing white, glowing, and passing the dolls to go to school; reading poetry, writing articles, and passing the champion ... This is a Shaanx