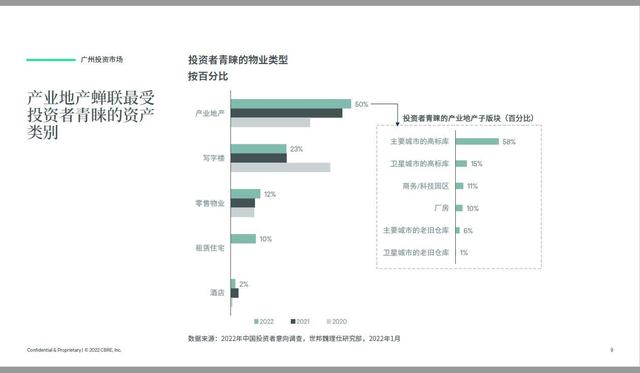

Institutional investors aimed at alternative targets: Industrial Real Estate

Author:Yangcheng Evening News Yangche Time:2022.07.14

Text/Yangcheng Evening News All -Media Reporter Zhao Yanhua Tu/CBRE Shibang Wei Shi

"The transaction record of 2021, the investment activities of Guangzhou individual investors tend to be active." CBRE Shibang Wei Lishi's latest "Review and Prospects of the Guangzhou Real Estate Market in the First Half of 2022" shows a new movement: the office building in the community trading market The transaction is still dominated, and its industrial real estate, as an alternative asset, has more market attention.

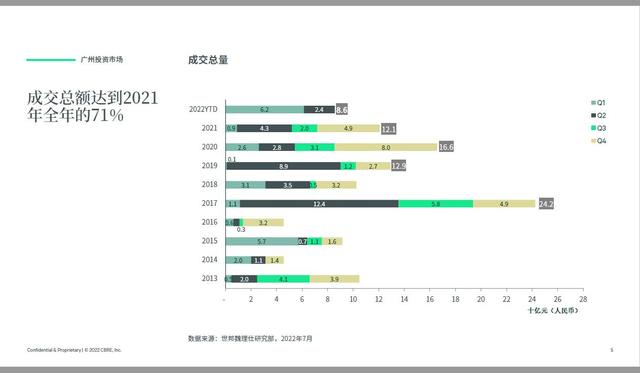

In the first half of the year, Guangzhou recorded a total of 12 single investment transactions, with a total transaction value of about 8.6 billion yuan, reaching 71%of the total transaction volume in 2021. Among them, 85%of the transaction amount comes from the transactions of Liuzong office buildings, distributed in major business areas such as Pazhou, Pearl River New City, Financial City, Tianhe Smart City, and Cisco Smart City. Among them, in the second quarter, the business park sold in Tianhe Smart City was sold with cash flow.

In addition, Haiyin Group announced in the first half of the year to sell the Panyu President Hotel and commercial podium, with a total amount of about 420 million yuan. In addition, a transaction of an asset package includes a number of properties such as a hotel located in Tianhe and Beijing Road. In the first half of the year, 4 shops and podium commercial transactions were also recorded, of which 3 were non -core properties disposed of by developers.

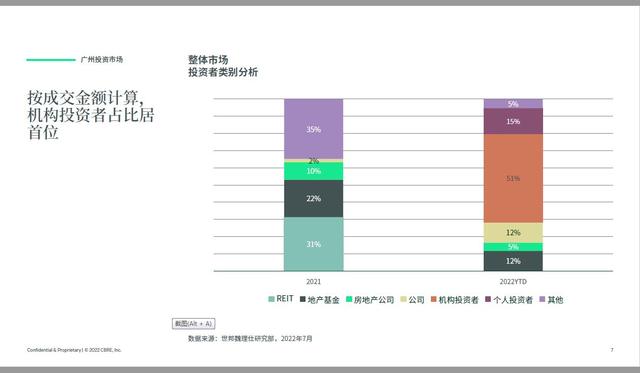

From the perspective of buyer composition, 42%of buyers who account for 42%of the transactions are from the company, developer, real estate funds, and institutional investors, and 33%are local individual investors. Looking back at the transaction record in 2021, the proportion of individual investors at the time was not high, which shows that the investment activities of individual investors in Guangzhou became active.

In the first half of 2022, the Grand Property Investment Market continued the situation in 2021. It is worth mentioning that institutional investors to industrial real estate (including high -standard libraries, business and science and technology parks, factory buildings, major cities and major cities and major cities and major cities and major cities, major cities, and major cities. Investment demand for old warehouses in satellite cities) is very strong, and actively find logistics assets that can be sold in the Greater Bay Area.

In addition, an alternative asset transaction was recorded in the first half of the year, which was the two data centers of Jibao's acquisition of Jiangmen. At the same time, the property that can be listed as the basic assets of public REITS is also sought after by investors. For example, traditional business park properties such as Science City and Tianhe Smart City have attracted market attention.

Source | Yangcheng Evening News • Yangcheng School

Responsible | Li Zhiwen

- END -

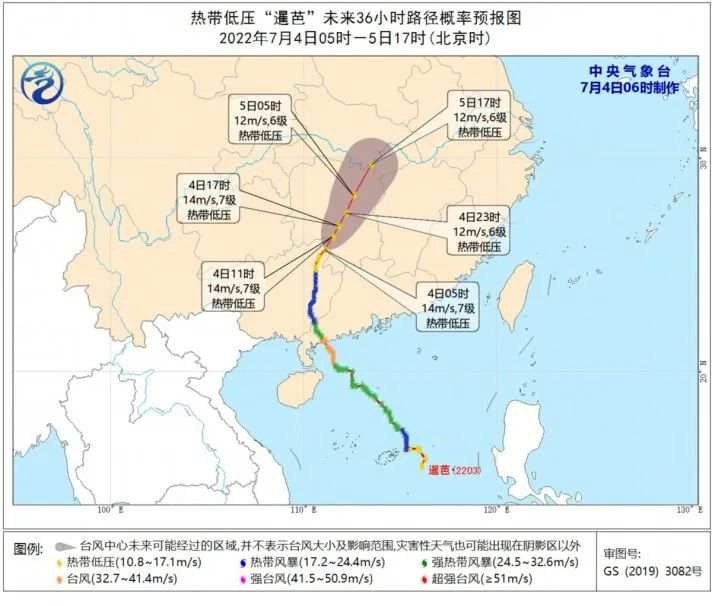

Notice!Although "Siam" has been stopped, the effect of rain is still not small!

Continue to followTyphoon Siaba No. 3 this yearthis morningSiam further weakened i...

Judge's eyes clearly abuse the right of visuality to show jurisprudence and reason compatibility to show judicial prudence and goodwill

The verdict finally came down, Xue Bao's mother clenched the judgment tightly, shed tears of excitement. She said: I just want to tell the child that my mother did not do something wrong, and now I...