This industry is crazy, Musk shouted "new oil"!Some companies earned more than 80 million for 6 months last year. This year only 39 hours this year

Author:Daily Economic News Time:2022.07.14

The production and sales of new energy vehicles have reached a record high, driving the rising prosperity of the lithium industry, and the wealth -making story of lithium companies continues. Judging from the performance and performance trailer announced one after another, the profits of more listed companies in the first half of the year have skyrocketed.

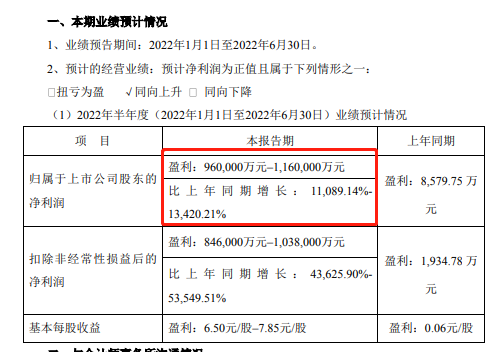

Tianqi Lithium announced on Thursday (July 14) in the morning that the net profit in the first half of this year is 9.6 billion yuan to 11.6 billion yuan, an increase of more than 110 times year -on -year.

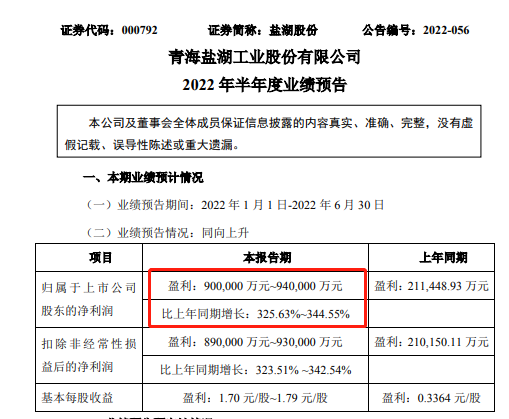

On the evening of the 13th, the salt lake shares, known as the "King of Potassium Fertilizer", disclosed the semi-annual performance forecast of 2022. The company is expected to have a net profit of 9 billion yuan to 9.4 billion yuan in the first half of 2022, a year-on-year increase of more than three times.

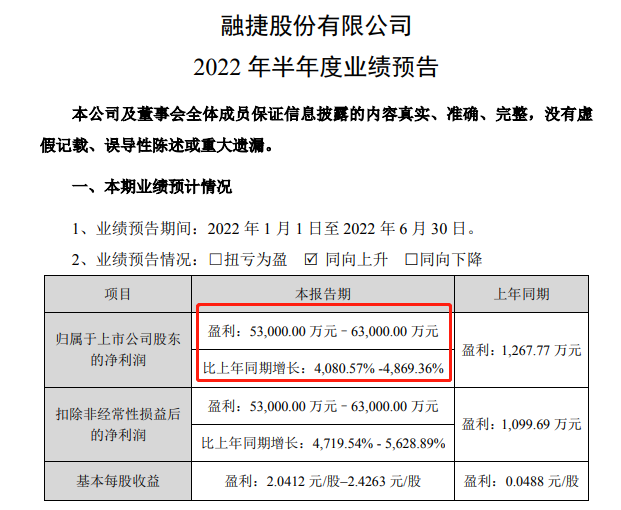

It was also announced on the evening of the 13th, and the lithium mine Daniel Rongjie shares announced that the net profit was 530 million yuan to 630 million yuan in the first half of the year, a year-on-year increase of more than 40 times.

On the 14th, David Sacks, a general partner of the venture capital fund CRAFT Ventures, wrote on Twitter, "If you can prove anything this year, there is no safety (to say)." Subsequently, Tesla CEO Musk replied under the tweet, "Absolutely. Lithium battery is new oil."

Due to the large increase in the previous increase, although the performance forecast has increased, the stock price of the above stocks is generally poor today. As of the afternoon closing, Tianqi Lithium A shares fell 0.89%, and Hong Kong stocks fell 2.32%. Salt Lake shares fell 2.59%, and Rongjie shares fell 6.1%.

Lithium industry listed companies make a lot of money

On the morning of the 14th, Tianqi Lithium announced that as of June 30, the company's net profit range was expected to be 9.6 billion yuan to 11.6 billion yuan, an increase of about 11089%to 13420%over the same period last year.

In the same period last year, the net profit of Tianqi Lithium industry was about 85.8 million. In the first half of this year, the net profit was calculated at 9.6 billion yuan. Tianqi Lithium earned 53 million a day. The net profit of only 39 hours was equivalent to the net profit of the first half of last year.

The main reason for the change in performance in the first half of this year is:

The company's expected operating income period has increased significantly compared with the same period of the previous year, mainly benefiting from many positive factors such as global new energy vehicle boom, lithium -ion battery manufacturers accelerated production capacity expansion, downstream positive pole materials, and other positive factors. The average price and sales price of products increased significantly compared with the same period of the previous year;

During the reporting period, SES Holdings PTE. LTD, which the company participated in, was listed on the New York Stock Exchange. Therefore, it was terminated to confirm long -term equity investment, and confirmed that the financial assets were included in other comprehensive income at fair value, and investment income was confirmed. The above -mentioned investment income generated by long -term equity investment due to passive shares is non -recurring profit or loss;

In addition, the company adopts foreign institutions to the joint -conservation company Sociedad Química Y Minera de Chile S.A. The second quarter of 2022 earnings per share for the company's investment income to SQM during the same period. The period is confirmed that the investment income of the associates has increased significantly compared with the same period of the previous year.

On the morning of the 13th, Tianqi Lithium Hong Kong stocks were listed, becoming the largest IPO of Hong Kong stocks so far this year. Tianqi Lithium Industry has also become the second lithium mine giant listed in the "A+H" two places after Ganfeng Lithium. On the first day of the listing of Hong Kong stocks, Tianqi Lithium opened 9.15%lower to HK $ 74.5, falling below the issue price of Hong Kong dollars per share, and once fell by more than 11%during the market; Essence

Tianqi lithium industry has recently been the focus of lithium battery sector and even A shares. On the evening of July 10, Xu Xiang's wife Ying Ying said: "Tianqi Lithium Industry Davis double -clicking has reached its peak, and the price has been overestimated." On July 11, the A -share Tianqi Lithium industry fell in less than half an hour. Essence

The performance is also dazzling. On the evening of July 13, Rongjie announced that it was expected to achieve net profit of 530 million to 630 million yuan in the first half of the year, a year-on-year increase of 4080.57%-4869.36%. In the same period last year, Rongjie's net profit was 12.68 million yuan. The net profit of only five days in the first half of this year exceeded the whole year of last year.

Rongjie's Q1 net profit is 254 million yuan. Based on this calculation, it is estimated that Q2 net profit is 276 million yuan to 376 million yuan, an increase of 9%-48%month-on-month, and a single quarter net profit hit a record high.

According to Rongjie, the performance increased significantly because the prosperity of the new energy industry continued to increase, the prices of upstream materials in the lithium battery industry continued to rise sharply, the demand for lithium battery materials and lithium battery equipment continued to increase, and the company's lithium concentrate, lithium salt, lithium battery equipment Both operating income and profits have increased significantly.

The performance trailer of the "King of Potassium" Salt Lake also exceeded most institutional expectations.

On the evening of July 13, the company released the first half of the year's performance forecast. It is expected that the net profit in the first half of the year will reach 9 billion to 9.4 billion yuan, a year-on-year increase of 325.63%-344.55%. This net profit level refreshes historical records and exceeds 2021 net profit.

Salt Lake shares have potassium lithium dual -main business. The company said that its performance has risen sharply due to the steady efficiency of potassium chloride, lithium carbonate stable production during the reporting period, and continuous rise in market prices. From the perspective of production and sales data, the company's potassium chloride output during the reporting period was about 2.64 million tons, and the sales volume was about 2.96 million tons; the output of lithium carbonate was about 15,200 tons, and the sales volume was about 15,000 tons.

Grab lithium resources

According to the latest data of the China Automobile Association, my country's new energy automobile industry is still in high prosperity. In June, the production and sales of new energy vehicles in my country completed 590,000 and 596,000, respectively, an average of 1.3 times year -on -year. From January to June, the production and sales of new energy vehicles completed 2.661 million and 2.6 million, respectively, a total of 1.2 times year-on-year, and the market share reached 21.6%. Moreover, from the perspective of sales rules, in the second half of the year, it is the real peak sales of new energy vehicles. It is superimposed to encourage car consumption policies in various places this year, as well as activities for new energy vehicles to go to the countryside. The demand for new energy vehicles will be further released. The China Automobile Association also increased the annual sales forecast of new energy vehicles to 5.5 million vehicles.

From the perspective of market price, according to Zhuochuang Information data, the price of lithium carbonate rose from 70,000 yuan/ton in early 2021 to 350,000 yuan/ton at the end of 2021. In March of this year, the price of lithium carbonate of battery -grade reached 500,000 yuan/ton. As of July 11 this year, the price of lithium carbonate at battery -level was 482,900 yuan/ton, an increase of 7.97 times from the end of 2020; the quotation of industrial -grade lithium carbonate was 460,000 yuan/ton, an increase of 7.94 times from the end of 2020.

On July 11, the "Lithium King" Ganfeng Lithium announced a big news.

According to the announcement, the company's board of directors agreed that the company will acquire 100%of Lithea's company through the wholly -owned subsidiary Ganfeng International, and the total price of the acquisition will not exceed 962 million US dollars (equivalent to about 6.5 billion yuan).

The annual report of Ganfeng Lithium 2021 shows that the company achieved net profit of 5.228 billion yuan, an increase of 410.26%year -on -year. In the first quarter of this year, net profit was 3.525 billion yuan, an increase of 640.41%year -on -year. What is the company that allows the company to buy "Lithium King"? The announcement shows that Lithea was established in 2009 and is mainly engaged in acquisition, exploration and development of lithium mining rights. Its main asset PPG project is a lithium salt lake project located in Salta Province, Argentina, including two lithium salt lake assets of Pozuelos and Pastosgrandes.

As a leading domestic lithium mine, Ganfeng Lithium has continued to accelerate the pace of production capacity expansion in recent years.

According to the previous planning of Ganfeng Lithium, the company will form a lithium product supply capacity of a total annual output of not less than 200,000 tons of LCEN in 2025. Ganfeng Lithium said on May 26 that at present, Ganfeng has the effective production capacity of 28,000 tons of lithium carbonate, 70,000 tons of lithium hydroxide, and 2150 tons of metal lithium. In order to further enhance production capacity.

Edit | Lu Xiangyong Du Hengfeng

School pair | Duan Lian

Cover Map Source: Photo Network_501911358

Daily Economic News Integrate from the announcement of listed companies, China Securities Journal, Wind, etc.

Daily Economic News

- END -

Citizens, please pay attention!These bus lines in Chengdu are adjusted

Hongxing News Network, June 24th According to the WeChat public account of Chengdu...

30 people live in one household, and they were all infected!The three buildings in the Shanghai comm

The distance between the neighborhood of the neighborhood at home for the epidemi...