The owner forced loan, the three major banks responded!

Author:Peninsula Metropolis Daily Time:2022.07.14

Affected by the suspension of loan storms, after the opening on the 14th, the stock price of a number of listed banks fell. On the afternoon of the 14th, Construction Bank, Agricultural Bank, and Industrial Bank took the lead in responding to the matter. The above banks all said that the overall risk was controllable.

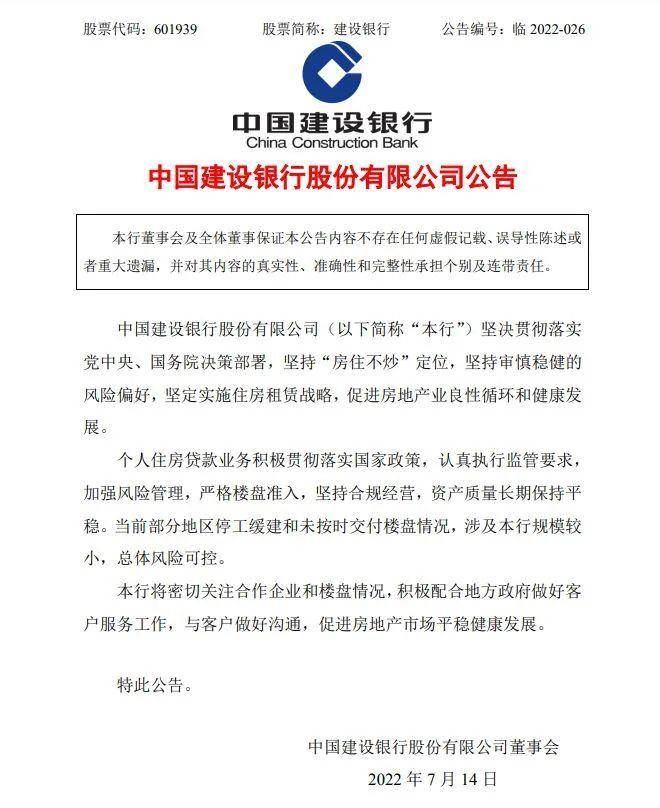

CCB: involved the small scale of the Bank, and the overall risk is controllable

The Construction Bank announced that the bank's personal housing loan business actively implemented national policies, conscientiously implemented supervision requirements, strengthened risk management, strictly enrolled real estate access, adhered to compliance operations, and maintained asset quality for a long time. The current suspension of work in some areas and the failure to deliver the real estate on time involve the small scale of the Bank and the overall risk controlled.

Construction Bank stated that the bank will pay close attention to the situation of cooperative companies and real estate, actively cooperate with local governments to do a good job of customer service, communicate with customers, and promote the steady and healthy development of the real estate market.

Image source: Construction Bank Announcement

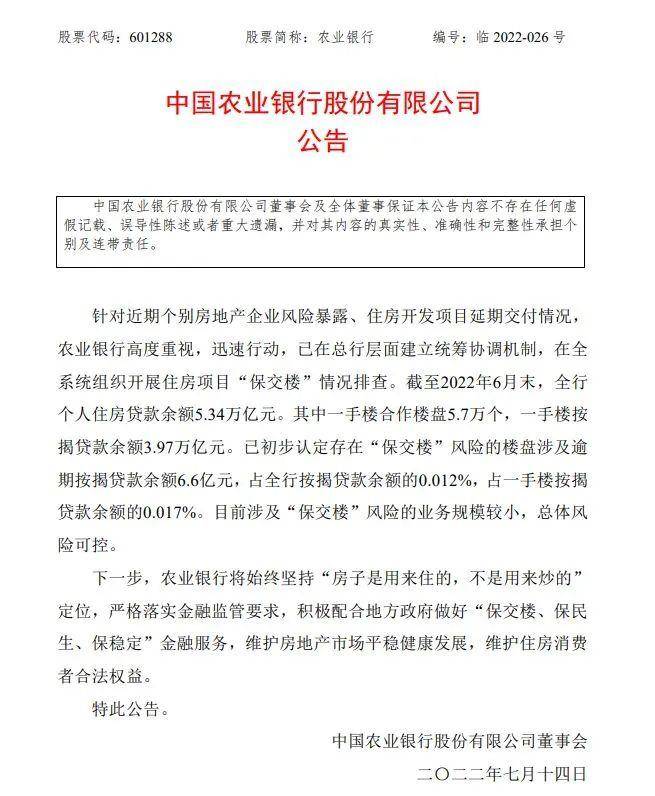

Agricultural Bank of China: The business scale involving the risk of "insurance delivery" is small

Agricultural Bank announced that in response to the recent risk exposure of individual real estate enterprises and the extension of housing development projects, Agricultural Bank attaches great importance to it and moves rapidly. Check.

Data show that as of the end of June 2022, the balance of personal housing loans of Agricultural Bank of China was 5.34 trillion yuan. Among them, there are 57,000 cooperative real estate in one -handed building, and the balance of mortgage loans of first -hand buildings is 3.97 trillion yuan. Real estate, which has preliminarily determined that the risk of "guarantee of the property" involves the balance of overdue mortgage loans, accounting for 0.012%of the bank's mortgage loan balance, and 0.017%of the balance of one -handed mortgage loan. At present, the business scale involving the risk of "insurance delivery" is small and the overall risk is controllable.

Picture source: Agricultural Bank of China Announcement

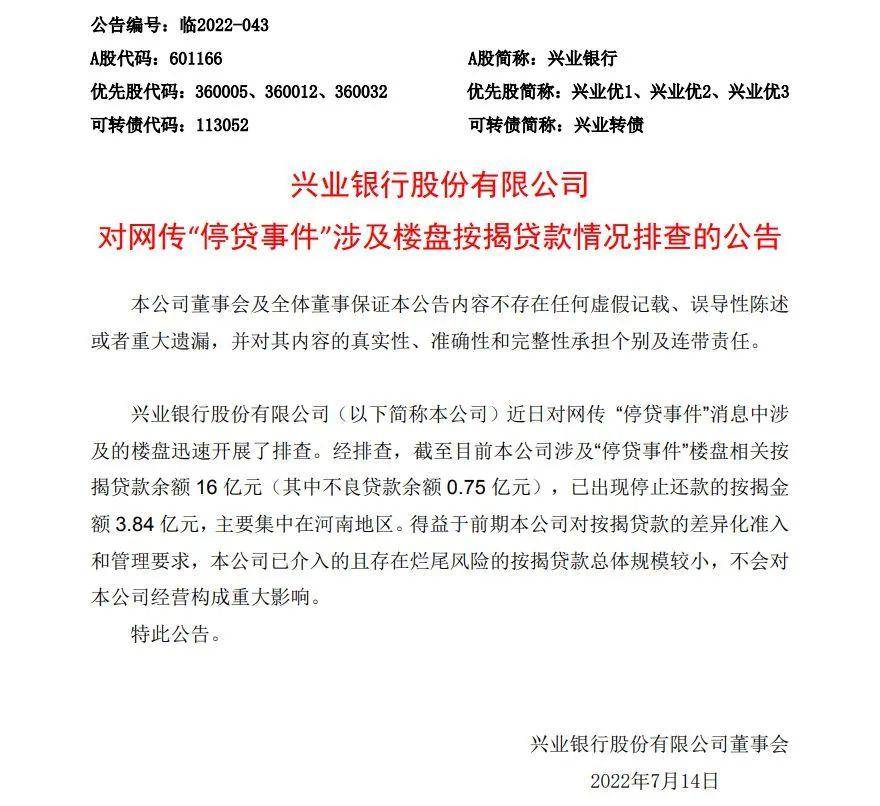

Industrial Bank: It will not have a significant impact on the company's operation

The Industrial Bank pointed out that recently, the bank's real estate involved in the news of the "suspension of loans" on the Internet has quickly launched a investigation. After investigation, as of now, the Industrial Bank has involved the balance of mortgage loans related to the "suspension of loan incidents" (of which the balance of non -performing loans was 75 million yuan), and the mortgage amount that had stopped repayment was 384 million yuan, which was mainly concentrated in Henan.

"Thanks to the company's differentiated access and management requirements for mortgage loans in the early stage, the overall size of mortgage loans that have been involved in and risk risks in the company is small, which will not have a significant impact on the company's operations." Industrial Bank said Essence

Image source: Industrial Bank Announcement

Recently, some of the owners of rotten tail buildings unilaterally announced the suspension of repayment of mortgage loans of commercial housing. According to incomplete statistics from the agency, more than 100 real estate in Henan, Hubei, Hunan, Jiangxi, Shandong, Hebei, Guangxi, Guangdong and other provinces issued a public statement, saying that if the work cannot be resumed within a certain period of time, the owner will be forced to suspend loan.

According to the estimation of Guangfa Securities research, the current area of the suspension of real estate enterprises accounted for about 20%, and the proportion of the total production capacity of the industry in the default housing enterprises accounted for about 25%. The total amount is about 500 million square meters.

Guangfa Securities believes that from the perspective of potentially affected bank assets, according to statistics from Guangfa Securities, if 500 million square meters are stopped, according to the price of 1W/square meter asset, the corresponding asset value is worth 5 trillion yuan. %, Corresponding to 2 trillion mortgage loans.

(China News Agency)

- END -

Chinese and foreign experts and scholars have discussed "Education Development and Right Protection of Ethnic Regions in China"

Xinhua News Agency, Beijing, July 4th (Reporter Zhao Xu) The 50th session of the United Nations Human Rights Council Education Development and Rights Guarantee of Chinese Ethnic Regions was held on

"Revolutionary Old District Public Security Bank" Chongqing Shapingba: Hongyan spirit integrates the blood of the public security

The police officers of the Shapingba Branch of the Chongqing Public Security Burea...