Data in the second quarter improved the short -term pressure of Tianshunfeng's performance in short -term performance.

Author:Public Securities News Time:2022.07.14

Tianshunfeng (002531) issued a interim reporting preview on July 13, and it is expected that net profit in the first half of the year will decrease by 60%-70%year-on-year. The agency believes that in the first half of 2021, the company reduced some of the stocks to generate a large investment income, resulting in a higher base and eliminating the base factors, and the company's performance has improved significantly. The market shows that the company's stock price increased from 16.58 yuan to 18.57 yuan from July 13 to July 14 after the disclosure of the company's interim results.

The second quarter performance improved from the previous month

According to the interim report, Tianshunfeng is expected to achieve a net profit of 240 million yuan to 3.19 billion yuan in the first half of the year, a year-on-year decrease of 60%-70%. In the single quarter, the company is expected to achieve a net profit of 210 million yuan to 290 million yuan in the second quarter, a year-on-year decrease of 5%-31%, and a month-on-month increase of 537%-782%.

"In the first half of 2021, the company's wholly -owned subsidiary Suzhou Tianli reduced its holdings of science and technology some stocks to generate 308 million yuan in investment income, resulting in higher bases. On the whole, the company's second quarter performance improved significantly from the previous quarter." The reasons for the decline in the company's performance, Deng Yongkang, a researcher at Minsheng Securities, analyzed.

In the first quarter of 2022, the company's production Duan Taicang, Tancheng, and Puyang plant, demand side logistics and customer demand were affected by the epidemic. In this regard, Sun Xiaoya, an analyst at Tianfeng Securities, believes: "The company's current land capacity capacity is returned to normal in May. For the production capacity, the land tower currently orders 800,000 tons in hand, and the factories are full. "

In the second half of the year, the volume and shipment volume is good

"Religion is gradually released, and short -to -medium and long -term logic has support." Deng Yongkang believes that due to the impact of restrictions on the production and sales and raw material prices of the epidemic, the second quarter performance pressure of the industrial chain company, including Tianshunfeng, has been expected to consider raw materials. The price pressure is loose, and the number of startups and shipments in the second half of the year is better. It is expected that profit and revenue will be significantly improved in the third quarter.

In terms of policy, on May 15th, the Shanghai Municipal People's Government issued the "Fourteenth Five -Year Plan for Energy Development in Shanghai", pointing out that the development of offshore wind power in the three major waters of Fengxian, Nanhui and Jinshan was the three major waters. Zhoushan City, Zhejiang Province recently issued the "Notice on the Development and Construction of Flowing Power and Photovoltaic Projects in 2022" to clarify the sea wind power support policy. At present, the three provinces of Guangdong, Shandong, and Zhejiang have announced the subsidy policy of offshore wind power.

"Wind power will usher in the demand resonance at home and abroad in the second half of the year." Huatai Securities believes that the current wind power project is economically good. In addition, the central state-owned enterprise installation target restrictions are expected to reach 50-60GW this year. Essence Overseas markets, European offshore wind power favorable policies are frequent. Denmark, the Netherlands, Germany, and Belgium are planned to reach 150GW until 2050.

So, how much is Tianshunfeng Energy Farm Resources? How much will be added every year in the future? Does the company have a maritime power generation business? In this regard, Tianshunfeng Securities Department said: "The company has started a 500MW project this year, and the other 600MW projects are under approval. The company's operations and power stations under construction are all land power stations."

Reporter Zhang Yan

- END -

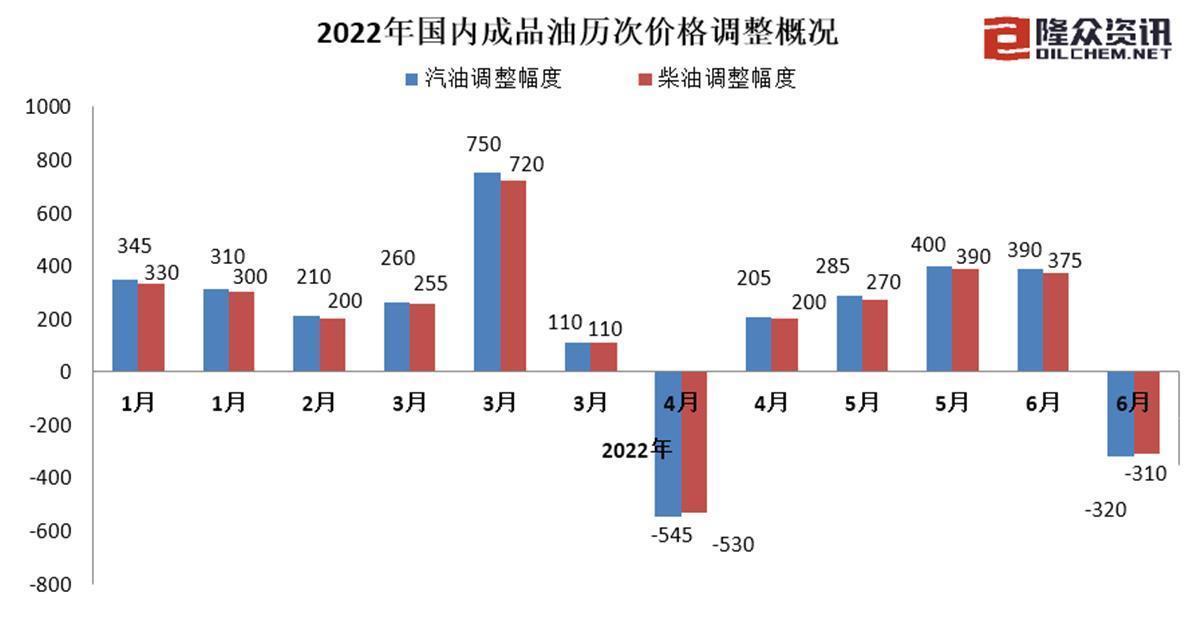

Full a box of oil or spend 12.5 yuan less. The institution is expected to have a downlink space in the future.

Jimu Journalist Zeng LingzhengThe international oil price has continued to rise si...

On June 19th, full traffic!

On June 13th, the Xi'an Bridge Reconstruction Project was completed as scheduled, ...