The CBRC responded to the "suspension of loan" incident!Multiple banks issue announcements →

Author:Look at the news Time:2022.07.14

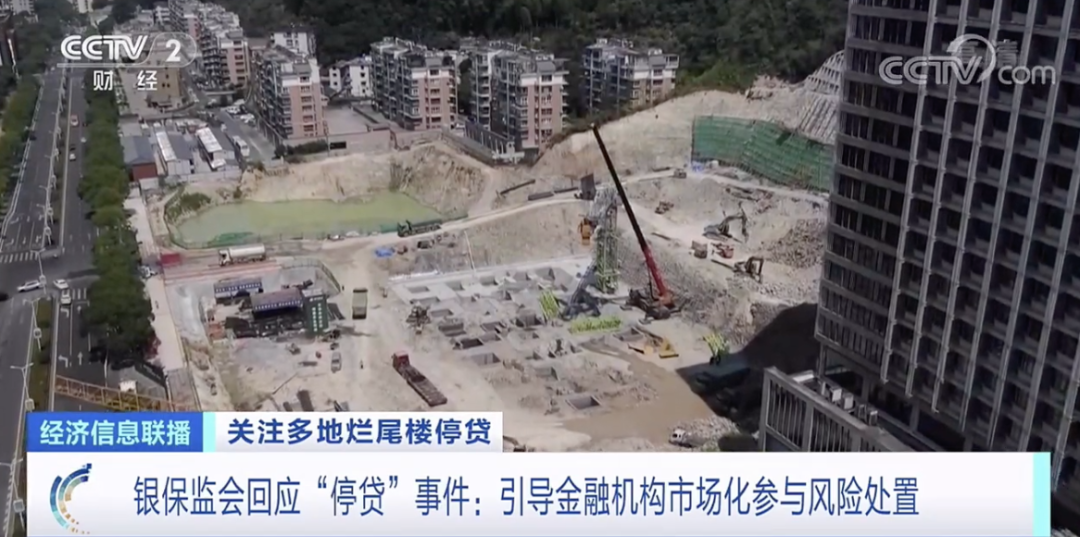

Recently, the owners of many places have attracted widespread concern due to the incident of post -loan repayment announced by the real estate delay. In response, the person in charge of the relevant departments of the Banking Insurance Regulatory Commission responded today, saying that it will guide the marketization of financial institutions to participate in risk disposal, strengthen the housing construction department, China China, China The work of the People's Bank of China supports local governments to actively promote the work of "keeping diplomatic relations, protecting people's livelihood, and stable stability".

The CBRC responds to the "suspension of loan" incident: Guide the marketization of financial institutions to participate in risk disposal

The person in charge of the relevant departments of the CBRC said that recently paying attention to the extension of the delay in the property of individual housing enterprises. The key to this incident lies in the "guarantee of the property", and the CBRC attaches great importance to this.

In the next step, the China Banking Regulatory Commission will continue to implement the decision -making and deployment of the Party Central Committee and the State Council, adhere to the positioning of "the house is used for living, not used for frying", adheres to stable price, stable house prices, stable expectations, maintain real estate financial policy policy Continuousness and stability, maintain the stable and orderly real estate financing, support the commercial housing market to better meet the reasonable housing needs of buyers, guide financial institutions to participate in risk disposal, strengthen work with the housing and construction departments and the People's Bank of China, and support local governments Actively promote the work of "keeping diplomatic relations, protecting people's livelihood, and stable stability", and do a good job of relevant financial services in accordance with laws and regulations to promote the virtuous circulation and healthy development of the real estate industry.

Many banks issued an announcement in response to the "suspension of loan" incident: smaller overall risk controlled

Today, a number of banks issued an announcement saying that the recent investigation of the risk exposure of individual real estate enterprises and the extension of housing development projects have been investigated. Many banks that have been issued currently issued have stated that the business scale involved is small and the overall risk is controllable.

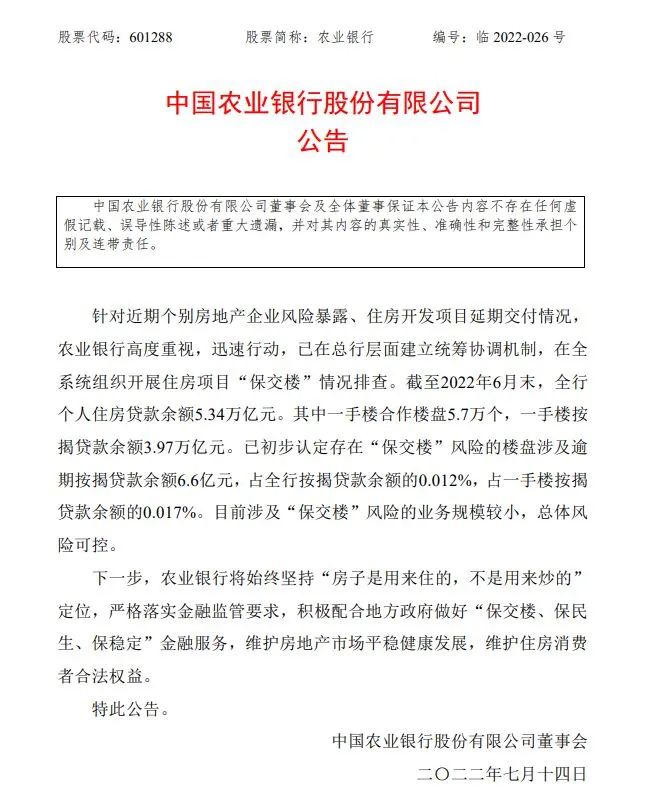

Agricultural Bank of China: involved "insurance diplomatic relations"

The business scale of risks is small

Agricultural Bank issued an announcement saying that in response to the recent risk exposure of individual real estate enterprises and the extension of housing development projects, Agricultural Bank attached great importance to it and moved rapidly. Investigation.

Picture source: Agricultural Bank of China Announcement

As of the end of June 2022, the balance of personal housing loans of the Agricultural Bank of China was 5.34 trillion yuan. Among them, there are 57,000 cooperative real estate in one -handed building, and the balance of mortgage loans of first -hand buildings is 3.97 trillion yuan. Real estate, which has preliminarily determined that the risk of "guarantee of the property" involves the balance of overdue mortgage loans, accounting for 0.012%of the entire mortgage loan balance, and 0.017%of the balance of one -handed mortgage loan.

The Agricultural Bank said that the current business scale involving the risk of "guarantee to the property" is small and the overall risk is controllable. In the next step, the Agricultural Bank will always adhere to the positioning of "the house is used for living, not used to speculate", strictly implement financial supervision requirements, and actively cooperate with local governments to do a good job of "keeping diplomatic relations, protecting people's livelihood, and stable" financial services. Maintain the steady and healthy development of the real estate market, and maintain the legitimate rights and interests of consumers in housing.

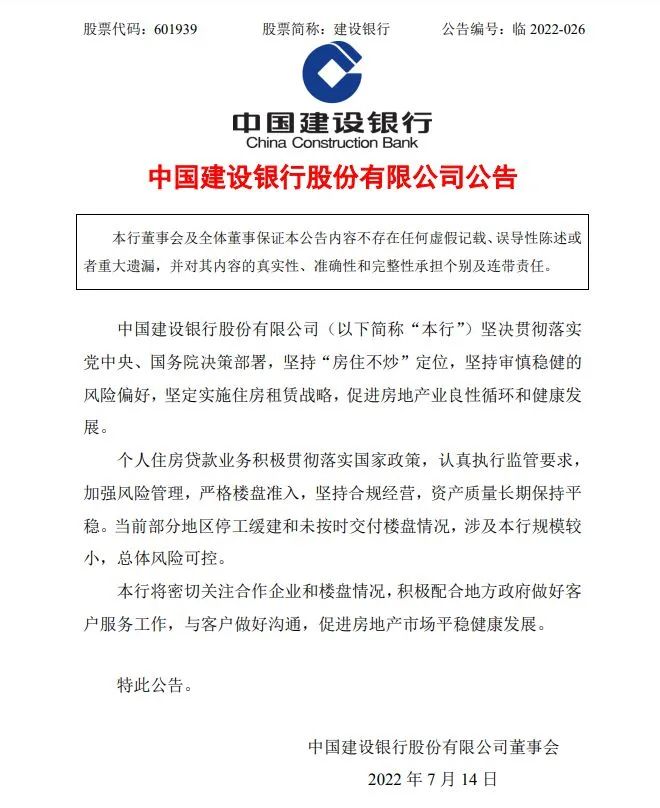

Construction Bank: Small scale involved

Actively cooperate with local governments

Do a good job of customer service

The Construction Bank issued an announcement saying that the current suspension of construction and the failure to deliver the real estate on time involved the small scale and the overall risk of the Bank. Construction Bank will pay close attention to the situation of cooperative enterprises and real estate, actively cooperate with local governments to do a good job of customer service, communicate with customers, and promote the steady and healthy development of the real estate market.

Image source: Construction Bank Announcement

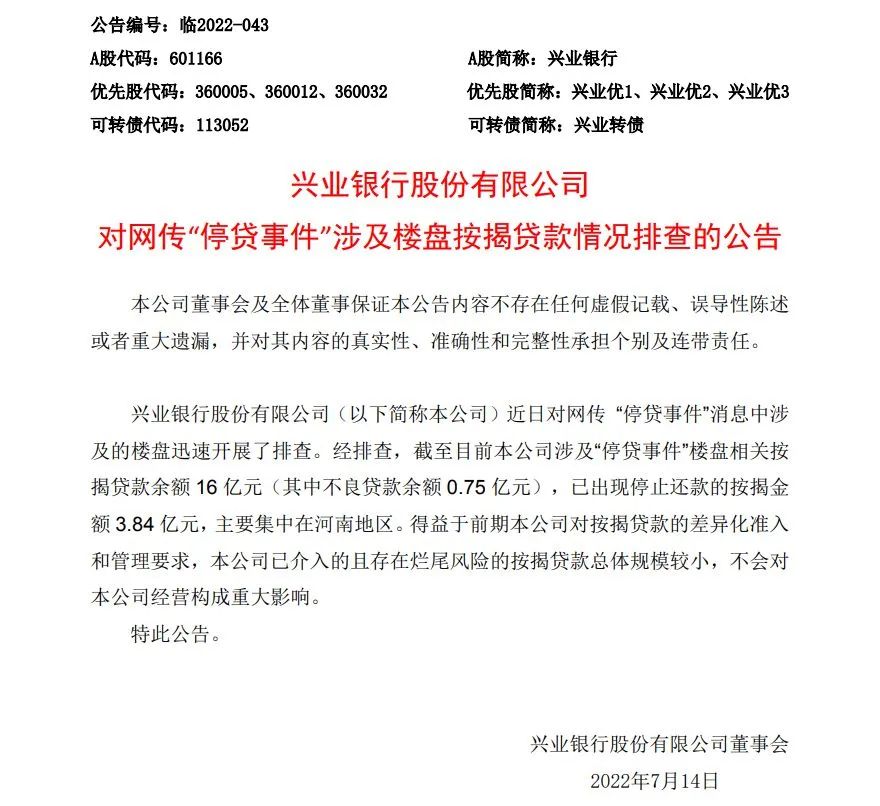

Industrial Bank: Involved in the "suspension of loan incidents" real estate

Related mortgage loans balance of 1.6 billion yuan

The "Announcement on the Investigation of Loans for Loans for Real Estate" issued by the Industrial Bank's "Discontinuation of Loans" shows that, after investigation, as of now The amount of mortgage that had stopped repayment was 384 million yuan, mainly concentrated in Henan.

Image source: Industrial Bank Announcement

According to the Industrial Bank announcement, thanks to the company's differentiated access and management requirements for mortgage loans in the early stage, the overall scale of mortgage loans that have been involved in the company's intervention and risk risks will not have a significant impact on the company's operations.

Bank of Communications: overdue housing involved

Mortgage loan balance of 099.8 billion yuan

The Bank of Communications issued an announcement saying that the company strictly implements the national credit policies, adheres to the positioning of "housing does not stir -fry", and actively supports residents' reasonable demand for self -residential home purchase. Since the beginning of this year, the company's mortgage loans have operated well. As of the end of June, the balance of mortgage loans in domestic houses was nearly 1.5 trillion yuan, and the quality of assets was stable.

Recently, the risks of individual real estate companies have been exposed, which has led to suspension and delay in projects in some cities. After preliminary investigations, the balance of overdue housing mortgage loans involved in the risk in media reports was 99.8 million yuan, accounting for 0.0067%of the company's domestic housing mortgage loan balance, the scale and accounted for relatively small, and the risks were controllable.

In the next step, the company will pay close attention to the status of cooperative enterprises and real estate, strictly implement the requirements of regulatory agencies, and actively cooperate with local governments to do a good job in financial services "guaranteeing diplomatic relations, protecting people's livelihood, and maintaining stability", maintaining the stable and healthy development of the real estate market, maintaining consumers Legal rights and interests.

Postal Savings Bank: Small scale and proportion

Provide support for extended repayment and credit reporting

The Postal Savings Bank issued an announcement saying that the Bank pays close attention to the suspension of the construction and the failure to deliver the real estate on time in some areas, and conduct in -depth investigations. The preliminary determined suspension project involves the overdue amount of housing loans.Controlled.The postal savings bank said that the next step, the Bank will resolutely implement the decision -making and deployment of the Party Central Committee and the State Council, adhere to the positioning of "housing and not frying", strictly implement financial supervision requirements, and actively do customer service.For customers affected by the epidemic, provide support for postponed repayment and credit reporting to rescue customers.

This article integrates from CCTV Finance, Global Times, etc.

WeChat editor: nano

- END -

What is going on?Guiyang's community must build kindergartens, but residents do not agree

Recently, a building in the Jinyang New World Royal Lake Community, Guanshan Lake ...

Longyou County Forestry Water Resources Bureau issued mountain flood disasters blue warning [Class I

Longyou County Forestry Water Resources Bureau and Longyou County Meteorological Bureau June 09, 19, 19:35, jointly issued a mountain flood disaster blue warning: It is expected to be 20:00 on June 09