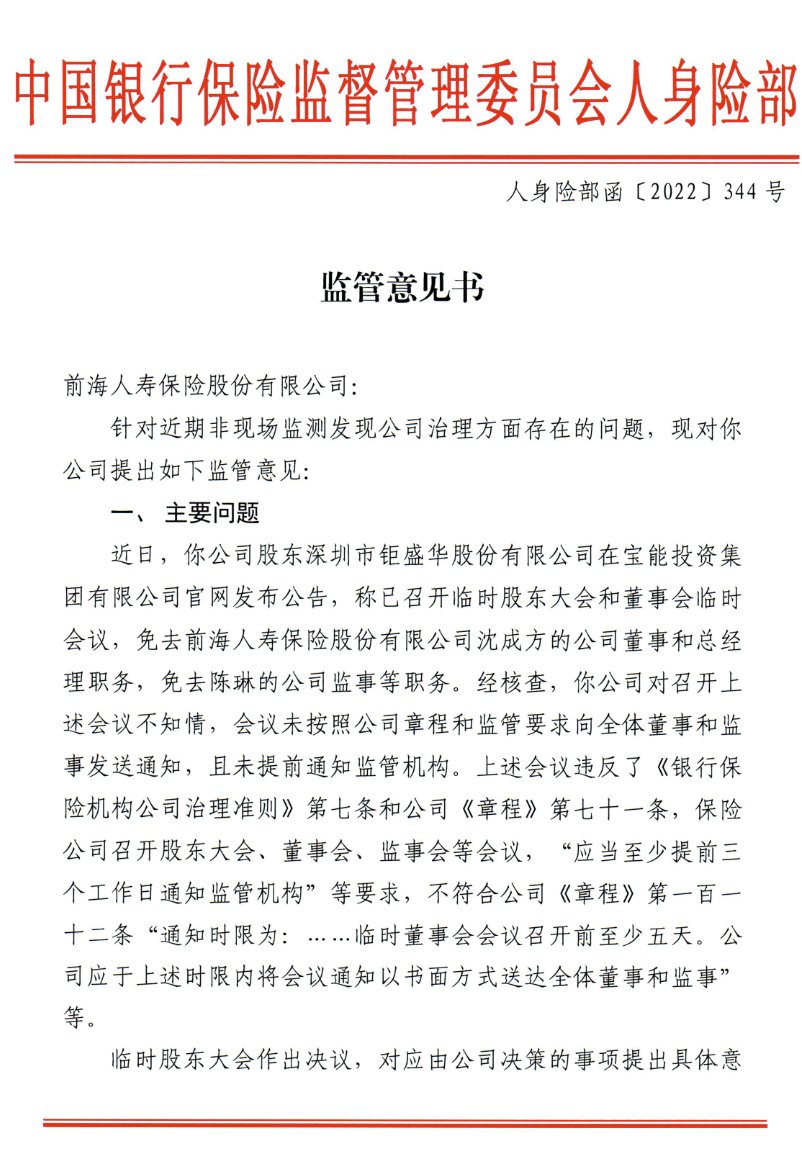

Sudden!Yao Zhenhua was interviewed by the China Banking Regulatory Commission, involving the issue of Qianhai Life, and asked to rectify immediately!Look at details ...

Author:Broker China Time:2022.07.15

Following at the same time, after exempting the general manager and a supervisor, Qianhai Life has attracted attention for a "Supervisory Opinions".

The securities firm China noticed that Qianhai Life hung up on the official website of the CBRC this morning. This document shows that there are problems with Qianhai Life's governance and should be rectified immediately.

It is worth mentioning that the CBRC has conducted a supervision and interview with Yao Zhenhua, the actual controller of the company, and ordered to correct the issue of violations; it is strictly forbidden to intervene in the company's operation; it is strictly forbidden to use affiliated transactions to transfer interests and asset transfer, and shall not invade the misappropriation of insurance insurance funds.

I have interviewed Yao Zhenhua and it is strictly forbidden to intervene in shareholders

The "Regulatory Opinions" mentioned that recently, Qianhai Life's shareholder Shenzhen Huishenghua Co., Ltd. issued an announcement on the official website of Baoneng Investment Group, saying that the interim shareholders' meeting and the board of directors have been held. The position of directors and general managers of the company, eliminating Chen Lin's company supervisors and other positions. After verification, the company did not know the above meeting. The meeting did not notify the regulatory agency in accordance with the company's charter and regulatory requirements, and did not notify the regulatory agency in advance.

The opinion of the opinion is straightforward, and the above -mentioned meeting violates Article 7 of the "Guidelines for the Governance of the Bank Insurance Institution" and the company's "Articles of Association".

In this regard, the personal insurance department of the Banking Insurance Regulatory Commission put forward three regulatory opinions:

First, the problem was rectified immediately, and the CBRC had regulated the company's actual controller Yao Zhenhua and ordered the correction of correction of violations of regulations. The company is required to notify the shareholders and members of the board of directors in accordance with the law. The relevant procedures and resolutions of the temporary shareholders' meeting and the temporary meeting of the board of directors do not meet the regulatory regulations and the company's articles of association. The company's shareholders are required to exercise shareholders' rights in accordance with laws and regulations, regulatory regulations, and corporate articles of association, and fulfill their responsibility and obligations in accordance with laws and regulations. The company's directors should perform their duties and perform their duties with their duties. Independent directors should express objective and fair independent opinions, and perform their duties with integrity and independent.

Second, it is strictly forbidden to intervene in the operation of the company, requiring the shareholders of the company to strictly implement the relevant supervision requirements of the "Regulatory Measures for the Supervision (Trial)" and other relevant regulatory requirements of the bank insurance institution to maintain the independent operation of the insurance company. The legitimate rights and interests of insurance companies.

Third, the company's situation is stable, requiring the company to implement the main responsibility, adhere to independent and independent operations, implement the risk isolation mechanism, maintain the company's business and personnel stability, and ensure the company's assets and funds. On the basis of reducing business scale and strengthening insurance funds, further effective measures are taken to improve the solvency of solutions and prevent risks.

The personal insurance department of the Banking Insurance Regulatory Commission also requires that Qianhai Life Shares should strictly implement relevant regulatory requirements and maintain the independent operation of insurance companies.

A reporter from securities firms noticed that the "Regulatory Opinions" was issued on July 14, and Qianhai Life hung the Internet on the morning of July 15.

The embarrassing status quo of Qianhai Life

On July 11, the official website of Baoneng Group issued an announcement saying that recently, Qianhai Life, a subsidiary of Shenzhen Yishenghua Co., Ltd., held a meeting to avoid Shen Chengfang's company's directors and Chen Lin's company supervisor position; Go to Shen Chengfang's general manager position and arrange separately.

Because Zhang Junshun, the chairman of Qianhai Life Insurance, resigned on March 12, 2021 for his personal reasons, and before, he had no chairman, no general manager, and no supervisor. The reporter noticed that this high -level change at the same time led to the only director of Qianhai Life Insurance's board of directors except five independent directors.

In addition to changes in high -level, Qianhai Life's operating data also deteriorated.

According to the company's first quarter solvency report, Qianhai Life's core payment capacity adequacy ratio was 66.39%, and the comprehensive solvency adequacy ratio was 110.17%, which was significantly lower than the average level of life insurance companies. Class C.

Qianhai Life explained that in terms of market risks, due to the high proportion of the company's investment in real estate and equity assets, the minimum capital of real estate price risk and equity price risk was relatively high. In the future, the company will strictly control the investment in real estate, and at the same time closely track market developments and industry trends, and timely select some projects to implement withdrawal; select the types of equity investment varieties and control the scale of investment in equity to reduce capital consumption of equity investment as much as possible Essence In terms of credit risk, it is mainly affected by the poor economic environment under the disturbance of the epidemic in recent years. Some combined with the risk classification level of underlying loan asset risks after the trust plan penetrated, leading to a significant increase in the minimum risk of trading opponents. Subsequent companies will actively promote the withdrawal of trust plans.

In terms of the main operating indicators, Hai Life Life realized insurance business income of 10.955 billion yuan in the first quarter, a year -on -year decrease of 80 %, and a net profit loss of 2.323 billion yuan in the first quarter.

The above -mentioned solvency report also revealed that in the first quarter, the company's actual premiums were less than expected, and the actual surrender expenditure was higher than expected.

Editor: Lin Gen

- END -

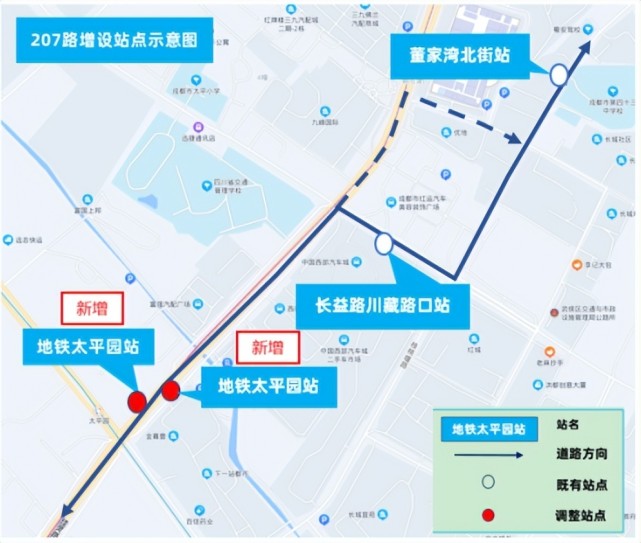

These bus lines in Chengdu are adjusted. Please pay attention to citizens travel

Hongxing News Network, July 21 According to the WeChat news of Chengdu Public Tran...

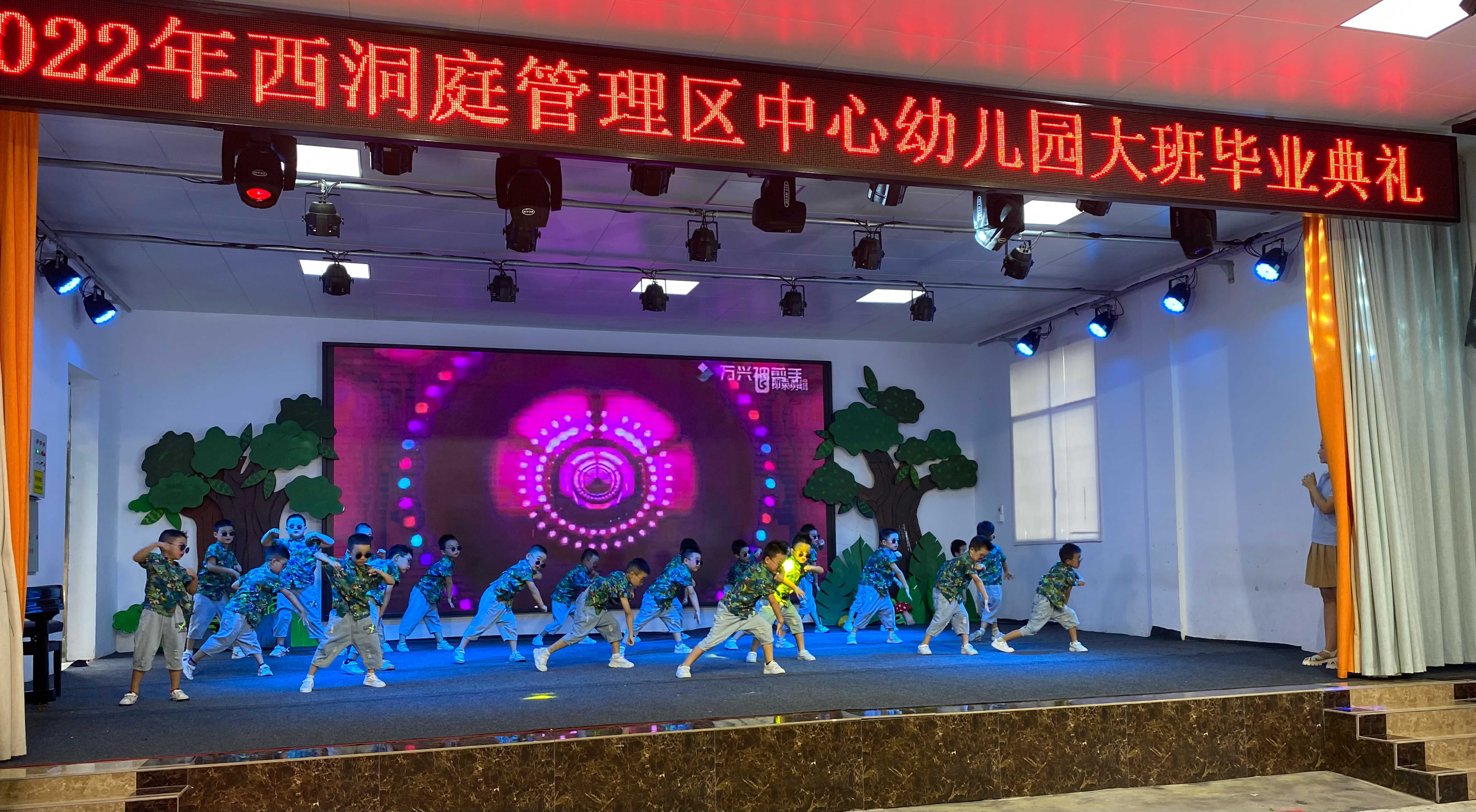

Changdexi Dongting: Graduation Ceremony in Kindergarten

On July 8th, the kindergarten in the central garden of the Xidongting Management Z...