Deep | Structural monetary policy has advanced or retreat: how to "advance" and how to "retreat"?

Author:21st Century Economic report Time:2022.07.15

21st Century Business Herald reporter Yang Zhijin Shanghai reported structural monetary policy is one of the focus issues of market attention this year.

"Structural monetary policy tool boxes are relatively rich and perfect. In general, structural monetary policy tools (with) 'focusing on key points, reasonable and moderate, progressive and retreat." It was said at the financial statistics at the first half of 2022 on July 13th. This is the central bank once again expressed the "progress and retreat" of structural monetary policy, and the market also pays attention to how structural monetary policy "advances" and how to "retreat".

There is no doubt that this year is still the stage of "advancement" of structural currency tools. In the second half of the year, monetary policy still needs to grow steadily, but the Fed's interest rate hike will restrict the space for the loose of China's total monetary policy. The contribution of monetary policy will be based on structural policy tools. Subsequent structural tools are still possible to set up or new quotas, but the general direction is implemented.

In particular, it is necessary to pay attention to the "retreat" of structural monetary policy. Historically, when a specific field is no longer a policy focus or when the situation changes in policy settings, the structural currency that originally supports the field will withdraw. In the long run, other structural tools may face the problem of exit except for the small re -loan of the agricultural branch.

Structural monetary policy intensive increase

Traditional economics theory believes that fiscal policy has structural characteristics, while monetary policy is a total policy. Therefore, the central bank mainly achieves policy goals by adjusting the total amount of deposit reserves and interest rates. "For it", it is auxiliary.

China's structural monetary policy was established earlier. As early as the 1980s, the two traditional structural monetary policy tools were established in the 1980s. However, it was not until Around 2014 that structural monetary policy tools ushered in a period of rapid development, including mortgage supplementary loan PSL, medium -term borrowing convenience MLF, and targeted reduction. At that time, it was mainly based on the macro ideas of "directional regulation" to strengthen support for specific fields. In addition, MLF and PSL can provide basic currencies.

"In the past, due to a large amount of foreign exchange inflows, the investment of basic currencies was mainly expanded through foreign exchange accounts. After 2014, foreign exchange accounts declined, and the central bank's basic currency distribution turned to MLF and PSL re -loans." Said Wu Ge, chief economist of Changjiang Securities. According to central bank data, MLF and PSL rapidly increased to a scale of trillions after the establishment.

After 2020, various types of special re -loan tools were established one after another, and this year was more densely established. According to reporters, the central bank once again launched at least 440 billion yuan of re -loan tools, including 200 billion yuan of scientific and technological innovation and re -loan, re -loan in the field of transportation and logistics in the transportation and logistics of 100 billion yuan, 100 billion yuan in support for coal clean and efficient use of special re -loans, and 40 billion yuan. Yuanpu Hui's re -loan in the field of pension. In addition, the central bank stated on April 26 that it would create a special re -loan of civil aviation, but the quota has not been clear.

"In the past ten years, we have gradually constructed a structural monetary policy tool system that conforms to China's national conditions, focusing on supporting key areas and weak links in national economic development such as inclusive finance, green development, and scientific and technological innovation. The promulgation of the introduction of the century's epidemic was effectively implemented, and at the same time, it actively implemented the new development concept and promoted the high -quality development of the national economy. "Chen Yulu, deputy governor of the central bank, said at the New National Office's press conference in June.

From the perspective of market participants, there are two major reasons for the central bank's densely creation of various re -loan tools this year: First, the problem of insufficient valid credit demand. After the two major "engines" of financing platforms and real estate are suppressed, credit investment urgently needs to find new support points, and structural monetary policy tools should be burdened with the heavy responsibility of stable credit growth. Second, the Fed started the interest rate hikes, which restricts China's total policy, and the constraints of structural monetary policies are small, and monetary policy is forced to rely on the latter.

"Balanced and stable growth and risk prevention have become the main goal of monetary policy. Monetary policy requires more accuracy and directability. Under the demands of cherishing normal monetary policy space, the types and functions of structural monetary policy tools are gradually enriched." CITIC Securities Securities Securities The joint chief economist clearly said.

Results and controversy

Regarding the efficacy of structural monetary policy, the article "Structural Monetary Policy Tools for Structural Monetary Policy Tools, helping market entities bailout, and real economy development published by the Research Team of the People's Bank of China in May this year pointed out that structural monetary policy tools are finance It has made important contributions to the key areas and weak links that support the real economy and support the development of the national economy. At the same time, it helps to maintain a reasonable liquidity of the banking system and support credit growth.

However, there are some doubts about the various re -loans that are intensive this year. There are already "lessons of the front car": about 3 trillion PSL support shed reforms from 2015-2018, resulting in the rise in housing prices in third- and fourth-tier cities. Some recent doubts include transparency, whether they are offside, the effect is not as good as fiscal policy, weakening the effects of total amount of tools, and difficult to regulate.

Huang Yiping, deputy dean of the National Development Research Institute of Peking University and former member of the Central Bank Monetary Policy Committee, wrote in June this year that if the structural components in monetary policy are getting higher and higher, the total number of monetary policy may be weakened. In addition, the central bank clearly decides the flow of funds and the scale, and its function is closer to the fund allocation department.

"Whether the structural monetary policy can really reach the target customer base, this is the second doubt. The monetary policy and the fiscal policy are different, and the liquidity has given financial institutions. One condition, one is whether the financial institutions are favorable, and the other is whether the central bank can supervise and implement it. "Huang Yiping said. In fact, as early as 2015, Li Bo, the director of the Monetary Policy Department, wrote that the structural monetary policy has side effects. Some targeted easing policies may have a significant impact on the asset prices purchased by the central bank. The role of market allocation of resources may be weakened, causing imbalances in resource allocation and distortion of market functions. And due to the asymmetry of information during the implementation process, banks may have room for arbitrage at the asset side. At the same time, if you use excessive use, structural monetary policy may lead to the "monetization" and "hidden" of fiscal deficit.

Regarding the question of weakening the total amount of structural monetary policy, Chen Yulu responded at the press conference of the New National Office that structural monetary policy tools were both regulatory and structural regulation. In other words, the policy effect of accurate drip irrigation through structural tools can also contribute to the regulation of total amount.

Chen Yulu explained that on the one hand, when the People's Bank of China was designing structural policy tools, in accordance with the principles of target consistency to establish a mechanism of incentive compatibility, that is, the central bank's funds and financial institutions were linked to specific fields and industry credit. Mobilizing the enthusiasm of financial institutions can more effectively promote the optimization of credit structure. On the other hand, structural monetary policy tools also have basic currency investment functions, helping to maintain the liquidity of the banking system reasonable and abundant, and support the steady growth of credit.

However, from the perspective of the market, structural monetary policy mainly contributes to broad liquidity, and does not contribute to the narrow liquidity between banks. That is to say, structural monetary policy can bypass "wide currency" to achieve "wide credit". The reduction of the same quota and the re -loan, the former constitutes a good part of the bond market, and the latter is sharp.

For other issues of structural monetary policy, further research may be needed. Zhang Xiaohui, former president of the central bank, said at the 2022 Tsinghua Wudaokou Chief Economist Forum in May this year that how to explain how to explain in a very period, structural monetary policy has become the role of a big beam. , Urgently need to be able to break through theory and innovate. Zhang Xiaohui served as director of the Central Bank's Monetary Policy Department from August 2004 to 2015. He was familiar with monetary policy theory and had rich practical experience.

"Entry" and "Retreat"

Chen Yulu also said that under the total framework of the People's Bank of China, the use of structural monetary policy tools will be "advanced and retreat" according to the key period and different stages of economic development, that is, the number and number of structural monetary policy tools and The scale control is controlled at a level of intention, forming a good cooperation with the policy tools of the total amount. This time, Zou Lan once again emphasized that the structural monetary policy will be "advanced and retreat".

Obviously, this year is the stage of "entering". The second quarter meeting of the Central Bank Monetary Policy Committee held on June 24 pointed out that structural monetary policy tools should actively do a good job of "adding methods", accurate efforts, increase support for inclusive small and micro loans, and support the stable employment of small and medium -sized enterprises. Use good use of coal cleaning and efficient utilization, scientific and technological innovation, inclusive pension, transportation and logistics special re -loan and carbon emission reduction support tools, comprehensively apply to support the coordinated development of the region, guide financial institutions to increase the development of small and micro enterprises, scientific and technological innovation, and green development. support.

Obviously, the loose orientation of the monetary policy under the goal of "steady growth, employment, and stable prices" will not change for the time being, but the implementation space of traditional total monetary policy will gradually narrow under the influence of the interest rate hike cycle overseas, or It will allow structural monetary policy tools and fiscal policies. Subsequent structural tools are still possible to set up or new quotas, but the general direction is policy implementation.

Zou Lan introduced that the three new tools (scientific and technological innovation, inclusive pensions, and transportation and logistics special re -loans) created this year were issued on a quarterly. (Financial institutions) will apply for the first time in July this year. At present Essence

Aspects of "retreat", for example, the central bank launched a special reinsurance of the 300 billion yuan epidemic in the epidemic prevention and control in 2020, the re -production and re -loan of 500 billion yuan, and the 1 trillion yuan to support small and micro enterprises for small and medium -sized banks, 18,000 The 100 billion quota will exit after the expiration of the expiration.

Guo Kai, then deputy director of the Central Bank Monetary Policy Department, explained at the central bank conference in July 2020 that these measures were designed for the special circumstances and different characteristics of the epidemic. For different times, you need to set it. When the policy setting is no longer applicable, it will be automatically exited. For example, the 300 billion yuan epidemic re -loan has completed its mission. Now the production capacity of medical products is already very large, and the material guarantee is very abundant. Therefore, the 300 billion yuan re -loan completes the mission and has withdrawn.

Another example is PSL. After PSL was founded in 2014, it supported shed reform through policy banks, which increased rapidly and reached a peak of 3.6 trillion in October 2019. However, it has fallen to 2.6 trillion yuan. The reduction and shed reform projects mainly through special debt financing.

Overall, when supporting a certain area and weak links need to be increased, structural monetary policy tools cannot be absent.When a specific field is no longer becoming the focus of policy or when the policy setting changes, the structural currency that originally supports the field will withdraw.Zou Lan said that the three new structural monetary policy tools created this year, coupled with the carbon emission reduction support tools issued in the fourth quarter of last year, and supporting the special re -loan of coal clean and efficient use.Mainly supporting agricultural support small re -loan and re -discounting tools.

In the long run, other structural tools may face the problem of exit except for the small re -loan of the agricultural branch.According to the latest data from the central bank, at the end of April 2022, the balance of small and retracted loans of the nation's branch agricultural branch was 1.86 trillion yuan, an increase of 529.4 billion yuan year -on -year.

- END -

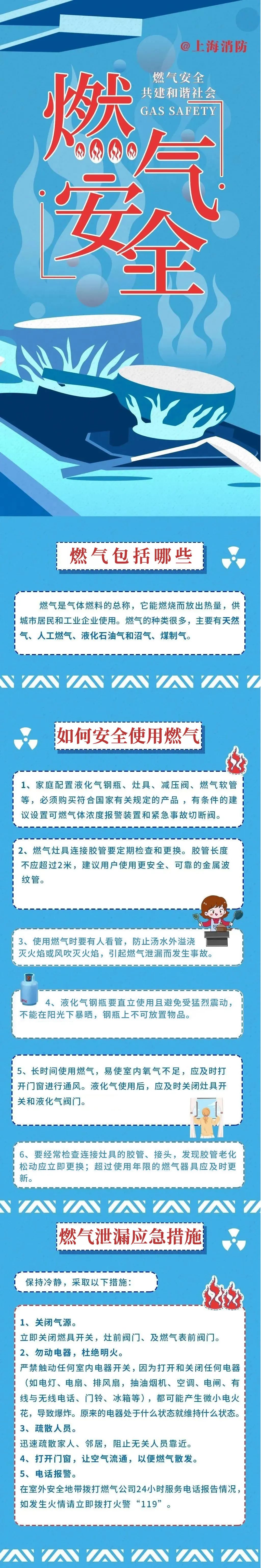

Emergency Science | Picture: You need to understand these gas safety knowledge!

Source: Shanghai Fire

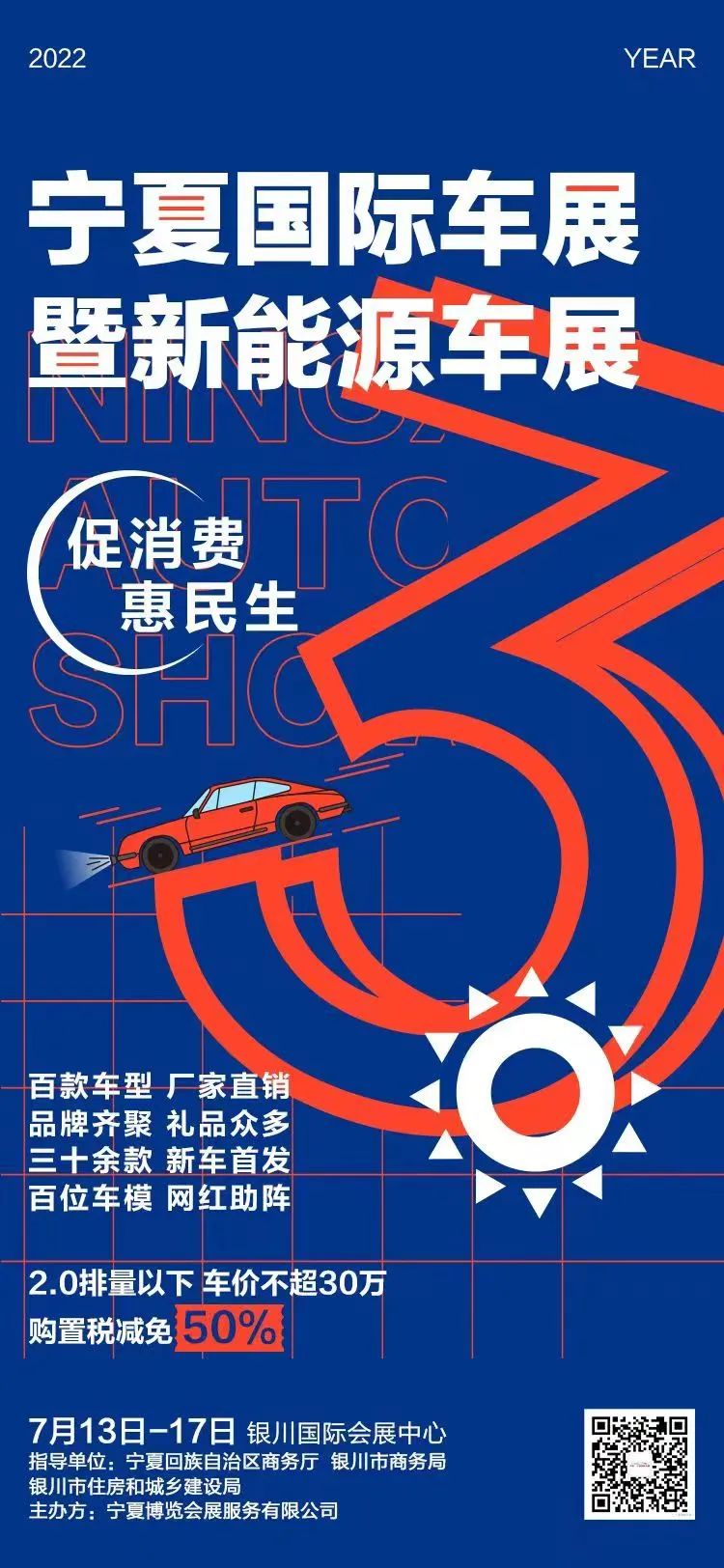

Diffusion | Yinchuan people come to the auto show quickly!There are subsidies to buy a car!

I plan to buy a car recently? You can't know this news! Save tens of millions of y...