Hao Baohua, an expert on Hang Seng Electronic Risk Compliance Planning: Securities Company needs a unified risk management platform

Author:Daily Economic News Time:2022.07.15

The importance of data governance to the comprehensive risk management of securities companies is self -evident.

On July 12, Hang Seng Electronics and its subsidiaries jointly organized the "financial risk compliance data" salon. Hao Baohua, an expert in Hang Seng Electronic Risk Compliance Planning, delivered a speech, stating that as the industry develops in deepening, securities companies are shifting from passive risk management to active risk management.

Hao Baohua proposed that risk data governance and risk data market construction is essential to improve the effectiveness of comprehensive risk management. Ignoring these two points, a series of risk management work cannot be carried out, risk management methods and tools are difficult to apply, and the effectiveness of risk management is difficult to guarantee or even flow.

In February 2022, the four departments of the central bank and other four departments issued the "Fourteenth Five -Year Plan for Financial Standardization", which proposed to vigorously promote the formulation of basic data standards and regulatory data standards for the capital market, study and build the capital market data standard system, improve the securities and futures industry data governance governance Level.

From the perspective of the construction practice of the securities company's comprehensive risk management system and the data market, Hao Baohua believes that the pain points and difficulties faced by the industry are mainly: the data standards of risk information are not uniform; the data data data is scattered in various business systems; ; The timeliness of risk information data collection is difficult to guarantee; offline risk information processing outside the information system is difficult to process; the accuracy of risk information is not high or even lacking; subsidiaries and overseas subsidiaries are difficult to classify and collect risk information.

With the continuous development of the industry, the construction of comprehensive risk management capabilities of securities companies needs to be continuously improved and improved. Looking forward to the future, Hao Baohua believes that securities companies can make efforts: unified risk management platform, risk monitoring and early warning, risk valuation and measurement capabilities.

The risk management platform brings a model of risk management. In the future, it will need to build an integrated risk management working system to cover all risk management links.

Specifically, one is to promote the use of a unified risk management platform, especially the unified use of various professional risk management systems to ensure the consistency of risk management. The exhibition industry and communication opportunities to improve the effectiveness of risk management.

For risk early warning, with the development of technologies such as big data, cloud computing, artificial intelligence, and blockchain, it is possible to discover hidden risks in time by processing internal and external data.

At present, the awareness of risk monitoring and early warning has changed. Some securities companies have established models for macroeconomics, regional economic development, and large customers' financial situation through tools such as public opinion monitoring, corporate portraits, related knowledge maps, and intelligent search tools, carry out risk assessment monitoring and early warning, strive to discover hidden risks early, take timely measures to take measures in time Transfer and resolve risks. This makes up for the shortcomings of traditional risk management and promote risk management from passive to active.

In addition, the valuation and measurement capabilities of risk management are important contents of risk management capabilities and securities company risk management. With the continuous launch of financial derivatives, the business is becoming increasingly complicated, and higher requirements for risk valuation and measurement capabilities, especially multi -business departments and domestic and foreign subsidiaries to carry out financial derivatives business at the same time, and collect financial derivative business risk data And the measurement of higher challenges.

Securities companies need to strengthen the comprehensiveness and timeliness of the collection of financial derivatives business data, increase the application of valuation models and the application of measurement methods, and enhance the effectiveness of risk identification and risk management of financial derivatives.

Daily Economic News

- END -

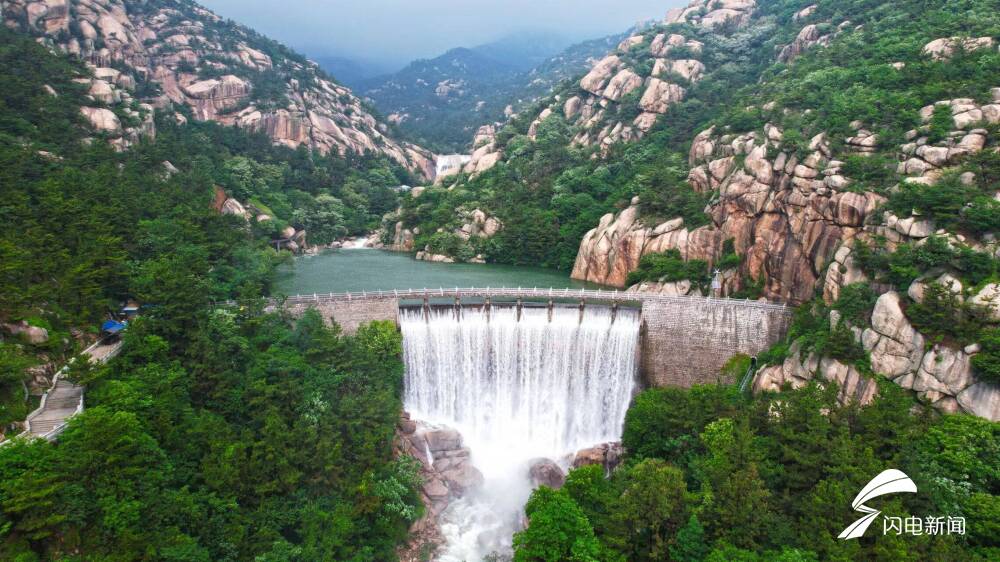

The strongest rainfall since Qingdao welcomes the flood.

Qilu.com · Lightning News June 27th News On June 26th and 27th, Qingdao ushered ...

The father and son were cleaned and the bottle of the hazardous chemical product died, and the local departments were involved in the investigation

Jimu Journalist Liu YiOn the evening of July 1, at the Bybolt 319 National Highway...