8.1 billion Hong Kong dollars!Li Ka -shing continued to sell British assets. What are he playing?

Author:Kanjie Finance Time:2022.07.18

Those who do not seek the overall situation are insufficient, and Li Ka -shing's assets have not stopped for a moment.

It took more than a year to buy British assets to selling British assets, and it was the complicated international environment that prompted him to make such a decision.

Since March of this year, Li Ka -shing has gradually sold British assets, re -deploying Southeast Asia and the Mainland, and this action has become more and more obvious, and the process is getting faster and faster.

On July 14, Li Ka -shing's Changhe, Changshi Group and the Yangtze River Infrastructure Group jointly issued an announcement saying that 25%of the 25%equity of the British water company's NORTHUMBRIAN WATER project was sold at a price of 867 million pounds (about HK $ 8.1 billion) to private equity in the United States Equity fund giant KKR.

According to the estimates of the three companies, this transaction may bring a profit of HK $ 2.4 billion. The announcement also disclosed that this transaction must be approved by the British Financial Market Candidate Administration, Main Island Financial Industry Administration and antitrust regulatory agency. If it is smooth, the transaction will be completed by the end of August.

After the transaction is completed, it is expected that the Changshi Group, the Yangtze River Infrastructure Group, Changhe and KKR will hold 15%, 30%, 30%, and 25%equity of projects.

It is reported that this is the second big sale plan of Li Ka -shing this month. As early as March this year, Li Ka -shing wanted to sell the British power network company in the UK's largest power distribution company. The participating bids are Magehstra Group Co., Ltd., APG, China Investment Co., Ltd., Ontario Teachers' Pension Planning Committee and PSP Investment Corporation.

The shortlisted transactions are the consortium led by Macquarie and KKR. However, on July 4th, there were media reports that the transaction eventually ended in failure.

The reason is that at the critical time, the Li Ka -shing family raised the price. Earlier, the British government had threatened hugeite taxes on some industries such as oil and gas companies and generators.

Some analysts believe that capital's interest in British infrastructure assets may remain strong. Therefore, Li Jiacheng's price raising at this time is also completely reasonable. It is not ruled out that Li Jiacheng continues to find buyers. Holding 12 years of Li Ka -shing's profit should reach £ 10 billion.

In addition to selling basic livelihood projects such as water conservancy and electricity, Li Ka -shing was not soft for British assets (real estate). On March 11, Changshi Group issued an announcement saying that all the equity of BroadGate, the London office building held by its companies, The price was 729 million pounds (about 5.8 billion yuan). It is reported that the project was purchased by Li Zezheng's 10 billion pounds in 2018. At first glance, the transaction seemed a bit losing money, but Changshi Group explained that in addition to considering the value of the property, the price was 1.21 billion pounds. 5 Broadgate's other assets and liabilities, in the end, the transaction actually made a profit of 108 million pounds (about 865 million yuan).

Judging from the current trend of the assets of the Li Ka -shing family, it will continue to sell British assets in the future.

In fact, from Li Ka -shing's investment style, they are basically similar to Buffett. The projects invested by the two are basically some basic livelihood projects, and most of them are mainly traditional industries. Among them, gas, petroleum, hydropower, insurance, etc. are the most popular because these projects are generally very good, and the valuation is not so high. Compared with the high -tech industry fluctuations, it is not so large and stability is good.

Since the beginning of this year, Buffett's investment has achieved a major "victory". In the year when the global wealthy assets shrink, Buffett's value has increased a certain increase, and Li Ka -shing is probably the same. However, unlike Buffett's large investment in oil, energy and other companies, the Li Ka -shing family began to reduce British assets.

The reason why Buffett bought Li Ka -shing sold was caused by the complex international situation. It is foreseeable that Li Ka -shing will continue to add in Southeast Asia. For British assets, I will continue to sell. In the future The family will also choose to sell British Electric Power Networks, and the price may exceed 15 billion pounds.

- END -

Late Jinsheng · Shi Shiyun | Rain and rain ... Pay attention

Fan friends of Taihang Daily, good evening! Today is July 1, 2022, on the third da...

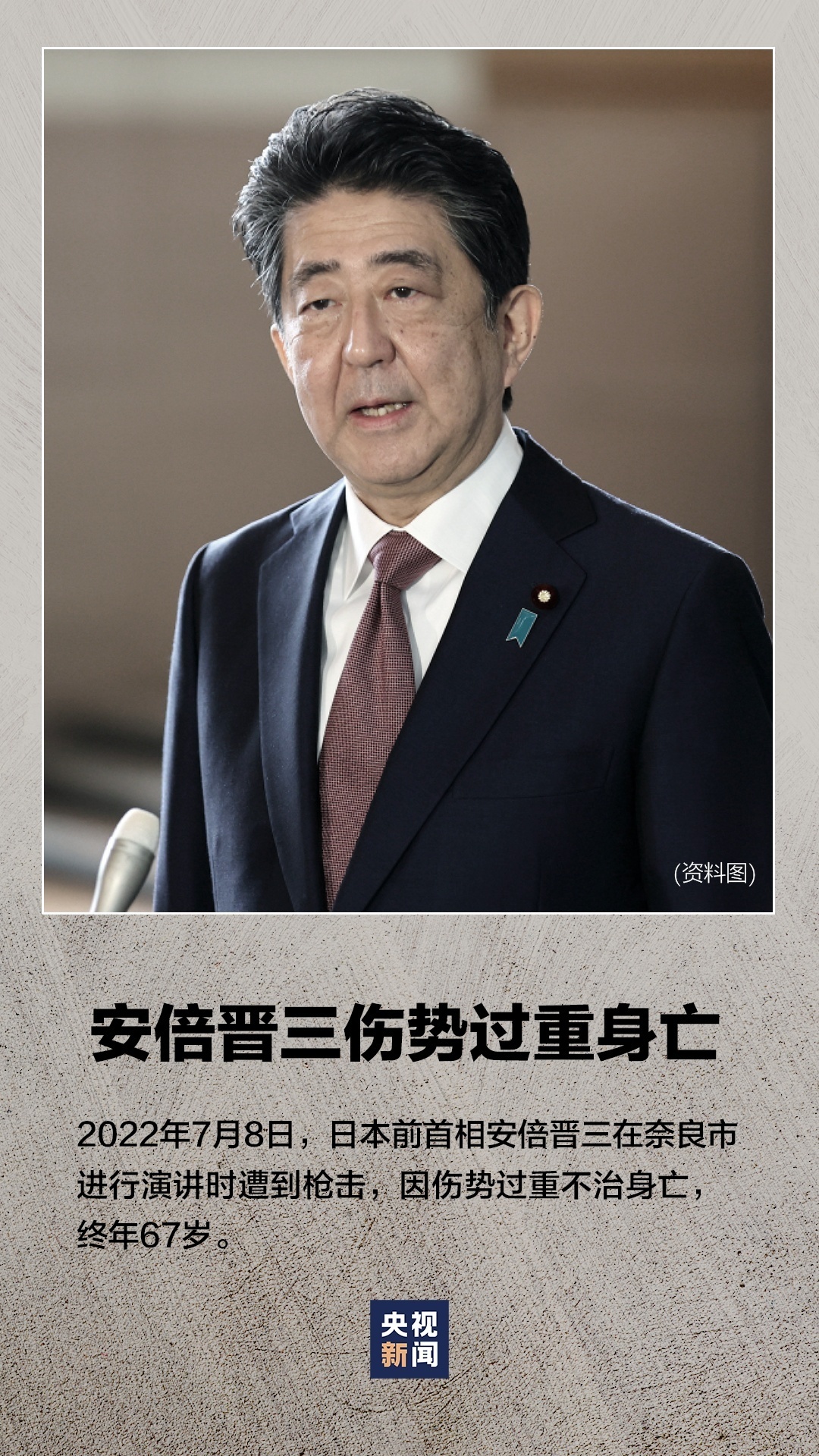

The treatment hospital confirms the direct cause of the death of Shinzo Abe

At around 18:00 local time, a press conference held a press conference on Nara Cou...