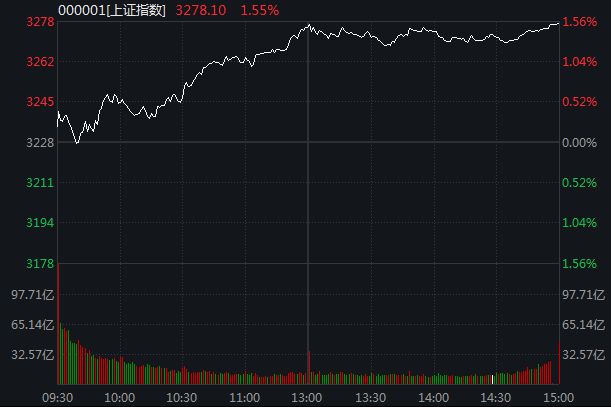

The Shanghai Index closed up 1.55%, and more than 4,000 stocks in the two cities fluttered

Author:Zhongxin Jingwei Time:2022.07.18

Zhongxin Jingwei, July 18th. On the 18th, the three major indexes rose collectively. The Shanghai Stock Exchange Index rose 1.55%to 3278.10 points. The Shenzhen Stock Exchange Index rose 0.98%to 12532.65 points. The GEM refers to 1.44%, at 2800.36 points.

Wind screenshot

On the market, integrated die -casting, medical waste treatment, and titanium pink concepts lead the two cities. Non -metallic materials, CRO concepts and other sectors have fallen first.

As of the closing, the ratio of all trading stocks in Shanghai and Shenzhen was 4111: 668, the daily limit of the two cities, and 2 daily limit.

In terms of northbound funds, the net inflow of northbound funds exceeded 5.7 billion yuan throughout the day, of which the Shanghai stocks underwritten exceeded 2.7 billion yuan, and the deep shares flowed for more than 3. billion yuan.

In terms of individual stocks, today's daily limit shares are as follows: Baoxin Technology (9.99%), Giant Wheel Intelligence (10.02%), Jingshan Light Machine (9.98%), Jinzhi Technology (9.98%), Fangda Group (9.96%). The limit of the limit of the limit is as follows: Tianjin Prince (-10.02%), Suzhou Longjie (-9.99%).

The first five stocks are: New Special Electric, Tengya Seiko, Huifeng Diamond, China Science and Technology Environmental Protection, and New Tiger, with 78.222%, 59.838%, 59.278%, 52.875%, and 51.228%.

Aijian Securities believes that although the market is facing a rebound after a short period of rapid decline, it still needs to be observed. Therefore, our strategy is mainly cautious as a whole. In terms of opportunities, there are still companies that have room for repairing space in terms of performance. The overall opportunity is limited.

In terms of industry configuration, Guangfa Securities Research Report suggested that the three main lines of China's superior assets of "policy warm wind" are continued: (1) postpartum manufacturing and consumption repair: cars (including new energy cars)/photovoltaic components/retail, etc.; ((((Including new energy cars) 2) Add leverage: Restricted policies turn to marginal loose (Internet media/innovative drugs/real estate leaders); (3) domestic pricing leading inflation chains: upstream resources/materials (coal/potassium fertilizer) and breeding industry.

Huatai Securities believes that it is recommended to continue to manufacture in midstream and consumption as the main position, and pay attention to the infrastructure sector that is concerned about the risk of hedging real estate: 1) the passenger car industry chain, general equipment, electrical equipment, and power operators of the right or inflection point of the prosperity; 2 ) Nourishment and food that requires toughness and price cycle; 3) large buildings and steel structures of hedge real estate risks. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Open the fence and enter the high speed, how can the "world first circle" go smoothly?

The transport vehicle has successfully entered the high speed and started to escor...

"Stranger" the fungus nest!Yunnan, the public security bureau of Yunnan, discovered beef liver bacteria again

In YunnanFungi not only grows in the mountainsEven the garden of the Public Securi...