Resume trading tomorrow!9 Liannan Ganneng shares are almost real materials

Author:British magazine Time:2022.07.18

Thermal power companies, which are deeply affected by high coal prices, will usher in the turning point of performance.

The US dollar index reached a new high of nearly 10 years. On July 12, the US dollar index reached 108.51. The last time was still around 2000. In a sense, it represents the outflow of domestic funds and north -oriented funds. After July 5th A -share transaction volume atrophy is evidence. Insufficient funds are one of the important reasons for the currently lost 3,400 and 3300 points in the A -share market. Continuously lost important points to more or less stimulate the "sensitive" nerves of market investors. The hot "carbon neutralization" and "new energy vehicles" in the early stage appeared to call back. Traditional stable brokers, banks, real estate, and energy sectors seemed to support the entire market.

However, recently, the upward trend of the electric power sector (thermal power+green power) has a strong rise. The rebound rate of more than 20%after the bottom April is bottomed out. On the first day of July, the independence market has risen by more than 8%. Ganneng (000899.SZ), as an old -fashioned coal power company in Jiangxi, has recently appeared in 9 consecutive boards, with a stock price of more than a dozen trading days of 2.6 times.

The decline of coal prices may bring an important turning point in this round of market.

Looking back at 2021, the most profitable in addition to lithium carbonate is coal. From mid -January 2021, the coal price reached 1150 yuan/ton. Although the short -term demand was reduced, the coal price was cut by about 571 yuan/ton at the end of February. How long is the coal price rose to 950 yuan/ton in May, and then in mid -October, coal prices rose to the highest historic 2600 yuan/ton. According to corporate statistics, the average unit price of comprehensive coal in 2021 rose 44.28%compared with the same period of the previous year. Affected by this, 47 of the 84 listed power companies in the CSRC industry classified, 47 net profit of the 2022 Q1 of 2022 fell decreased year -on -year. Among them, 22 of them decreased by more than 50%, and 22 were staged losses. Among them, Huaneng International (600011.SH) lost losses. The losses in the first quarter of this year were 956 million, compared with the profit of 3.13 billion yuan in the same period last year.

01

The performance regression of the thermal power sector is available

Thermal power companies, which are deeply affected by high coal prices, will usher in the turning point of performance.

Although the world has vigorously advocated green power generation and carbon neutrality in the world in the past two years, domestic and even the world is still the energy structure of fossil energy as the main means of power generation. It is difficult to change structural changes in the short term. Important power source.

一般来说,无形的手会对大宗商品价格进行有效的调控,但是近期由于通货膨胀加剧,同时叠加局部地缘政治,煤炭价格出现单边上涨的情况,一般煤价直接挂钩下游企业的成本,而The high level of coal has directly brought losses in many industries. Therefore, proper policy regulation is particularly important. Domestic coal supply and stability prices are important regulatory methods.

The supply side, from January to May 2022, the national coal output of raw coal was 1.814 billion tons, an increase of 10.4%year -on -year, and the average daily output of raw coal exceeded 12 million tons, a record high. While continuously expanding production capacity, the policy has also been restricted to the reasonable price range of coal prices. The implementation of the new version of the long -term coal mechanism has further regulating coal prices. 20%"Effective connection of the electricity price range.

The demand side, as high temperature weather in advance this year, the power pressure brought about by the peak of electricity has increased significantly. According to statistics from State Grid, the maximum electricity load after June exceeded 844 million kilowatts, and the electric load growth rate of electricity in Northwest China, North China and other places had a rapid growth rate of 8.81%and 3.21%compared with the same period last year. The growth rate of electricity consumption is between 5%and 6%.

Coal prices have been reasonably regulated, the demand for electricity use has increased significantly, and the return of thermal power performance is just around.

02

Is Ganneng shares transformed or hype?

Ganneng shares are mainly produced and sold for electricity. The actual controller is a state -owned assets in Jiangxi Province, and it is also the only power listed company in Jiangxi Province. Ganneng shares, as an old -fashioned thermal power listed company, failed to rise in the face of upstream coal prices, and could not be spared. Fortunately, the company has less losses in the entire A -share power sector. In 2021, it was also for the first time due to the rise in coal prices in the past ten years. year 2011.

Affected by losses last year, its performance was not ideal in the first quarter of 2022. The net profit attributable to the mother also showed a loss of 1.015 million yuan, a decrease of 103.75%year -on -year. It can be seen from the company below. , Up to 2757 billion, an increase of 30%year -on -year.

Obviously, the current performance of Ganneng shares is not enough to support the strong performance in the secondary market for nearly half a month, even the interim report and annual report performance turned losses. the reason is:

First of all, the company does not have a strong performance increase. Looking at the historical performance of Ganneng's shares, the average operating income of 25-2.7 billion has maintained for almost ten years. The average net profit margin in the years, even if the price of coal has plummeted, the company's net profit will not exceed 4.5 throughout the year. According to the 14.1 billion market value that was suspended on July 11, the minimum PE (TTM) of Ganneng shares will reach 31.33 More, if the amount of installed capacity that has been put into operation recently, the total installed scale of the production and operation has a total of 1578.4MW, of which the scale of thermal power installed capacity is 1400MW (89%) and the scale of hydropower installed capacity is 100MW (6%). Even if the market is more promising The scale of photovoltaic power generation is only 78.4mW (5%), photovoltaic grid -to -grid electricity is only 39 million kilowatt -hours, and the capacity of photovoltaic power generation is 67.08MW. It can be seen that from the current 95%of the income from firepower and hydropower, the market value of 14.1 billion is significantly high. Secondly, even if the company is transforming green power, including Shanggao County Clean Coal Power Project, 1200MW Ganxian Pumping Power Power Station project, and other photovoltaic power generation projects, due to the long construction cycle, it is difficult to bring performance increase in the short term. At present, the price -earnings ratio of the green electricity sector is less than 30 times. Furthermore is the energy storage sector business, and the company also said that there is no energy storage machine. According to the company's announcement of its subsidiary Gaoan Jianshan and Ganneng New Energy Company, it will invest in the construction of Gao'an Ganneng 50MW Agricultural Optical Complement of Ground Photovoltaic Power Power Power Project, supporting storage storage, and supporting storage storage. It can be 5mW/5MWH. The current project is under construction. Even if it is built, it can be regarded as "nine cattle and one hair" from the perspective of installation. And the concept of super critical power generation of hype is unknown whether the concept of super critical power generation can be promoted.

Ganneng's transformation of green power generation is only in the early stages. So, who is behind the back?

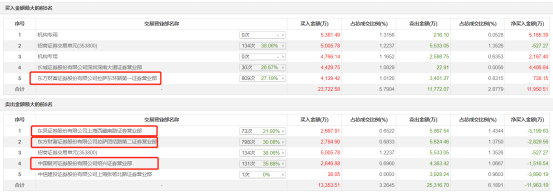

From the perspective of the Dragon Tiger List, Ganneng shares on July 11 Due to the three consecutive trading days, the departure value of the increase has reached 20%of the securities on the Dragon Tiger List. This time is the third time on the list within the nearly 5 trading days, and the fifth time in the past month. The first five seats bought a total of 119.5051 million yuan, and the special business department of the two institutions was on the list. The five were the Lhasa business department. Securities Shanghai Tibet South Road, the Lhasa Sales Department, which sells two, and the Shaoxing Sales Department of China Galaxy Securities, which sells four, is a well -known first -line capital on the market.

Although the electric power sector, especially thermal power, is affected by the rise in coal prices in the early stage, the sector is overall in the downturn. With the recovery of coal prices, the company's performance will be relieved, and the market will make up for strong emotions. Whether logic can match the performance of the secondary market.

Author of this article | Liu Chaoran Source | Yingcai Magazine

- END -

The "Concentrated Publicity Day" activity carried out in the New Era Civilization Practice Institute of Zhizhen Town

On July 8th, Lingxing Plaza, where the practice of civilization in the new era of ...

The anchor explore the class party meeting 丨 "Monkey Brother" comes!

The Twelfth Party Congress of Hubei Province is underway, and ecology has become a hot topic at the meeting.Not only did the party representatives gathered heated discussions, but the two cute Yangt