It is hot, and coal ETF performance is also hot

Author:Capital state Time:2022.07.19

On July 18, A shares continued to rise in the early morning. In the afternoon, the SSE Index closed up 1.55%, and the GEM index rose 1.44. The northbound funds bought 3.552 billion yuan throughout the day, ending for 5 consecutive days of net sales. On the disk, the low -level environmental protection stocks broke out strongly, the coal sector rebounded, and the real estate sector recovered. All A over 4000 stocks rose, and the effect of making money was better.

Source: Wind

Yesterday, the person in charge of the relevant departments introduced the recent key work progress. It mentioned that the risks of the five villages and towns and towns banks in Anhui, Henan in accordance with laws and regulations, and actively do a good job of financial services such as "guaranteeing diplomatic relations", which has stabilized market confidence to a certain extent. However, it is necessary to wait for a more detailed and specific policy statement for "disconnection" in order to completely dispel market doubts.

Incidents such as short -term "suspension" and interim report disclosure reduce market risk preferences. The large -scale lifting of the science and technology board of science and technology board may still cause market concerns. Internal and external disturbances are superimposed, and the market may still be at high fluctuation windows. However, the economic and financial data in June is relatively bright. It is expected that the policy implementation in the second half of the year is still effective and the economic recovery is still the fundamental main line.

On July 18, the coal plate rebounded, and the coal ETF (515220) rose 4.53%. We have repeatedly introduced it before (see "The increase in negative factors, the market may continue to be adjusted in the short term", "the new and old kinetic energy conversion, the future opening of the coal ETF"), which was officially entered last week, and there are extremely high temperatures in many places across the country. Support, with electricity loads, have repeatedly reached high, and the peak summer has ushered in a critical period, and the daily consumption of power plants continues to rise. The daily consumption of power plants is basically the same year -on -year, and the speed of destruction has accelerated, and the purchase demand is expected to be released. The daily consumption continues to rise, and the coal supply of the market for the market is increasingly tense, and it is expected to support the power coal price to run strongly.

The daily consumption (10,000 tons) of the 8 provinces of the coastal province, Source: Guosheng Securities

Short -term coke coke demand is under pressure, and steel mills are mostly in a loss state. It is expected that the phenomenon of production reduction of steel mills will gradually increase. Considering that the demand and profit restoration of steel companies still take time, the price of double -focus may run weakly in the short term.

At present, 24 coal companies have released the 2022 interim reporting preview. On the whole, 21 pre -increased increases, and the medium number of the net profit growth rate of the foreshadows exceeded 100%. In addition, as of July 18, the dividend rate of the CSI Coal Index still exceeded 6%, far exceeding the 2.5%of the Shanghai and Shenzhen 300 Index. Therefore, in the context of excellent performance in the interim report, the coming of summer electricity, high dividends, and the long -term transformation of coal companies to clean energy or improve energy efficiency, coal ETF has a good configuration value.

Source: Wind

In addition, the game sector also performed well on July 18. The game ETF (516010) and the Shanghai -Hong Kong Shenzhen ETF (517500) rose 3.56%and 2.58%, respectively. Last week, the relevant departments website announced the domestic online game approval information in July 2022. A total of 67 games received the version number. The number of time intervals was shortened, and the number of time was also increased by some previous two.

Since the beginning of this year, the relevant departments have issued three batches of game versions in April, June, and July, respectively, and a total of 172 games have won the version number. The 67 version number involves 6 client games and 61 mobile games, including a number of listed companies. The normalization of the game version number is verified, the future development uncertainty of the industry will weaken, and the new game will create a new increment.

Game version number distribution, Source: Wanlian Securities

The large -scale factory has not obtained the version number in the first three rounds. It may be mainly due to the order of approval. The backlog of the backlog of the version number is given priority approval, and small and medium manufacturers can pass the low tide period. In the long run, the existing game of the head company is outstanding, the version number reserves are sufficient, and the minor protection system is continuously updated, which is more stable than small and medium manufacturers.

Although the industry supervision policies are strict, under the support of multiple product lines in the first half of the year, the profits of old products are effectively released. Last week, the A -share game company disclosed the preview of the first half of the year, and the growth rate was relatively bright. For example, the net profit of Sanqi Mutual Entertainment was expected to increase by 87%to 99%year -on -year. %and many more.

The subsequent version number distribution returns to normalization. The development of overseas markets for medium and long -term and long -term overseas is expected to bring new growth points. The policy supervision of the Internet industry is continuously active. The game industry is still at the bottom of the valuation and can focus on attention.

- END -

"Finance and Economics" Liu Shijin: Digital economy, not development is a greater problem

Liu Shijin: Digital economy, not development is a bigger problemFinance

At a glance

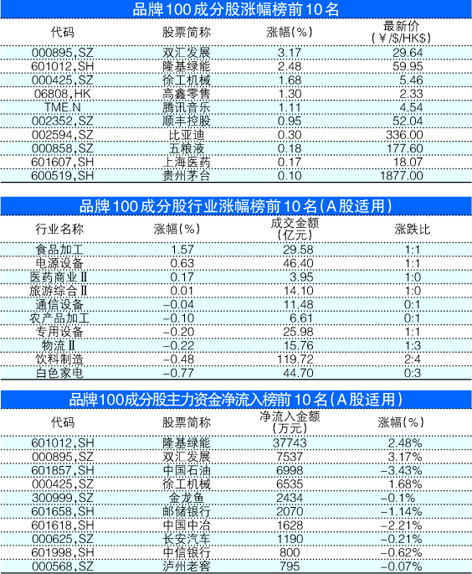

Each brand 100 yesterday sold 115.642 billion yuan of Longji green energy net infl...