The Chen Yong family in Taizhou, Zhejiang is trapped in debt defaults, with a amount of nearly 200 million Hong Kong dollars

Author:Science and Technology Corner Time:2022.07.19

Chen Yong, a native of Taizhou, Zhejiang, is engaged in the automotive retail and investment industry. Public information shows that in 2018, the Chen Yong family appeared on the Hurun Rich List. In 2017, Chen Yong introduced through a business partner that he borrowed nearly HK $ 200 million in circular loan financing from a company with a lending license in Hong Kong. The final repayment period was 24 months after the loan conditions stipulated in the loan agreement. In 2019, the circular loan financing was renewed for 24 months.

In 2020, Chen Yong did not repay interest in accordance with the loan agreement, and the creditor will sue Chen Yong to court. It is reported that the case was conducted in May 2022, and the judgment was expected to be announced in August.

Yu debt does not execute Chen Yong in the debt crisis and become the defendant

According to relevant materials, after signing the loan agreement with the debt company's loan company, Chen Yong took the total loan of HK $ 200 million in November 2017 in November 2017, and then stopped paying several interests and some principal. Repayment.

After that in October 2020, Chen Yong received a lawyer's letter asking him to immediately pay the agreement to agree on the total interest and other funds of HK $ 140 million. In July 2021, Chen Yong was sued to the Taizhou Intermediate People's Court.

In December 2021, relevant units seized Chen Yong and outsiders Chen Xuanlin (son of Chen Yong) and Jiang Qiwei (Chen Yong's wife) related real estate and vehicles in accordance with the law; frozen Chen Yong's bank account and the equity of many companies he was located.

Investment or use of the money or for his son Chen Xuanlin's investment and use

According to people familiar with the matter, Chen Yong's borrowing of this amount was used for his son Chen Xuanlin for corporate investment and operation. Chen Xuanlin, the son of Chen Yong, shows about his online information on the Internet: He was born in a businessman family in Taizhou, Zhejiang in 1987; starting a business in 2006; in 2020, the Chen Xuanlin family ranked "2020 New Fortune 500 Rich List 2020 New Fortune 500 Rich Man List in 2006 "No. 173, currently the chairman of Aichi Automobile.

The car manufacturing industry is known for its burning money, and it is difficult to do without money. According to the amount of funds disclosed publicly, since October 2016, Aichi Automobile has completed a total of 8 rounds of financing, and its total financing has exceeded 10 billion yuan. In the meantime, Chen Xuanlin has provided financing for Aichi Automobile many times since 2017; it is speculated that these funds used to financing Aichi Automobile are exactly the related funds that Chen Yong borrowed in 2017.

On January 3, 2022, according to the information of Aichi Automobile's official website, the company's executives have changed a lot. Investor Chen Xuanlin took over as chairman. A new round of financing, this round of financing parties comes from Chen Xuanlin and its Dongbai Group, with a financing amount of hundreds of millions of dollars.

According to public information, in August 2017, Chen Xuanlin acquired Shanghai Vientiane Motor Manufacturing Co., Ltd. through Guangwei Holdings, and re -sorted out the company's business direction, focused on the development and development of new energy bus vehicles, and developed new energy logistics vehicles and sanitation vehicles. Wait for new products. In September 2018, Chen Xuanlin's Strategy Strategic Stock Sub -Babe (SH.600843), a subsidiary of Chen Xuanlin, deployed the high -end manufacturing industry, exerted the advantages of strong acquisitions and integration capabilities, and continued to promote the global development strategy.

On July 15, 2022, the Surging Automobile Circle published an article "The two -year scenario sold about 5,000 vehicles, how long can Aichi Auto be supported? "

Obviously, at this stage, Edi Automobile, who was at the helm of Chen Xuanlin, the son of Chen Yong, did not perform well, but it was not known whether the company's poor management was the reasons why the Chen Yong family refused to repay. Combined with Chen Yong and his family, they have faced the status quo of litigation, arbitration, bank accounts frozen, and assets, and assets.

- END -

The 43 -year -old vice president is suspected of private division of state -owned assets and bribery. The crime of bribery was surveyed to investigate Oriental Group's response: it has nothing to do with the company

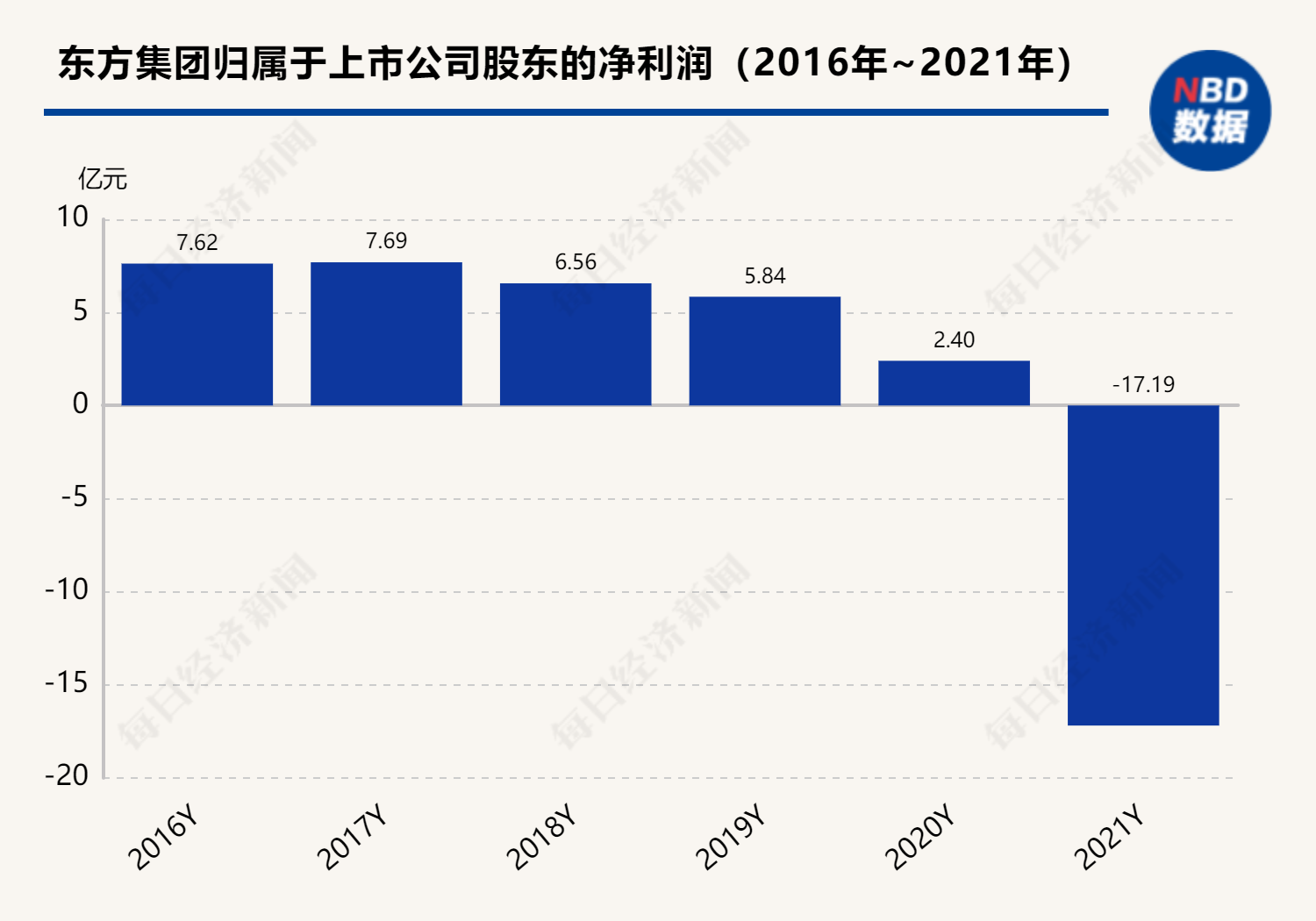

In the evening of this (June 20), Oriental Group (SH600811, the stock price was 2....

The CRO sector has weakened again, and the transaction of 340 million yuan in one hour of medical ETF (512170) is significantly measured

In the early morning of the 7th, the medical sector was adjusted sharply at the be...