The Fund's second quarterly report was released one after another, and many fund managers maintained the operation of the high position

Author:Capital state Time:2022.07.19

As of July 19, 2022, Choice data shows that there are 270 (only the main code, the same below) of the market announced the second quarter of 2022. Among them, Qiu Dongrong, Lu Bin, Shi Cheng and other well -known fund managers have attracted attention during the reporting period.

Specifically, Qiu Dongrong's separate management of Zhonggeng Value and Zhong Geng's value and quality held one year. As of the end of the reporting period, the stock positions were 90%and 92%, respectively. And the non -ferrous metal, petroleum petrochemical, real estate, Internet, banking and other sectors in the A -share market.

6 funds managed by Lu Bin: HSBC Jinxin low -carbon pioneer, HSBC Jinxin dynamic strategy, HSBC Jinxin core growth, HSBC Jinxin Longteng, HSBC Jinxin research selection, HSBC Jinxin Intelligent Manufacturing Pioneer, as of the end of the reporting period, At the end of the second quarter, the average stock position was 90.54%, compared with 84.86%of the average stock position at the end of the first quarter of this year, significantly increased. The rise of positions is mainly due to the increase in the position of HSBC Jinxin Longteng stock position. Its stock positions increased from 53%at the end of the first quarter to about 92%at the end of the second quarter.

In addition, a number of fund stock positions such as SDIC Yinjinbao, SDIC's advanced manufacturing, SDIC UBS New Energy, and SDIC UBS industrial trend have been managed by the fund manager.

Qiu Dongrong said that he will actively find value stocks with low valuations, limited supply but stable or expanded demand, as well as growth stocks that are relatively low -valued but uplifted, and obtain excess returns by grasping structural opportunities. In addition, from the perspective of various valuation dimensions, Hong Kong stocks are at the lowest level in history. Based on the systemic opportunities of Hong Kong stocks, they continue to conduct strategic allocation.

Lu Bin is also quite optimistic about the investment opportunities of Hong Kong stocks. "The current risk premium of Hong Kong stocks is attractive, and many industries and high -quality companies are expected to usher in the fundamental inflection point, which is optimistic about Hong Kong stock market performance."

It can be seen that many fund managers choose to maintain more than 90 % of the high positions. Looking forward to the market outlook, the fund manager believes that there are still more investment opportunities in the A -share market. In the short term, they pay more attention to the certainty of individual stocks.

- END -

Future ecological integration of home furnishings creates a "design industry chain"

□ Our reporter Lu JunThe future development trend of home design is no longer a s...

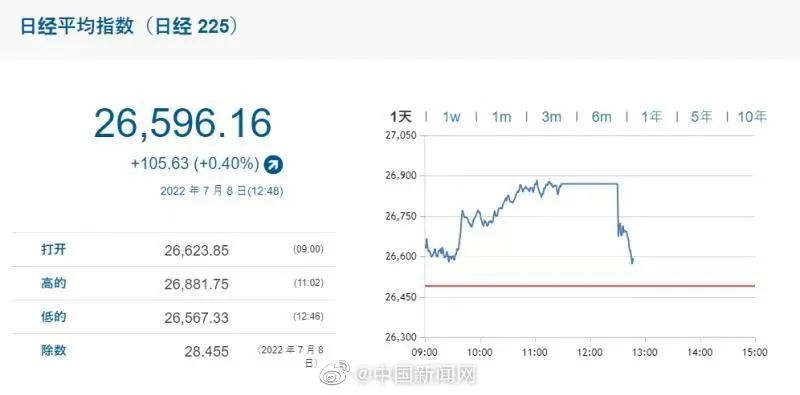

Japanese stock market diving in the afternoon

In the afternoon of July 8, the Nikkei 225 index fell rapidly, and most of the dai...