The two sisters and brothers of Jiangxi did a super IPO, Jiang Bolong's market value of 40 billion yuan

Author:Investment community Time:2022.08.08

An inconspicuous chip IPO creates a market value myth-

This week, Shenzhen Jiangbo Long Electronics Co., Ltd. was listed on the GEM of the Shenzhen Stock Exchange, becoming the "first share" of GEM under the registered system. The company closed at 99.00 yuan on the first day, an increase of 77.83%, with a total market value of 40.874 billion yuan.

There was a pair of sisters of Jiangxi twins behind Jiang Bolong -Cai Huabo and Cai Lijiang. In the 1990s, Cai Huabo came from his hometown to Jiujiang, Jiangxi, and came to Shenzhen. He started in Huaqiangbei from an electronic component salesman. Subsequently, Cai Huabo pulled his twin sister Cai Lijiang to establish Jiang Bolong in Shenzhen. In the following 20 years, Jiang Bolong started with a storage chip trade to develop various memory, computers, and automobiles, such as mobile phones, computers, and cars.

This is a track that is crucial but is "stuck". The storage chip, also known as the "food" of electronic products, is the carrier of data. For a long time, giants such as Samsung, SK Hynix, and Micron Technology monopolized the domestic memory market. Nowadays, domestic storage chips have begun to rise -in addition to Jiang Bolong's IPO, super unicorns such as Yangtze River Storage and Hefei Changxin came.

Jiangxi sister and brother go south to Shenzhen

Do a super IPO, wealth 24 billion

This is the story of a pair of sisters and brothers in Jiangxi.

In the 1990s, Shenzhen's rise became the largest semiconductor distribution trading market and distribution center in China, and electronics factories blossomed. At that time, Cai Huabo, who graduated from high school, went south to Shenzhen and entered the then Shenzhen Ocean King Investment Development Co., Ltd., becoming an ordinary salesman, and began to contact the division of resistance, capacitors, diode, triode, etc. At that time, Shenzhen Huaqiangbei became the well -known Asia -Pacific electronic component trading market, and various myths were staged every day here.

Two years later, Cai Huabo began to plan to do business under his brother -to do semiconductor trade, and found his sister Cai Lijiang. Cai Lijiang is Cai Huabo's twin sister. The two were born in 1976. After graduating from Jiangxi Hualian Institute of Foreign Trade, Cai Lijiang also came to Shenzhen and served as a design engineer in a company in Shenzhen. In 1999, Cai Huabo and Cai Lijiang formally established Jiang Bolong. The names were taken from the names of Cai Huabo and her sister Cai Lijiang, and a combination of dragons born in 1976.

At first, due to the restrictions on the terms of competition, Jiang Bolong could not do a separate component business, but only helped customers buy Mask ROM (only read memory). At that time, if Jiang Bolong encountered product technical problems, most of them were looking for part -time workers to solve it, which also laid a foreshadowing for subsequent mistakes.

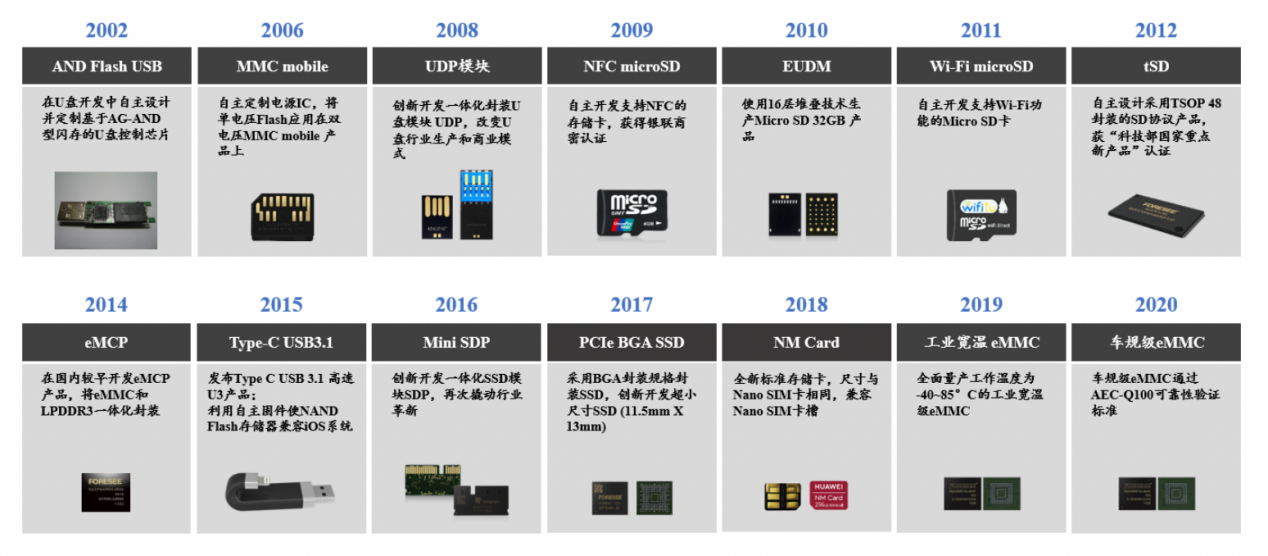

In 2002, Jiang Bolong purchased a group of expensive storage products, and did not notice that the batch of And Flash and NAND Flash had great technical differences. Due to the slow reading and writing speed of And Flash and no support for the main control chip, the seller refused to return the goods. Cai Huabo looked at the payment of millions of dollars to make water, and he could only find a way to make these goods into a product. As a result, Cai Huabo found a Hong Kong company customized USB controller chip, set up a technical team to design software firmware, and developed the world's first U disk product based on And-NAND flash memory.

At this time, Apple's iPod uses a large number of NAND flash memory to replace the micro -hard disk, which has caused the flash memory in the market to be seriously out of stock. Jiang Bolong's alternative product becomes fragrant, which quickly attracts many customers. Turn losses into profit. In an interview with the Southern Daily, Cai Huabo recalled the past and defined a crisis as an important turning point in the history of Jiang Bolong. Since then, Jiang Bolong has transformed from the storage trade -the OEM foundry of the memory.

After taste the sweetness of technological innovation, Cai Huabo paid more attention to the investment in technology research and development. In order to make up for the technology shortcomings of the founding team, he invited Li Zhixiong, the company's current deputy general manager. Li Zhixiong graduated from Huazhong University of Science and Technology, and received a master's degree in electronics and communication engineering from Huazhong University of Science and Technology. Later, he was responsible for R & D and design at Fujian Shida Network Technology Co., Ltd. and Fujian Shengteng Information Co., Ltd. Since joining Jiang Bolong, Li Zhixiong personally set up a R & D team and led the team to build all Jiang Bolong's product line.

Around 2010, when China's domestic smartphone rose, Jiang Bolong began to focus on EMMC of embedded storage chip, and gradually formed a comprehensive solid development capabilities, integrated packaging design capabilities and storage chip test capabilities, and cultivated the industry. Class storage brand Foresee.

For a long time, Jiang Bolong was very low -key. Until 2017, he acquired Micron Technology's internationally renowned consumer storage brand Lexar (Lexar), which has caused a sensation in the storage industry. After that, Jiang Bolong's trendy high -end consumer storage market began to upgrade to technology brand companies. Today, Jiang Bolong has four product lines: embedded storage, mobile storage, solid -state hard disk and memory barrier, and provides consumer, construction regulations, vehicle -level memory, and industry storage software and hardware application solutions.

In the process of Jiang Bolong's growth, VC/PE can also be seen. From 2018 to 2019, Jiang Bolong has also rarely announced financing. Investors include the national integrated circuit industry investment fund, Yuanhe Puhua, SMICS, Hongtai Fund, Chuanyin Holdings, Shangkai Creative Investment, Lichery, Liechhehe Science and Technology, Taikeyuan, etc. Among them, in the A+round of financing, the National Integrated Circuit Industry Investment Fund, as a leading investor, spent 600 million yuan, is the second largest shareholder of Jiang Bolong. Today, after 23 years of wind and rain, Jiang Bolong finally appeared on the IPO knock on the bell, and Sister Cai also gained the first IPO in life. The prospectus shows that after the issuance, Cai Huabo and Cai Lijiang directly and indirectly controlled 2.46 million shares, accounting for 59.58%. Based on the market value of 40.874 billion, Cai Huabo and Cai Lijiang had over 24 billion.

Relying on the memory, nearly 10 billion yuan in annual income

This super track is hot

The market value is 40 billion, what exactly does Jiang Bolong do?

The prospectus shows that since its establishment in 1999, Jiang Bolong has been deeply cultivating the research and development, design and sales of Flash and DRAM memory, and has been a witness to the domestic semiconductor storage industry. The company's memory is widely used in smartphones, smart TVs, tablets, computers, communications equipment, wearable devices, IoT, security monitoring, industrial control, automotive electronics and other industries, as well as personal mobile storage. Beat, ZTE, Samsung Electronics, Amazon, Wal -Mart, Bestbuy and other well -known domestic and foreign companies.

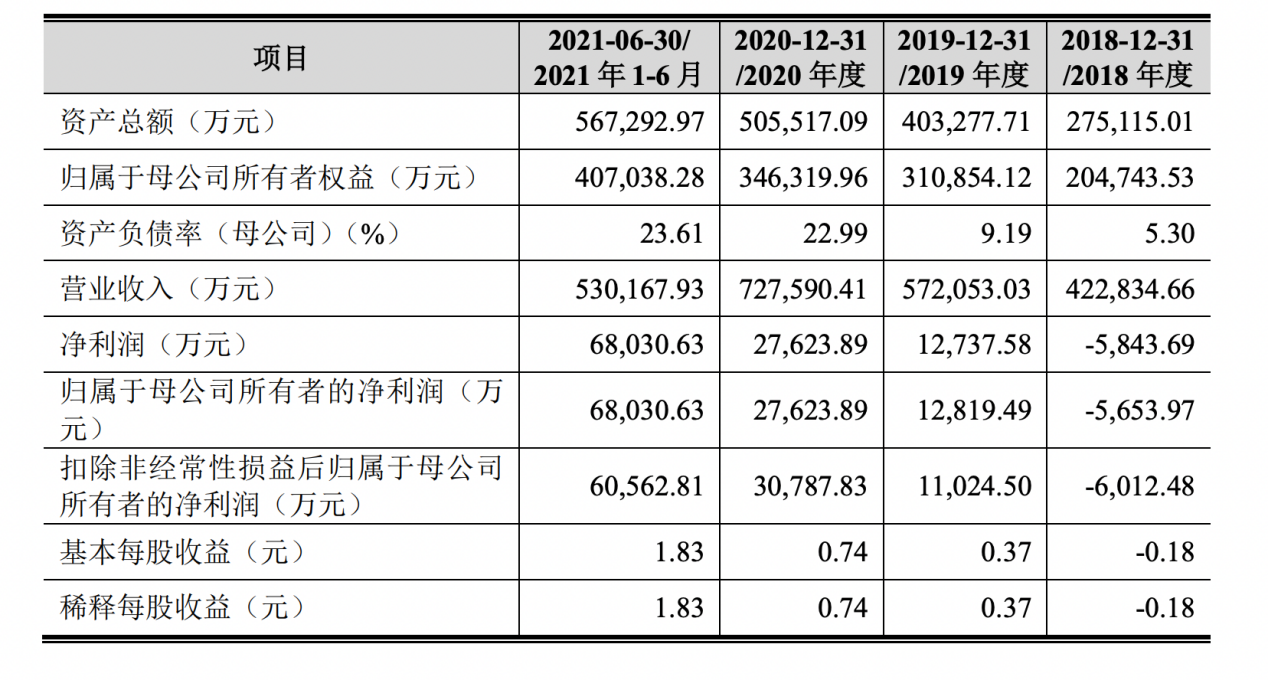

The business is not bad -the prospectus shows that from 2019 to 2021, Jiang Bolong's operating income was 5.721 billion yuan, 7.276 billion yuan, and 9.749 billion yuan, respectively, with an average annual growth rate of 30.54%. 276 million yuan and 1.013 billion yuan, the average annual growth rate of compounds reached 182.42%.

From a product point of view, Jiang Bolong has formed four major product lines: embedded storage, solid -state hard disk (SSD), mobile storage and memory strips. It has industry storage brands ForeSee and international high -end consumer storage brand Lexar. Among them, the company's more than 90%of the products are NAND Flash, and embedded storage is the company's main source of revenue, and in 2021, it accounts for nearly 50%of the proportion revenue.

In the first quarter of 2021, the overall market price of storage products showed an upward trend, bringing a large increase to the company's performance. But now the market demand for downstream smartphones and personal computers has fallen, and end customers have adopted a more cautious stock preparation strategy, which will directly affect the performance of upstream chip companies. In response, Jiang Bolong made a prediction: the company is expected to achieve a decline in operating income in 1-6 in 2022.

The outside world is curious. In the context of many new chips, why is Jiang Bolong's stock price rising against the trend? This is to start with the status of Jiang Bolong's industry -when giants such as Samsung, SK Hynix, and Meiguang Technology monopoly monopolize the domestic memory market, Jiang Bolong made good results in the subdivided field. According to OMDIA (IHS Markit) data, from January to June 2021, the global market share of the Lexar memory card ranked second, and the Lexar flash memory disk (U disk) global market share ranked third.

More importantly, behind Jiang Bolong, the domestic storage chip industry is facing unprecedented popularity.

For a long time, the storage chip is called the "food" of electronic products, which is the carrier of data, which is related to the security of data. However, such chip investment risks and high technical thresholds, so domestic storage chip manufacturers have always been backward. For a long time, neither entrepreneurs nor investors did not dare to touch this "hard bone".

Until in recent years, as the state has made a comprehensive efforts to the integrated circuit industry, the huge domestic storage chips have begun to rise. In 2016, the Yangtze River Storage was born, mainly developing NAND Flash; subsequent Hefei Changxin Storage was officially born, specializing in the research and development, production and sales of dynamic random access to storage chips (DRAM), and began an unprecedented domestic replacement journey.

Among them, Hefei Changxin was stored in the VC/PE circle, and each round of financing was a fierce battle. In 2021, the Case C financing even appeared in the queuing of 220 institutions; in February this year, Changxin Storage added 19 new shareholders, including Yunfeng Fund, Sunshine Insurance, Jianxin Equity, TCL Venture Capital, PICC Capital, and formerly. Sea Mother Fund, Greater Bay Area Common Home Development Fund, Deep Investment Control, Mizuki Investment, China Post Insurance, Junhe Capital, Oriental Asset Management, Harmony and Health, Huaden International ... The figure. Some institutional partners lamented that such a project can win.

As we have seen, the storage chips monopolized by giants such as Han, Japan, and the United States all year round have begun to become a hot land. According to incomplete statistics from the investment community, in 2021 alone, domestic storage chips have completed over 20 financing. Among them, Zeshi Technology, Yixin Technology, Derui Lingxin, Xinyuan Semiconductor, and Zhicun Technology have received hundreds of millions of financing. Behind these storage chip companies, many front -line venture capital institutions have emerged, with many Sequoia China, Shenzhen Venture Capital, Northern Optical Venture Capital, Source Capital, Country Garden Venture Capital, Lenovo Star, Shunwei Capital, China Science and Technology Star, Yao Road, Yaotu, Capital and other well -known institutions.

However, the localization of storage chips is a difficult and long journey. In this race, we can run with it but we must not lose behind. As a chip veteran said, "As long as you persist, with our market advantage, it is entirely possible to overtake the curve." Semiconductor began to knock out:

Some people have skyrocketed market value, and some people have ushered in closure

The hotness of domestic storage chips is just a microcosm. Recently, the field of "card necks" such as EDA, CPUs, and domestic semiconductor equipment ushered in a wave of listing, and the scene of market value rising was vivid.

Just this Friday (August 5), domestic EDA software manufacturer Guang Liwei was listed on the GEM of the Shenzhen Stock Exchange. As of the close of the first day, Guangli Micro News was 148.35 yuan, an increase of 155.78%, and the total market value was 29.670 billion yuan. Established in 2003, Guangli Micro headquarters is located in Hangzhou. It is very competitive in software and hardware, test structures, and generating software that are improved in good rate analysis and improvement rates. The product has entered the world's leading semiconductor factory early.

Huada, who is also on the EDA track, has just completed the IPO bell. On July 28, the domestic EDA leading enterprise, Huada Jiutian, was listed on the GEM, and it has been strong since the first day of listing. Only 6 days after listing, the stock price of Huada's nine days has increased by more than 200%from the issue price of 32.69 yuan/share, and the latest market value exceeds 68 billion.

CPU, known as the domestic chip's life door, is also lively. In June of this year, the domestic CPU enterprise Longxin Zhongke of the Chinese Academy of Sciences landed on the science and technology board, becoming the first domestic CPU. As the helm of Longxin Zhongke, Hu Weiwu, who was a researcher at the Chinese Academy of Sciences, led the R & D team to set up a Longxin research team in the Chinese Academy of Sciences in 2001. There is no history of independent CPU chip. For more than 20 years, Longxin Zhongke became the leader of the domestic independent CPU. After listing, Longxin Zhongke's stock price fluctuated, and the current market value exceeded 43 billion yuan.

Next, the CPU track will usher in a giant IPO -Haiguang Information. Haiguang Information, established in 2014, is the Chinese Academy of Sciences. The products mainly include Haiguang General Processor (CPU) and Haiguang Association processor (DCU). In early August, Haiguang Information had been purchased, and the issuance price was 36 yuan/share, and the corresponding price -earnings ratio was 315.18 times, which was higher than the average price -earnings ratio (117.73 times) of comparable listed companies. For example, according to the total share capital after the issuance, Haiguang Information issued a market value of 83.676 billion yuan this time, which is expected to become the highest market value of the science and technology board this year.

Earlier, domestic semiconductor equipment manufacturers Takuyun Technology officially landed on the Science and Technology Board. On the first day of listing, it rose 28%, breaking the curse of new stocks in the first half of this year. Na core, the stock price also rose in fluctuations. The current market value exceeds 45 billion, far exceeding the market value of 27 billion yuan on the first day of listing.

In the past six months, secondary market semiconductor companies are like roller coasters. The scenes of the break early are worrying, but from April, the stock price of semiconductor companies began to rise, especially the market value of listed companies in core areas such as equipment, materials and design areas has basically returned to the level at the end of last year. Essence

The fiery performance of these segmented areas in the secondary market will also be transmitted to the first market. In the above -mentioned major fields, the head projects are very sought after, especially the projects of semiconductor equipment are very difficult to grab, and some head projects even need to reverse the investment institutions. "Our partners want to tell the founder's team to tell the founder's team to show our depth of layout in the semiconductor field." A chip investor Zhao Ming from Shanghai said that some investment institutions from consumption to chip tracks have no chance to get at all opportunities to get get The qualifications for bidding are cruel.

But overall, VC/PE gradually returns to rationality in the semiconductor field. The most direct performance is that some chip startups with money -burning models and no cash flow began to face huge challenges-

Recently, a star GPU unicorns in Shanghai have reported the news of incomplete financing progress. Earlier, the valuation of the valuation and the star investment institutions tied; there was still a unicorn chip company that still burned money. FA broke the news that it owed the intermediary service fee; some founders of semiconductor companies put down their posture and were willing to accept the valuation flat wheels; there was also a B -round of two billion chip startups, which reported the news of bankruptcy.

Obviously, the semiconductor knockout has begun. Recently, people familiar with the matter broke the news in social media that the ARM CPU startup Kn Lingxin is about to reorganize. Quoting Leifeng.com reported that from the closer to Kai Lingxin, the industry learned that Qi Lingxin did encounter some difficulties and is currently in a state of suspension of operation. According to the data, Qi Lingxin was established in January this year, and has completed the angel round and A round of financing with a total of about 600 million yuan. The investment community tried to further verify the status quo of the company, but there was no latest response before press time.

"In the second half of this year, more chip companies will close the door because of poor financing." An investor who has been paying attention to semiconductor for a long time admits that with the contraction of the first -level market, the domestic semiconductor industry is entering the shuffle period. On the one hand, the head company It is running out, and on the other hand, the projects below the waist gradually disappear.

Shi Anping, the chief partner and chairman of the middle school capital, told the investment community before that the next 2-3 years is likely to be the best M & A.Right now, the leading enterprises of each subdivided track have successively boarded the capital market, and the financing capabilities have increased. Starts in the first -level market have gradually exposed some problems, and companies with poor management are facing closure.From the perspective of capital operation, future opportunities should come from mergers and acquisitions, not to support a batch of small seedlings with independent IPOs.The worst semiconductor entrepreneurship has not arrived yet.Many investors have admitted to the founders of the chip company, "can afford it, let go, and accept mergers and acquisitions appropriately."

- END -

Huadian Yongsheng Livestock Trading Market is officially operated

On July 4, the Yongsheng Livestock Trading Market in Huadian officially opened and...

Data School | Policy Interpretation: Macro and Guiding Policy Documents in the country's first rural homestay field

Since the 18th National Congress of the Communist Party of China, the Party Central Committee with Comrade Xi Jinping as the core has attached great importance to rural revitalization and rural touris