Shengquan Group's one -year stock price breakthrough executive promised to fall below the starting price and not reduce its holdings temporarily

Author:Public Securities News Time:2022.08.12

Shengquan Group (605589) was listed on the main board of Shanghai City in 2021. August 10, 2022 is the first anniversary of the company's listing, and it is also the time for the company's 534 million shares to lift the ban. This part of the banned shares account for 68.94%of the company's total share capital. Affected by the news of the huge number of lifting shares, on August 10 and 11, the company's two consecutive trading days of the stock price "a word" fell. As of the closing on the 12th, the company's stock price closed at 21.52 yuan/share, compared with the listing price of 24.01 yuan/share, the company's stock price has fallen below the issue price.

The stock price of the huge number of "scare collapse" stock price

The Shengquan Group is a high -tech enterprise with the development, production and sales of synthetic resin and composite materials, biomass chemical products.

On August 5, the company disclosed that it will have 534 million restricted sales stocks on August 10, accounting for 68.94%of the total share capital. Based on the closing price of the announcement date, the company's market value reached 12.756 billion yuan. This part of the sales restricted shares are the first public offering of the Shengquan Group, which involves a total of 3,769 shareholders, including Jinan Shengquan Group Co., Ltd.'s unsatisfactory account for holders' securities.

Affected by the huge news of the ban on the market, the company's stock price fell on August 10 and 11 for two consecutive days. As of the closing of the 12th, the company's stock price has fallen below the listing price of one year ago. In response to the changes in the stock price, Shengquan Group explained: "After self -inspection, the company's current operating conditions are normal, the market environment and industry policies have not been adjusted, and the internal and external operating environment has not changed significantly."

So, the stock price of Shengquan Group has a lower stock price, does the company have measures to deal with? In what way the company plans to return to investors? In this regard, the company's Securities Department said: "The stock price of the secondary market is affected by various factors, please pay attention to investment risks. "According to Shengquan Group August 9th announced the annual equity distribution plan of 2021, the company plans to send 2.0 yuan per 10 shares, the equity registration date is August 12, the division of rights and removes is August 15th, and the Sabba date is August. On the 15th, a total of 155 million cash dividends were distributed

The executive promises that if it is broken, it will not be reduced for the time being

In response to the listing and circulation of this limited -sale stock, the company's directors Zhu Jianxun, Jiang Chengzhen, Meng Qingwen, Meng Xin, and other executives Xu Chuanwei, Xiao Meng, Lu Dongsheng, Tang Lei, Deng Gang, and Zhang Yaling promised: " If you reduce your holdings within 2 years, the price reduction price is not lower than the issuance price. "

Within 6 months after the listing of the company's stock is listed on the Shanghai Stock Exchange, the closing price of the company's stock for 20 consecutive trading days is lower than the issuance price, or the closing price at the end of the 6 -month period after the company's stock is listed is lower than the issuance price. The lock -up period of the company's shares will be automatically extended for 6 months after the expiration.

Equity incentive "from scratch"

It should be mentioned that at 16:09 on July 21 this year, some investors asked the company: "Whether the company will have an equity incentive plan for outstanding employees and management

At that time, Shengquan Group bluntly stated: "The company has not implemented the equity incentive plan yet."

However, in the face of the stock price of continuous frustration, on the 12th, in order to maintain the market, Shengquan Group revealed that "In order to establish and improve the company's long -term incentive mechanism and attract and retain outstanding talents, the company is currently on related equity incentive matters Planning, the specific plan is still being prepared. "

In addition, according to the interim report, the latest shareholding of the top ten shareholders of Shengquan Group shows that as of June 30, compared with the recent regular report holdings, the company's total shareholders' shareholding in two shareholders has changed. Among them, the number of shareholdings of the National Social Security Fund has increased, an increase of 790,000 shares, and the number of shares of the society after increasing its holdings is 12 million shares; After reducing holdings, the number of shares holds is 17.227 million shares. Reporter Cai Fang

- END -

Total 19.67 billion yuan!Putian 5 private enterprise industry projects concentrated signing contract

Recently, the seventh World Fujian Commercial Conference was held at the Fuzhou Strait International Convention and Exhibition Center.At the meeting, a total of 5 private enterprise industrial project

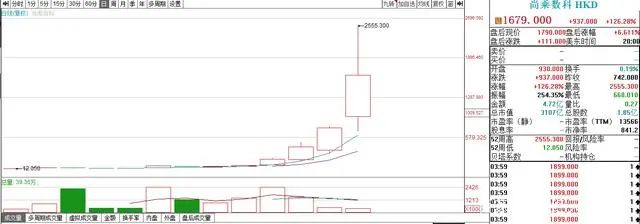

Li Ka -shing makes money!The "China Stock Myth" has risen 214 times in 15 days, and the market value is super Ali Tencent

Chinese stocks still have a single show.On August 2nd, the three major stock index...