The five tax measures of Qinghai Taxation promotes the "spring breeze" of large enterprises

Author:Qinghai Tax Time:2022.08.15

The tax services and management departments of the Grand Enterprise of the State Administration of Taxation Qinghai Provincial Taxation Bureau will combine the "Spring Wind Action" with the key tasks such as deepening tax collection and management reform, expanding the results of party history learning and education, and rectification of satisfaction. Five measures for tax services, and strive to provide professional, accurate and efficient high -quality services for large -scale enterprises in the province.

Pictured: Tax and fee business counseling for tax personnel for large enterprises (photographed by Zhu Zhenyang)

The coordination mechanism of complex tax -related issues of solidification enterprises will continue to solve the suspicion of taxation and difficulties in large enterprises. In 2022, continue to receive the request of complex tax -related matters in a timely manner through the exclusive "green channel" of the large enterprise taxpayer, strengthen the horizontal communication with the tax administrative department, and timely solve the complex matters of "urgent and worried" in the operation of large enterprises, better for large enterprises for large enterprises Provide tax policies for certainty services, improve the efficiency of tax -related matters, and reduce tax -related risks in large enterprises.

Deepen the "total pair" communication mechanism, and carry out "symmetry" service management. In 2022, we will continue to take the headquarters at Qingqianhu Group as the object, combine the annual tax risk management plan, and take the group headquarters as the starting point, to carry out high -level dialogue and communication in a timely manner, expand the direct service channels, properly solve the group, systemic risks and systemic risks and There may be major taxes disputes. Pilot the data interconnection of tax companies, reduce the cost of taxation of large enterprise groups, and improve the taxpayer service experience.

Pictured: Qinghai Taxation Precision Services Disabled Tax Enterprise Governance (shooting from Zhu Zhenyang)

Refine the "online and offline" dual communication channels, and customize exclusive policy push services. Through online communication channels such as WeChat groups and hotline telephones in large enterprises, timely respond to taxpayers' demands, push the preferential tax policies in the industry in a timely manner, help taxpayers to remove tax cuts, and promote the steady progress of tax cuts and fees; , Tax companies discussions, high -level dialogue and other forms to collect offline tax policy training needs, carry out customized specialized tax business training, expert teams to teach on -site to answer confusion, further enhance the accuracy of tax policy training and counseling, enhance the sense of obtaining a lot of enterprises Essence

Strengthen the cooperation and co -governance of tax companies, and talk about the taxation of large enterprises to follow the cooperation agreement. Explore and improve the Group's compliance system, continue to sign the "Tax Comply with the Cooperation Agreement" with a large enterprise group with improvement of more internal control mechanisms, high willingness to cooperate, and strong ability to follow the ability, establish a work ledger, promptly publicize the significance and significance of the agreement and compliance agreement and the significance and the significance of the agreement and the agreement of the agreement. The process, agreed that the rights and obligations of both tax companies will promote the prevention and control of tax risks, integrity operations, do good examples, existing the role of demonstrations, and establish a good tax enterprise relationship of mutual, mutual trust, and interaction.

Credit evaluation of quantitative enterprise groups, escort large enterprises to increase tax credit. In response to the pursuit of high -quality evaluation of large enterprises' tax credit, based on the tax credit evaluation of members of large enterprise group members, it helps large enterprises to improve the internal control mechanism. According to the compliance of the corporate group, the group has pushed the corresponding services and management measures in a designated point to guide the lower -member enterprises to carry out credit repair, put forward suggestions and suggestions for improvement, and enhance the overall credit evaluation of the enterprise group.

Correspondent: Ma Dejun

- END -

Xinhua Pharmaceutical: Mr. Du Duping resigned as a director and general manager of the company

Every time AI News, Xinhua Pharmaceutical (SZ 000756, closing price: 26.38 yuan) issued an announcement on the evening of July 1st, saying that the board of directors of Shandong Xinhua Pharmaceutical

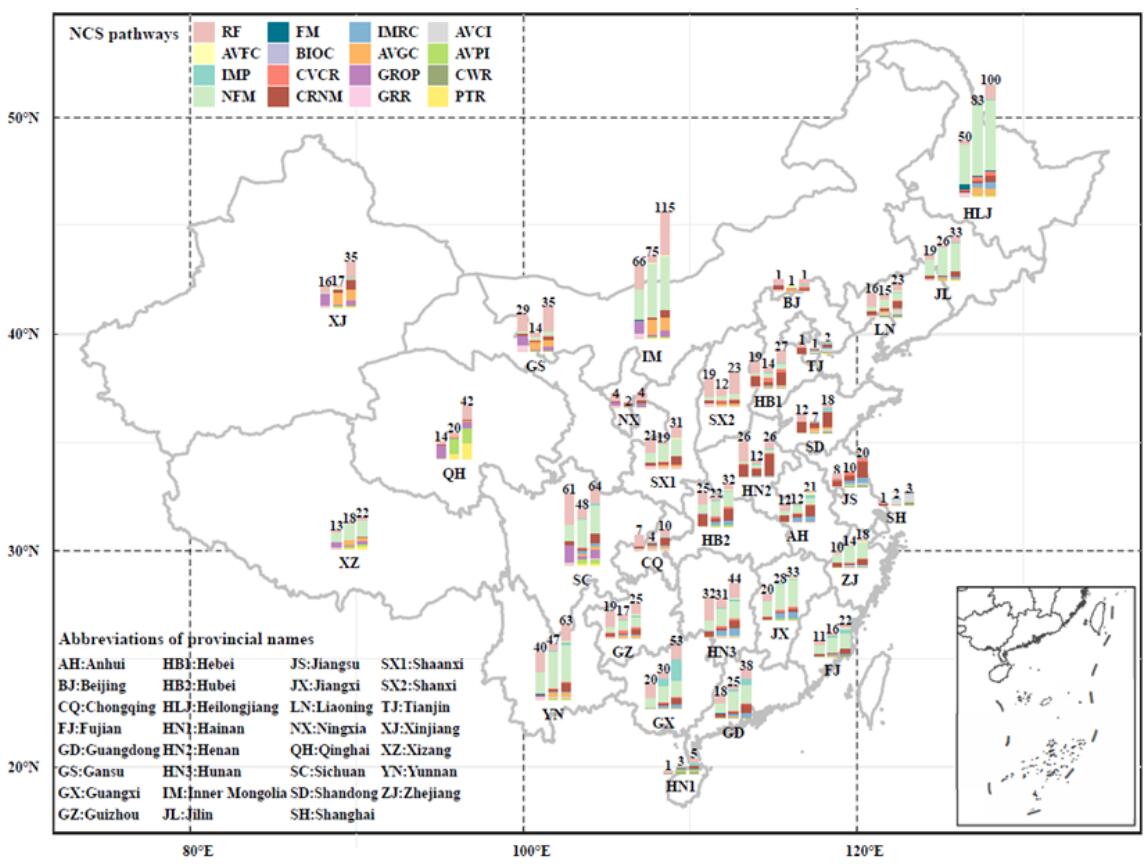

Ecosystem management: Realizing carbon neutrality requires "natural solutions"

China Network/China Development Portal News In the middle of the 21st century, the...