Every hot review 丨 "Boyfrings Fund" is behind a "hunger marketing" coat

Author:Daily Economic News Time:2022.08.16

Recently, there is a product that investors call the "window fund".

What is a window fund? In short, this kind of fund has good performance, received the attention of the foundation, and at the same time has taken very strict purchase restrictions. It's like the goods in the window. Due to the limited number, even if you pay money, you may not be able to buy it. Is it very appropriate?

The "restriction of purchase" has often suspended large purchase and increase the threshold for purchasing. It is a common practice for public funds. The threshold is 100,000, 500,000, and 1 million yuan, and there are relatively low settings at 10,000 yuan. Some top -flow fund managers managed by investors because of the large amount of funds for investors and influxing funds, they will adopt the practice of phased purchase restrictions.

But it is interesting that this year's popular "window fund" is usually 100 yuan, 50 yuan, or even 10 yuan. Each time for purchase restrictions can be issued, it can attract the attention and discussion of the people, and even set off a wave of "more difficult to buy", which is a bit of "hunger marketing".

First of all, let's analyze why there are funds adopting such a "purchase restriction" model?

Looking at the more common "window funds" in the market, most of them are solid -income products represented by pure debt funds. This type of fund has a relatively large probability that institutional customized products are clearly known that the investment cycle will probably be long, and they do not want too many retail customers to enter, so it has strictly limited the funding threshold for purchasing funds. There are also some active equity funds. Such products are usually better performance than funds during the same period, which has attracted the attention of the industry and the citizens and the influx of funds. The fund manager hopes to control the scale by restricting purchase to ensure that holding holders to ensure holding holdings to ensure holding holdings to ensure that holding holders to ensure holding and holding holdings to ensure holding. People interests. In addition, there are a small amount of fund restrictions because the fund size is too small and is close to or preparing for liquidation.

Secondly, what benefits can be brought by "window fund".

The most obvious is the increase in geometric levels of topics and attention. For example, a recent active equity fund that strictly restricted purchase restrictions, because of its leading performance and frequently reduced the purchase quota, instead aroused the attention of more investors. Many people even heard that the fund was "50 yuan for purchases of 50 yuan. "And the news of the popular market came to follow, and also produced the psychology of" the more you want to buy if you can't buy ". Regardless of whether this operation is intentional, the effect of "hunger marketing" has been achieved, and I am afraid that many consumer companies' marketing staff are envious.

After repeatedly lowered the purchase limit during the year, the fund will officially close the door next Monday. In fact, the latest data shows that the fund has doubled the scale in half a year, and both "face" and "Lizi" have. From the perspective of ensuring the stable operation of the fund, the suspension of purchase is also reasonable.

Finally, why not "hunger marketing" for public funds?

When it comes to the "hunger marketing" of the public offering industry, in the past, we see more about the "routine" of the institution ’s initiative to sell several billion yuan and shout out of the proportion of doctrines and selling. The desire for buying often receives good results. However, the problem of doing this is that once the subsequent market fluctuates and brings losses to investors, it will not only bring hidden dangers to the follow -up services of financial institutions, affect the brand reputation, but also cause the citizen's step -like redemption, which further affects Performance. The final result is the "double losing" of investors and fund managers.

The author still remembers that in a previous public speech, a general manager of a large fund in South China made a very exciting discussion on the topic of "hunger marketing". , But resolutely do not engage in 'hunger marketing' because of the hot spot in the market. Behind the growth of scale, the investment capacity must keep up. "

Daily Economic News

- END -

Comprehensively build happiness and beautiful New Gansu

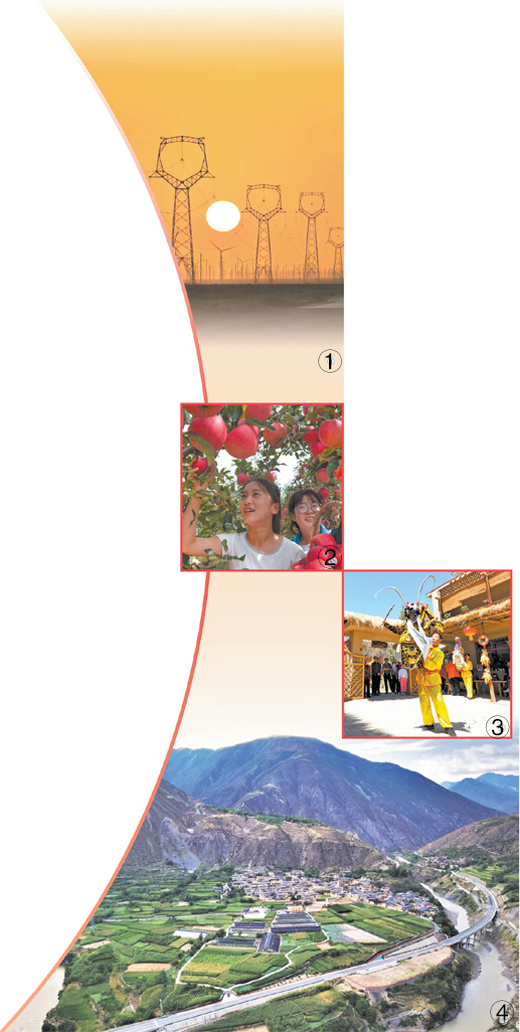

Figure ①: Ultra -high -voltage grid by the National Grid Gansu Power Company's op...

Ansha Society: The growth of Italian family income cannot keep up with inflation.

China Well -off Network, July 6th, ISTAT, the Italian Statistical Bureau of Malays...