The high -scoring list is here!These companies in the first half of the year's dividend cash exceeded the net profit of returning mother

Author:Securities daily Time:2022.08.17

Our reporter Ren Shibi entered a dense disclosure period in the semi -annual report of 2022. The dividend plan of listed companies, especially cash dividends, has attracted much attention from the market. According to the Flush Data data, as of the close of August 16, a total of 24 companies in A shares disclosed the distribution plan of the 2022 half -annual report (including the company that has implemented a dividend scheme and a dividend plan). ; Yiyi launched the distribution plan for 4 shares per 10 shares in the first half of 2022. Among them, the dividend plans for the first half of 2022 to distribute the current profit more than the net profit of their mother -in -law in the first half of this year. In response, Zhang Xiaodong, a gecko capital fund manager interviewed by the Securities Daily, said, "The dividend policy of listed companies is an important signal reflecting the company's operations. Dividends can increase investor returns, boost market confidence, create value investment and value investment and value investment and value investment and value investment and value investment. The concept of long -term investment. "From the perspective of single companies, the number of 6 companies' dividend plans exceeded the net profit of home, and 8 of the above 23 companies intend to distribute the current amount of each share. Ge Mining plans to settle the cash per share, reaching 1.898 yuan. China Mobile follows closely. It reached 1.5 yuan, 1.2 yuan, and 1.05 yuan, respectively. Tibet Mining was generous in the first half of this year, and it was planned to distribute about 3 billion yuan (including tax), accounting for 125.16%of the current net profit ratio of the current mother. The company is about to implement a dividend plan. The equity registration date is August 18, and the division of rights and dividends will be August 19. At the same time, China Mobile's "red envelopes" of investors are also high. The company plans to send 18.942 yuan (including tax) per 10 shares. In the first half of 2022, the cash amount of dividend plans for dividends reached 40.465 billion yuan, accounting for the current net profit ratio of home mother reached reaching the current mother -in -law's net profit ratio reached reaching the current mother's net profit ratio reached reaching the current mother -in -law. 57.58%, the score ratio in 2019 and 2020 was 56.23%and 54.10%. China Mobile said that the profits distributed in cash in 2023 gradually increased to more than 70%of the company's shareholders that year. Chen Li, chief economist of Chuancai Securities and Director of Research Institute interviewed by a reporter from the Securities Daily, said, "For listed companies with a cash per share of over 1 yuan, the industry's prosperity is relatively good. Louxin material belongs to the new energy industry. With the continuous advancement of the "double carbon", the overall profit of the industry is good, and there are sufficient profits to make cash dividends; China Mobile is a communications head enterprise, with good cash flow and good profits; Zhonggu Logistics is the logistics; It belongs to the port shipping sector. In the past two years, shipping prices are at a high level, and the company's profit growth rate is relatively fast. "Among the above 23 companies, Edison, Hengjin induction, East Sunshine, Tibetan Mining, Xianglou New Materials, Zhonggu Logistics, etc. In the first half of 2022, the current dividend plans for the dividend of 2022 exceeded the net profit of returning to the mother in the first half of this year. It can be said that the "red envelopes" of these companies returned to investors in the first half of this year were very generous. Taking Ebison as an example, the company's net profit attributable to her mother in the first half of the year was 81.4223 million yuan, an increase of 313.36%year -on -year; Tax), a total of 537 million yuan in cash dividends were distributed, accounting for 659.13%of the net profit ratio of mother -in -law in the first half of this year. Such a "pride" dividend plan has aroused the attention of the Shenzhen Stock Exchange. On August 2nd, the Shenzhen Stock Exchange issued a letter of attention, asking Edison to explain whether the profit distribution plan matches the growth of the company's performance, whether it will cause the company to have a liquidity risk, whether it is in line with the company's development strategy, whether the company will be available for the company. Continuous operations have caused adverse effects, and the company is requested to fully remind the relevant risks. Ebissen announced on August 4 that the company's future operating performance is expected to continue to improve. At the same time, combined with the company's current funding situation, daily operations, and major future capital expenditure arrangements, the company has formulated this profit distribution plan. Matching with performance growth. However, Chen Li believes that "the short -term profits caused by non -recurring profit or loss are unsustainable. Investors need to pay attention." The net profit of 18 companies in the first half of the year increased the year -on -year increase. Make the company's dividend more confident. The performance of the above 23 companies in the first half of this year is generally dazzling. In the first half of this year, the net profit of the 18 companies increased year -on -year, accounting for 75%. Among them, the net profit of the mother -in -law during the reporting period of Dongguang increased the highest year -on -year increase. In the first half of the year, the net profit attributable to the mother was 624 million yuan, an increase of 646.16%year -on -year; The net profit of the five companies such as Chao Chao's home in the first half of this year doubled year -on -year, showing strong growth. The popularity of high dividends to attract institutional investors not only stable income, but also enhance confidence in the development of listed companies. Statistics show that of the above 23 proposed companies, based on the closing price on August 16, 13 companies calculated the dividend ratio of the bank in one year (1.75%) based on the plan, accounting for nearly 60%. Among them, Ebison ranked first based on the plan to calculate the dividend rate of 11.74%, and two companies including Zhonggu Logistics and Tibet Mining also calculated the dividend rate of more than 5%according to the plan.

"We are optimistic about investment opportunities of high -scales: First of all, the current market is in the semi -annual report. The highlights of the semi -annual report will get the market's continuous mining, and the high -scalp variety will also get the market's attention. SecondThey are all companies with good profitability, and the value of investment appears; in the end, high scores are a kind of confidence and vitality, boosting investor emotions. Especially after the market rises for a period of time, the defense of high -dividend companies will be highlighted. "Liu Jixin, assistant to Rongzhi Investment Fund, a subsidiary of Pai Lai.com, told reporters.Table: It has been disclosed that the semi -annual newspaper dividend plan company lists: Ren Shibi's picture | Site Cool Hero Bao Map Network Production | Zhu Lingzi Audit | Zhao Ziqiang Edit | Qiao Chuanchuan Final Audit | Peng Chunlai

Recommended reading

The latest voice of the National Development and Reform Commission: 300 billion yuan of financial bonds invest here!Infrastructure Reits reappears ...

The decline in performance is close to supervision "Red Line" Guizhou Huaxi Rural Commercial Bank's equity is difficult to "turn hands"

- END -

Liuchuan Town, Jingyuan County, Baiyin City: "Vegetables" write a good "money" scene in the rich industry

In Jingyuan County, Baiyin City in August, the mountains and rivers are green. Ent...

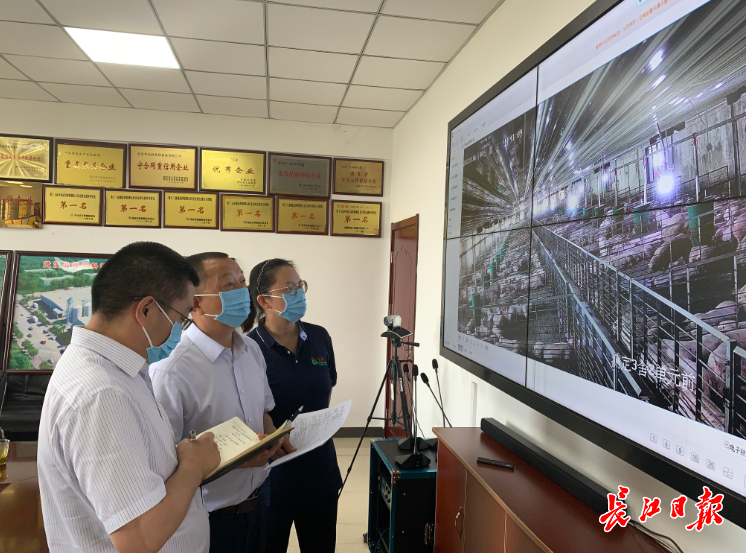

The funds of the animal husbandry company have a lot of pressure on funds, and the "financial village official" on -site service promotes 80 million yuan loan

You see, the tens of thousands of pigs and pigs in our base are now growing up. Th...