Bad!The Dow plummeted over 1,000 points. How much influences Powell's "scaring collapse"?US wealthy wealth evaporates 530 billion overnight!Is a larger tightening storm?

Author:Broker China Time:2022.08.27

A speech completely "frightened" US stocks.

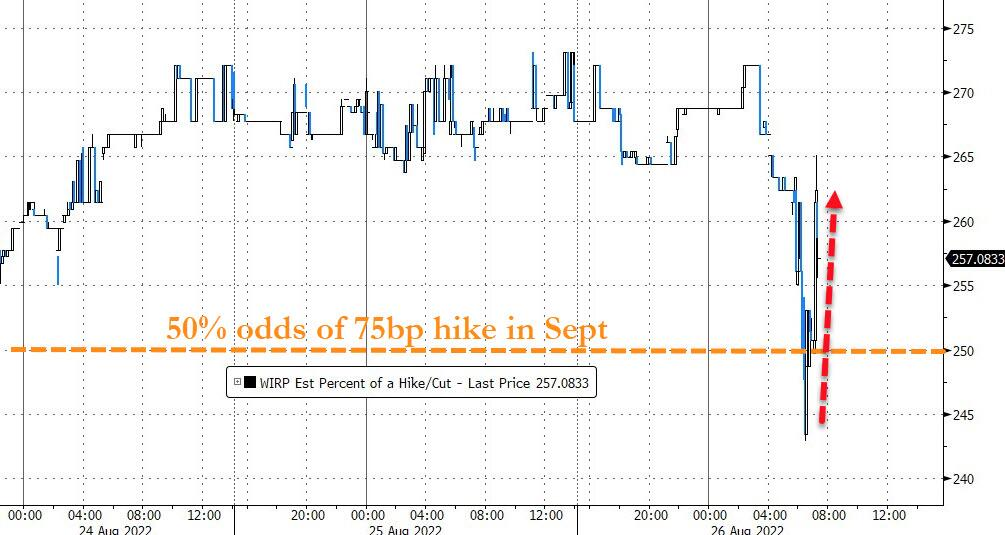

On the evening of August 26, Beijing time, Fed Chairman Powell gave a speech on the US economic prospects. Powell's speech clearly stated that the Fed will not be around one or two months of data. The current inflation situation in the United States is still severe, and the Fed must continue to raise interest rates. At the same time, Powell directly refuted the currency market's pricing of interest rate cuts in the second half of 2023. After this statement, the market's expectations of the Fed's 75 -basis point in September soared to nearly 60%.

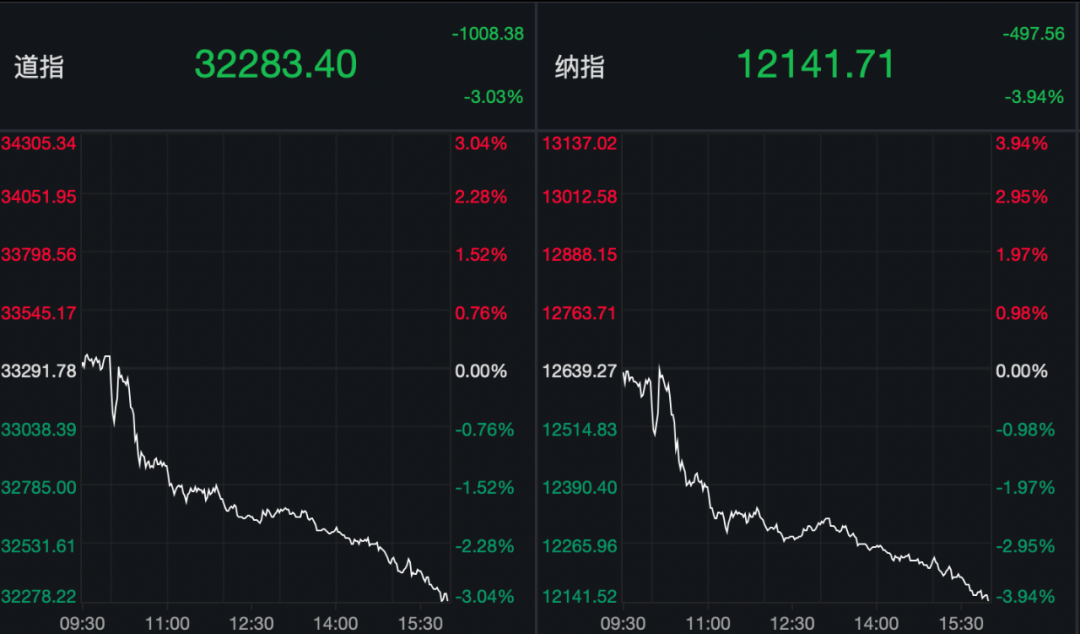

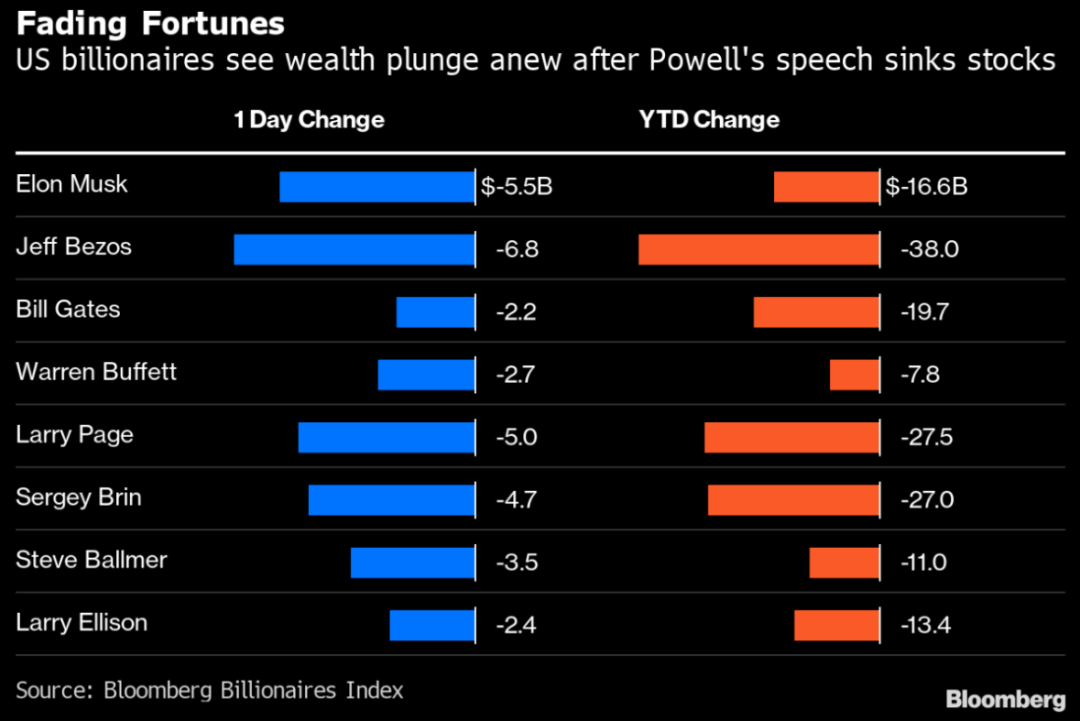

As soon as Powell's words fell, the U.S. stock market staged a big diving, and the decline in the market expanded rapidly. The Nasda Index fell more than 2%in an instant. As of the closing, the Nasda Index plummeted 3.94%, the largest closing decline since June 16; the S & P fell 3.37%, the biggest decline since June 13; The first day has plummeted by more than 1,000 points in a single day. According to statistics from Bloomberg, Powell's speeches in just 10 minutes made the wealth of the richest people in the United States exceed $ 78 billion (about RMB 536 billion).

In addition to interest rate hikes, another storm set off by the Federal Reserve is quantitative tightening. According to policy arrangements, the scale of quantitative tightening of the Fed will be more aggressive starting in September this year, and the reduction of holdings will increase from $ 47.5 billion per month to $ 95 billion/month. Greg Jensen, the chief investment officer of Qiaoshui Fund, warned that as the Fed accelerates QT, the US real economy and financial markets will decline sharply. Generally speaking, the asset market will fall by 20-25%.

Powell's speech "Scared Crash" US stocks

Central bank officials, Nobel Prize winners and top economists around the world are gathered in Jackson Hall, a small town of Mingzhou. Degree almost reached the highest peak.

According to the schedule of the official website, at 10 am local time on August 26 (22:00 on the 26th Beijing time), Fed Chairman Powell delivered a speech on the U.S. economic prospects. There is no doubt that this is the most critical of the 2022 Jackson Hall Global Bank Annual Conference A highlight.

The theme of Powell's speech is "Monetary Policy and Price Stability". The content is short and intensive. It is finished in only 10 minutes, but it is a disaster for the US stock market.

Powell's speech clearly stated that the Fed will not be around one or two months of data. The current inflation situation in the United States is still severe, and the Fed must continue to raise interest rates. At the same time, Powell directly refuted the currency market's pricing of interest rate cuts in the second half of 2023, and bluntly stated that "the benchmark interest rate at the end of next year is slightly lower than 4%."

After this statement, the market's expectations of the Fed's 75 -basis point in September soared to nearly 60%.

In fact, on the eve of Powell's statement, the expectations of the US stock market are relatively optimistic, and even expected that American inflation has been at the top, and the Fed will shift from interest rate hikes to interest rate cuts at some time next year.

Wall Street even considered the Federal Reserve's previously released interest rate hike signal as "virtual momentum". The US stock market has continued to rebound up in July to August. Some analysts pointed out that since the second half of 2022, the US market is experiencing the most weird "painting style".

Therefore, Powell's "inflation is not rest, and the interest rate hikes" on the evening of the 26th significantly exceeded market expectations, and it has also become a risk event in the market.

As soon as Powell's words fell, the US stock market staged a big diving, and the decline in the market expanded rapidly. Later, after the close, as of the closing, the Nasda Index plummeted 3.94%, the largest closing decline since June 16; the S & P fell 3.37%, the largest decline since June 13; It has plummeted for the first time since May 18.

All the US stocks are almost overwhelmed by the entire army, and technology stocks have become a severe disaster -stricken area. Among them, the IT sector where the chip stocks such as Nvidda plummeted 4.3%. Google's communication sector and Amazon's non -essential consumer goods sector fell 3.9%.

Among the six major technology stocks of US stocks, Google fell 5.4%, setting a new low since July 26; Amazon fell nearly 4.8%, Naifei fell nearly 4.6%, Facebook's parent company Meta fell nearly 4.2%, Microsoft fell nearly 3.9% Apple fell nearly 3.8%.

According to statistics from Bloomberg, at the Jackson Hall Annual Conference, the Federal Reserve President Powell's speeches in just 10 minutes made the wealth of the richest people in the United States exceed 78 billion US dollars (about RMB 536 billion). Among them, Musk's wealth evaporated $ 5.5 billion, Bezos lost $ 6.8 billion, Gates lost $ 2.2 billion, Buffett also lost $ 2.7 billion, Google Sergey Brin's wealth fell to less than $ 100 billion.

In fact, on the eve of Powell's speech, the position of other Federal Reserve officials also shifted significantly, and the "Eagle School" stated that it was one after another.

On Thursday, many Federal Reserve officials including San Louis Fed Chairman Brad, Kansas City Fed Chairman George, Philadelphia Fed Chairman Harker, and Atlanta Federal Reserve Posk, almost emphasized the Federal Reserve's continued interest rate hikes in an interview. The necessity. They also said that the Federal Reserve will start to cut interest rates next year, but it will continue to raise interest rates until the benchmark interest rate exceeds 4%. Anti -inflation is more important than supporting economic growth

The importance of the "Jackson Hall Global Central Bank Annual Meeting", which is being held, is self -evident. The inflation, employment market, and economic recession of the "explosive table" in the United States are the key points for the Fed to do their best to weigh, and it is also the focus of market attention.

In the just delivered, Powell mentioned the above three aspects.

Powell said that the recovery of prices not only takes time, but also needs to use the central bank's tools to make demand and supply better balance. This also means that the United States may go through a period of economic growth that continues to be lower than the trend, and there will be some softening labor market.

For the judgment of American inflation, Powell believes that the latest economic data is half -mixed, the labor market is particularly strong, and the demand for workers is far exceeding the supply; in July, inflation fell slightly, but it is far from reaching the level of FOMC's determination of "inflation is falling". Essence

Powell said that there is no stable price and the economy is not good for anyone. For those with weak financial affordability, the negative impact of high inflation is the most serious.

Powell further issued a warning that the current special risk is that the longer the high inflation time, the more likely the expected expectations of inflation will continue to rise. Then, a vicious self -realization between inflation and public expectations.

In addition, Powell has an important statement about the decline of the US economy. Powell pointed out that although the US economic recession is not an inevitable result, the Fed's continued interest rate hike will inevitably cause "some pain" to the economy, but in view of the current inflation and labor market situation, the Fed must continue to raise interest rates.

Regarding Powell's speech, Wall Street analysts said that the signal released by Powell is already very clear, and it is more important to fight inflation than supporting economic growth. Therefore, it is also clearly stated that the Fed will still raise interest rates more actively in the short term, and Powell's current plan has no interest rate cuts. The market attempts to make pricing at the earlier at the end of 2023.

More violent quantitative tightening is being implemented

In addition to interest rate hikes, another storm set off by the Federal Reserve is quantitative tightening.

According to the Federal Reserve's policy arrangements, starting in September this year, the quantitative tightening scale of the Fed will be more radical, and the scale reduction will increase from $ 47.5 billion per month to $ 95 billion/month. Among them, the upper limit of US debt reductions increased from 30 billion US dollars per month to $ 60 billion/month; institutional bonds and institutional mortgage loan support securities (MBS) reduced the upper limit from US $ 17.5 billion to $ 35 billion/month.

This reduction table is performed in a "passive" manner, that is, the expiration is not continued, and the assets are automatically redeemed instead of actively selling.

The market generally believes that the Federal Reserve has a more aggressive watch from 2017-2019. At that time, the shrinkage began after the Federal Reserve ’s first interest rate hike for the first time, and the Federal Reserve was raising interest rates and“ double prongs ”.

How much will the impact of the United States reserve (QT) on the market?

Greg Jensen, the chief investment officer of Qiaoshui Fund, warned that as the Fed accelerates QT, the real economy and financial markets in the United States will decline sharply. Generally speaking, the capital market will fall by 20-25%.

In Jensen's view, asset prices "need to decline", the reason is that there is a lot of disconnection between the financial market and the real economy.

Jensen further explained that QT, the profit of US companies will decline, and the Fed's QT and interest rate hikes will lower inflation and economy. If in the face of stubborn inflation, the Fed is forced to tighten the policy for a longer time, and the Fed will turn to a loose policy 6-9 months after the market expects that it will not become a reality. The future investment will be "more difficult". The depletion of sex with the growth of profits and economy, which eventually leads to weak economic growth in the United States.

The latest research reports of CITIC Securities' clear team also pointed out that economic leading indicators, employment indicators, and U.S. Treasury trage margin indicators have good predictive significance for the US economic recession. Especially in the first half of next year, the possibility of entering the recession this year will not be ruled out. In the context of the inflation expectations, the Fed's tightening will continue to support the upward increase of US bond interest rates. Seeing that the top point is expected to stop raising interest rates at the Federal Reserve, then due to economic deterioration US bond interest rates will face large downward risks.

Responsible editor: Gui Yanmin

- END -

With the high peak accompanied by the high break, when the "beggar version" IPO runs back to Hong Kong stocks, when will the Hong Kong stocks warm back?

China Economic Weekly reporter Zhang YanOn August 15, China, which had just passed...

Beijing's "two districts" overseas promotion specialized Changping policy "circle fan" many well -known foreign companies

Wen | Liu RunanOn July 19, the Beijing two districts policy overseas cloud promoti...