Some say that the L2 quarterly national and commercial bank's financial management capabilities and single rankings are released

Author:Cover news Time:2022.08.29

Recently, the Puyi Standard · Puyi Huanyu Research Institute released the comprehensive ranking of bank financial management capabilities and single rankings in the second quarter of 2022. According to the information disclosed, the local Chengdu Rural Commercial Bank performed well in various evaluation indicators, and the bank was in the top ten in each positive indicator disclosure.

The advanced institutions generally show a relatively balanced development strength

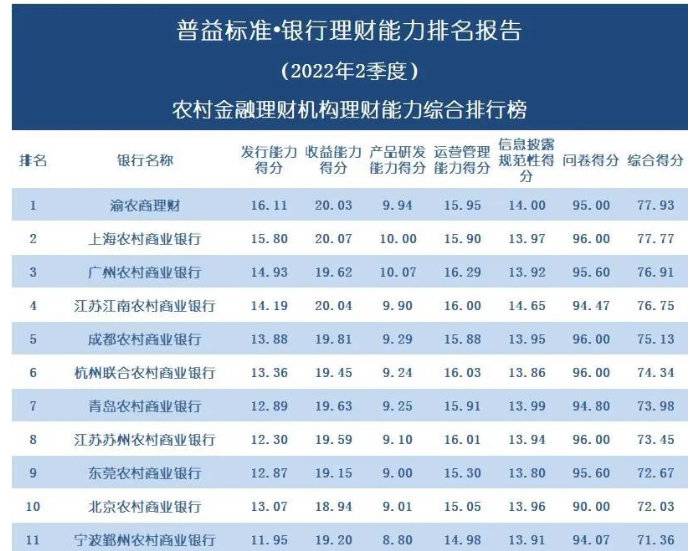

The data shows that the top ten in the comprehensive financial management capabilities are Chongqing Rural Commercial Finance, Shanghai Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Qingdao Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Bank, Dongguan Rural Commercial Bank, Beijing Rural Commercial Bank.

From the perspective of data, there were 149 rural financial financial management institutions participating in the ranking in the second quarter of 2022, an increase of 5 from the first quarter of 2022. On the whole, the phenomenon of polarization of various rural financial management institutions in financial management has continued to exist.

On the whole, institutions with the top financial management capabilities in banks generally show a relatively balanced development strength, while some single -item measurement indicators are prominent, while there are no shortcomings. Among the types of banks belonging to their own bank types have the characteristics of net worth of net worth wealth management products, complete marketing channels, complete operating management teams, strong financial management business risk control capabilities, and product lines that can cover customers with various liquidity needs.

In terms of revenue capacity disclosure, the top ten rural financial financial management institutions are Shanghai Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Yu Rural Commercial Finance, Chengdu Rural Commercial Bank, Qingdao Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Commercial Banks, Guiyang Rural Commercial Bank, Hangzhou United Rural Commercial Bank and Ningbo Yinzhou Rural Commercial Bank.

The scale of net worth wealth management products in the front of the institution is high

According to the statistics of Puyi Standard Standard, the number of products in rural financial financial management institutions (including Rural Commercial Bank and its wealth management companies, agricultural cooperatives and agricultural credit cooperatives) in the second quarter of 2022 was 12013, with a duration of approximately 1.37 trillion yuan Essence

In the second quarter of 2022, the average score of 8.13 points for rural financial and financial institutions was 8.13 points, a decrease of 0.63 points from the first quarter, and 2.94 points lower than the financial institution of the city and business department. The gap between the two increased. In terms of net worth products, the cumulative continuation scale of net worth products in rural financial financial management institutions in the second quarter stopped declined and increased by 50 billion yuan.

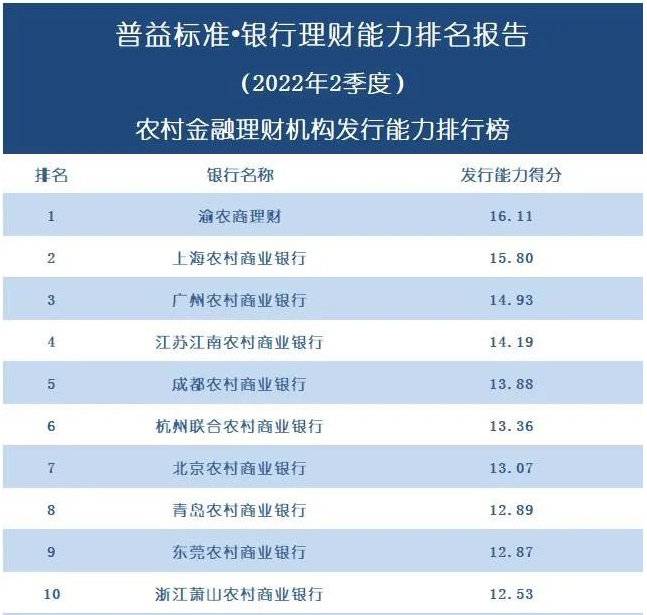

In summary, institutions with strong circulation capabilities have a high scale of net worth wealth management products on the one hand, and the scale of financial management is generally in the stage of continuous rise; on the other hand, it also attaches great importance to the construction and optimization of marketing channels. The types of offline direct sales channels, broadening the number of agencies, and increasing the scale of agency products have been continuously improved to continuously improve the construction of channels to broaden the breadth of the coverage of wealth management products.

The top ten of the rural financial financial management institutions in the issuing capabilities are in turn, Shanghai Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Beijing Rural Commercial and Commercial Bank Bank, Qingdao Rural Commercial Bank, Dongguan Rural Commercial Bank, Zhejiang Xiaoshan Rural Commercial Bank.

The front institutions have a relatively comprehensive wealth management product line

In summary, the leading institutions of product research and development capabilities are a relatively comprehensive wealth management product line, which can cover a variety of product types such as fixed income, mixed, equity, etc., and can support customers' multiple liquidity needs and risk tolerance; second It is a strong product innovation capacity, based on national macro policies and the grasp of customer needs, accelerate the pace of product research and development, and continuously launch innovative products such as themes, investment strategies, and payment methods. Management, developing exclusive wealth management products for high net worth customers.

In terms of product research and development capabilities, the top ten rural financial management institutions are Guangzhou Rural Commercial Bank, Shanghai Rural Commercial Bank, Chongqing Rural Commercial Finance, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Qingdao Rural Commercial Bank, Hangzhou United Rural Commercial Commerce Bank, Jiangsu Suzhou Rural Commercial Bank, Beijing Rural Commercial Bank, Dongguan Rural Commercial Bank.

In terms of revenue capacity disclosure, the top ten rural financial financial management institutions are Shanghai Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Yu Rural Commercial Finance, Chengdu Rural Commercial Bank, Qingdao Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Commercial Banks, Guiyang Rural Commercial Bank, Hangzhou United Rural Commercial Bank and Ningbo Yinzhou Rural Commercial Bank.

In addition, the top ten in operating management capabilities are Guangzhou Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chongqing Rural Commercial Finance, Qingdao Rural Commercial Bank, Shanghai Rural Commercial Bank, Chengdu Rural Commercial Bank, Jiangsu Zhangjiagang Rural Commercial Bank and Guangdong Shunde Rural Commercial Bank.

The top ten in the top ten in information disclosure are Jiangsu Jiangnan Rural Commercial Bank, Yu Rural Commercial Finance, Qingdao Rural Commercial Bank, Shanghai Rural Commercial Bank, Beijing Rural Commercial Bank, Chengdu Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Bank, Guangzhou Agricultural Agricultural Bank Commercial Bank, Ningbo Lizhou Rural Commercial Bank and Hangzhou United Rural Commercial Bank.

Cover reporter Ran Zhimin

- END -

How can smart steel and modern logistics strike the water in the water

Zhuzhou Daily All Media Reporter/Ren YuanLogistics such as blood is an important p...

Financial helps to paint a new picture of Jiaxing rural revitalization

In recent years, the Jiaxing Branch of the Agricultural Bank of China has always t...