Sino -US signing audit supervision cooperation agreement!CSRC responded →

Author:Audit observation Time:2022.08.29

Introduction

The Sino -US audit supervision and cooperation agreement is expected to avoid passively retreating from the United States from the United States, and information security liability will be clearer.

The China Securities Supervision and Administration Commission and the Ministry of Finance of the People's Republic of China signed an audit supervision cooperation agreement with the U.S. Public Corporation Accounting Supervision Committee (PCAOB) on August 26, 2022, which will start related cooperation in the near future.

According to the laws and regulations of the two countries, the cooperation agreement respects the international approach, and in accordance with the principles of peer mutual benefit, the two parties clearly agree on the cooperation and investigation activities of relevant accounting firms to carry out supervision inspections and investigation activities, forming a framework of cooperation that meets the requirements of both parties and regulatory requirements.

The signing of the cooperation agreement is an important step in the common concern of the regulatory agency between China and the United States to solve the issues of audit supervision and cooperation. It has laid the foundation for the next stage of active, professional, and pragmatic promotion cooperation. Promoting cross -border audit supervision and cooperation in accordance with the law will help further improve the quality of practice of accounting firms, protect investors' legitimate rights and interests, and also help the enterprise to create a good international regulatory environment for enterprises to carry out cross -border listing activities in accordance with laws.

Industry experts believe that the signing of the cooperation agreement provides a positive signal for securities supervision and cooperation between China and the United States, which is expected to avoid passively retreating from the United States from the United States. At the same time, the information related to the information involved in the audit work is resolved in the agreement. Accounting firm and enterprises need to implement the responsibility of the information security subject, and do a good job of information disclosure of listed companies on the basis of strictly obeying their national laws and regulations and obligations.

While the Sino -US cross -border regulatory cooperation was promoted, the listing channels for the United States remained unobstructed. Choice data shows that there are more than 280 Chinese stock companies listed in the United States, with a total market value of more than $ 1 trillion. As of August 27, 13 Chinese -funded enterprises have been listed in the United States since this year.

Relevant person in charge of the China Securities Regulatory Commission signed a reporter from the Sino -US audit supervision cooperation agreement:

Q: What is the significance of signing the Sino -US audit supervision cooperation agreement?

Answer: The signing of the Sino -US audit supervision and cooperation agreement is an important step for the two parties to solve the issue of Sino -U.S. It laid the foundation for the next step on the premise of compliance with their respective laws and regulatory requirements, and cooperated efficiently, and complied with the international traffic of the capital market supervision and cooperation. The development of audit supervision and cooperation between China and the United States has positive significance for improving the quality of the practice quality of the accounting firm and protecting the legitimate rights and interests of investors, and also helps to create a good regulatory environment for enterprises to carry out cross -border listing activities in accordance with laws and regulations.

Q: What are the main contents of the Sino -US audit supervision and cooperation agreement?

Answer: The Sino -US audit supervision cooperation agreement signed this time is based on the memorandum of understanding of law enforcement cooperation in 2013 and the memorandum of pilot inspection cooperation in 2016, according to the domestic laws and regulations and regulatory requirements of the two parties, referring to the relevant international practices, summarize the past in the past The cooperation experience of the two parties reached after repeated consultations. The cooperation agreement mainly made specific arrangements for the daily inspections and law enforcement investigations on the cooperation of relevant accounting firms in both parties, and agreed that the purpose of cooperation, scope of cooperation, cooperation form, information use, and specific data protection.

The cooperation agreement includes the following key contents:

The first is to establish the principle of peering. The clause of the agreement has the same binding force on both parties. Both China and the United States can conduct inspections and investigations on relevant offices within the area under the jurisdiction of the region of the other party in accordance with legal duties. The request party shall provide full assistance within the scope of the law.

The second is to clear the scope of cooperation. The scope of the cooperation agreement includes assisting the other party to conduct inspections and investigations of relevant offices. Among them, the scope of China ’s assistance also involves part of the audit services for China Stocks, and the audit draft is stored in the Hong Kong firm in the Mainland.

The third is to clarify the way of collaboration. The two parties will conduct communication and coordination on the inspection and survey plan in advance. The United States must obtain documents such as the audit draft through the Chinese regulatory authorities, and conduct interviews and inquiries on relevant personnel of the accounting firm with the participation and assistance of China.

Q: What is the purpose of carrying out cross -border audit supervision and cooperation?

Answer: Enterprises issuing securities and listing in the capital market shall regularly release financial reports to provide information for investors' informed decisions. Laws and regulations of various countries require accounting firms to audit relevant financial reports, and require regulatory agencies to supervise relevant accounting firms to ensure that they perform their duties in accordance with laws and regulations, improve the quality of information disclosure of capital market, maintain investment Legal rights and interests.

In the case of corporate cross -border listing, local accounting firms that provide audit services for these companies generally need to register in the listing site and accept the supervision of the listed land supervision department. Because these firms may spread all over the world, the listing regulatory authorities must supervise them in order to supervise them, and they must establish a cooperation mechanism with the local regulatory agencies of relevant offices and carry out cross -border regulatory cooperation. This is the practice of the global capital market. If you cannot effectively carry out cross -border audit supervision and cooperation, it is difficult to convince whether the audit work of the relevant firm meets the regulatory requirements. The quality of relevant listed companies' financial reports will lack a layer of protection, which will cause investors to question It is impossible to continue to be listed in the place.

With the gradual deepening of the two -way opening of China's capital market, the cross -border listing and accounting firms of enterprises are becoming more and more frequent. At present, more than 200 Chinese companies are listed in the US capital market, and more than 30 domestic accounting firms in China have registered in PCAOB registration. , Auditing services to Chinese companies listed in the United States. In order to fulfill the audit supervision of the above office, PCAOB needs to establish a cooperative relationship with the Chinese regulatory authorities and implement cross -border supervision and cooperation. Similarly, if a Chinese regulatory agency needs to implement audit supervision on the US accounting firm within its scope of supervision, it shall also be carried out through the supervision and cooperation mechanism. This is an international practice, and both sides need this mechanism. The reservation of Chinese stocks in the United States is beneficial to investors, beneficial to listed companies, and beneficial to both China and the United States. It is a win -win institutional arrangement. This is an important foundation for both parties to sit down and negotiate and reach an agreement. Question: What is the role of audit work in cross -border audit supervision and cooperation?

Answer: The supervision of accounting firms will inevitably involve the audit draft. Taking daily inspections as an example, in addition to inspecting the internal control system of the accounting firm, regulators also need to check the audit work draft of some listed companies to inspect the work quality of the firm. The audit work draft is the "work record" made by the firm's audit plan, the audit procedures for implementation, the relevant audit evidence obtained, and the relevant audit evidence obtained. The main function of the audit work is to record whether the auditors have performed their due diligence to verify the accuracy of financial information such as corporate income expenditure, so generally do not include sensitive information such as state secrets, personal privacy or corporate underlying data.

It should be noted that the direct object of audit supervision is an accounting firm, not a listed company for their audit. From the perspective of cross -border audit supervision and cooperation, listed land supervision agencies generally select some accounting firms each year for inspection, and the audit projects with representative or potential audit quality risks are spot -checked in listed companies audited by the inspection firm Verify to evaluate the quality of the audit work. This is also the case for Sino -US audit supervision and cooperation. There is no need to check all the audit projects in the US listed company each year.

Question: Under the framework of the cooperation agreement, if the audit work contains some sensitive information, can they get necessary protection?

Answer: In recent years, the relevant laws and regulations of information security such as data security law and personal information protection law have been implemented one after another. The information security responsibilities of relevant market entities have become more clear, and there are more chapters in operation. Regardless of whether it is listed or not, it is obliged to strictly abide by the laws and regulations of the country.

Recently, the China Securities Regulatory Commission and other departments have improved the relevant confidentiality and archives management regulations of overseas listing, put forward clear requirements on the information security management of regulatory audit drafts, and further implemented the main responsibility of information security for listed companies. Regulatory management and processing of sensitive information related to confidentiality provides more detailed and executable guidelines, which helps to do a good job of preparing for the premise of meeting the requirements of accounting audit, and protect relevant information security in accordance with the law.

The Sino -US audit supervision cooperation agreement incorporates the inspection and investigation activities of the relevant accounting firms in the cooperation framework. The two parties will fully communicate and coordinate beforehand. supply. At the same time, the cooperation agreement has made a clear agreement on the processing and use of sensitive information in the audit supervision and cooperation. Special processing procedures for specific data such as personal information are set up, which provides feasibility for the security of relevant information to protect the relevant information security duties of both parties. path.

Q: Does the reach of the Sino -US audit supervision and cooperation agreement mean that the risk of China -stock stocks from the United States has been lifted?

Answer: The signing of the China -US Audit Supervision Cooperation Agreement marks that the two parties have taken a key step through strengthening cooperation to solve the problem of Sino -stock audit supervision, which is in line with market expectations and expectations. In the next step, the two parties will conduct daily inspections and investigation activities on cooperation with relevant accounting firms in the cooperation agreement, and make objective assessments on the effect of cooperation. If subsequent cooperation can meet their respective supervision needs, it is expected to solve the problem of Chinese stock audit supervision, thereby avoiding passively delisted from the United States. We look forward to actively promoting cooperation with the US regulatory authorities with a professional and pragmatic attitude and work together to achieve active results.

Source | China Securities Supervision and Administration Commission

- END -

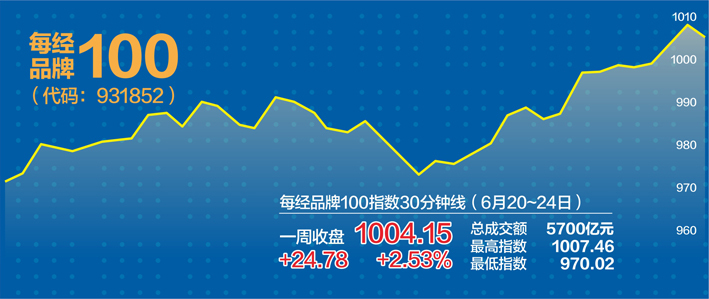

Car consumption remain strong every 100 points through the brand 100 indexes

When overseas markets are stable, every 100 index of brand 100 rushes thousands of...

Looking at the power of consumption from the World Fortune 500 list

Yan YueOn the afternoon of August 3, in 2022, the Fortune 500 rankings of Fortune were announced. Wal -Mart, as an international retail giant, became the world's largest company for the ninth consecut...