Gao Jinggui Circuit is a dazzling transcript!New material ETF ingredient stock reports are complete!

Author:Capital state Time:2022.09.06

As of now, the new material ETF (516360) ingredient stock market data has been disclosed! According to statistics, 38 of the 50 stock stocks have achieved positive growth, of which 13 net profit has doubled year -on -year! The highest net profit increased by more than 1000%year -on -year! The industry's high prosperity is continuously verified!

It is worth noting that the performance of the "lithium battery concept stocks" continued to perform strongly. Yongxing Materials Interim Report realized operating income of 6.414 billion yuan, an increase of 110.51%year -on -year; the net profit attributable to shareholders of listed companies was 2.263 billion yuan, an increase of 647.64%year -on -year! During the period, the company's lithium battery new energy business seized the opportunity of the industry, the volume and price of lithium carbonate products increased, and the profitability increased significantly!

"Fluorochemical Downsa" Polyfront Fluoropoli performance is also dazzling! Due to the strong growth of the new energy industry, the core product of the core product of the multi -fluorophytic multi -new material business sector has a strong market demand. In the first half of 2022, the net profit attributable to mothers increased by three times year -on -year!

"Silicon Mao" Tongwei Co., Ltd.'s performance is strong! In the first half of this year, Tongwei achieved operating income of 60.339 billion yuan, an increase of 127.16%year -on -year, and the net profit attributable to listed companies was 12.224 billion yuan, an increase of 312.17%year -on -year. In the first half of the year, Tongwei Co., Ltd. settled in the "boss" of the domestic silicon material, and high -pure crystalline silicon achieved a large increase in volume.

Note: The bidding yellow stock is the top ten heavy stocks of the new material ETF (516360)

It is worth noting that the overall valuation of the new material sector has fallen sharply since this year. As of now (8.31) New Material ETF (516360) tracking index, the latest dynamic price -earnings ratio of the new material index is 28.63 times, at 5.19%of historical divisions. Valuation is more cost -effective!

[New Materials ETF (516360) 2022 mid -weight adjustment]

The first adjustment of the new material ETF (516360) officially took effect on June 13th in 2022, and the position involved 3 constituent stocks.

Including the "Lithium Corporation Concept Stock" Tibet Mining, "Photovoltaic Concept Stock" double star new material and "chemical concept stock" Shengquan Group. The average market value of three newly included ingredients stocks was 20.4 billion yuan, and the average market value of ingredients stocks was 16.5 billion yuan, which further optimized the leading representation of the new materials ETF (516360).

At this point, the CSI New Material Index has completed the semi -annual regulatory stock adjustment, and the ingredients stocks are still unchanged. Based on the latest disclosure of the PCF list of the Shanghai Stock Exchange, the newly included three constituent stock weights are estimated to be about 1.53%.

【Stock Exchange Views】

Zhongyuan Securities pointed out that in July, the lithium battery sector continued to be significantly stronger than the main index performance. It mainly continued to rise upward, and some high -quality target valuations in the sector were low. At the same time, the industry policy was issued. hand. Combined with the domestic and foreign industries, the price trend of the domestic and foreign industries, the price trend of the segments, the monthly sales and the industry's development trend, the industry's prosperity continues to rise. Combined with the industry trend, the current industry valuation level, and the growth of individual stock performance, short -term recommendations are recommended to continue to pay attention to the investment opportunities of the sector, and at the same time, we need to pay close attention to the major index trend. In the middle and long term, the development prospects of the new energy vehicle industry at home and abroad are determined, and the sector is worthy of focusing on. At the same time, it is expected that the performance and trend of individual stocks will also be differentiated. It is recommended to continue to focus on the leading layout of the subdivided field.

Looking forward to the future trend of the photovoltaic sector, Guojin Securities is optimistic about 5 main lines: 1) Concentrated ground power stations starting from 2022Q4 and driven the proportion. 2) Silicon supply to accelerate the downward price and profit transfer of the driver component. 3) Silicon material with Alpha logic. 4) New technology iterative+overseas self -built industrial chain. 5) In the context of continuous demand, it is expected to continue to grow.

湘财证券认为,2022年半导体产业下游需求保持结构性增长,新能源汽车、工控、中高端IOT领域需求保持平稳;三季度随着新能源汽车新品入市及各地促消费政策的发力,国内新Energy vehicle sales will continue to rise and drive the demand for semiconductors in the semiconductor of the vehicle regulations; just coincides with Q3 to release a dense period for new products for consumer electronics products, new products are expected to improve consumer electronics sales. In the medium and long term, the rapid advancement of domestic alternatives of the semiconductor industry is imperative, which will help the development of domestic semiconductor enterprises.

[New Materials Circuit High -priced A -share Investment Treasure: Hundred yuan with Qi Ningde Times, Longji Co., Ltd., Wanhua Chemistry, Northern Huaduang]

The concept of "carbon neutral" is hot. New energy vehicles, photovoltaic, and semiconductors have become the current popular sector. Want to configure these core asset stocks in these sectors in a complete configuration? This is a bit difficult, after all, the stock price is too high. Essence Essence

From the perspective of investment thresholds, the general prices of new materials in the material industry are higher. Take the closing price on June 30, 2022 as an example. Of the 50 leaders of the new material ETF (516360), the transaction threshold of 14 stocks exceeded 10,000 yuan, of which 5.34 was invested in the "trillion lithium battery leader" Ningde Times. 10,000 yuan, the "semiconductor equipment leader" in the north Huachuang exceeds 27,700 yuan, and the "lithium battery septum leader" Ensijie shares exceeded 250,000 yuan ...

So ... Where is the solution? New Material ETF (516360) is closely tracking the theme index of CSI New Materials, and the index component stocks focus on new energy vehicles, photovoltaic, semiconductor, chemistry, new buildings and military industries and other hottest sections! Hold 50 high -quality faucets in the new material industry, and grasp the strategic emerging industries of the great country with one click! New material ETF (516360) only costs about 133 yuan (calculated at 2022.6.30), and ETF sells without stamp duty (the stock is 1 ‰), the low threshold and lower transaction cost of the people make ordinary SME investors You can also participate in investment in the new material industry and share carbon neutralization bonus!

[New Materials ETF (516360) and Special Tips for its connection funds]

New Materials ETF (516360) and its connection funds exceed 70 % of the positions focusing on new energy vehicles, lithium batteries, chips, and photovoltaic concepts; the remaining 30 % of the topic leading stocks such as military industry, chemical industry, and new building materials. Comprehensively characterize the performance of the mainstream industry in the background of the new economy, carbon neutral and background. Investors who have no securities accounts on the spot can be on the online sales platform 7*24, and the ETF connection fund (A: 013473, C: 013474) can be bought at a minimum of 10 yuan, which is convenient and efficient!

Risk reminder: The new material ETF and its connection fund passive tracking CSI new material theme index. The index base date is 2008.12.31 and the release date is 2015.2.13. The above index component stocks are only displayed. The description of individual stocks does not act as any form of investment suggestions, nor does it represent the positioning information and transaction trends of any fund of the manager. The index composition of the stock composition is adjusted in a timely manner according to the rules of the index, and its recovery historical performance does not indicate the future performance of the index. Any information that appears in this article (including but not limited to individual stocks, comments, predictions, charts, indicators, theories, any form of expression, etc.) is only used as a reference. Investors must be responsible for any self -determined investment behavior. In addition, any viewpoint, analysis and prediction in this article do not constitute any form of investment suggestions for readers, and the company does not bear any responsibility for direct or indirect losses caused by the content of this article. Fund investment is risky. Fund's past performance does not represent its future performance, and fund investment needs to be cautious.

- END -

"Hanyuan Zanthong" appeared at the 2022 China Electronic Commerce Conference

From September 1st to 2nd, the 2022 China Electronic Commerce Conference with the theme of Innovation, Rongtong · Sharing was held at the Beijing National Convention Center. In accordance with the

Qingdao Listed Company Hot List | Listed Youth Enterprise's first semi -annual report has doubled revenue and profit growth.

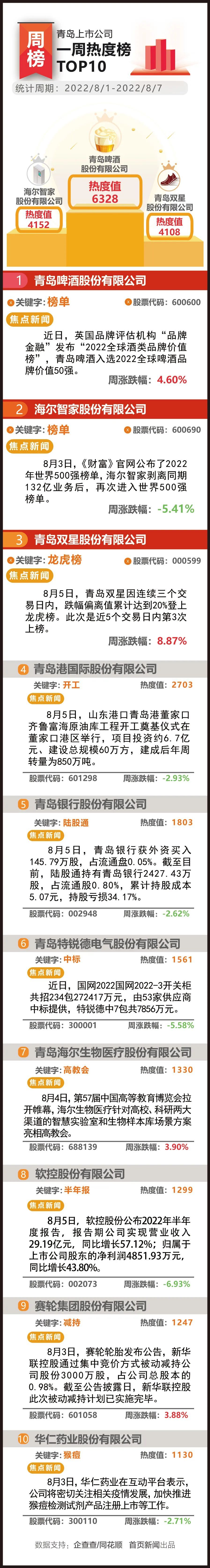

This week, Tsingtao Beer, Haier Zhijia, and Qingdao Two -stars listed the top thre...