Zeng Gang: The net profit of the trust industry fell in the second quarter, and the changes in the response must be adjusted with fundamental adjustment

Author:Zhongxin Jingwei Time:2022.09.08

Zhongxin Jingwei September 8th. Question: The net profit of the trust industry declined in the second quarter, and it must be treated with fundamental adjustment.

The author Zeng Gang Shanghai Financial and Development Laboratory Director

Compared with the first quarter, GDP growth in the second quarter of 2022 slowed down significantly. In the second half of the second quarter, the epidemic was controlled, the logistics gradually unblocked, and the intensity of re -production and re -production acceleration was promoted to recover. The continuous impact of strict supervision of the trust industry, most trust companies still face greater pressure on business transformation.

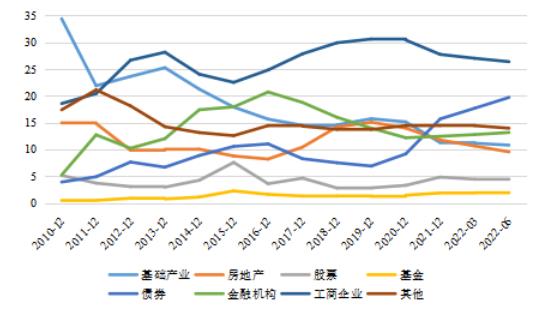

The scale stops and rebounds, the structure continues to optimize

In the second quarter, in the context of economic downlink pressure and the impact of the impact of epidemic conditions, the scale of trust assets rebounded unexpectedly. At the end of June, the scale of trust assets was 2.11 trillion yuan, an increase of 471.5 billion yuan over the same period in 2021, a year -on -year growth rate of 2.28%, an increase of 948.3 billion yuan from the 20.16 trillion yuan at the end of the first quarter, a month -on -month growth rate of 4.70%.

Among them, the financing trust decreased by 220.359 billion yuan in the first quarter, and the investment trust increased by 382.877 billion yuan from the end of the first quarter. The transaction management trust increased significantly by 785.774 billion yuan from the first quarter. The increase in the growth of investment trusts is related to the recovery of the capital market in the second half of the second quarter. The sharp rise in transaction management trusts mainly comes from asset service trusts related to HNA's bankruptcy and reorganization.

Figure 1: The scale of trust assets changes (100 million yuan)

Data source: According to the public data of the China Trust Association

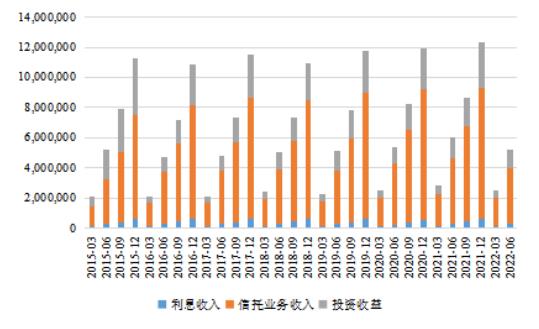

From the perspective of the investment structure of fund trusts, the size of the securities market investment (stocks, funds and bonds) has increased faster, an increase of 18.350 billion yuan, 14.569 billion yuan, and 319.3 billion yuan from the end of the first quarter. %, 1.99%, and 19.7%reflect the transformation of investment in the trust industry under the new rules of asset management.

At the same time, the scale of funds invested in industrial and commercial enterprises was 3.92 trillion yuan, accounting for 26.37%. Affected by factors such as internal and external environment and weakened demand, the proportion of funds invested in industrial and commercial enterprises has been slightly declining since the second half of 2021. The situation of the situation is still far more than the investment orientation of other fields, reflecting the continuous support and services of the trust industry in the real economy.

Figure 2: The proportion of capital trust investment (%)

Data source: According to the public data of the China Trust Association

The owner's rights and interests grow steadily, and the capital strength continues to consolidate

Since 2022, the capital strength of the trust company has continued to increase. As of the end of the second quarter, the total ownership of the entire industry was 712.745 billion yuan, an increase of 20.2 billion yuan from the same period last year, an increase of 2.92%year -on -year, and a month -on -month increase of 1.742 billion yuan. Judging from the composition of owners' rights, the preparations for revenue capital and trust compensation have maintained growth, and uniplied profits have declined slightly.

From the perspective of specific institutions, at the end of the second quarter of 2022, the average of the owner of the trust company was 12.571 billion yuan, an increase of 5.33%over the first half of 2021. From the perspective of interval distribution, in the first half of 2022, the number of trust companies with the owner's equity greater than 20 billion yuan was 9, and the number of trust companies between 100 and 20 billion yuan increased by 3, and trusts between 50 to 10 billion yuan The number of companies is reduced by 3.

Under the situation where the economic downward pressure, the tightening of regulatory policies, and the exposure of industry risks, consolidating the strength of the capital is the prerequisite and cornerstone of the transformation and development of the trust company. upgrade.

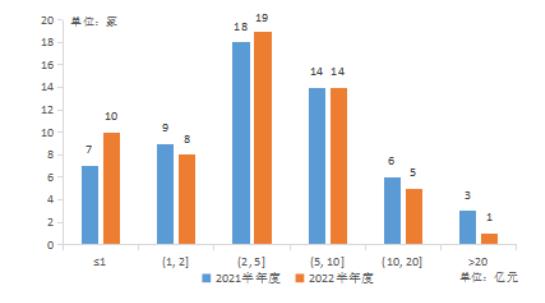

Operating pressure increases, operating income declines

In the second quarter, the operating performance of the trust industry faced downward pressure, and the operating income, total profit and per capita profit declined significantly year -on -year. At the end of the second quarter, the trust industry achieved a total of 47.346 billion yuan in operating income, a year -on -year decrease of 21.39%, but the decline was narrowed from the end of the first quarter.

Figure 3: Trust revenue composition and change (10,000 yuan)

Data source: According to the public data of the China Trust Association

Specifically, the inherent business income and trust business income of the trust industry at the end of the second quarter fell a certain degree of decline compared with the same period of the previous year. Among the income of inherent business, investment income has declined compared with the previous year, but compared with the end of the first quarter, it has improved significantly. At the end of the second quarter of 2022, the industry achieved investment income of 1.2.065 billion yuan, a year -on -year decrease of 1.272 billion yuan, a year -on -year decrease of 9.54%, a decrease of 24.02%in the first quarter, and it has narrowed significantly. Investment income is closely related to the performance of the capital market. After the fierce adjustment of the first quarter, the stock market in the second quarter has improved, thereby driving the repayment of the inherent asset investment of the trust industry and the profit and loss of fair value changes from the first quarter. Essence

From the perspective of trust business income, at the end of the second quarter, the entire industry realized trust business revenue of 36.828 billion yuan, a decrease of 6.727 billion yuan from the same period last year, a year -on -year decrease of 20.64%. In the context of the rise of inherent businesses, the trust business income accounted for a significant decline in the first quarter, from 93.43%in the first quarter to 77.78%, and returned to a relatively normal state.

There are several reasons for the decline in trust business income. First, the growth of trust assets has slowed down, and the driving force of scale expansion continues to decline in revenue. , To reduce the cost of financing of the real economy. In this context, the income and financing interest rates of various financial assets continued to decline; Third, during the transformation of the trust industry, the trust capital investment structure continued to be adjusted, and the proportion of basic industries, real estate, and industrial and commercial enterprises with relatively high asset returns accounted for the proportion of industrial and commercial enterprises. The proportion of standardized financial asset investment (especially bonds) with relatively low returns increased significantly. The net profit has declined, and the industry differentiation continues

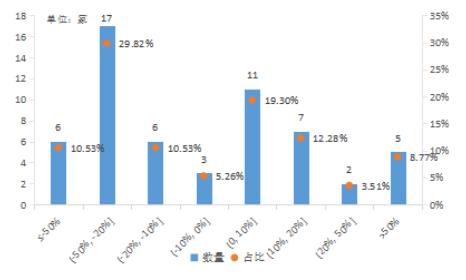

At the end of the second quarter, the total profit of the trust industry was 28.022 billion yuan, a year -on -year decrease of 29.21%; the per capita net profit was 997,000 yuan, a year -on -year decrease of 24.60%. Judging from the 57 trust companies that have been published, in the first half of 2022, the average net profit of 57 trust companies was 470 million yuan, a decrease of 20.62%from the first half of 2021, which was greater than the decline in operating income.

From the perspective of the situation of various trust companies, the interval of net profit is distributed in the first half of 2022 to present the situation of "increasing tail increase, reduced head". In the first half of 2022, a trust company with a net profit distributed above 1 billion yuan in higher areas decreased by 3, and the number of trust companies with a lower range of 100 million yuan increased by 3, distributed in the intermediate range of 5 to 1.5 billion. Yuan's trust company remains unchanged.

Figure 4: The interval distribution of the net profit of the trust company

Data source: According to the public data of the China Trust Association

In the first half of 2022, of the 57 companies that published data, 25 trust companies' net profit achieved positive growth (or decreased from negative to positive, loss), accounting for 43.86%. There are only 7 trust companies with a growth rate of more than 20%, and the number of trust companies with a decline in net profit declines by more than 20%, of which the number of trust companies with a decrease of -20%to 50%is the largest. 17, while the overall decline in the industry's profits, showed obvious differentiation.

Figure 5: The interval distribution of the net profit growth rate of trust companies

Data source: According to the public data of the China Trust Association

Outlook for the transformation and development of the trust industry

Since the release of the new asset management regulations in 2018, the trust industry has officially entered the stage of transformation and development. The overall transformation and development of the industry shows the following characteristics:

First, the effectiveness of transformation is great. Not only has a relatively certain transformation business system, the corresponding internal management system has also been adjusted accordingly, and the transformation business has become one of the profit growth points. However, some trust companies have not reached a consensus and no clear transformation and development direction for transformation and development, and it is more difficult for the transformation business to become a profit support point.

Second, differentiated development has become a trend. After entering the new stage of development, the transformation business puts forward higher requirements for professional and comprehensive service capabilities. The market capacity of new businesses is limited, and it is difficult to support all trust companies to enter the field. For example, securities service trusts are recognized as fast -scale and controllable risks, but several trust companies on the head have formed an absolute leading position in the market, and the market competition is extremely fierce. Therefore, differentiated development is not only the direction of regulatory encouragement, but also the choice that a trust company has to face.

Third, the transformation will continue to deepen. Regardless of the current transformation of the trust company, the transformation and development will be further promoted in the future, otherwise there may be no chance to enter the new stage of development in the industry. At the regulatory level, the amendments to the trust law and the improvement of the trust system, at the same time promote the category of trust business, differentiated trust supervision, and guide the trust company to find the future direction of the industry through transformation. The public information of each trust company has also mentioned the deployment of transformation from the strategic level. From the perspective of business, securities investment, family wealth management, asset securitization, green trust, equity investment, service trust, industrial finance have been mentioned mentioned that they are mentioned. More. These are also real asset management business and service business, indicating that the industry will move towards differentiated development in the future, but the probability will not return to the development stage of financing business.

For trust companies, fundamental adjustments must be made to cope with changes and plan the future.

The first is to adjust strategic positioning. Trust companies will turn to real asset management institutions that are based on financing business -oriented bank -class bank financial institutions that are mainly based on financing business and centered on credit risk control. Social responsibility, in the context of the third distribution, carry out public welfare/charity trust.

The second is to reconstruct the management of organization. The adjustment of strategic positioning has brought about changes in business. The changes in business must inevitably require organizational management to support and guarantee. For many trust companies, only by organizational management can we have a new journey to start again.

The third is to optimize the talent team. Existing employees should actively study and take the initiative to transform, use their own advantages of familiarity with the trust system, and transition to asset management and asset service trusts; at the same time, the external introduction of talents that meet business needs.

Fourth, corporate culture reshape. Culture is the fundamental guarantee of corporate soul and long -term development. How to reshape through corporate culture and transform transformation from institutional constraints into action consciousness is a great challenge to the trust company, of course, it is also the root of transformation. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual.The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.Editor in charge: Wang Lei

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Shandong Digital Economy helps rural revitalization to insert "cloud wings" for agricultural products

Volkswagen.com · Poster reporter Tian Tian Tian Zaozhuang reportA few days ago, i...

The stock price is cut, and the sales are five consecutive!Adidas CEO acknowledged that making mistakes in China

Zhongxin Jingwei, August 11th (Chen Junming Wang Yongle) According to Reuters, Adi...