"Financial Knowledge Popularization Month" rational identification does not invest and protect your "old -age money"

Author:Jining Finance Time:2022.09.13

After a lifetime, the old people wanted to be happy and care for the elderly after retiring. I wanted to make the pension "steadily appreciate", but frequently trapped the trap of investment and fraud. Since the beginning of this year, all parts of the country have continuously set off a wave of cracking down on publicity and education. As the popularity of the popularity of financial knowledge, the Jining City Insurance Industry Association also reminds the majority of elderly consumers to keep the money bags and pay attention to the five types of "investment misunderstandings".

Misunderstanding 1: Follow the trend. Many elderly people "invest in wealth management to see neighbors" and "buy insurance with relatives." When others buy a fund, he buys a fund. Which other people say that the insurance is good, he will buy which one. The elderly do not follow the investment channels. Investment must be sober, rational, and not blindly obedient, otherwise the savings of life may be east.

Misunderstanding 2: Blind investment. Some elderly people do not know how to choose in the face of a wide variety of financial products in the market. They are easily deceived by some personnel who are clever. They blindly invested blindly without knowing the product, causing capital loss. When buying financial products, you must carefully understand the operation mode and risk control measures behind the product. Do not be blind and passive. You can ask your children more.

Misunderstanding 3: Investment in greed. In recent years, some criminals in the society have raised fund -raising fraud with "high interest" as bait. Many elderly people have lost their blood due to greed for high profits. Fund fraud usually fictional projects that match their promises to match the projects, lack of actual business support and profit source, and it is very easy to occur risks such as roll running and fund chain.

Misunderstanding 4: Borrow money to invest. Some elderly people mistakenly turn the investment and money directly, and believe that as long as they spend money, they can earn money, which will give birth to high -risk behaviors such as borrowing money investment and loans to buy insurance. It seriously affects normal family life. Elderly, the elderly keep in mind that you can do your best, start from your own economic strength, and avoid risk investment behavior higher than his own ability.

In addition, you should also take care of the investment links and winning links for mobile SMS. Do not disclose privacy information such as your ID card and telephone at will.

Keep in mind the following tactics and protect your "old -age money":

Gao Li's temptation is unbelievable, and you don't understand the business to stay away.

Investment should not be too great, and you need to discuss with your family.

The risk of income is proportional, and wealthing overnight is a trap.

Buy products with regular channels and do not sign agreements with individuals.

(The content of this article comes from the "Beijing Banking Insurance Regulatory Bureau consumer risk reminder: rational identification does not invest and protect your" old -age money "")

- END -

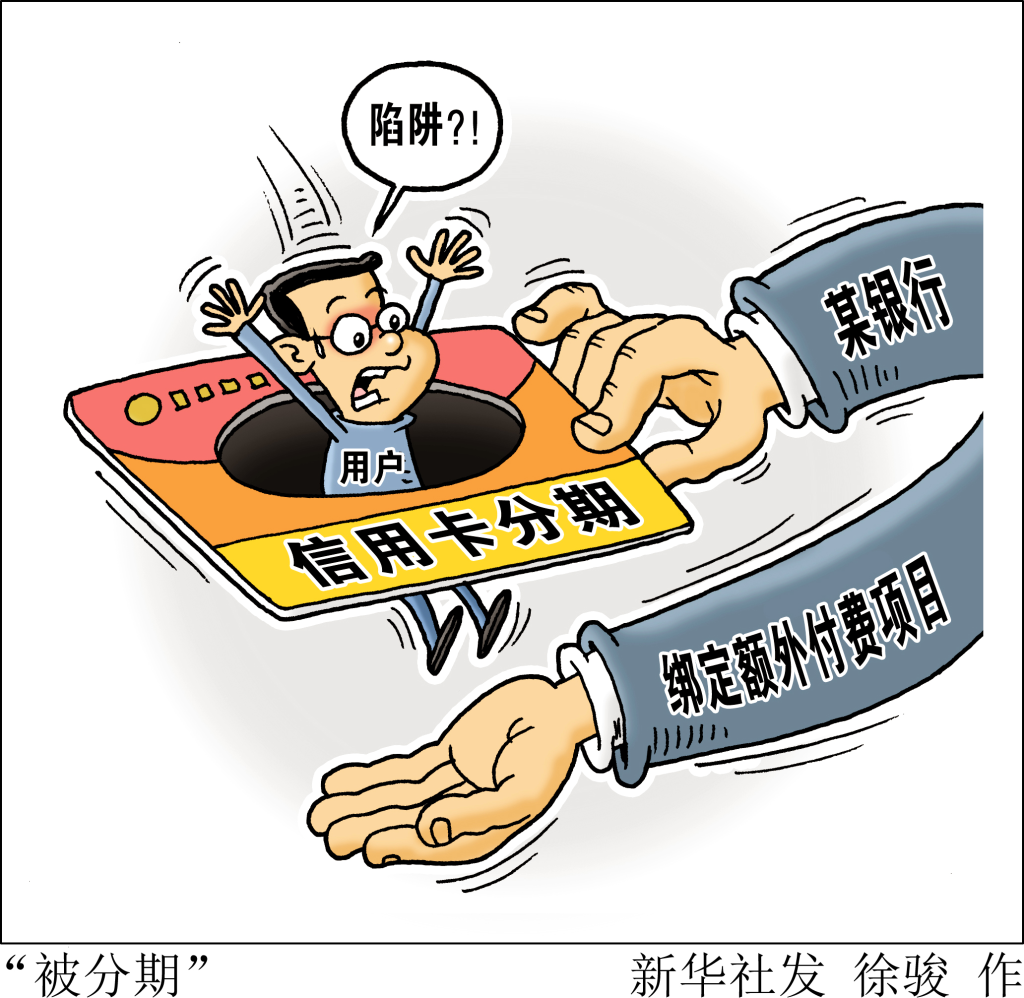

New rules for credit cards are issued by you and me

Xinhua News Agency, Beijing, July 7th.Xinhua News Agency reporter Li YanxiaThe Chi...

The new urban employment of 12.42 million people throughout the year issued the announcement of the development statistics of the provincial human resources and social security undertakings in 2021

Qilu.com · Lightning News, July 6th. Recently, the Shandong Provincial Human Resources and Social Affairs Department released the statistical bulletin of the development of human resources and social