Fengkou Think Tank · Chief Connection | Yang Delong: The Fed accelerates the pace of interest rate hikes, which does not affect my country's monetary policy independence

Author:Costrit Finance Time:2022.09.14

Liu Xiao, chief reporter of Fengkou Finance Liu Xiao

On September 13, data from the US Labor Statistics showed that the US CPI in August increased by 8.3%year -on -year, higher than the market expectations of 8.1%, but still below 8.5%in July. In the previous June, the US CPI increased 9.1%year -on -year, the highest since 1981.

After the data was announced, the three major indexes of the US stocks closed down sharply. The S & P 500 index fell 4.32%, the Nasdaq index fell 5.16%, and the Dow Jones Index fell 3.94%. The S & P 500 Index Futures and spot gold dive quickly, and the US dollar index and US debt yield rose straight. On September 14, the Asia -Pacific stock market also continued the decline in US stocks, and the chills of the capital market swept the world.

Why does the US CPI data in August cause such a big response? What impact will the next step on the stock market? Will it affect my country's monetary policy? On September 14th, Yang Delong, managing director and chief economist of the Haikou Fund before the Truth Dialogue of Fengkou Finance.

Wind Financial: The United States in August CPI increased by 8.3%year -on -year, higher than the market expectations of 8.1%. What are the main reasons do you think the United States inflation is high?

Yang Delong: The US August Consumer Price Index (CPI) rose 0.1%month -on -month and 8.3%year -on -year, which once again strengthened the Fed's expected continuous radical interest rate hike. The US President Biden admits that it takes more time and determination to control inflation. Since the beginning of this year, the inflation that the United States has faced is the highest level of inflation in the past 40 years, and the causes of this round of inflation have been different. The currency school represented by Friedman believes that inflation is mainly the asset bubble that has been spawned by the Federal Reserve in the past two years, which is a currency phenomenon. However, more economists believe that the rise in prices is not so simple. It is not only affected by the asset bubble brought by the large water, but also affected by the shortage of supply chain. Due to the raging global epidemic, it has affected the supply chain of many industries. Russia and Ukraine's conflict is protracted, and the prices of crude oil, natural gas, and agricultural products have also had a significant impact, all of which have led to high prices.

Fengkou Finance: Since March of this year, the Fed has raised interest rates four times, and the rate hike has reached 225 basis points. On September 22, the Federal Reserve interest rate meeting will be ushered in. Previously Will such inflation data further strengthen the expectations of interest rate hikes? What impact will it affect the US economy?

Yang Delong: According to data released by the US Department of Labor, the CPI increase in the US consumer price index in August fell to 8.3%year -on -year, and the data in July was 8.5%. Although the inflation level fell again, it was still at a historical high and the decline was not large. From the previous month, the CPI increased value of 0.1%in August, and the core CPI of food and energy components rose 0.6%month -on -month, up 6.3%year -on -year. Really reduced inflation. Next Wednesday, the Fed will hold the September Federal Public Marketing Committee (FOMC) monetary policy conference. The inflation data announced this time is the last important data disclosed before the meeting. The market is expected to continue to raise 75 basis points to suppress inflation, and it may continue to maintain a radical tightening policy in the future, which is not good for the stock market. The end of the four -Lianyang killing of the U.S. stocks has fallen sharply, which reflects such expectations.

The long -term neutral target inflation rate formulated by the Federal Reserve is 2%, and now there is still a long distance from 2%. After interest rate hikes in March, May, June, and July, 75 basis points in June and July, the federal benchmark interest rate has increased to 2.25%to 2.5%. 75 basis points in interest rate hikes, the federal benchmark interest rate will be increased to more than 3%. This will undoubtedly have a significant impact on the economic growth of the United States, causing economic growth to decline and fall in stagflation, that is, the state of economic stagnation inflation.

Fengkou Finance: After the data was announced, the three major indexes of US stocks closed down sharply. Today (September 14) A -share transactions were less than 730 billion yuan, and individual stocks fell. What impact do you think the Fed ’s interest rate hike will have on the stock market?

Yang Delong: The three major stock indexes overnight, the biggest decline since June 11, 2020, the Dow fell 3.94%, the S & P 500 index fell 4.32%, the Nasdaq index fell 5.16%, especially large technology stocks encountered a severe frustration. Essence The inflation without bull market also means that the performance of US stocks should not be too good this year. Overnight US stocks were washed by blood, and the Dow is about 1,000 points, reflecting the concerns of investors' high inflation; the US dollar index rose sharply and exceeded 109; The base point to 3.69%, all of which reflect the market's expectations for the Federal Reserve's interest rate hikes.

Coincidentally, Europe is also facing pressure of high inflation. The European Central Bank has raised interest rates twice in a row, which has completely bid farewell to the era of negative interest rates, and European economic growth is worse than the United States. This has also caused a greater impact on European interest rates, which may have a greater impact on the European economy. Europe The stock market has also fallen generally. On September 14, due to the influence of the overnight US stocks, the A -share market has trended in shock adjustment, but the decline is not large. Compared with US stocks, it is more resistant to falling.

Wind Financial: In order to cope with high inflation, the Federal Reserve ’s interest rate hike is expected to enhance, will it affect my country's monetary policy? Is it expected that my country's financial data will recover further in September? Yang Delong: Relatively speaking, my country's current inflation level is not high, and the level of benign inflation that has been controlled within 3%has also provided a certain foundation for my country's monetary policy to maintain independence. Of course, the sharp interest rate hike in the Fed has caused the US dollar index to soar instead of depreciation of U.S. currencies. The RMB exchange rate was approaching the 7.0 index mark overnight, which compressed the space for the central bank's loose monetary policy to a certain extent. Sino -US currency policy deviation is an important factor in the short -term depreciation of the RMB exchange rate. Under the policy goal of steady growth, the central bank is mainly based on a relatively loose monetary policy before the end of the year, but the possibility of re -reduction has decreased. More may release liquidity by implementing open market operations. Economic data released before the Mid -Autumn Festival shows that the central bank is increasing its efforts to support the economic recovery, and the M2 growth rate has reached a new high in the year. In August, M2 increased by 12.2%year -on -year, and has maintained a double -digit growth rate for five consecutive months. From the perspective of the new loan structure, the characteristics of "weak enterprises and strong residents" were shown in August, mainly due to the influence of the downturn in the property market, dragging down the growth rate of residents' medium- and long -term loans. The significant recovery of the medium and long -term loans of the enterprise reflects the return of enterprise investment and the recovery of the confidence in production. Under the circumstances of the economic recovery and policy force, financial data may be further recovered in September. The following is mainly to depend on whether the macro policy can continue to increase the demand for credit.

At present, due to lack of market confidence, private investment is declining, and real estate investment has declined for more than ten months. It is essential to stabilize investment growth by increasing policy investment projects. At the end of August, the year -on -year growth rate of M2, social financing scale, and loan balance remained above 10%, reflecting that finance maintained a greater support for the real economy. But on the other hand, August narrow currency (M1) increased by 6.1%year -on -year, and the growth rate was 0.6 percentage points lower than at the end of last month. It shows that corporate operations and investment activities still need to be further promoted. big.

Recently, the executive meeting of the State Council has deployed the continuation policy and measures to implement the policy of stabilizing the economy, and the foundation of the restoration of economic recovery and development has been strengthened. The central bank is increasing its efforts to support the rebound of the real economy. Affected by the excellent factors, the growth rate of consumption is relatively sluggish, and the growth rate of consumption in some areas has declined significantly, which has dragged down economic recovery. Promoting the confidence of enterprises and residents is the key to effectively stimulate the demand for loan in the real economy. There is still a long way to go from wide currency to wide credit. This is also a key factor in the next economic recovery and even the strengthening of the capital market.

- END -

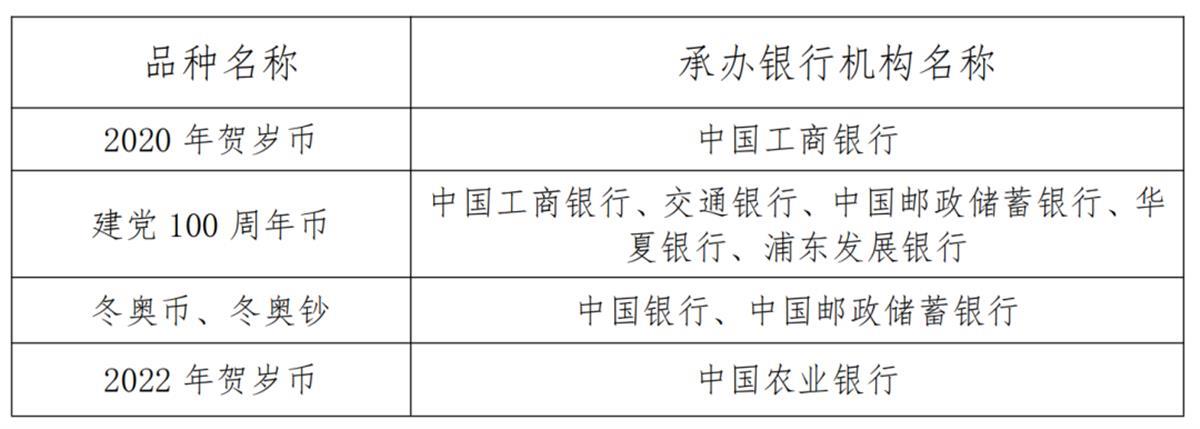

Hubei has been announced!Some currency banknotes for exchanges are released

Jimu Journalist Chen HongAccording to the issuance of commemorative coins of the P...

Twenty years of tide cards, the song of ice and fire

In 2002, it is a vital year for global tide cards.At that time, Edison Chen, who w...