Fund watching the market 丨 See the fund again, and the bottom signal came?

Author:Financial Investment News Time:2022.09.26

There are 1148 words in this article

About 3 minutes after reading

Financial Investment Reporter Liu Qinghua

See the fund company to hold a card.

Since September, after the Nuoan Fund has raised its cards, it has recently raised the Hong Kong Stock Connect. The Yifangda Fund has continuously bought Hygia Medical in the near future, and its shareholding accounts for 5%and 6%of the number of issued shares. This is interpreted by some market participants as one of the signals to copy the bottom, especially the Hong Kong stocks and the bottom of the medical stock.

Not long ago, the Noon Fund also gave a semiconductor concept stock Zhuo Shengwei, and Zhuo Shengwei had fallen by nearly 70 % in the past year. Some people in the industry believe that the investment decision -making decision -making decision -making of public fund is aimed at obtaining yields, which shows that it is optimistic about investment value.

Yifangda Lab Haijia Medical

Recently, the information disclosure information of the relevant rights and interests of the Hong Kong Stock Exchange's listed company Haijiia Medical shows that the E Fund Fund bought Haijiia Medical on September 14 and 22, accounting for 5.02%and 6.04%of the number of shares of Hygia Medical. Over the license line, it is announced.

As of September 22, the number of Haijia medical stocks held 37.272 million shares of Hygia Medical stocks and calculated at the closing price of 43.01 yuan per share on September 22. The market value of Hygia's medical treatment was 1.6 billion yuan.

Haijia Medical Group is a private medical group with oncology as its core. In the first half of this year, operating income was 1.526 billion yuan, an increase of 63.8%year -on -year, and a net profit of 301 million yuan, 46.6%year -on -year.

According to Wind data, as of the end of the second quarter of this year, a total of 128 funds held Hygia Medical and held a total of 96.5355 million shares. These 128 funds came from 45 fund companies, of which the public fund owned by the E Fund Fund held a total of 210.792 million shares.

Compared with the number of stocks when it is raised, since the third quarter, E Fund's funds have continuously increased holding of Hygia Medical, and eventually exceeded 5%of the license line.

Specifically, at the end of the second quarter, the Yifangda Blue Chip management of the well -known fund manager Zhang Kun, under the end of the second quarter, selected 5.5 million shares of Haijia Medical. More than 10,000 shares, all three funds are managed by Chen Hao, manager of the same fund.

Among them, since the end of 2020, Hygia Medical has appeared in the selected list of Blue -chip selected by the Blue Chips of E Fund. It is the 27th heavy positions. In the following year and a half, the proportion of positions has increased. The growth time of the growth of the Ichida Hong Kong Stock Connect, the Innovation of E Fund's Innovation, and the Embassy of the Balanced Growth of the Embarrants have not been in operation.

In addition to Yifangda, as of the end of the second quarter of this year, funds holding more Hygia Medical also include Ruiyuan's growth value and prosperity. Stocks are public funds with the most stocks.

Pay attention to the meaning and risk of holding cards

The Yifangda Fund's Hong Kong stock Haijiya Medical, in the eyes of some markets, was considered one of the signals of the additional medical sector. In particular, the performance of Hong Kong stocks was sluggish, the Hang Seng Index hit a new low in nearly a decade, and the value of the allocation of Hong Kong stocks has also been considered improved. Not long ago, the Noon Fund also gave a semiconductor concept stock Zhuo Shengwei.

In early September this year, Noon's growth increased the total shareholding of 519,500 shares through centralized bidding transactions. After the transaction was completed, Noon's growth held 26.72223 million shares of the company, accounting for 5.0065%of the company's total share capital, which constituted " "Lift the card".

According to Zhuo Shengwei's 2022 half -annual report, as of the end of the second quarter of this year, Noon's growth was Zhuo Shengwei's fifth largest circulation shareholder, holding Zhuo Shengwei 19.33 million shares, holding a share of 3.62%. This also means that since the third quarter, Noon has continued to increase its holdings until "to raise cards."

Zhuo Shengwei is a chip design company in radio frequency devices and wireless connections. In the first half of this year, the operating income achieved 2.235 billion yuan, a year -on -year decrease of 5.27%; net profit was 752 million yuan, a year -on -year decrease of 25.86%; the basic earnings per share was 1.4091 yuan.

While the performance decreased, its stock price also declined sharply. From the second half of 2021 to the end of August 2022, with the adjustment of the semiconductor sector, Zhuo Shengwei's stock price fell 70%. This time, the signing of cards also means "bottoming" and "replenishment".

As an institutional investor, the most direct goal of the investment movement of public funds is often to obtain income and bring good returns to the foundation. It can be seen that when they think that the target cost performance is already high, it may be an important reason for its continuous increase in holdings and even "holding cards."

However, the funding behavior of the fund should also pay attention to its risks. For example, if the proportion of the fund's shareholding accounts for the fund's net asset value is too high, when the scale of the fund has obvious redemption and has to sell a certain position to deal with it, there is a certain position to deal with it. It may cause suppression of individual stocks that hold positions, and damage the level of return on investment.

Edit | Chen Yuhe School Inspection | Yuan Gang Review | Qin Chuan

- END -

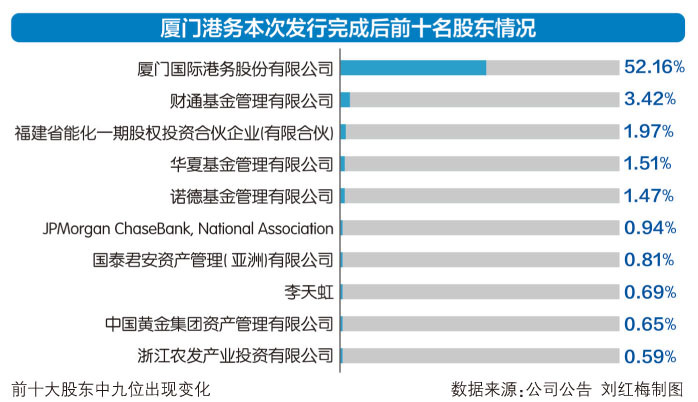

Xiamen Port's approximately 800 million yuan fixedly increased JPMORGAN and other institutions to share the shares

On August 3, Xiamen Port Affairs (SZ000905, stock price was 7.70 yuan, and a marke...

Japanese media: Will the "sky -high" moon cake disappear this year?

Japan's Oriental New News on August 21, the original topic: restricting the sales of sky -high moon cakes, and the unit price of more than 500 yuan or more, which will become the Mid -Autumn Festiva...