Deloitte: It is expected that about 168 new shares listed financing in A shares will rise by 49% in 2022

Author:Cover news Time:2022.06.23

Cover reporter Xiong Yingying

On June 22, Deloitte China released the "Review and Prospects for the In the first half of 2022" in Mainland China and the Hong Kong IPO market. The report predicts that in the first half of the year, the Shanghai Stock Exchange had a cumulative 68 new shares listed, raised 208.7 billion yuan, and the financing amount ranked first in the world. The Shenzhen Stock Exchange was listed in 81 new shares, with a financing of 99.4 billion yuan, ranking second in the world.

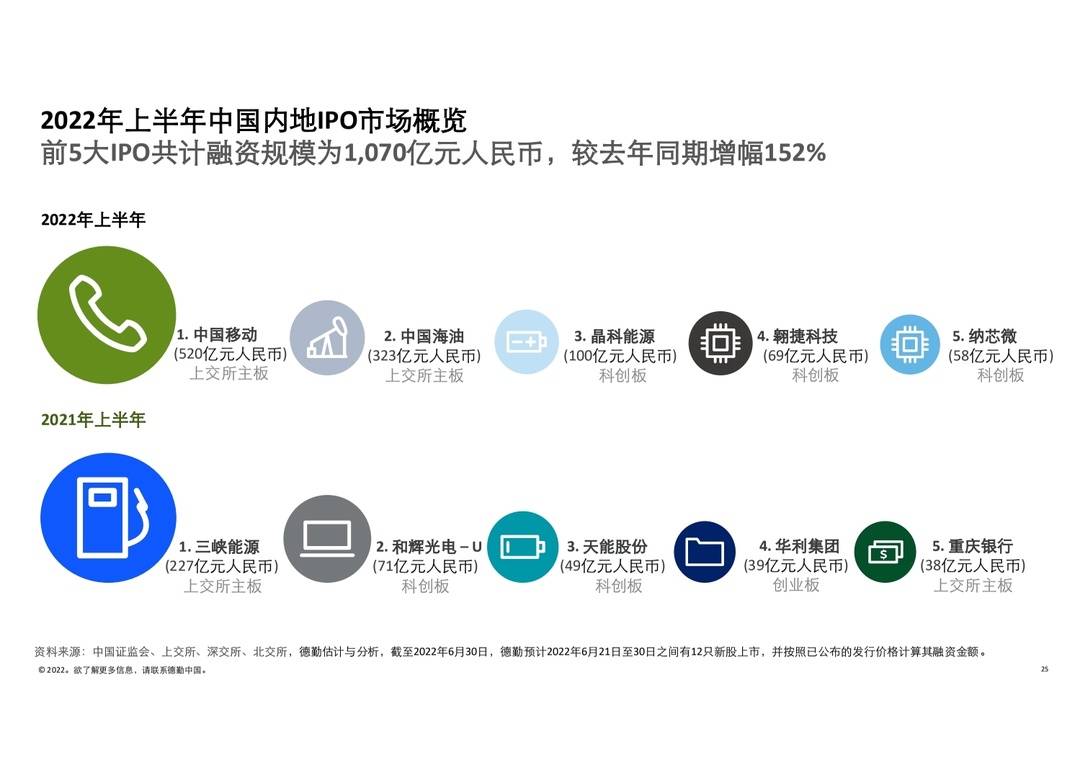

Specifically, in the first half of this year, there were about 168 new shares in the Mainland market, and financing was 310.9 billion yuan. Compared with the same period in the first half of 2021, the number of listed companies fell 31%, but the financing volume rose 49%. Among them, China Mobile and China Oil returned to the listing of A shares with a large scale, which greatly drove the increase in total financing in the first half of this year. Data show that the total financing scale of the top five IPOs in the first half of the year was 107 billion yuan, an increase of 152%over the same period last year.

Deloitte believes that the reform of the stock issuance registration system and continuous deepening of the capital market launched by Shanghai and Shenzhen's motherboards will inject strong needles into the performance of the A -share market in the second half of 2022, and the issuance of new shares is expected to speed up.

Looking forward to the year, Deloitte expects that there are about 140 to 160 companies landing in 2022, and the financing amount will reach 230 to 260 billion yuan; the GEM has 190 to 210 companies landing, with a financing amount of 1900 to 215 billion yuan RMB; Shanghai and Shenzhen motherboards are estimated to have about 80-100 new shares, and financing of about 1400 to 170 billion yuan; the Beijing Stock Exchange will issue about 50-80 new shares, and the financing is about 100 to 15 billion yuan.

The report shows that due to the sharp interest rate hikes of the Fed, the contraction of the table, the conflict between the Russia and Ukraine, and the epidemic, the number of new shares of the Hong Kong stock market in the first half of this year has fallen simultaneously and the total amount of financing has been simultaneously. It is expected that there will be 24 new shares in the Hong Kong stock market in the first half of this year, with a financing of about 17.8 billion Hong Kong dollars. Compared with the same period of 2021, the number of new shares fell 48%, and the total financing fell 92%.

Deloitte expects that the performance of the Hong Kong stock market in the second half of 2022 will still be subject to the development of the global new stock market. The number of new shares and the amount of financing will be reduced. However, the market adjustment is still ideal compared to the decline in the global new stock market. About 70 new shares will be listed throughout the year, and the financing amount will be between 160-180 billion Hong Kong dollars.

- END -

Starting from office, practice "zero abandonment"! Shenzhen released the "zero dare plan" and proposed 100 office "zero waste" good recipes

June 15th is a national low -carbon day. The theme is to implement the double carbon operation and build a beautiful home. On the same day, the Zero Dare Plan jointly launched by the Shenzhen Duck

what happened?This brokerage management and general manager were warned together

China Fund reporter Yan YingRecently, there have been repeated brokerage firms for...