Evening Announcement | These announcements on June 23 are watched

Author:First financial Time:2022.06.24

23.06.2022

On the evening of June 23, a number of listed companies in the Shanghai and Shenzhen cities issued an announcement. The following is the summary of the First Finance and Economics for some important announcements for investors for reference.

▍ ▍ ▍ ▍

Midi Kai: The results of the second nucleic acid test of the imported equipment of the subsidiary are negative

Midi Kai (688079) announced that the company earlier announced that the initial inspection results of the initial inspection of the subsidiary Germany's imported equipment on June 23 were positive. , Store the environment for anti -killing operations, the nucleic acid test results of the sample are negative; the test results of the three personnel of the loading and unloading equipment are negative, and 7+7 management measures will be implemented. After the test results are negative, the closed management is fully lifted; after 15 days of sealed materials such as the equipment and other related materials, the nucleic acid test will be performed again. At present, the incident does not have a substantial impact on the company's production and business activities.

Guizhou Moutai: The annual profit distribution plan of 2021 is a cash dividend of 21.675 yuan per share

Guizhou Moutai (600519) announced that the profit distribution of 2021 was based on the total share capital of the company's total share capital before the implementation of the plan, and the cash dividend of 21.675 yuan (including tax) per share was distributed, and a total of 27.228 billion yuan was distributed. The equity registration date is June 29, the removal (interest) date is June 30, and the cash dividend issuance date is June 30.

Duofluoro: Subsidies plan to build a joint venture to produce and sell super fast charging core products

Dorfluoro (002407) announced that Ningfu New Energy, the company's subsidiary, plan to sign the "joint venture agreement" with Guangzhou Juwan Technical Research Co., Ltd., and jointly invests in the establishment of Guangxi Ningfu Ju Bay New Energy Technology Co., Ltd. The operating scope of the joint venture is production and sales of super fast -charged lithium -ion -powered soft bag overlapping batteries above 3C and 3C. The expected construction capacity is 2GWh.

Haiqi Group: Stock transaction abnormal fluctuations on June 24th will be suspended from the market to check

Haiqi Group (603069) announced that the company's stock price has recently increased a lot, and during the period, it has repeatedly touched stock transactions abnormal fluctuations. The company checked the fluctuations in stock transactions. The company's shares started on June 24th and stopped trading.

Zhejiang Shibao's follow -up letter requires check whether the company's stock price has recently increased with fundamental changes such as production and operation.

Zhejiang Shibao (002703) received a letter of attention from the Shenzhen Stock Exchange, requiring the market demand of the company's main business products, the company's production and operation status, etc., to verify whether the company's stock price has recently increased with basic changes in production and operation, and combined with the combination of the combination of production and operation The company's operating performance and changes in the stock price, compared with the valuation of listed companies in the same industry, make full risk prompts on the company's stock transactions abnormal fluctuations.

ST Huading: Starting from June 27

ST Huading (601113) announced that the company's shares will be suspended for one day on June 24th. From June 27th, it will resume and revoke other risk warnings. Company securities will be changed from "ST Huading" to "Huading Shares".

Qin'an Co., Ltd.: Recently, the production and sales of the automotive industry have recovered the company's current production and operation.

Qin'an (603758) issued a non -motion announcement, affected by the epidemic in April, the production and sales of the automotive industry have fallen seriously. With the reduction of some passenger vehicle purchase taxes of the Ministry of Finance and the launch of the subsidies of major automobile companies to actively promote automobile consumption measures The launch of the automotive industry has recently recovered, and the company's current production and operation situation has become normal.

Futian Automobile: Establish a new energy commercial vehicle joint venture

Futian Automobile (600166) announced that the company intends to jointly invest in Beijing Kavin New Energy Automobile Co., Ltd. with Bosch Venture Capital, Boshima, Yitong, and Fuyuan Smart. 65%of the shares. This time, the company intends to jointly invest in the establishment of a joint venture with other investors. It aims to share the advantages of the resources of all parties and concentrate the advantages of resources to cultivate new energy business. This project helps the company's new energy commercial vehicle business.

Xiong Plastic Technology: Terminate major asset reorganization matters

Xiong Plastic Technology (300599) announced that in view of the major changes in the market environment since the planning of major asset reorganizations, the parties to the transaction have agreed and jointly decided to terminate the transaction. The company originally planned to purchase 100%equity of Kangtai Plastic by issuing shares and payment of cash, and also raised supporting funds at the same time.

Tai Chi Industrial: 2021 annual equity division of 10 factions 1.7 yuan equity registration date June 29

Tai Chi Industrial (600667) announced an announcement of the 2021 annual equity distribution. The profit distribution plan was 0.17 yuan per share cash bonus per share. The equity registration date is June 29, 2022.

Beijing -Shanghai high -speed rail: signed the Beijing -Shanghai high -speed railway customer station commercial asset commissioned business contract, etc.

The Beijing -Shanghai High Speed Rail (601816) announced that the company signed the "Beijing -Shanghai High -speed Railway Transport Management Contract" and the "Beijing -Shanghai High -speed Railway Terminal Business Assets entrustment contract" with Beijing Bureau Group Corporation, Jinan Bureau Group Corporation, and Shanghai Bureau Group The period is from January 1, 2022 to December 31, 2024. The business assets entrustment of the business assets of the guest station are clear: the trustee shall pay the company's commercial asset use fee to the company. The amount of income distribution is based on the use of commercial assets that the company actually paid in the previous year's trustee. ▍ ▍ ▍ ▍

Excellence new energy: It is expected to increase by about 260 million yuan in the first half of the year by about 144.5% year -on -year

Excellence Xinneng (688196) announced that it is expected that the net profit attributable to the owner of the parent company in the first half of the year is about 260 million yuan, an increase of about 144.5%year -on -year. During the reporting period, the company overcomes the adverse impact and difficulties of domestic epidemic and logistics, ensuring that the company's production and operation is normal.

▍ ▍ ▍ ▍ ▍ ▍

Chinese architecture: The total amount of several major projects has been obtained in the near future 42.19 billion yuan

China Building (601668) announced that recently, the company has obtained a number of major projects with a total amount of project amount of 42.19 billion yuan, accounting for 2.2%of the audited operating income of 2021.

ST Zhongli: The subsidiary signed a supply contract for 117 million photovoltaic components

ST Zhongli (002309) announced that the subsidiary Tengyou Photovoltaic and North Macheton Energy Doo Spear signed the "Photovoltaic Component Supply Contract", which sold photovoltaic components from MEJ ENERGY from Tengyou, with a transaction amount of about 117 million yuan Essence In addition, the subsidiary Changzhou Ship and Cable with China Ship Group Materials Co., Ltd. signed two "Ship and Cable Sales Contracts". The transaction amount is about 47 million yuan from Changzhou ship cable to CITIC materials.

▍ ▍ increase or decrease

Ginza: The controlling shareholder intends to increase its holdings by 1%-2%

Ginza (600858) announced that the company's controlling shareholder Shandong Commercial Group increased its holdings of 60,000 shares on June 23, with an average holding price of 4.985 yuan/share, accounting for 0.0115%. The Shandong Provincial Commercial Group plans to increase its shareholding shares within 6 months from the date of the implementation of this holding holdings (June 23, 2022). The cumulative number of increasing holdings and subsequent holdings for the first time in this holding plan is not lower than the company's current total share capital and does not exceed 2%of the company's current total share capital.

Huatong thermal force: Shareholders intend to reduce their holdings not exceeding 6%of the shares

Huatong thermal power (002893) announced that shareholders Chen Xiuming and his consistent actor Chen Xiuqing intends to reduce the company's shares of 12.168 million shares through centralized bidding and large transaction methods (accounting for 6.00%of the company's total share capital).

Yang Dian Technology: Shareholders intend to reduce their holdings of not more than 5.71%of the company's shares

Yang Dian Technology (301012) announced that Zhou Feng, a 5.71%shareholder, intends to reduce its holdings of not more than 5.71%of the company's shares.

Reliable shares: Shareholders intend to reduce their holdings not exceeding 3.96%of the shares

Reliable shares (301009) announcement, shareholders Cherish Star and Gracious Star intend to reduce their holdings of the shareholding plan for three trading days from six months after three trading days, reducing the company's shares by concentrated bidding, community transactions, etc. (not more than 10.776 million shares ( It accounts for 3.96%of the company's total share capital).

Titan Technology: Shareholders intend to reduce their holdings not more than 2.6%of the company's shares

Titan Technology (688133) announced that Zhong Ding 5 and his unanimous actor Zhong Ding Qinglan held a total of 6.14%of the company. Zhong Ding 5 and Zhong Dingqing planned to reduce holdings by concentrating bidding and large transaction methods of not more than 1.985 million shares, that is, no more than 2.6%of the company's total share capital.

Nawei Technology: Shareholders intend to reduce their holdings of not more than 1.5%of the company's shares

Nawei Technology (688690) announced that Song Gongyou, a 5.38%shareholder, intends to reduce its holdings of not more than 1.5%of the company's shares.

Patek Precision: The controlling shareholders' unanimous actors intend to reduce their holdings of not more than 1.08%of the company's shares

Patek Precision (603331) announced that the controlling shareholder's unanimous actor Taizhou Mingfeng Investment Partnership (Limited Partnership) held 1.08%of the company. Mingfeng Investment plans to reduce its holdings of not more than 1.08%of the company's shares by centralized bidding transactions.

This content is for reference only, not as the basis for your transaction.

- END -

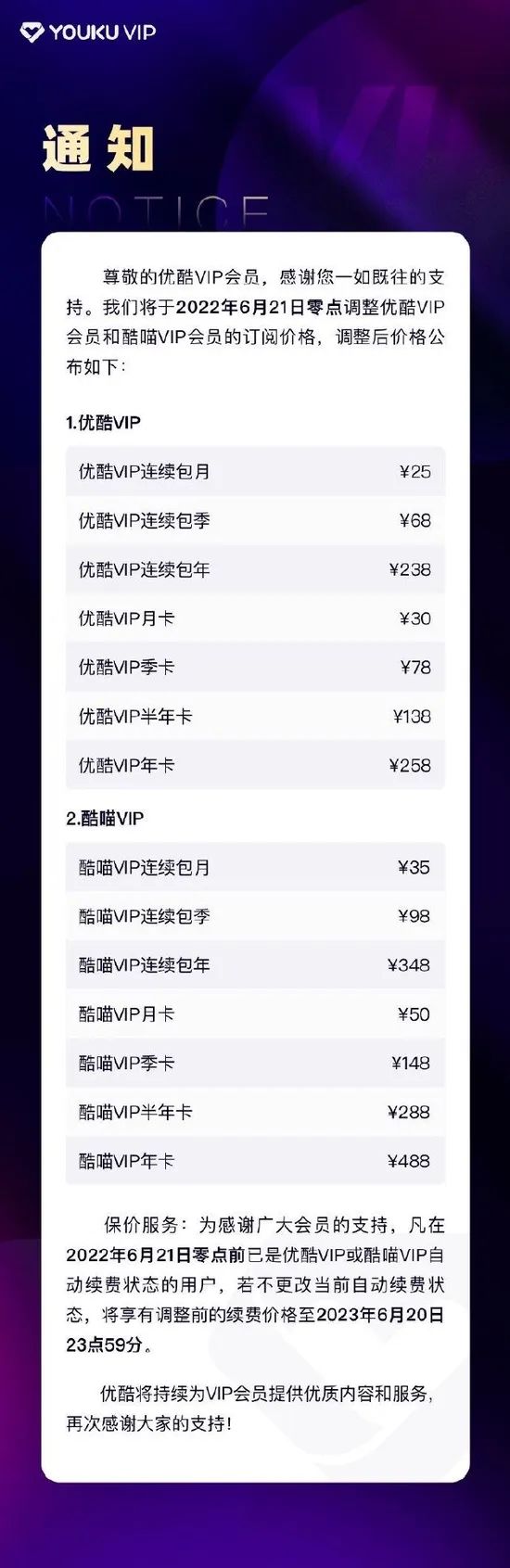

Another family!Price increased on June 21st

Source: Xiaoxiang Morning News (ID: XXCBWX)The copyright belongs to the original a...

Song Yun Guofeng "Breaking the Circle" followed the anchor to experience the charm of the national tide

Zhejiang News Client Zhang Ye Zhang Mengyue Zhou Yi Nie Li Dai Fang Li Lingjing Ha...