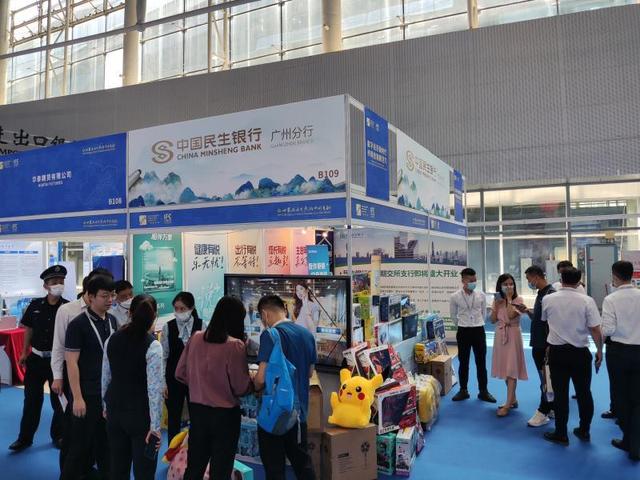

Deep cultivation of the Bay Area and helping dual carbon, Minsheng Bank Guangzhou Branch appeared at the 11th Gold Fair

Author:Yangcheng Evening News Yangche Time:2022.06.26

Text/Yangcheng Evening News All -Media Reporter Demanmantu/Interviewee provided

On June 24th, the 11th China (Guangzhou) International Financial Trading · Expo (hereinafter referred to as the "Golden Fair") with the theme of "New Era of Digital Economy, New Vitality of Lingnan Financial" was officially opened in Guangzhou. In the eleventh year, he participated in the exhibitors.

As a financial institution that is rooted in the Pearl River Delta and deeply cultivated the Greater Bay Area, Minsheng Bank Guangzhou Branch deeply combines major national, provincial, and municipal high -quality development ideas, and continues to increase key areas of the real economy, green finance, rural revitalization and other key areas. The asset investment intensity, with the spirit of hard work with the Bay Area, advances with the Bay Area to help the high -quality economic development of the Bay Area.

Deep cultivation of local enterprises, service bay area construction

One of the highlights of the Gold Fair this year is that the financial "living water" enables industrial innovation and development, encourages the docking of production and finance, makes full use of the financial "living water" to empower industrial innovation and development, and promote financial resources to greaterly integrate into the real economy.

It is reported that the Guangzhou Branch of Minsheng Bank has established a new service model centered on strategic customers, increasing the service support for leading enterprises. Since 2021, Minsheng Bank Guangzhou Branch has provided a group of comprehensive financial services for a group of leading manufacturing companies in its jurisdiction through the "five -in -one" service team of strategic customers, and promoted the transformation of enterprises from "manufacturing" to "smart manufacturing". As of the end of May, Minsheng Bank Guangzhou Branch's manufacturing loan balance was 55.039 billion yuan, an increase of 20.323 billion yuan at the beginning of the year, an increase of 56.17%, effectively supporting the development of the Bay Area manufacturing industry.

In addition, the Guangzhou Branch of Minsheng Bank also pays special attention to the services of science and technology enterprises, and launched a package of solutions such as "Science and Technology Loan, Firefly Plan, Minsheng Yi Chuang". In 2021, the Guangzhou Branch of Minsheng Bank provided credit support for small and medium -sized manufacturing customers with high -tech enterprise certification, with a loan balance of over 900 million yuan.

Focus on green finance and help double carbon targets

In addition to the traditional manufacturing industry, Green Finance is also one of the key services of the Guangzhou Branch of Minsheng Bank. In response to the goal of green financial development, Minsheng Bank Guangzhou Branch actively acts to actively explore the new path of financial support for carbon peaks and carbon neutralization, innovate and create a green financial product system, focus on the construction of clean energy, bus systems, new energy sources in the Greater Bay Area , Green Building Materials, including six key green industries, provide high -efficiency and diversified financial services, and contribute people's livelihood for the "double carbon" goal.

As of the end of May 2022, the green loan balance of the Guangzhou Branch of Minsheng Bank was 5.1 billion yuan, an increase of 3 billion yuan from the beginning of the year. The growth rate of green loans reached 142%, and the proportion of green finance continued to increase.

In addition, the Guangzhou Branch of Minsheng Bank created and promoted the "peak and" green financial product system with four major products of "investment, integration, chain, and camp". Through "Green Investment", "Green Rongtong", "Green Chain" and "Green Camp" products, the green development concept is implemented to all aspects of operation and management, and social responsibility is continuously strengthened to achieve continuous growth in value.

Practice rural revitalization and contribute to the power of "people's livelihood"

Featured finance helps the country's development strategy. The Golden Fair has held the "New Era, New Village and New Journey" to help rural revitalization forums, aiming to explore the long -term mechanism of rural revitalization. For a long time, the Guangzhou Branch of Minsheng Bank has actively implemented the work of rural revitalization, providing diversified financial services for the development of agricultural villages and towns in the agricultural villages and farmers' creation of farmers.

At the Greater Bay Area, Minsheng Bank Guangzhou Branch revolves around the agricultural industry segments such as feed, seasoning, deep processing of agricultural, agricultural centralized procurement, and continues to carry out in -depth cooperation with local leading enterprises to promote the integrated development of the industry chain. The key projects of local state -owned enterprises in western Guangdong, northern Guangdong and other regions helped the local area to accelerate the transformation and upgrading of traditional industries. Improved improvement, skills training, etc., promote the steady development of various rural revitalization causes, and continue to create a new situation in rural revitalization.

Source | Yangcheng Evening News · Yangcheng School

Editor -in -law | Shen Zhao

- END -

Fine End of Tianya Road Jiangong Port | Baoqian Village to get out of the new model of "Village Collective+State -owned Enterprise+Company"

June 13thSanya Daily special reportTianya District Hangqian Village actively explo...

New exploration of financing new enterprises

China Economic Weekly reporter Shi Qingchuan | Chengdu reportOn May 17, the Minist...