India, closing the door to fight dogs | Earth Knowledge Bureau

Author:Earth Knowledge Bureau Time:2022.06.27

(⊙_⊙)

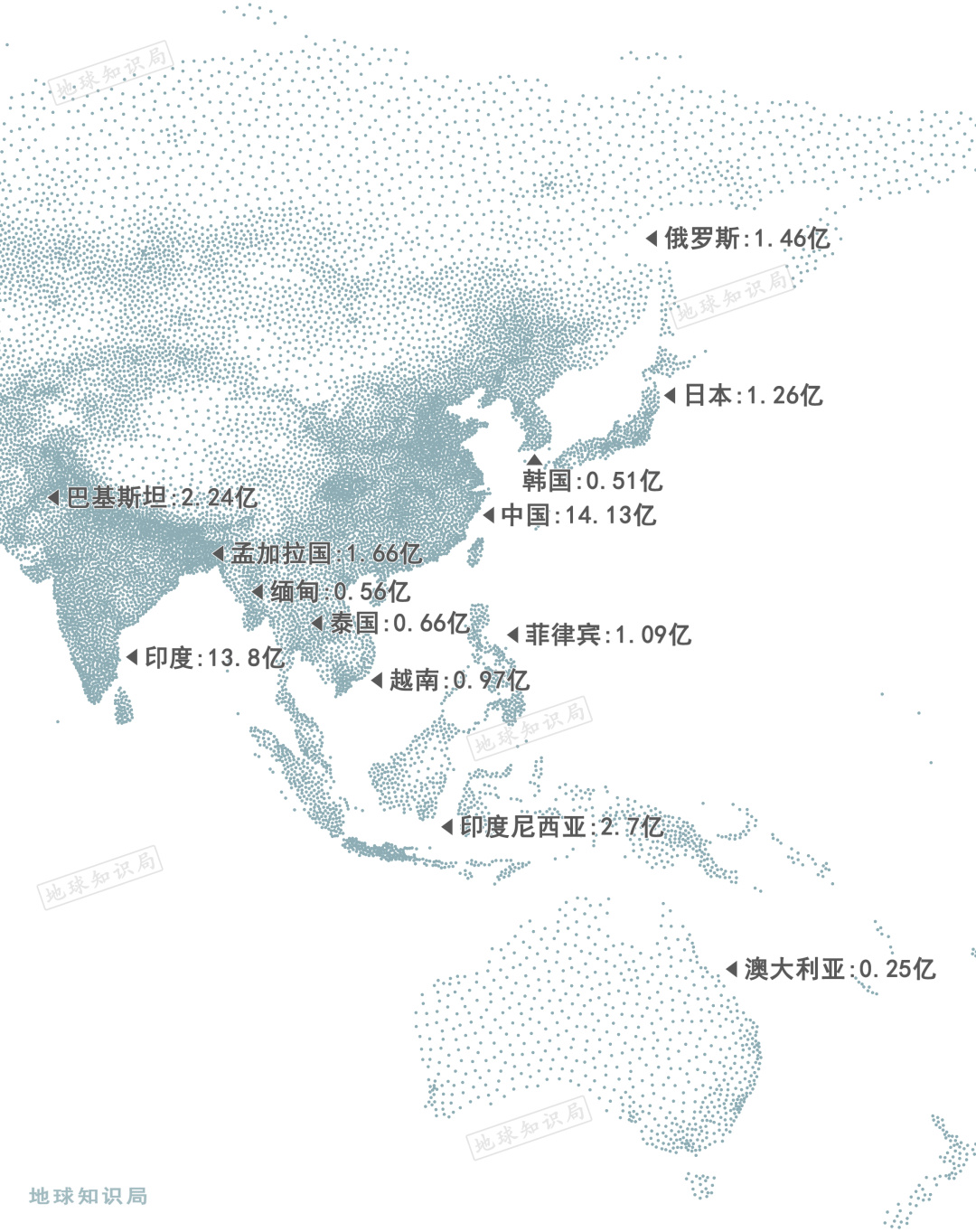

As a country with the largest volume, the largest population, and the widest area of South Asia, India has been regarded as a huge blue ocean market that needs to be pioneered by many people.

After all, although the data of infrastructure construction, education popularization rate, per capita GDP, and per capita life span, the data that reflects the comprehensive national strength has lagged behind China, the total amount of GDP in India in 2020 has reached 2.94 trillion US dollars, ranking around the world. Sixth, the mark that over 3 trillion yuan was so bad.

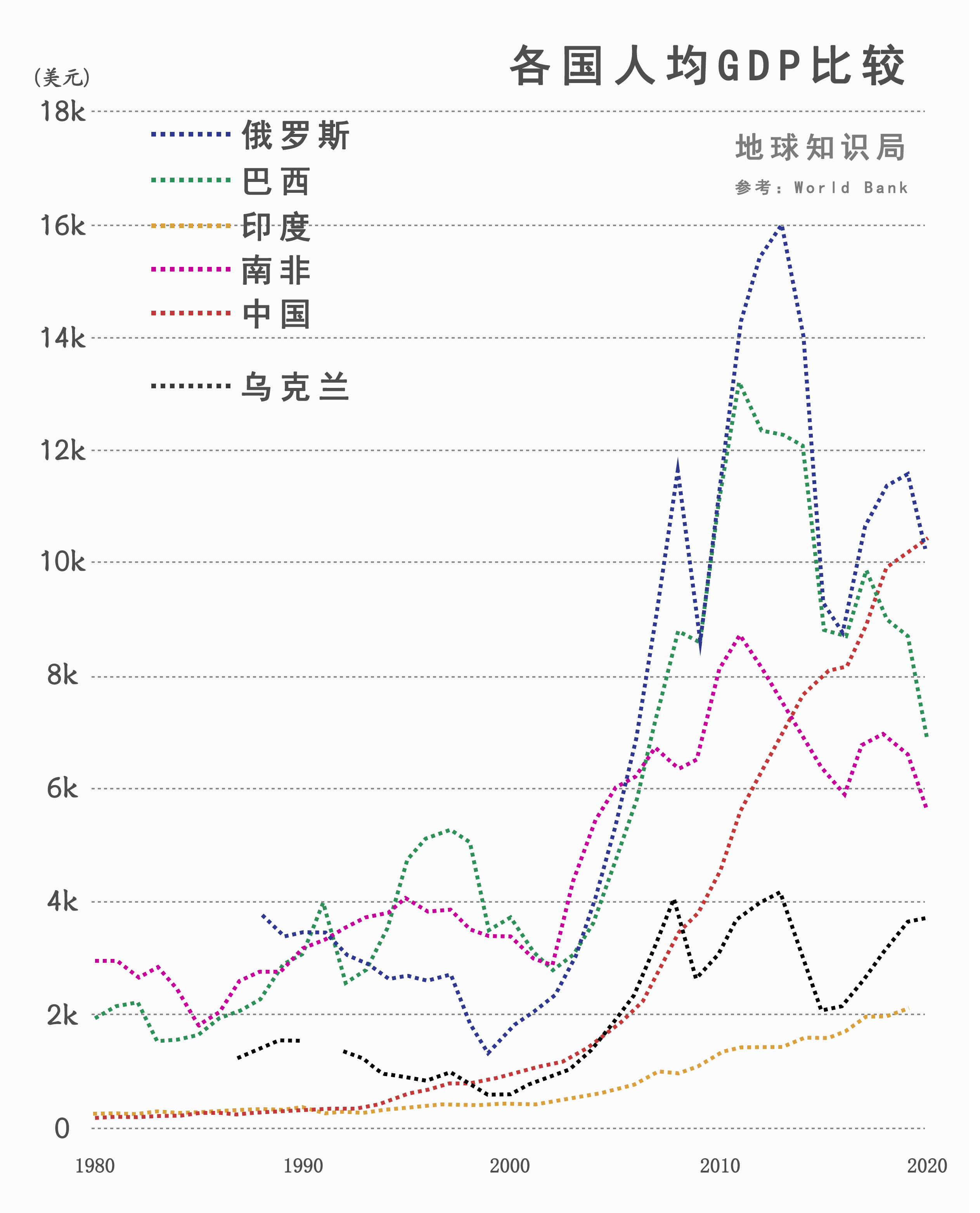

The total world is 6th, and even in the developing country, the per capita

It's still very low (Reference: World Bank) ▼

You know, when China entered the new millennium, GDP also had only 1.21 trillion US dollars, but has maintained a high -speed growth of more than 10%in succession since then. From the perspective of Chinese models, India's second largest population in the world has ushered in the air outlet of the economy, and it is about to enter a long -term and stable high -growth range.

A complex division of labor based on population -based population

Looking at Asia, only India can replace China's volume

For foreign capital, this is the opportunity not to be missed ▼

Under such temptation, a large number of international consortiums have entered India to invest, wanting to occupy the Indian market as much as possible, and even throw a lot of money.

Having said that, a ruling made by the Court of Law of the Indian National Corporation recently sounded the alarm to all international capital that wanted to get rich in India.

Transnational capital, tragically punched

According to Indian media reports, on June 14 this year, India made a judgment on the "Indian National Company Law Court", which was responsible for the dispute of business in business, and determined that Amazon, an American online retail giant, was investing in the second largest retail chain company in India -the future In the process of "future retail" of the group's subsidiaries, the facts concealed the facts, "there was no disclosure of fairness, frankness and frankness."

In the future, retail claims that the operation is not good

It has been seeking acquisitions for a long time (Figure: Facebook) ▼

The court not only ruled that the investment was invalid, but also requested that Amazon must pay a fine of 2 billion rupees (about 171.8 million yuan) within 45 days in accordance with the advice of the Indian Competition Commission.

At first glance, this seems to be just a commercial dispute encountered in the process of entering the Indian market in the process of entering the Indian market, but if we combine the background of this case, then the whole thing will become worthy of fun.

This may be Amazon on the road of commercial acquisition

Laughing quite bitterly (Figure: shutterstock) ▼

As a retail giant born in the United States, Amazon actually had a long time of salivating India's big cake. It established his branch in India as early as 2000, but India did not have a cold at that time of these retail industry's foreign capital. Essence

The reason is that at this time, there are two leading companies in the retail industry of Tata Group and Xinshi Group in India. Although its scale cannot be compared with industry giants such as Amazon, after all, it is a native "home family" in India. And there are many employment in the entire retail chain. If the market is open, local companies will inevitably be greatly impacted.

From cars to liquor, from retail to electricity, almost all of them are involved in the two major groups

It has become the economic pillar of Indian society (Figure: one picture network) ▼

After the first attempt to enter India failed, Amazon was not discouraged. Instead, he chose to step up the lobbying Indian government on the one hand to explain the benefits of the introduction of foreign capital. market.

After some efforts, the Indian government finally loosened in 2012 and agreed to introduce retailers with foreign backgrounds in the form of pilot.

India's expansion under the leadership of the National University of the National University is blocked

Many people who support openness to the outside world are therefore protesting

To defeat the National Party and strive for foreign capital! (Figure: One picture network) ▼

Although the mouth is open, in order to protect the interests of the country as much as possible, the Indian government has introduced various policies in the retail industry to limit the expansion of foreign capital.

For example, at least 30%of the products sold by foreign retailers must come from local small and medium -sized enterprises, which greatly improves the purchase cost of Amazon.

Another example is that e -commerce companies themselves cannot hoard inventory, nor can they sell goods directly to consumers like Chinese offline stores. In turn, Amazon had to choose to cooperate with Indian local companies to let these Indian companies as Amazon's warehouses, which ensured the storage and smooth circulation of goods.

Later, India also levied 2%of digital taxes for e -commerce foreign companies

Dual -eyed dual -standard treatment (Figure: shutterstock) ▼

Theoretically, the Indian government faces a multinational capital like Amazon, and it is understandable to properly introduce some policies with trade protectionism. After all, if the market is fully liberalized, then the strong multinational giant enterprises are likely to defeat Indian domestic enterprises through dumping and other means. After completing the monopoly, they seize huge profits. Many emerging developing countries have encountered similar problems with more or less.

Simply put, India is in the absence of industrial competitiveness

Frequent use of government forces to engage in trade protectionism

But it is difficult to make other people's money and don’t want others to make money.

However, the Sao operation of the Indian government has not been finished. The next wave of operations really performed the world what it means to "cheat foreign capital in and kill". The speed of light changes the face, closing the door to hit the dog

As a well -known Internet business giant, Amazon has few enemies online, and we mentioned on it that in order to limit the expansion of Amazon's offline expansion of India, the Indian government introduced various measures. Enterprises, "ground snakes" like faithful Group and Tata Group with offline links.

After some careful selection, Amazon chose the second largest retailer that is second only to Shinshi Group, which is the "future retail" controlled by the future group.

Earlier, Amazon's jealous India market for a long time and suffered

I also acquired India's Flipkart Company in the name of Wal -Mart

In order to carry out various business activities (Figure: One Photo Network) ▼

In order to prevent this transaction from being stirred by the Indian government, Amazon can be described as hardworking. They first spent 200 million US dollars in August 2019 to buy 49%of the shares of a gift voucher department under the Group in the future, in order to indirectly obtain a 3.5%shares in the future.

In this contract, Amazon requires that the group will not sell its retail business to their competitors in the future, including Shinshi Group, and said that they will acquire the remaining stocks of the future retail in the future three years later.

Perhaps because of the distrust of the Indian legal system, Amazon also stated that if the group violates the contract in the subsequent operations in the future, the relevant disputes will be submitted to the Singapore International Arbitration Center for trial.

Amazon's small movement is frequent behind the back

Faith is not a fool, step up the layout of its own e -commerce business

Brother gradually configured online (Figure: Flickr) ▼

What Amazon never expected was that in October 2020 after the contract was reached, the future group announced that it would sell its retail, wholesale, logistics, and warehousing business at a price of $ 3.4 billion to faith. Group, the transaction has also been approved by the Indian Competition Commission that has the final ruling in business.

As a result, Amazon, which was spent by Indians, was very angry. A paper appeal was handed to the Singapore International Arbitration Center, while the latter was invalidated by the two parties' previous contracts to judge the acquisition agreement of the future retail.

After all, it was a matter of eating tiger mouth.

No one thought no one was in their own camp (Flickr) ▼ ▼

It is reasonable to say that the matter is over, but in the future, the group will take a bite immediately, claiming that Amazon's acquisition case illegally interfered with its business decisions and appealed to the Supreme Court of India. However, the Supreme Court of India still made a judgment in August 2021, determining that Amazon's requirements for restricting faithful Group and future retail mergers are legal.

At this step, the Indians simply lifted the table. After the Supreme Court made a ruling, the Indian Competition Commission announced the withdrawal of the approval of the previous Amazon's acquisition of future group shares, saying that Amazon had obvious misleading behavior during the transaction.

The Indian Competition Commission (CCI) is also a typical typical of elbows

In the name of antitrust, Chinese and American companies have been done by him

(Figure: shutterstock) ▼

The lawsuit was in February 2022, and Amazon finally couldn't bear it. He agreed to abolish the previous acquisition of the future group, provided that the latter returned the 200 million US dollars of Amazon's purchase of equity at the beginning. RMB 100 million, but the transaction that sells its retail business to Xinshi Group will continue.

And the next scene is the beginning of the article -in this three -year acquisition case, Amazon not only did not buy the retail business of the future group as much as possible, but the 200 million US dollars of deposits could not be returned. Paying 2 billion rupees compensation ...

Bezos: If you do n’t stay here, I will go (Figure: One Photo Network) ▼

Amazon, who has seen the wind and waves in the international e -commerce field, has eaten a strong loss in India this time.

There is a lesson in front of the car, it is not an example

In 2014, Amazon's boss Jeff Bezos was unprecedentedly welcomed when visiting India. Modi, who was just elected, met him in person because the latter promised to invest 2 billion US dollars in India and said that he would create a lot of work. post.

Some data say that Amazon's actual investment in India has reached $ 4.5 billion

(Figure: Indian government information and radio department) ▼

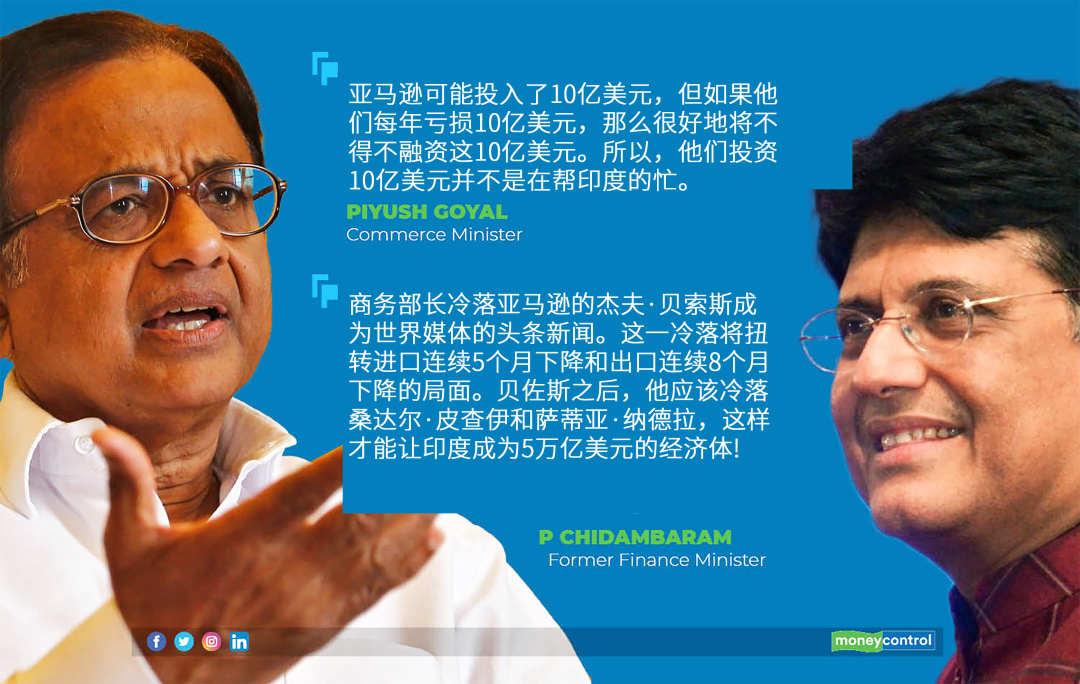

And until 2020, when Amazon's development in India was unfavorable, when Besos went to India again, the treatment was very different. Meeting his Indian Minister of Industry and Commerce Piesh Goyal stated in a straightforward manner, "Any attempt to make the e -commerce market model model model model Those who enter the field of multi -brand retail will be questioned and investigated. "

"Amazon may give a lot, but he wants to make more"

(Compared to competitors) I still give too little

(Figure: MoneyControl) ▼

Although in 2020, Bessel said that he was willing to raise investment in India to $ 5.5 billion, but this e -commerce model greatly impacted the Indian market, which was the direct reason that Amazon suffered a variety of targets.

On the one hand, more than 50 million people in India use retail as a industry. They are mostly small businessmen who are husband and wife model. They basically have no shops. They make money on the streets. And Amazon's comprehensive three -dimensional online+offline retail model is to reduce dimensions for them, and almost no individual households like Amazon. It is terrible that most of these people are the current ruling party -the loyal supporters of the Indian People's Party, and Modi could not afford to crimes. On the other hand, entrepreneurs such as Angel Group's Ambani, Adiden Group of Adida Group, and Tata Group's Latan Tata are closely related to high -level India.

For example, Adidi, who ranked second in the Asian rich list with $ 95.8 billion, was closely interactive with his private relationship when Modi served as the chief minister of Gujarat. Adida provided Modi's political contributions, while Modi used his position to Ada to Ada Niger's enterprise turned on the green light, which made its wealth rolled several times within a few years.

By the way, the first ranking is the boss of the Shinshi Group ...

Mukesh Ambani (Figure: Flickr) ▼

For example, in 2018, the Indian government is preparing to pilot the privatization of 6 state -owned airports. Adidi, who has not had any experience in operating the airport before, has won all the 6 airports' operating rights with the special relationship with Modi. This public protection, even the financial minister of Karara, couldn't stand it, and shouted "this is a shameless behavior."

There are "millions of workers" and "skirt relationships" on the top, and in the middle of the middle of corruption, the bad investment environment in India can be imagined.

Equivalent to the Indian version of the business consortium, hollow out the country together

(Figure: shutterstock) ▼

In fact, Amazon is not the first foreign company to suffer in India.

In 2004, the South Korean Puwen iron that wanted to transfer production capacity to overseas to reduce labor costs had signed a memorandum of understanding with India's Olesa government. 10,000 tons of large steel plant.

This is for the long -term lame India of heavy industry

It is indeed sending charcoal in the snow (Figure: one picture network) ▼

As a result, it was not only impossible to recruit, but the Indian government also from time to time on the grounds that "the construction of steel mills to destroy the local environment" was also requested to increase the expenditure of Pu Xiang iron to increase the environment, and to announce the cancellation of land acquisition permits for a while. Of course, from the signing of the contract in 2005 to the 2016 South Korea ’s Puxi Railway announced the abandonment of the initial investment and termination of the factory in India, the steel mill has not been able to start construction.

For eleven years, the Korean side has been working with India lawsuits

Local residents waiting for land acquisition are estimated to be anxious (Figure: one picture network) ▼

Similarly, in 2014, India proposed a plan for the construction of Daxing high -speed rail in China, and 6 high -speed rail lines are expected to build. After some fierce bidding, the Japanese government successfully won the project with a preferential loan with a loan period of 50 years and an annual interest of only 0.1%.

Unfortunately, India's first high -speed rail construction was very unsuccessful. The high -speed rail line from Benne to Ahamadabard was originally planned to start construction in April 2020 and completed in December 2023.

But Mumbai's Mahara Satrabon selected the candidate Udiff Sakri, the candidate of the "Wanpao God Army Party" in the November 2019 election, and the wet mother -in -law party and Modi of Modi The Indian People's Party has always been very incapable of dealing with it. Udaf himself determined that this high -speed rail project was not true. It was a project that Modi was forced to go to the horse in order to force himself in his political achievements, so he deliberately did not promote the land acquisition project.

For such an opportunity to attack Modi

Dampo God Army Party naturally likes to hear (Figure: One Photo Network) ▼

In March of this year, less than 60%of the land acquisition of Mahara Satra was completed, and the most critical land near Mumbai still did not complete the levy.

After such a central and local internal puppets, Mumbai-Ahamadbad's estimated completion time has been delayed to October 2028 ...

Obviously, although the Indian market is broad, it is still questionable whether all parties to be rushed here are copying their glorious economic success in China.

The main obstacle to the business in India

Not the market, but the government (Figure: One Photo Network) ▼

references:

1. https://en.wikipedia.org/wiki/future_group

2. https://en.wikipedia.org/wiki/reliance_retail

3. https://en.wikipedia.org/wiki/adani_group

4. https://en.wikipedia.org/wiki/blowberg_billionaires_index

5.

*The content of this article is provided for the author, which does not represent the position of the Earth Investment Bureau

Cover: shutterstockend

- END -

HKUST Xunfei: It is planned to repurchase company shares from 500 million to 1 billion yuan

On July 4, Capital State learned that the A -share Corporation Science and Technology (002230.SZ) repurchased the company's shareholding plan with a centralized bidding transaction.In order to activel...

The development of the postal express industry into the development of the postal courier industry into the rural rejuvenation performance assessment of the party and government team

Recently, the Sichuan Provincial Rural Work Leading Group issued the 2022 Welcome to the Central Committee of the Sichuan Provincial Party and Government Leadership Team and Leading Cadres to Promote