Sino -micro -semi -guided packaging has surgical replacement of equity or floating earning 200 million yuan to sell the company's participating company dress up

Author:Jin Ziyan Time:2022.06.27

"Golden Syllarsia" Southern Capital Center Chi En/Author Wu Enyingwei/Ratings

Against the background of informatization and intelligent acceleration, the investment cycle of semiconductors is shortened, and a number of semiconductor companies have emerged in the list of science and technology boards that have shocked listing. Among them, Sino -Micro Semiconductor (Shenzhen) Co., Ltd. (hereinafter referred to as "Sino -Micro -Director") predicts its risk of decline in performance in the first half of 2022, of which operating income is expected to decline by 12.12%to 19.6%, net profit declines 64.42%to 86.08% Essence

In 2021, through the sale of 49%of the 49%stake in the sale of Chongqing CINICS Electronics Co., Ltd. (hereinafter referred to as "Xin Yida"), Xin Yida became CSSCO Sheng Electric Technology Co., Ltd. (hereinafter referred to as "Sound and Optoelectronics At the same time, the wholly -owned subsidiary of the subject, Sino -micro -semi -Director obtained 1.84%of the shares of the Soncover and Optoelectronics Department. As of June 27, 2022, Sino -micro -semiconductor held the equity or floating earning 200 million yuan.

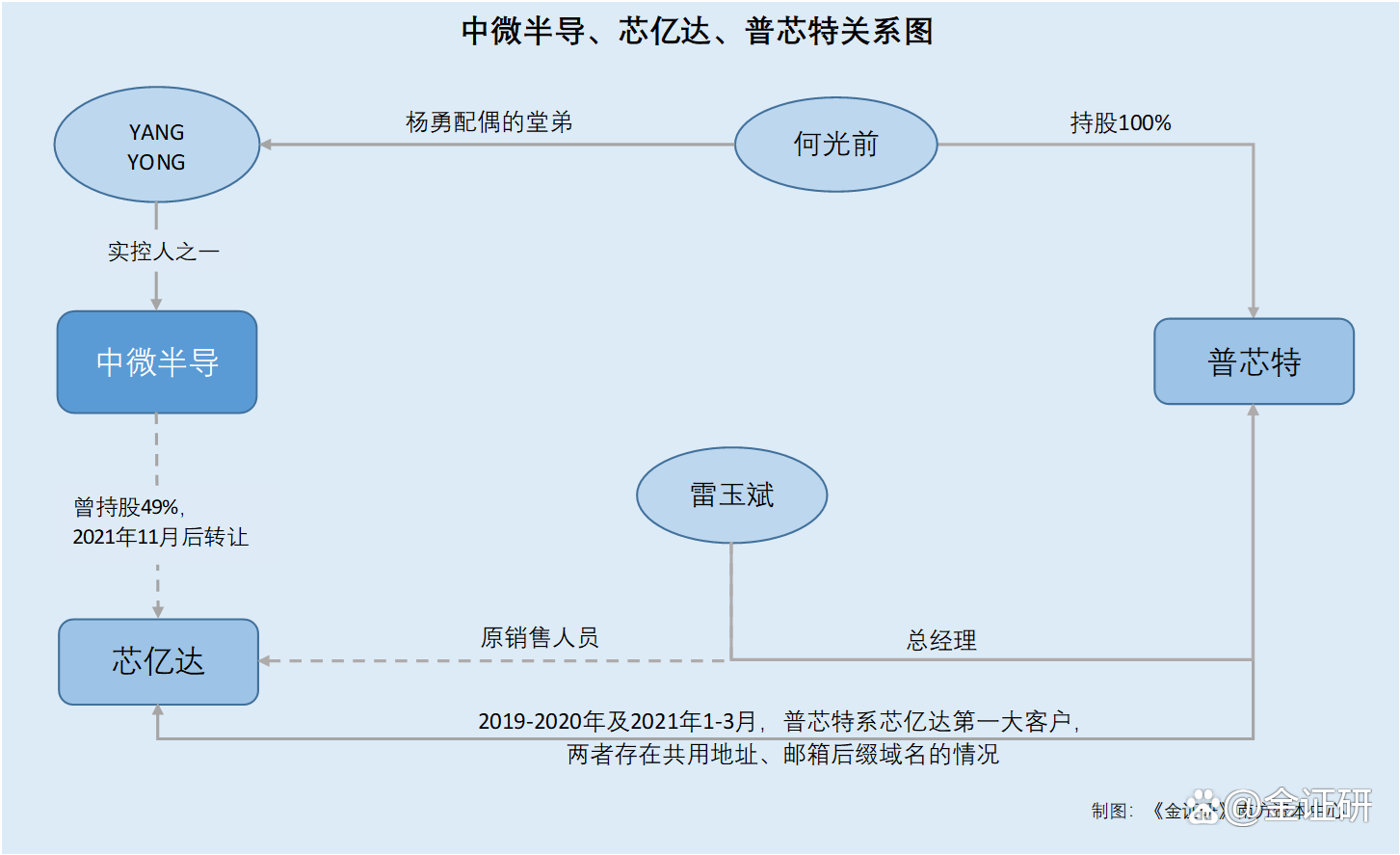

Behind the reorganization, Xin Yida's largest customers and China Micro semi -semi -guided or have a lot of relationships. In addition, in 2021, the investment income obtained by Sino -Micro -semi -Director Cordonic Coca Yida, the amount of profit or loss of the fair value of the shares held by the sound and light of the sound, and the shares held by the Sino -Micro -semi -Disposal Disposal, involved the amount of profit or loss of the equity of the shares of the sound and light, and the profit or loss involved in the amount of profit or loss of 263 million yuan, accounting for more than 30 % of the net profit of the year. Before listing, "assault" selling shares participating companies, did the Sino -micro -semi -Director mean that they were "dressing up" reports?

1. The company's participating company Xin Yida was placed in a listed company, and the largest customer control rights of Xinyida had doubts

Equity replacement is a common way of establishing a common interest relationship between enterprises. This method promotes corporate cross -holding shareholding, has closer contact, and increases a certain difficulty of supervision.

In November 2021, Sino -Micro -Director transferred the core Yida shares it held to the Sound and Optoelectronics Department of the listed company, thereby obtaining 1.84%of the shares of the sound and photovoltaic department. Behind the reorganization, Xin Yida's largest customers and China Micro semi -semi -guided or have a lot of relationships.

1.1 In 2021, the transfer of core billion up to 49%of the equity, Xinyi reached a wholly -owned subsidiary of the listed company's Sound and Optoelectronics Department

According to the signing date of June 10, 2022 (hereinafter referred to as the "Prospectus"), during the reporting period, the CINICS Semi -semi -Director's shareholding company with 49%of the equity was held. On December 26, 2020, the decision of the third interim shareholders' meeting of the Sino -Micro -semi -Director agreed that Zhongwei Semi -Directors transferred a 49%equity of the core of the Son and Optoelectronics Department, priced at 99.999 million yuan, and the Son and Optoelectronics Department paid by issuing shares.

According to the prospectus, on June 1, 2021, based on the results of the evaluation results of the Sino -Micro -semi -Director and Son and Optoelectronics Department, the transaction price of the 49%equity of the core of the core is 99.999 million yuan. 90%, that is, 5.42 yuan/share. Based on this, the number of shares of the Soncur and Optoelectronics Department will issue 18.297 million shares to China Micro -Director.

On November 3, 2021, Sino -micro -semi -Director's sale of 49%of the equity of CINCO completed the registration of industrial and commercial changes, and Sino -micro -semi -guided no longer held core Yida equity. In the prospectus, China Micro -semi -Director still disclosed Xin Yida as a related partner, that is, China CIDA is still a related partner of Sino -Micro -Director.

After the registration is completed, the Department of Sound and Optoelectronics holds 100%equity.

According to the "Report on the Issuance of Stocks Issuance of Stocks and Non -Public Issuances of Sound and Optoelectronics's Issuance of Sound and Optoelectronics's Issuance of shares to purchase assets and raised supporting funds and related transactions on December 22, 2021. As of December 10, 2021 Guide to hold 18.297 million shares of Sound and Optoelectronics Department, with a shareholding ratio of 1.84%.

In other words, through the transfer of 49%of the shares of the core of the CSR, 1.84%of the shares of the sound and optoelectronics department are transferred. As of December 10, 2021, Sino -Micro -semi -Director's indirect holding of 1.84%of the shares of the Department of Sound and Optoelectronics held a equity of 1.84%.

Behind the above reorganization, Xinyida's largest customers are related to China Micro semi -semi -guided or "unusual".

1.2 From 2019 to 2020, Puxinte contributed to the sales of more than 40 % of the sales of Sida

According to Sound and Optoelectronics (formerly known as CSIC Energy Co., Ltd., hereinafter collectively referred to as "Sound and Optoelectronics"), "China Electric Science and Energy Co., Ltd. issued shares to purchase assets and raised supporting funds released on October 25, 2021) "Reporting Report on Relevant Transaction" (hereinafter referred to as "Issuance Share Report"), from 2019-2020 and January to March 2021, Shenzhen Pintonte Electronics Co., Ltd. (hereinafter referred to as "Pintonte") Da's largest customers, Xin Yida's sales of Puxinte was 66.4525 million yuan, RMB 79,40,200, and 16.226 million yuan, accounting for 46.2%, 47.91%, and 37.71%, respectively.

Among them, Bugit is mainly responsible for the motor drive series and toy electronic control series IC of the agent core Yida in Shantou.

It can be seen that from 2019 to 2020, Puxinte was the largest customer of Xin Yida, and Xin Yida's sales revenue to Puxinte accounted for more than 40 %.

1.3 General Manager of Puxin Special Manager, the relative of the actual controller of the Micro -Director, the general manager is the original Yida original sales staff

According to the issuance report of the issuance, the Department of Sound and Optoelectronics said that there is no connection between CINING and Puxinte.

In fact, Lei Yubin, the general manager of Puxinte, is a former sales staff of Yida.

According to the first round of inquiries, on May 31, 2018 and June 1, 2018, Xin Yida authorized Puxinte to sell and service agents for related products or product lines in South China and East China The only dealer of the regional customer toy market expanded from the expansion, from June 1, 2018 to December 31, 2021. In the development of the Promit business, in June 2018, Lei Yubin joined Puxinte in charge of specific business management.

Earlier, the historical evolution of Puxinte first.

In June 2015, He Guangqian and Yang Bin invested 150,000 yuan respectively to jointly set up a general core. Among them, Yang Bin was a mini -semi -directed early employee.

In August 2017, Yang Bin transferred all the shares he held to He Guang before the transfer of the equity. Among them, He Guang's former controlling shareholder and actual controller Yang Yong's cousin, Yang Bin's brother Yang Yong's younger brother. At the same time, the general manager of Puxinte was changed from Yang Bin to Lei Yubin, and Lei Yubin was originally a salesperson.

According to data from the Market Supervision and Administration Bureau, on August 4, 2017, Puxinte's shareholders held 50%of the shares from Yang Bin and He Guangqian, respectively, and why the change was 100%of the shares. On the same day, the general manager of Puxinte was changed from Yang Bin to Lei Yubin.

As of June 21, 2022, He Guanglian held 100%of Puxin special shares.

This means that in May and June 2018, Xin Yida authorized Bonitt as its agent. In June 2018, the need for the development of Puxinte's business, Lei Yubin, a salesperson of Xinyi Da, joined Puxinte to be responsible for specific business management. As early as August 2017, the general manager of Puxinte had changed to Lei Yubin. Whether this shows that Lei Yubin did not participate in its specific business management after becoming the general manager of Puxinte in August 2017; and in June 2018, after Pucox became a sideline agent, Lei Yubincai Start participating in the management of Pinton special?

In addition, China Micro Semi -Director also had a transaction. After 2019, it was changed to Pointe's procurement to China Micro -Micro -Director through the core Yida.

The first round of inquiry replies showed that from June to February 2018 and 2019, the transactions of Sino-Micro-semi-Director and Puxinte were 199,000 yuan and 10.265 million yuan; after 2019, Puxinte and China Micro-Director Direct transactions were terminated and changed to China -Micro -half -guided procurement through Xinyida.

The doubt about Pintitte has not dissipated.

1.4 core Yida and Pusin use the same mailbox suffix, and share addresses

According to the prospectus, as of December 31, 2021, Sino -Micro -semi -Director has 5 domain names, including "mixic.com.cn". Obtained for the original.

And mentioned above, China Micro -semi -Director said that "mixic.com.cn" is one of its domain names. However, Xin Yida once used the domain name and as of June 21, 2022, the website address involved in the domain name was pointing to the core Yida official website.

Moreover, Xin Yida's contact mailbox suffixes overlap with the above domain name.

According to Xin Yida's official website, as of June 21, 2022, the contact mailbox of Xin Yida was [email protected].

In addition, the e-mailbox of Puxinte also has a vision similar to the e-mail box of 2018-2020.

According to data from the Market Supervision and Administration Bureau, from 2018 to 2020, the e-mailbox of Puxinte's enterprise was [email protected]. As of June 21, 2022, Puxinte did not disclose the 2021 annual report.

It is not difficult to find that the email suffixes of the core Yida and Pinton are both "mixic.com.cn".

Not only that, the address of Xin Yida and Bonitte may also overlap.

According to the product manual of the MX630LD, which was released on October 22, 2021, it was released on October 22, 2021. The address of the Shenzhen office of Xinyida was 1408 of Wanjun Economic and Trade Building, West West on Baoxing Road, Xin'an Street, Baoan District, Shenzhen.

According to data from the Market Supervision and Administration Bureau, on December 25, 2019, Puxinte's residence was changed to "1408-1409, Wanjun Economic and Trade Building, No. 21, Baoxing Road, Haiwang Community, Xin'an Street, Baoan District, Shenzhen. As of June 21, 2022, Puxinte's residence was still the above address.

That is, the email suffixes of the core Yida and Puxinte are "mixic.com.cn". In addition, the address of the Shenzhen office of Xinyida overlap with Puxinte, and the relationship between the two may be "a lot".

What needs to be pointed out is that the "Sino -Micro -semi -Director", which was published on June 23, 2022, "Sino -Micro -semi -Director" assets of "convenience" assets of the original company, "pointed out." A domain name owned by Sino -Micro -Director, the corresponding website uses the main system core Yida. However, the two parties have no information disclosure of the domain name transaction. In addition, the gross profit margin of the semi -finished wafer of the semi -finished product of Sino -micro -semi -semi -semi -conducting sales is lower than the gross profit margin of the wafer products to other customers during the same period. At the same time, 40 % of the total number of wafer procurement of Xinyi Da Da Da Dada came from the procurement of the wafer procurement for its replacement.

It can be seen that behind the Sino-Micro-semi-Director's sale of core Yida's equity, Xinyian's largest customer may have a lot of relationships with it in 2019-2020. As a China -Micro -Director's former shareholding company, the domain name used by Xinyi Da Da's official website points to the domain name of the China Micro -Director, and the email suffix between the core Yida and the Puxinte is the aforementioned domain name and also shared the address. In addition, after Cither authorized Bonitt as his agent, the original sales staff Lei Yubin was responsible for the specific management and management. Under the overlapping vision of various domain names, there is no connection between Citrine and its largest customer Puxinte, or it is difficult to explain. Is a medium -Personal controlled by Cither Yida? And is China Micro -semi -Directory suspected of sharing domain names with Xin Yida? Under the layers of analysis, the relationship between Bonitte and Xin Yida is intriguing with the relationship between China and Micro -semi -Directors.

Second, the packaging has surgery to transform into the shareholders of the voice and photoelectric department or the floating profit of 200 million yuan, assaulting the sales company or the "dress up" statement

Mo looking at the river as a mirror, it depends on the bottom of the water. In the capital market, as a potential company that may occupy an important position in the future market, the phenomenon of "packaging" of the financial "packaging" before listing is endless.

And this time, Sino -Micro -Director has become one of the shareholders of the Sound and Optoelectronics Department of the listed company through the sale of the company's participating companies. Profit has skyrocketed.

2.1 Micro -semi -Director holding the shares of the Department of Sound and Optoelectronics, or the floating profit of 200 million yuan

According to the January version of the prospectus, the Sino -Micro -Director divided the shares held by the sound and photoelectric department as a financial assets measured at fair value and its changes were included in the current profit and loss. Calculated on the closing price on November 26, 2021, the profit or loss amount brought by it was 305 million yuan.

According to the issuance report of the issuance, in December 2009, the 24th China Electric Power Department and China Micro -Director set up a core billion yuan, with a capital contribution share of 4.08 million yuan and 3.92 million yuan, respectively. Essence

Later, in August and April 2021, Xichen Yida had changed two equity changes. At that time, Sino -Micro -Director's capital contribution was 3.92 million yuan. Before the reorganization, Sino -Micro -semi -Director's capital contributing to Xinyida was 3.92 million yuan.

That is, from the establishment of Xinyida to the Sino -Micro -Director, it will be sold, and the Sino -Micro -Director has 49%of the shares of Xinyida, and the cost of capital contribution is 3.92 million yuan.

According to Oriental Fortune CHOICE data, on November 26, 2021, the closed price of the shares of the Department of Sound and Optoelectronics was 17.97 yuan/share. On June 27, 2022, the stock price of the shares of the Department of Sound and Optoelectronics was 11.36 yuan/share.

After research by the Southern Capital Center of "Jin Securities", if China Micro -semi -Director holds 1.84%of the shares of the Department of Sound and Optoelectronics, as of November 26, 2021, China Micro -semi -Director holds the equity or floating of the shares of the sound and photoelectric department. A profit of 325 million yuan; on June 27, 2022, China Micro -semi -Director holds the equity of this part of the sound and optoelectronics department or a floating profit of 204 million yuan.

From the above situations, it is shown that in November 2021, Sino -Micro -semi -Director obtained 1.84%of the equity of the sound and photoelectric department due to the equity of the sound and light and photoelectric department of the listed company. As of November 26, 2021, 1.84%of the equity of the Senate Optoelectronics Department held by the above -mentioned Sino -micro -semi -Director was included in the financial assets of the current profit and loss, and the profit and loss amount of profit and loss was 305 million yuan, and it closed on June 27, 2022. In terms of price calculation, the shares of the Senior Semi -Director of Son and Optoelectronics may be 208 million yuan, compared with the cost of investing in Sino -micro -semi -guided investment or a floating profit of 204 million yuan.

In fact, through the above -mentioned equity replacement, China Micro semi -guided or "assault" pretending to be pretended to be a beautiful statement.

2.2 The net profit of Micro Semi -Director in 2021 has skyrocketed, and the investment income of 75.1481 million yuan in the disposal of the shares of Xinyida

It should be pointed out that behind the equity of 49%of the sales of cores, in 2021, the net profit of China Micro -Director and the owner's equity showed a "skyrocketing" vision.

According to the prospectus, from 2019 to 2021, the net profit of Sino-Micro-semi-Directors was RMB 249.749 million, 93.69 million yuan, and 785.479 million yuan. Among them, in 2021, the net profit growth rate of Sino -Micro -semi -Directors reached 737.92%.

From 2019 to 2021, the investment income of Sino-Micro-half-guide was 6.7819 million yuan, 8.4487 million yuan, and 81.997 million yuan.

In 2021, the investment income of Sino -micro -semiconductor was 81.997 million yuan, of which the investment income generated by the 49%equity of the division core was 75.148 million yuan.

It can be seen that compared with 2020, the net profit of Sino -micro -semi -guide increased by 691 million yuan, and the Sino -Micro -semi -Disposal Shida shares generated a investment income of RMB 751.481 million.

2.3 The profit or loss of the fair value of the shares held by the sound and light department held in 2021 is as high as 187 million yuan

Look at the income of the fair value of the micro -semiconductor.

From 2019 to 2021, the benefits of the fair value of China and Micro-Directors were 54,500 yuan, 09,500 yuan, and 188,895,600 yuan, respectively.

Among them, in 2021, the benefits of changes in the fair value of Sino -micro -semi -directed value were 188,895,600 yuan, of which the profit or loss of the fair value of the shares of the sound and light of the sound and light of the sound and light of the sound and light and light is 187.3615 million yuan.

Moreover, the investment income obtained by the above -mentioned refueling core Yida and the profit and loss of the fair value of the shares held by the sound and light and light of the sound and optical electrical electrophoresis department are included in non -recurring profit and loss.

According to the calculation of the Southern Capital Center of "Golden Syllabus", the investment income obtained by China Micro -semi -Disposal Cossida, as well as the amount of profit and loss involved in the fair value change of the shares of the sound and light of the sound and light, and the total amount of profit and loss of the shares. The ratio is 33.44%.

2.4 2021 The value of the shares of the sound and photoelectric department held by Micro Semi -Directors, accounting for more than 20 % of the owner's equity

Look at the changes in the rights and interests of the micro -semiconductor owner.

According to the prospectus, from 2020 to 2021, the ownership of the Sino-Micro-semi-Director was 536 million yuan and 1.311 billion yuan, respectively. In 2021, the year -on -year growth rate of owner's equity was as high as 144.43%.

From 2020 to 2021, the trading financial assets of Sino-Micro-half-guide were 120 million yuan and 588 million yuan, respectively. In 2021, Sino -micro -semiconductor trading financial assets are the bank wealth management products and sound and photoelectric stocks held by the purchase of bank wealth management products. Among them, the amount of the shares held by Sino -micro -semi -Director -oriented sound and lighting department was 287 million yuan.

It can be seen through estimates that in 2021, the value of the shares held by Sino -micro -semi -Director -oriented sound and light, accounting for 21.86%of the equity of the owner and interest of the Chinese and Micro -Directors that year.

In other words, in November 2021, through the sale of 49%of the equity of cores, 1.84%of the shares of the Seno Optoelectronics Department were obtained by Sino -Micro -semi -Director. Essence In 2021, the net profit and owner's equity of Sino -Micro -semi -Directors skyrocketed. Among them, the net profit of Sino -micro -semi -guide increased by 691 million yuan compared to 2020. Among them, the investment income obtained by Sino -Micro -semi -Directors Cordonic Cordonic Core Cordyllaria, the amount of profit or loss of the fair value of the shares held by the shares held by the Sino Yuan, accounting for more than 30 % of net profit. Before listing, "assault" selling shares participating companies, did the Sino -micro -semi -Director mean that they were "dressing up" reports?

The surface is exquisite and gorgeous. By selling the capital of the company's participating companies, Sino -Micro -Director has in exchange for the value of a listed company's shares. The net profit behind the "assault" reorganization has skyrocketed, can it reflect the true competitiveness of Sino -Micro -Director?

- END -

Through the article, TMSA and Sire2.0 Those things

This article will explain in detail what TMSA is, what is Sire2.0, and the relatio...

Press release 丨 Large project construction press the "acceleration key" Harbin uses "four seasons ice and snow" to stay guests

At the Bingxue Economic Special Conference of Harbin City's Promoting the Four Eco...