Shareholders fry the pan!Why is the Ningde Times using 2.3 billion to buy a wealth management listed company is keen on this?

Author:China Well -off Time:2022.06.29

Picture source: official website of Ningde Times

On the evening of June 27, the Ningde Times announced that the company's board of directors reviewed and approved the "Proposal on the use of some idle raised funds for cash management", and agreed that the company's use of no more than 23 billion yuan of idle raised funds for cash management. Good liquidity -keeping investment products.

In Ningde Times, the company will strictly control the risks in accordance with relevant regulations and strictly evaluate investment products. The investment products raised funds must be met: 1. High security, to meet the capital preservation requirements. Well, it does not affect the normal progress of the investment project. The proposed product varieties include but are not limited to the capital preservation wealth management products, structural deposits, regular deposits or large deposit orders, etc. The holding period is not more than 12 months. The above -mentioned investment products must not be used for pledge.

In the Ningde Times, the purpose of this investment is to improve the efficiency of the company's funds. Without affecting the construction of funds and investment projects and the company's normal operation, the company intends to use some temporary idle funds for cash management to increase capital returns, as for the income of funds, as for the income of funds, as for the income of funds, as for the income of funds, as for the income of funds, as for the income of funds, it is for the income. The company and shareholders get more returns.

Judging from the announcement, the funds for cash management this time are from 45 billion yuan just completed recently. According to the fixed increase plan disclosed by Ningde Times, these funds will be mainly used to expand power battery production capacity. "It is proposed to use the idle funds of not more than 23 billion yuan for cash management." Obviously, it is obviously not in the fixed increase plan.

It is worth noting that this round of Ningde Times has been controversial. Now this move has put the company into the cusp of public opinion.

The discussion of shareholders also fry the pan, raised 45 billion, why did they buy half of the wealth management products?

45 billion yuan in Ningde Times will be added

After the market on June 22, the Ningde Times announced the disclosure of the final result. At the issue price of 410 yuan/share, it raised funds from well -known domestic and foreign institutions such as Gaoma, Morgan Chase Bank, Barclays Bank, Guotai Junan, Shen Wanhongyuan and other well -known institutions at home and abroad. The total amount is about 45 billion yuan, and the actual net fundraising fund is about 44.87 billion yuan. In accordance with the funds disclosed in Ningde Times, the use of funds raised at 38 billion yuan involves expanding production, and the remaining 7 billion yuan is used for new energy advanced technology research and development and application projects.

Earlier, in August 2021, before the Ningde Times thrown 58.2 billion fixed -increase plans, it also used 5.5 billion funds to make financial management. The 31st meeting of the second board of directors on July 20, 2021 adopted the "Proposal on the use of some idle raised funds for cash management", and used no more than RMB 5.5 billion idle raised funds for cash management.

Subsequently, the Shenzhen Stock Exchange issued a review letter from the Ningde Times to ask if there was an excessive financing. In October 2021, the Ningde Times issued a reply announcement, denied that it had excessive financing.

In November 2021, the Ningde Times adjusted the fixed increase plan, and it was planned to reduce the total amount of funds raised from more than 58.2 billion yuan to no more than 45 billion yuan. In April 2022, the Ningde Times fixed increase application was approved by the CSRC's consent.

Buying financial management with idle funds has become the usual operation of the active funds of listed companies. Especially for the long -term investment plans such as battery production projects, the operation of this cash management in Ningde Times is still difficult to escape the vortex of public opinion. Cash management is not in the original fixed increase plan. Some netizens even questioned that the Ningde era was "a game that raised funds in the name of science and technology, and then played money to make money."

Based on the 3%annual interest rate, the annual interest income corresponding to the 23 billion yuan investment amount is 690 million yuan. Even if calculated by the current currency fund's interest rate of 2%, the one -year interest income is 460 million yuan.

Earlier, the Ningde Times disclosed the "worst" quarterly report since its listing. From January to March, the company's net profit attributable to the mother fell to 1.493 billion yuan, a year-on-year decrease of 23.62%; the non-net profit of deduction dropped to 977 million yuan, a decrease of 41.57%. The company's gross profit margin dropped from 27.28%in the same period last year to 14.48%, and the net profit margin rate fell from 12.23%to 4.06%, which was a record low in history.

At present, in the Ningde era, the performance of the second quarterly report, whether the second quarterly report has been in the market, it is difficult to unify the market.

On June 27, in a general rising market, the Ningde Times fell 2.57%to 549 yuan/share, with a total market value of 1.28 trillion yuan; 33.90%.

New energy industry competition intensifies

Relying on the continuous expansion of production capacity and the advantages of large -scale cost, in just a few years, the Ningde Times quickly grew into a lithium battery leading enterprise covering the world. The company's market value rushed from 50 billion yuan at the beginning of the listing to a high point of 1.6 trillion yuan. In many previous evaluations, the "bargaining" ability brought by the high market share is the most distinct "label" in the Ningde era. Relying on the "core" status in the industrial chain, the Ningde era was considered to have the "right to speak" far exceeding the upstream and downstream of the industry. In the year when upstream and downstream companies suffered losses, the company always maintained steadily operating performance.

However, with the sharp decline in operating performance in the first quarter, the "pricing" ability of Ningde Times began to be impacted. The second -tier brand continues to break through and the car companies are "going to Ninghua". Behind these dilemma in Ningde Times are the smoke in the power battery industry.

According to data from the China Automotive Power Battery Industry Innovation Alliance, before, the market share of Ningde Times has been more than 50%for two consecutive years, occupying half of China's power battery. However, since this year, the status of "King Ning" has been shaken. In the first five months, the proportion of the market for power battery installation in Ningde Times fell to 47.05%, a decrease of more than 5 percentage points compared to last year's market share (52.1%). The second month in BYD, which ranked second, increased to 22.58%in the first five months of this year, an increase of 6.38 percentage points compared to last year's market share (16.2%). In April of this year, BYD also used the "blade battery" to overtake the Ningde era in the market share of lithium iron phosphate batteries.

After 45 billion yuan, on June 23, the Ningde Times released the third -generation CTP -Kirin battery. According to information released by Ningde Times, the volume utilization rate of Kirin batteries exceeds 72%, the system energy density can reach 255Wh/kg, which can achieve 1,000 kilometers of vehicle battery life and 10 minutes fast charge. The new battery will be mass -produced in 2023.

Listed companies are keen on "financial management"

According to CCTV News, since 2022, more than 850 listed companies have purchased more than 430 billion yuan in wealth management products.

The data shows that on June 27, including Ningde Times, nearly 30 listed companies issued relevant announcements for cash management with idle funds for cash management. From the perspective of the scale of funds, the Ningde era rode the dust. The investment scale of other companies ranges from hundreds of millions to billions of yuan, such as: sealing technology (284 million yuan), German nanomant (3.2 billion yuan), Andalian sharpness (900 million yuan), Shen Hao Technology (Shen Hao Technology ( 250 million yuan), Ying Feituo (800 million yuan) and so on.

However, listed companies, which are tens of billions of funds in Ningde Times, are still rare.

Overall, the popularity of listed companies to buy wealth management products with idle funds this year still continued. Data show that as of June 27, the number of listed companies subscribed/holding wealth management products this year had reached 903, and last year was 1306. From the perspective of subscription scale, the total subscription funds are Jiangsu Cathay (17.788 billion yuan) and China Telecom (10.170 billion yuan). There are 6 subscribed amounts of more than 5 billion yuan, including CITIC Securities (9 billion yuan), Weichai Power (7.298 billion yuan), Daa (6.394 billion yuan), and aviation motivation (60 billion yuan).

CITIC Securities Chief Economist claims that most of the funds of listed companies will be placed in production and operation activities to support the development of the real economy. I am idle funds can buy financial management, but they must pay attention to security and not speculative activities. For investors, you don't have to worry too much about buying wealth management products by listed companies. It is more important to pay attention to the development of the company's own business.

Tao Jin, deputy director of the Macroeconomic Center of Suning Financial Research Institute, believes that in the context of the decline in return on investment, the purchase of financial management of listed companies is objectively conducive to increasing expected profitability. However, over -purchase wealth management products will increase investment risks and affect its operating stability and competitiveness. Therefore, investors need to pay attention to the changes in the scale and short -term abnormal investment behavior of listed companies' purchase of wealth management products.

(China Xiaokang.com Comprehensive Beijing Youth Daily, First Finance, Surging News, Cai News Agency, China Economic Net, Xinhua Newspaper, etc.)

- END -

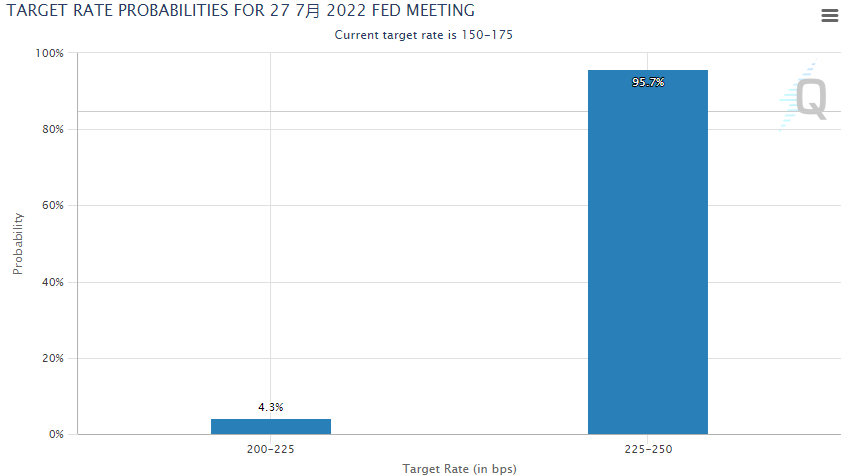

The probability of 75 basis points raised in July to 95.7%.

On June 19, Eastern time, the Federal Reserve director and the Federal Public Mark...

It has maintained a leading advantage in ten years. Why can Jiangsu manufacturing industry be?

Jiangsu uses 1%of the country's area and 6%population in the countryCreated about ...