Sunshine City replied to the Shenzhen Stock Exchange's annual report inquiry letter all customer service, insurance delivery is still the key this year 丨 company

Author:China Real Estate News Time:2022.06.30

China Fang Daily reporter Fu Shanshan 丨 Shanghai report

The continuous rising debt is still a mountain that is still pressed on the Sunshine City.

On June 28, after 14 days of extension, Sunshine City responded to the Shenzhen Stock Exchange's inquiry letter on the company's 2021 annual report.

Previously, on May 30, the Shenzhen Stock Exchange issued a inquiry letter of the 2021 annual report of Sunshine City, and asked him to give a reply to related issues before June 13. In the 27th announcement, Sunshine City responded to the company's inquiry on the company's gross profit margin, other receivables, debt risks, liquidity risks, etc. to the Shenzhen Stock Exchange.

Among them, Sunshine City mentioned that as of June 27, the company and the holding subsidiaries had expired to the debt scale of about 37.688 billion yuan, an increase of about 7.5 billion yuan from two months ago.

Among the total overdue non -paying debt, Sunshine City stated that 3.183 billion yuan is in execution. Except for the unrefined bonds of 14.539 billion yuan in the public market, the rest (including the execution status) are undergoing it with financial institutions or other partners. If the negotiation is reached, the execution status can be revoked.

At present, Sunshine City is taking different measures to resolve the risk of overdue debt overdue, including but not limited to discounts to sell assets, transfer projects, comprehensively stop land acquisition, implement cost reduction and efficiency, revitalize stock resources, increase the value of assets, introduce strategic partners, etc. A variety of measures to carry out self -rescue relief and debt risk resolution.

"It must be difficult." According to people close to Sunshine City, in the environment of the industry as a whole, the company's operations are difficult, but the work of various departments is still carried out normally. The person said that the company's current difficulties have nothing to do overnight solutions, which can only be solved little by little.

With the recent frequent incentive policies in the property markets in various places, the transactions of the property market in first- and second -tier cities have gradually recovered. The company's work focus this year is still to ensure delivery and implement all customer service, and do their best to solve the problem for the owners.

Bleak

The decline in gross profit margin is reasonable

In the inquiry letter, the Shenzhen Stock Exchange first questioned the gross profit margin of Sunshine City, and required it to combine the reasons why the real estate gross profit margin during the reporting period was only 5.51%during the reporting period of real estate business operations, income confirmation, and cost -revolving situation in recent years. And rationality.

In this regard, Sunshine City disclosed that in 2021, the company's real estate business confirmed revenue of 37.667 billion yuan, a year -on -year decrease of 52.25%; the cost of transfer was 35.591 billion yuan, a year -on -year decrease of 44.39%. Cause. The company's gross profit margin during the same period was 5.51%, a decrease of 13.37%from the same period last year.

For the cause of the decline in gross profit margin, Sunshine City believes that this is an industry trend.

In 2021, especially in the second half of the year, affected by the real estate regulation policy and multiple rounds of epidemic, the real estate market

Weak demand, continued sluggish sales prices, extended construction periods, limited personnel flow, raw materials, labor costs, interest and other costs continued to rise. Showing a downward trend.

For example, among the A -share listed real estate companies with the same scale and Sunshine City in the Cape Rui sales list, Huaxia Happiness fell by 16.8%in 2021, the gross profit margin of Jinke shares decreased by 6.32%, and the gross profit margin of real estate decreased by 4.13. %, The gross profit margin of Zhongnan Land also dropped by 8.45%.

Compared with these companies, there are two reasons for the decline in the gross profit margin of Sunshine City in 2021: revenue decrease and cost increase.

In terms of income, some projects in Sunshine City were obtained in 2020 and before. Affected by the national regulatory policies and epidemic conditions, the sales price of these projects continued to slump, and the actual selling price was not as expected, which led to a decrease in the gross profit margin of the project or even negative. From half a year, the market has declined. In order to cope with this change, the company's active price reduction promotion has also eroded the gross profit margin. This is why the gross profit margin of the entire industry has declined. In addition, since the fourth quarter of 2021, Sunshine City exposed a large risk of liquidity, which caused customers to wait and see significant emotions. Its project de -production is more difficult and the volume and price fall. Taken together, in 2021, the settlement area of Sunshine City's real estate business decreased by 46.61%year -on -year, and the settlement unit price also dropped by 11.82%to 10203.04 yuan/square meter.

In terms of cost, Sunshine City stated that some projects are obtained when the real estate market is good and the land market price is high, and the land price is high; the price of building raw materials in the past two years has also continued to rise, and at the same time, due to multiple rounds of epidemic conditions, some project projects are affected. The progress was affected, which eventually led to an increase in construction costs and labor costs.

In addition, due to the extension of the sales cycle and the impact of the epidemic situation, the overall cash flow returns to the positive cycle. The use time of some loans is prolonged, the burden of capitalized interest increases, and the cost of funds incurred increased.

According to Sunshine City, in 2021, the company's real estate business switching cost was 9640.62 yuan/square meter, an increase of 4%year -on -year. In addition to land costs, the higher cost of Jian'an increased by 8.47%year -on -year. Wait) 0.46%year -on -year.

In terms of above, Sunshine City believes that the company's gross profit margin is reduced to a certain reason, and the decline is also basically comparable to the company's gross profit margin level. Bleak

Cumulative overdue debts reached 37.688 billion yuan

In 2021, there was a large amount of loan that had not been returned in Sunshine City, and it involved many unsuccessful matters. Its subsidiaries did not fulfill their repayment obligations and were listed as the executed person. In this regard, the Shenzhen Stock Exchange also asked Sunshine City to disclose.

According to the announcement, as of June 27, the total amount of the principal of Sunshine City and subsidiaries did not pay the debt principal of 37.688 billion yuan. Sunshine City said that 3.183 billion yuan of these is in execution. Except for the total number of bonds in the open market, which has not paid 14.539 billion yuan, the rest (including the execution status) are negotiating with financial institutions or other partners. Reconstruction, the execution status can be revoked. Except for the above, other cases and the company have not been included in the execution.

Specifically, Guizhou Junyue Sunshine Real Estate Co., Ltd., the relevant subsidiaries of the executed person, Kunming Tongying Real Estate Development Co., Ltd., Chongqing Yuneng Construction Installation Engineering Co., Ltd., Fuzhou Shengjing Sunshine City Real Estate Development Co., Ltd. The total amount was 22.508 billion yuan, and the total liabilities were 22.147 billion yuan. The impact on the total assets, net assets, and net profit of Sunshine City did not reach more than 10%.

According to Sunshine City, the company is currently communicating and coordinating with financial institutions and other partners. It is intended to adopt various methods including asset sales and financing replacement, and hopes to do their best to achieve implementation of reconciliation and properly resolve this dispute.

In the response to the inquiry letter, Sunshine City also mentioned that in order to resolve the company's debt risks and accelerate the promotion of orderly operations, the company will actively strive for local government support. With the guidance and support of local governments, regulators and other departments at all levels, adopting Three measures to resolve liquidity and debt overdue risk.

First, take strategic contraction to ensure operation. Sunshine City said that the company is actively cooperating with the work of provincial and municipal special classes, accelerating the implementation of the comprehensive risk resolution plan, focusing on the concept of "focusing on core development areas, strengthening operating cash flow", and changing space with time and resources to change funds. Implement strategic contraction, the project returns to the edge; reduce the scale of financing and strengthen the overall planning of funds; revitalize restricted funds, return the cage precipitation funds; long -term debt combination, domestic and overseas market linkage and other measures to continue to carry out slimming debt reduction work to ensure the company's normal operation.

Secondly, in -depth communication of the creditors, ensure that it is not drawn, non -crusted, and loan, and reducing interest rates on the expiration of debt, trying to slow down the company's financing cash outflow pressure, rationally adjust the debt expiration time, and maintain the overall stability of the debt balance.

In addition, Sunshine City stated that it would accelerate the realization of assets and reduce costs and increase efficiency. Through discounts to sell assets, transfer projects, comprehensively stop land acquisition, implement salary reduction and expenses, revitalize stock resources, increase the value of assets, introduce strategic partners, etc., actively respond, and make every effort to carry out self -rescue relief and debt risk resolution. Work.

In terms of Sunshine City, if the above reasonable measures can be fully implemented, it can basically eliminate doubts about the company's continuous uncertainty in continuous operation in the next 12 months.

Bleak

Continue to promote all customer service and insurance delivery

Although the company's current debt pressure is high and its operations are in trouble, the above -mentioned people close to Sunshine City said that the company's business is still ongoing.

In addition to paying attention to debt pressure, the person said that the current work focus of Sunshine City is still to protect the delivery and continue to promote all customer service, and concentrate the power to solve the problem for the owner.

At the beginning of this year, at the press conference of the New National Office, the senior management mentioned that it was necessary to resolutely dispose of the risks of overdue delivery of real estate projects caused by individual real estate companies due to debt defaults. In addition, the central government's pre -sale supervision fund system issued by the central government is also to ensure delivery.

Since the beginning of this year, "insurance delivery" has become the consensus of many housing companies, especially for insurance companies.

According to Sunshine City, the company's key work this year is to ensure delivery. Since the beginning of the year, many districts in Sunshine City have started. In the Shanghai region, projects such as Shanghai Future Yue, Taicang Wenlan House, Keqiao 2020, Suzhou Tan Yue, Nanjing Baijia Lake, Tai'an Tanjing and other projects have begun construction. Zhejiang District has implemented online and offline. Hangzhou Tan Yingli, Jinhua Tanyuan, Luzhou Tanjing and other projects have been built normally.

In addition to insurance delivery, Sunshine City is still continuing to implement the customer service plan. In 2021, Sunshine City held more than 400 "All Customer Service" activities, covering 216 projects. The whole year of the group deputy director level and above received a total of 8,580 owners, and the reception time was 15,685 hours. The rectification rate of the problem reached 93%.

After 2021 exploration and practice, in 2022, Sunshine City put forward higher standards and requirements in terms of service system and customer operation.

From the perspective of Sunshine City, the more the company is in a critical moment, the more the product of the delivery and product quality is the company's lifeline; adhere to the service awareness of "all customer service" to continuously optimize the quality of service.

Data-nickName = "China Real Estate News" Data-ALIAS = "China-CRB" Data-Signature = "Focus on Real Estate, and understand China. This number is the only official certification number of China Real Estate Newspaper." Data-from = "0" />Editor in charge: Li Hongmei Liu Ya

- END -

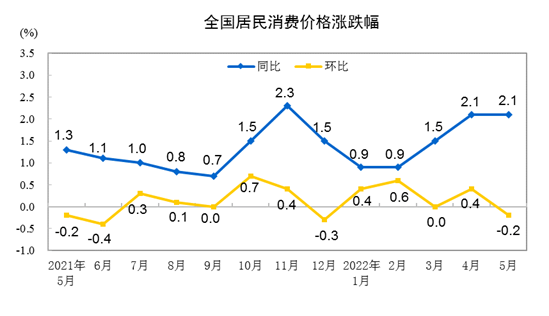

In May, the consumption prices of residents decreased by 0.2%month -on -month, and expert interpreta

In May 2022, consumer prices across the country rose 2.1%year -on -year. Among th...

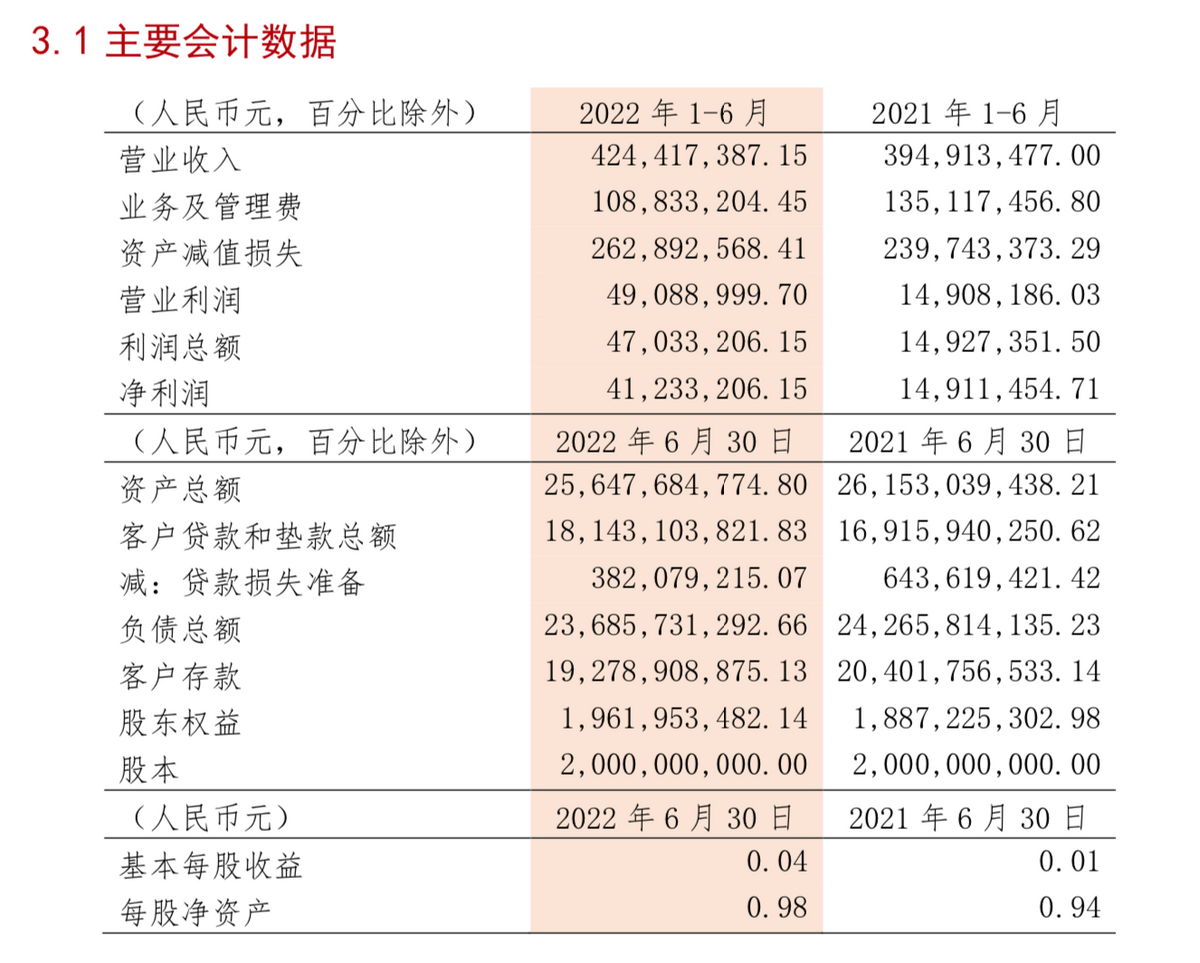

The first private bank's half -year report was released: Liaoning's revitalization bank's assets shrink, net profit increased by 176.52% year -on -year

Produced | WEMONEY Research RoomWen | Liu ShuangxiaThe first semi -annual report of ...